Key points:

- Syros stock is down 86% over the year

- SYRS is also up 879% today

- Can we say this is recovery, or is something else happening here?

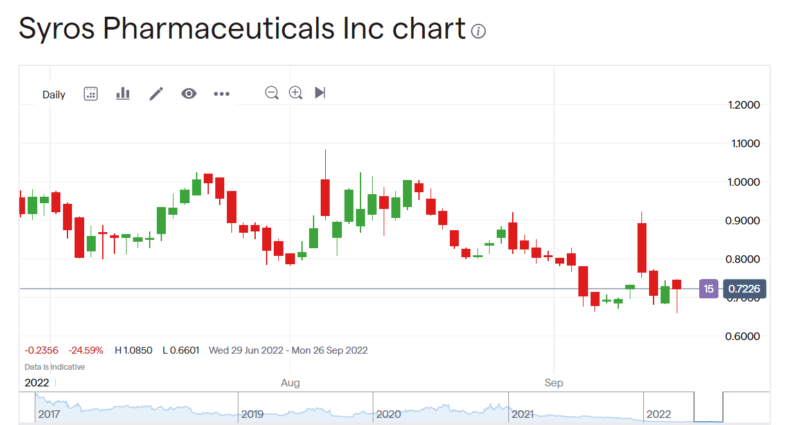

Syros Pharmaceutical (NASDAQ: SYRS) stock is listed as up 879% today – which is nice, given that it is also recorded as being down 86.6% over the past 12 months. We could hope that this is some signal of a recovery but, alas and lack, we must distinguish between nominal price changes and real price changes here with SYRS. The actual price move today is probably better described as being down some 12% in real terms. This all being made a little more complicated by there being a 35% or so rise last week. So, over a week's time span we might say that Syros is a few percent ahead of the game, over a day a little behind it.

The problem is that distinction between nominal and real price changes. Real price changes are about changes in real events of course and that has happened for Syros Pharma. As we said last week about SYRS stock, it gained Orphan Drug Designation for one of the products in the development pipeline. This is good news as a drug for only certain types of pancreatic cancer probably isn't economic to develop without such a reduction in the FDA expenses of getting to market.

This though isn't a sufficient condition for approval, it's just one that makes it possibly economic to pursue. So there's still the issue of it actually working and so on – we're at an early stage here. It's also true that Syros received such a designation on another treatment back in February and while that too was nice the effect on the stock price faded over time.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

Then there's the nominal change. American markets think that stocks with prices under $1 are “penny stocks” which they are, of course. But this also carries connotations of their being the preserve of charlatans and all that. So, no stock may maintain a price below the minimum $1 offer price and still remain on a major exchange like NASDAQ or the NYSE. Syros has this problem and is, in time, in danger of losing its NASDAQ listing. The answer to this is a reverse stock split, a consolidation to Brits. Simply declare that what used to be 10 pieces of stock are now one – a 10 for 1 reverse stock split. This should not change the real price of the market capitalisation, nor that of any individual holding. Not in itself at least. There might be some value to retaining the NASDAQ quote of course.

The effect of the reverse split should be to increase the SYRS stock price by 1,000%. The rise has been only that 879%. So, the real price change is not the 8.7 times, it's the gap between that an 10x, or a drop of perhaps 12%. But perhaps we should also include that rise last week as part of it all – that initial 35% jump retreated to about a 10% rise. Add that all together and we get to Syros being about level over the past week, perhaps a little ahead.

It really is important for us to distinguish between real price changes and purely nominal ones.