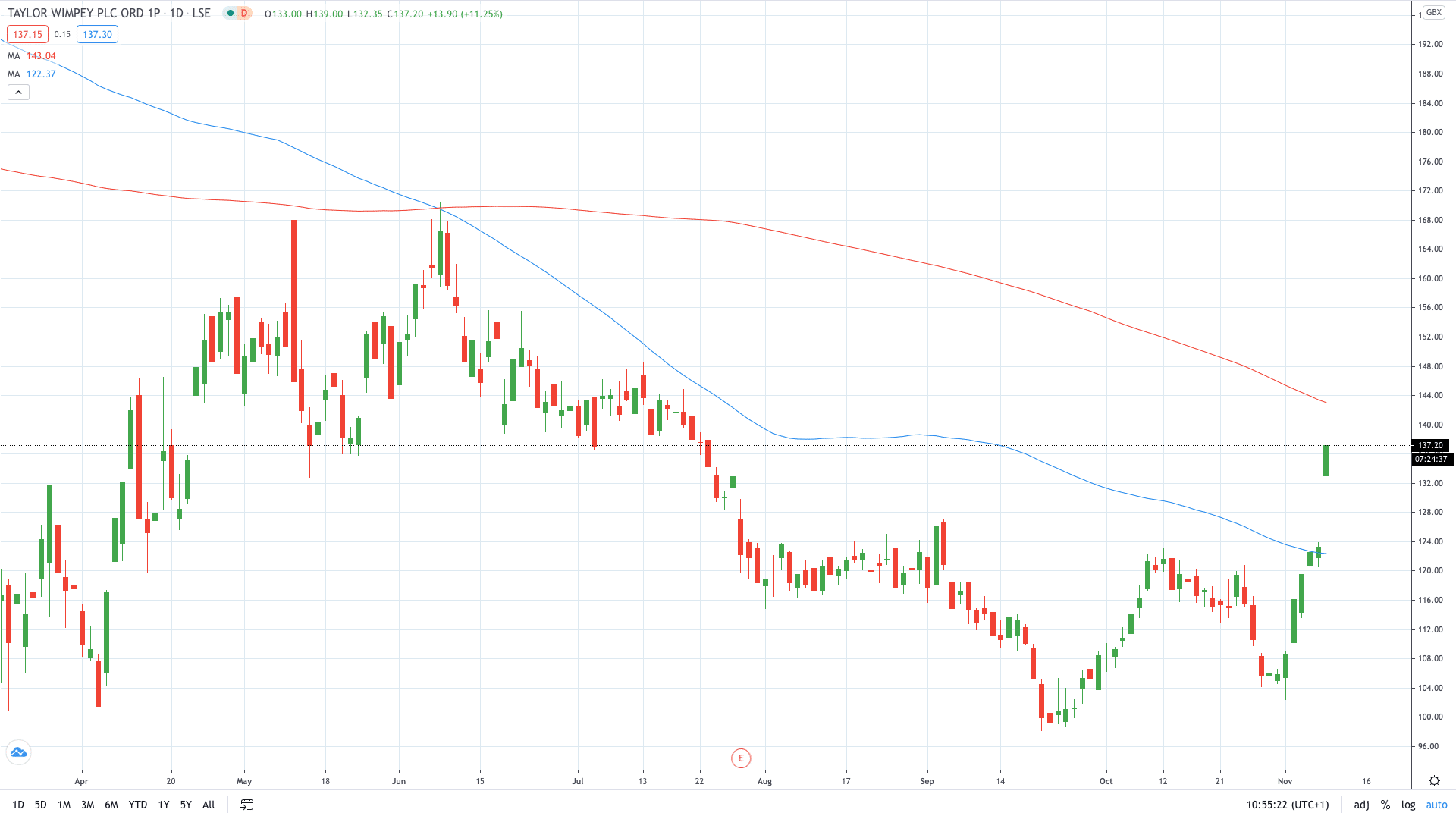

Shares of Taylor Wimpey (LON: TW.) soared about 13% Monday after the housebuilder said it expects full-year profit to come at the upper end of expectations.

The FTSE-listed company said that the business has almost fully normalized as the total order book is at 11,530 homes or about £3 billion at November 1.

“The trading backdrop remains resilient and the quick recovery of the housing market is testament to the underlying strength of demand and supportive lending backdrop. We have made good progress in the second half of the year to date, maintaining a robust sales rate and building a strong forward order book,” Pete Redfern, Chief Executive, said.

“Looking ahead, we are on track to deliver full year 2020 results towards the upper end of market expectations and with strong operational momentum and positive forward indicators, our confidence in 2021 has increased.”

Taylor Wimpey also added that it expects its 2021 operating profit to also arrive above the top end of the current consensus range.

The housebuilder said that it is now selling 0.76 homes per site per week since July, which is still lower compared to 0.93 for the same period a year ago.

Taylor Wimpey share price gained around 13% to trade at 139p, the highest level since July.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading