Key points:

- Syros is up 35% on FDA news

- Orphan Drug Designation for the SYRS pancreatic cancer treatment

- This is a necessary, but not sufficient, step for the economics of the program

Syros Pharmaceuticals (NASDAQ: SYRS) stock is up 35% this morning premarket on the news that the FDA has granted them Orphan Drug Designation for their pancreatic cancer treatment. This could mean a further rise in SYRS as it makes a vast difference to the costs of developing the treatment. On the other hand Syros has received such designations before for at least one other treatment and it hasn't led to a significant and sustained rise in the stock price. The reason for this is that while Orphan status does indeed reduce development expenses it neither entirely wipes them out nor ensures that the development itself is successful.

Syros as a company is, as the name would suggest, a biopharmaceutical company. They're working on treatments for cancer and monogenic diseases and trying at least to build a pipeline of gene control medicines. They've varied candidates in Phase III, Phase I trials and so on. So there's a pipeline there. But the markets for specific drugs could be fairly small – precisely because they're working on monogenic and genomically defined treatments. Only this subset of people with this particular genetic make up might benefit and so on.

This is what makes the Orphan Drug Designation so important. So called “big” drugs aimed at the general population may well be able to make their development costs back. And those development costs are vast. Depending upon how you count – with or without capital, failure and opportunity costs for example – in the $1 to $2 billion range.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

The problem with this system from the Food and Drug Administration is that drugs that address a limited marketplace cannot support that $1 billion in development costs. The value of what is gained from their existence simply doesn't cover that FDA mandated development cost. So, there's another system – Orphan Drug Designation. This means a drug to address a market of fewer than 200k people and a number of other things. Show that your development meets the rules and the authorisation process is both easier and cheaper.

This is what Syros has just gained, they've a drug candidate for a pancreatic cancer treatment. Which is a market of less than 200k people a year, so it meets these rules. The FDA has approved the designation – that reduces the costs to Syros of bringing it to market. Actually, it makes it possible to bring it to market.

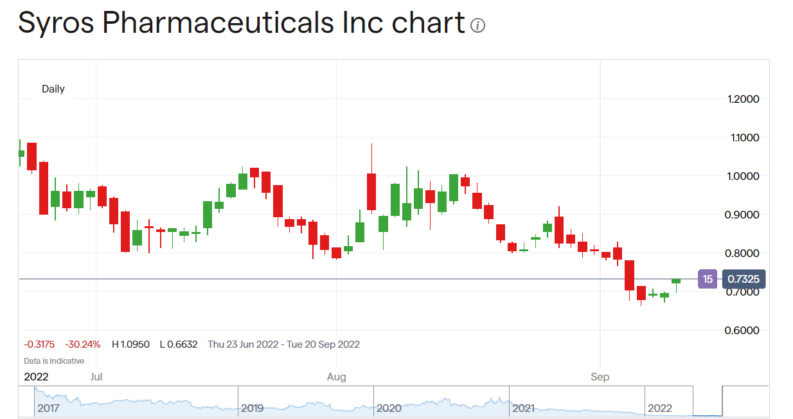

Now, we might think that this should lead to a greater than merely 35% rise in SYRS stock. But as the day wears on that rise is falling – even in the time to write this it's down to a 28% gain. One reason is that the orphan designation is necessary to make economic sense – but the development program still has to work. The treatment needs to work, not be poisonous itself and so on.

The other is that we've been here before. Back in February Syros was granted the same designation for their MDS treatment. Again, it makes that treatment potentially economic to develop – but it does still have to be developed. Orphan Drug Designation is a necessary stage of small market drug development that is, but not a sufficient one.