The THG PLC (LON: THG) share price surged 9.67% after its Q4 and full-year results were released for the year ended 31 December 2023. The company revealed that following the sale of its THG OnDemand division, the Group concluded its strategic review and phased out select legacy brands within THG Beauty and THG Nutrition in Q4.

The decision, affecting about 2% of the Group's yearly revenue, led to the quarter's revenue excluding these discontinued brands. Key achievements in Q4 included the best quarterly revenue performance of the fiscal year, with a 1.1% increase. THG Beauty excelled, driven by significant app growth and reduced dependence on paid marketing channels.

Operational efficiencies through automation in order processing led to cost savings and enhanced customer satisfaction.

The Group's cash performance remained strong, achieving free cash flow breakeven for the year, a significant improvement from the previous year's £213 million outflow. This was accomplished alongside substantial capital expenditures, reflecting improved profitability and inventory management.

THG also announced a new Ingenuity partnership with leading UK wellness retailer Holland & Barrett (H&B). The deal will see THG Ingenuity become H&B's main e-commerce UK and Ireland operational partner. THG will provide fulfilment and courier management services for H&B's swiftly expanding digital business.

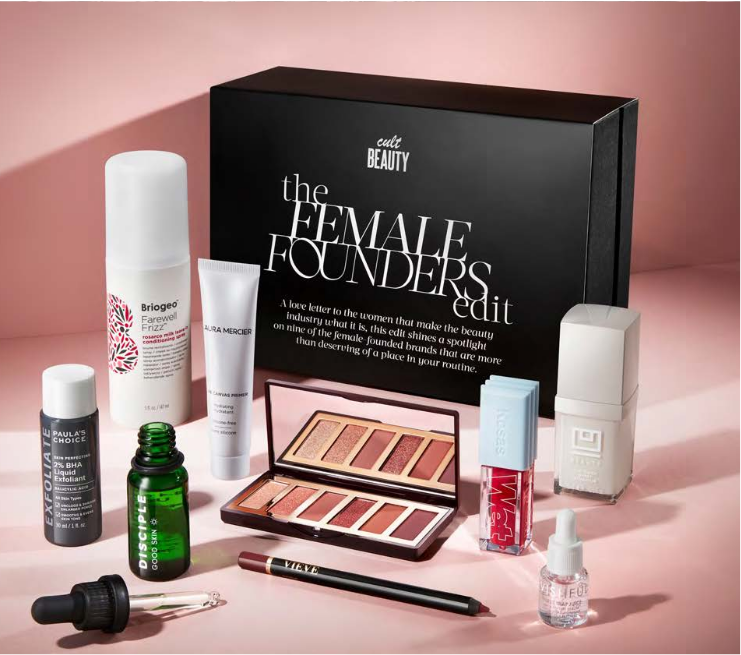

THG Beauty saw a 2.6% revenue growth in Q4, with notable contributions from its brands and Cult Beauty. The UK market, accounting for over half of THG Beauty's revenue, grew by approximately 9%. The focus on higher-margin sales and strategic adjustments in international orders supported a robust margin performance.

THG Nutrition's full-year revenue remained steady, with a record EBITDA performance, benefiting from effective margin management and partnerships in key markets like the UK and Japan. Licensing deals contributed significantly to revenue, with Myprotein emerging as a rapidly growing brand in UK retail.

THG Ingenuity's shift to higher-margin Enterprise clients began to yield results, with significant client onboarding and partnerships expected to boost GMV in 2024. The Group anticipates a positive EBITDA outlook for FY 2023 and continued growth across all divisions in FY 2024. Planned reinvestment in capital expenditures will support long-term growth.

The Group's strategic direction remains focused on individual growth and capital platforms for its three core businesses – THG Beauty, THG Nutrition, and THG Ingenuity – with the prospect of public market listings or partnerships. The Group aims for approximately 9% adjusted EBITDA margins in the medium term.

THG share price.

The THG share price surged 9.67% to trade at 73.7p from Monday’s closing price of 67.2p.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY