Key points:

- Tintra shares jumped this morning on restructuring news

- Tintra continues the already announced changes in business lines

- Out with the old lottery business, in with the new web3

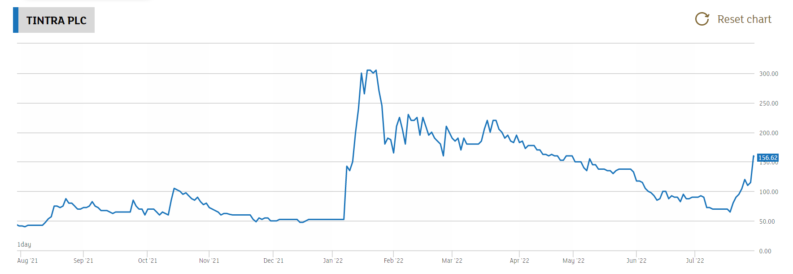

Tintra (LON: TNT) shares have jumped 37% this morning on the release of the AGM statement. That's an odd thing to produce such a share price surge but there we are. What's happened is that confidence in the corporate restructure seems to be rising. That is, it might actually be working. Given that the Tintra share price hit 300p when the idea was first announced back in January and is not, even after this rise, only just above 150p, this would be nice, that the restructure does indeed work.

What happened is that after the excitement of the change in business line TNT shares fell back again. Something that does happen, hope possibly getting ahead of implementation. The actual basic business idea here is that Tintra should stop doing near everything it used to do and do something else entirely. Something which might indeed produce that river of profits that all desire. But, of course, given the entirely different line of business it's to be valued more as an opportunity than as a collection of stable businesses which can be analysed by cash flow and so on.

Corporate transformations, restructures, can indeed work. But obviously the risk profile is different. It's this which is a useful explanation for the volatility in Tintra's share price.

Also Read: Best Financial Stocks To Buy Right Now

The actual change is that Tintra is selling out of, or closing down, all of its old business lines. The lottery business for example. Nothing wrong with it but not really going anywhere, not expanding particularly and no obvious signs that it would do so. There was a capital raise back earlier in the year and that was conditional on exactly that happening – the exit from the lottery business. Selling off perfectly reasonable but low growth businesses to concentrate upon high growth opportunities, yes, this can be a winning strategy.

The obvious caveat here is that the new business lines taken up are in fact high growth and profitable. Which is the point at which we've got the risk associated with Tintra shares – the risks associated with that new business line. For as the company points out: “build out our revolutionary banking platform. That relationship has already proved to be a huge success, resulting in 4 patent applications in the UK and USA along with some major advancements into web3 and the metaverse; we will start to share these soon.

This year has seen a laser focus on building for tomorrow. Our strategy is an unusual one, we are running what in many ways is a private US style VC strategy from a public UK business.”

Well, yes. We can think of this in two different ways. One is that it's about time that the retail investor was able to gain access to those VC style investment opportunities. These days it is indeed the early stages of those online strategies which produce the significant equity gains. On the other hand of course that's also where are the risk is – crypto, metaverse and web3?

Evaluations of those risk profiles is what has to be the start of any trading position here.