- Investors are circling Tesco (LSE:TSCO) as the mood towards retailers shifts to ‘big could be beautiful’ as the supermarket giant accounts for 26.8% of the UK grocery market.

- The coronavirus pandemic is acting as a catalyst for the firm to introduce sweeping changes, which may soon come through to the bottom line.

- The overhaul has only just started with the firm issuing stringent demands to its suppliers and expecting a two week turn around on a change of business terms.

- This could be the moment to act. Trade entry points are potentially appearing as more light is shed on the broader economy with jobs, inflation and retail sales data being released this week.

The formidable track record of UK grocery retailer Tesco is based on its reputation for driving a hard bargain. The story goes that Tesco buyers would consider a ‘win-win’ situation one where they visited a supplier, drove a one-sided bargain, and then sometime later go back to drive an even harder one. The firm secured its position as a sweetheart of the financial markets as turning the screw in that way drove the Tesco share price upwards.

The long-term interests of suppliers were dismissed to such an extent that the worst behaviours had to be eradicated by a change in the regulation. In 2013 a government body, the Groceries Code Adjudicator was set up as an independent statutory office responsible for enforcing the Groceries Supply Code of Practice. The excessively aggressive actions of grocery stores was then curtailed by state-backed regulation of the relationship between supermarkets and their direct suppliers within the United Kingdom.

Fast forward to 26th of October 2015 when Dave Lewis, the then CEO of Tesco, startled suppliers when he stood up at an industry conference. Bemoaning his company's ‘naked pursuit of growth’ Lewis said there was ultimately only one word to say, ‘sorry’ (sources: The Times).

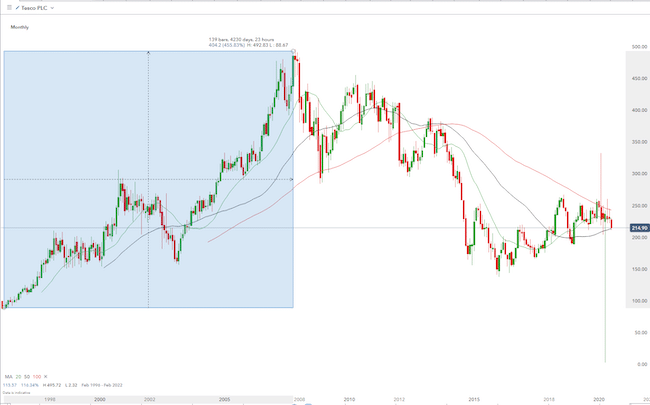

Tesco share price – monthly candles – 1996–2020

The hard-nosed approach by Tesco might have signalled tough times for suppliers but in the space of 11 years, the Tesco share price rose by more than 450%. A remarkable return considering the relatively tight margins in the industry.

The famous statistic is that, at its peak, one pound in every seven spent in the UK went into a Tesco till.

Its expansion plans saw it grow to become the UK's biggest retailer by sales and also the nation's biggest private employer. At one time it employed more than 330,000 staff, working in 3,146 stores.

The slump in the Tesco share price has mirrored the change in approach. Since its peak of 495p in November 2007, the share price has slumped as low as 137p. Suppliers may have appreciated the change of approach but from an investor's perspective, the firm had lost its mojo. Reports emanating from industry sources suggest that could be about to change. Having overcome a financial reporting scandal in 2014, Tesco appears ready to do what it does best, and COVID-19 inspired changes in shopping habits seem likely to support those efforts and the Tesco share price.

Timing

Two triggers are in play that act as indicators for buy trades. The entry points could be now due to COVID inspired shifts in consumer habits and a looming recession.

Tesco chief executive, Dave Lewis said COVID-19 social distancing measures mean consumers are shopping less frequently. The ‘weekly shop’ is back. It's also being done online with home delivery and click and collect services booming during the lockdown.

With individuals making personal judgements on what activities are worth the risk-return of greater degrees of social interaction, food shopping can be ticked off as being ”done safely”.

A retail consultant has reported that online sales now account for 10.2% of the UK grocery market.

At the outbreak of the coronavirus pandemic, Tesco increased its online capacity by 103% in a matter of weeks.

Speaking in April, Lewis talked about how his firm was capitalising on the opportunity the change in habits represented. He said:

“People are shopping once a week, a little like they did 10 or 15 years ago, rather than two, three or four times a week that was happening before the crisis.”

Source: BBC News

He added that the firm had at the peak of panic buying “seen seven weeks of sales going in one or two days.”

Source: BBC News

Retail consultancy Kantar reports that:

“On average, households shopped only 14 times for groceries over the past month (March), a record low and down from 17 in more normal times.”

Source: BBC News

Shopping habits are leaning towards online and larger stores just as the UK heads into a recession. Grocers are often favoured as being ”defensive” stocks, everybody's got to eat, but being the best performer in the sector would boost the Tesco share price. The signs are that the Tesco management team are ahead of the curve. Buying Tesco shares now would be rewarded if the next company earnings report due on 7th of October surprises to the up-side.

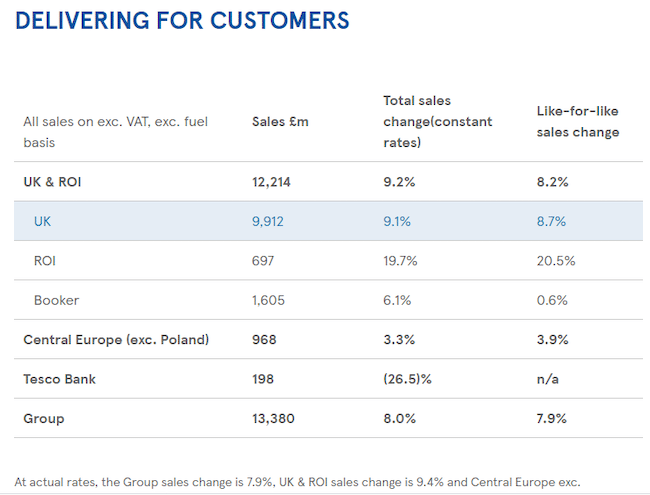

First Quarter Trading Statement 2020/21

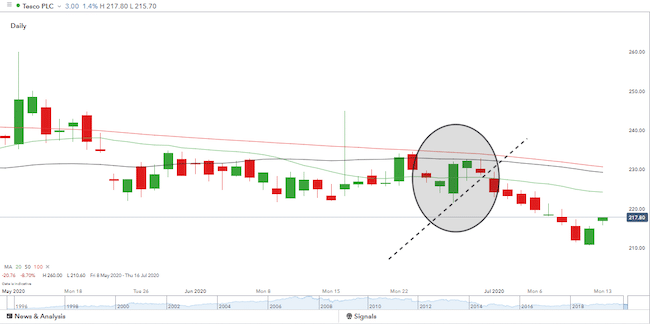

The Q1 report on the 26th of June caused a murmur in the Tesco share price. The intraday price range was 221.4 – 232.0 but the resistance of the daily 50 SMA at that time proving too much for the price to break through. Following that fall away in prices, there is now room to the upside before the SMA's once again come into play. The price action can't be described as ”bullish” but the buy Tesco trade being talked about is based off fundamentals being activated by a catalyst.

Tesco share price – Daily candles – 11th May – 13th July 2020

One supplier, speaking off the record with The Grocer said:

“Tesco got it wrong in the last recession and Aldi got the jump on them on price and they are absolutely obsessed with not allowing themselves to be outgunned by the discounters again.”

Source: The Grocer

Size matters

To make the most of morphing societal trends, Tesco has gone back to driving tough bargains with its suppliers. The change of approach is best illustrated by the firm giving its suppliers a two-week ultimatum to respond (favourably) to Tesco's new pricing strategy. That deadline passed on the 10th of July and those who didn't accommodate the grocery giant look set to see fewer of their products promoted in-store. There were no corresponding guarantees of extra capacity and the move seems like a straightforward money grab. One supplier told The Grocer that the jargon used to soften the blow included the phrase “those who join the journey will be rewarded”.

The time pressure on the suppliers is also a surprise. Ged Futter, a director of The Retail Mind, shared his thoughts regarding the time constraints with the Sunday Times:

“It is ridiculous for Tesco to ask suppliers to completely rewrite business plans for the whole year in two weeks.”

Source: Sunday Times

The price war between the UK's leading grocers has escalated in line with announcements of job cuts across the economy. The stated aim is to support consumers as the economy heads into a recession. Still, the real target for Tesco is its competitors, particularly the small-store German retailers Aldi and Lidl. The two newcomers to the UK scene have, in recent years, carved a successful niche as consumer habits embraced the discount store methodology.

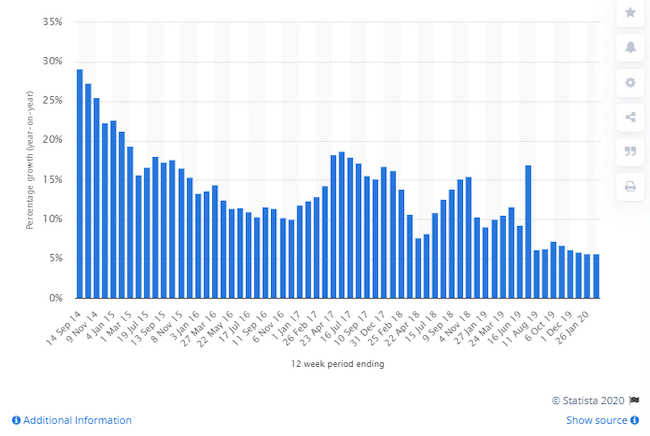

Between January 2015 and March 2019, Aldi was able to expand its market share on the grocery market from 4.9% to 8%. During the same period, all supermarkets with a higher market share lost percentage points.

Percentage change in sales at Aldi in Great Britain compared to a year earlier from September 2014 to February 2020

Aldi appears to be the firm Tesco is focussing on. The good news for investors in the larger firm is that the Tesco share price will benefit if it can claw back some of the market share it has lost to its smaller rival over recent years. Time spent rekindling the ethos which made Tesco preeminent won't win it many friends, but given the relatively benign approach of the firm in recent times, there is a window of opportunity for it to get back to basics. That should improve the retail giant's bottom line reporting.

Bounce

Long-term downward pressure on the Tesco share price was also self-inflicted. Accounting malpractice in 2014, when the firm’s misreporting of profits by £326m resulted in a fine of £129m in 2017 and all-round investor displeasure since then. The firm was found being overly aggressive in terms of reporting income and not reporting expenditure across the same time-frames. The desire to meet earnings targets caused the staff to massage the dates when different items were recorded in the company accounts.

At the time, the loss of trust was seen as an existential threat to the firm. That was reflected by the Tesco share price having £2bn wiped off it in one day. Buying Tesco shares while the memory of that scandal lingers could be beneficial. There have been no subsequent skeletons falling out of the closet and it can be assumed that internal procedures are now tighter there than at their rivals.

Yield

One of the main attractions for investors is the dividend yield. Harvey Jones, an analyst at The Motley Fool, wrote:

“The payout also looks solid, and I'd buy Tesco for that reason alone. With luck, you'll get share price growth as well, in the longer run.”

Source: The Motley Fool

The current dividend yield is close to 4%. That looks very attractive compared to the interest paid on cash balances. There is less political pressure on the firm to reign in that payment. The latest statement on the subject attracted some negative press because the firm received support from the public purse during the pandemic. However, the management stuck with its approach and weathered the storm.

When to buy

In terms of timing, there is one negative item on the horizon. Current CEO Lewis has many fans in the City of London. His departure, due to take place on the 30th of September could weaken the Tesco share price but a counter-argument is that it is already priced in. The knowledge of the change at the top being one of the drags on share price performance. Once the change in personnel takes place, it could well be that investors realise the loss of Lewis is not too much of an issue.

There are some further clues about how to manage the situation being released before Lewis departs.

Earnings season is ramping up. PepsiCo reports Q2 earnings on Monday and of particular interest to those monitoring the Tesco share price will be the Ocado 1H earnings due on Tuesday. Are the figures going to lead to a bloodbath for share prices or have expectations been effectively managed?

Other releases from official agencies will also provide some colour on the situation. On Tuesday the UK releases GDP growth data. Inflation data is published on Wednesday and on Thursday UK jobs numbers and retail sales figures are to be shared with the market.

Those who held their Tesco shares for the yield will be hoping the time has come for a return to core values; the societal changes and pending recession forming a particular sweet-spot for the UK firm. Critical mass appears to be turning into an advantage rather than a handicap and the management team seem willing to use it, even if it does discomfort their suppliers. There is hope the firm has rekindled its understanding of the market.

Phil Lyon, a retail historian at Queen Margaret University Edinburgh, was speaking with BBC News when he commented on the core values of its founder Jack Cohen. He said:

“Cohen built his business when there was still a lot of austerity around. To drive business development of that kind at that time was quite remarkable. He totally understood what worked for the mass market.”

Source: BBC