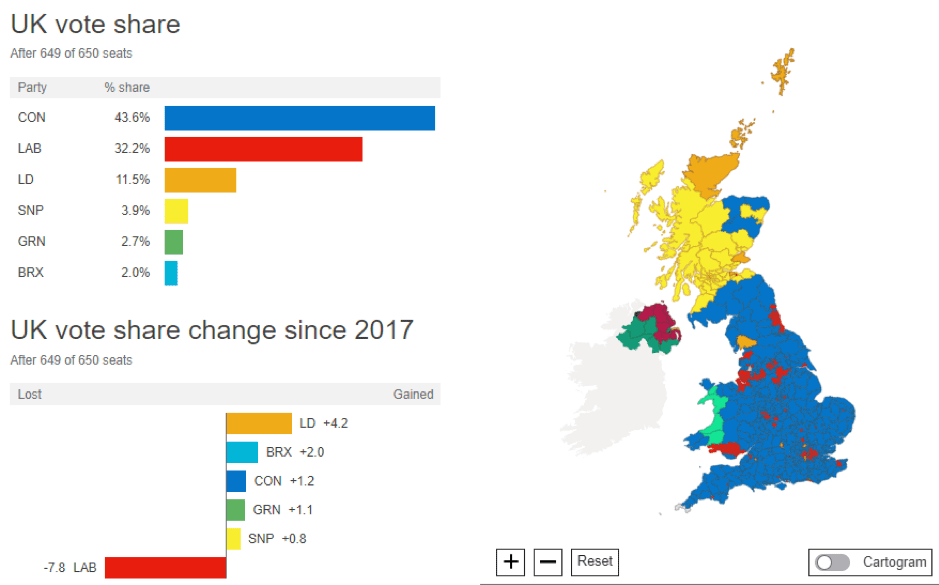

- The UK general election has been decisively won by Boris Johnson’s Conservative party.

- The strength and surprising source of the support for Boris has given political analysts something to think about.

- For the markets, the result makes a move out of the European Union inevitable and provides some political certainty for the next five years.

- A host of related financial ‘barometers’ of Brexit have rallied. Sterling and the UK FTSE 100 gapped up during Friday’s early trading. The German DAX index was up 1.4% in morning trading showing that the eurozone is also optimistic about the idea of a clean Brexit.

With most of the votes counted, the Conservative party look set to secure 364 parliamentary seats. A majority of 78 in the House of Commons means that prime minister Johnson is now able to press forward with his Brexit withdrawal agreement. Or as he has put it during his campaign: “We will get Brexit done on time by the 31st of January, no ifs, no buts, no maybes” (source: Reuters).

The popular support for Johnson and his manifesto is demonstrated by the fact that he won a higher vote share than Tony Blair did during his own ‘new paradigm’ style victory 1997. By 8:30am Friday morning, Johnson had won 44% of the vote compared to 32% for Labour. The last time a UK election was so one-sided was 1987.

The arithmetic at Westminster means that he can manage the splinter groups within his own group with a stick as well as carrot. There is no need for him to horse-trade support with other parties such as the Democratic Unionist Party. He can also look to benefit from the support of the new intake of Tory MPs, in the same way that the intake of first-time female MPs was dubbed ‘Blair’s Babes’ in 1997.

Anatole Kaletsky, chief economist and co-chairman of Gavekal Dragonomics, described the result was a “big surprise” but sees short term opportunities for investors. “For the next year or two this creates a lot of upside for the pound, for a lot of other British assets, British property, British domestic stocks,” he added (source: CNBC).

Having such a free hand and a completely blank canvas could ironically mean that his policies, and Brexit in particular could be more moderate rather than more extreme in nature. The European Research Group (ERG), the EU-sceptical sub-group of the Conservative party will have less influence over the policies decided at number 10. The cabinet reshuffle pencilled in for next week will provide more clarity regarding the new direction of the Johnson government. Jacob Rees-Mogg is one hard-line Brexiteer who will be nervously looking over his shoulder. The markets will be looking to see if Johnson does sacrifice Rees-Mogg. The move would bring the Brexit transition debate closer to the middle ground. He also needs to make way for the young and dynamic politicians such as Rishi Sunak who performed so well during the campaign.

The result has been welcomed by the markets. It means the UK will likely leave the European Union on 31st January 2020, kickstarting a transition period in which the two sides attempt to negotiate a trade deal. The European Union negotiating team can, for the first time in years, negotiate with a UK leader who is secure in their position and able to implement the terms of any agreement.

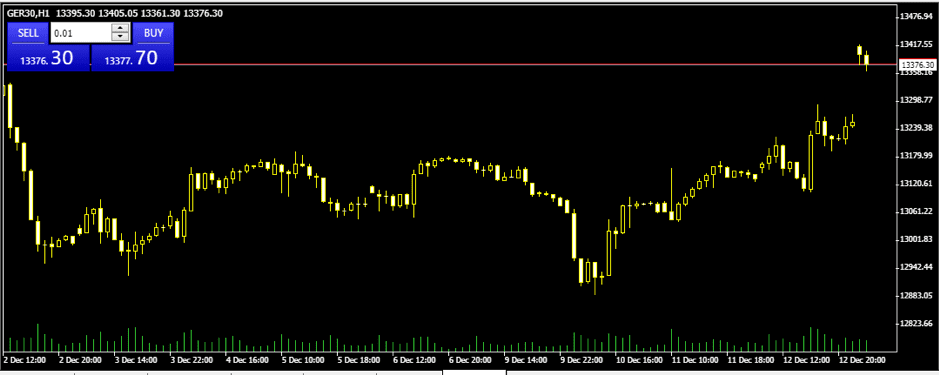

It’s not only the UK-based financial markets that are showing strength on Friday morning. The German DAX equity index rallied and at 11:30am Frankfurt time was 1.40% up on Thursday’s close.

GER30 — 1H 2nd December–13th December 2019:

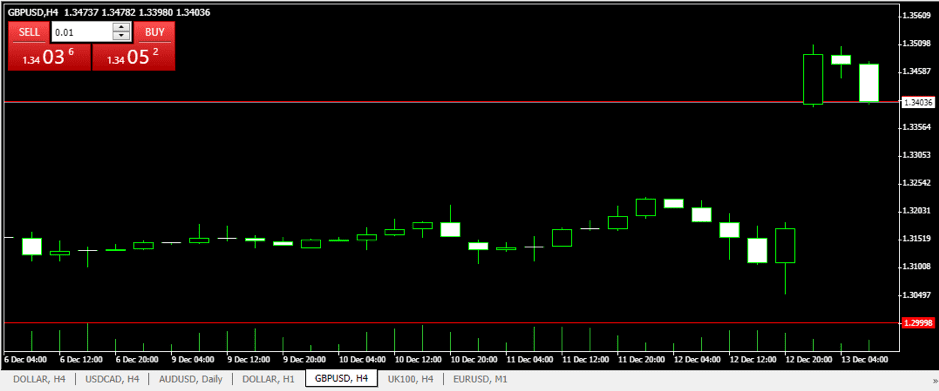

Cable, the GBPUSD forex pair, which continues to be the de facto measure of the probability of an orderly Brexit, gapped up on the release of exit poll data at 10:00pm on Thursday.

GBPUSD — 4H 6th December–13th December 2019:

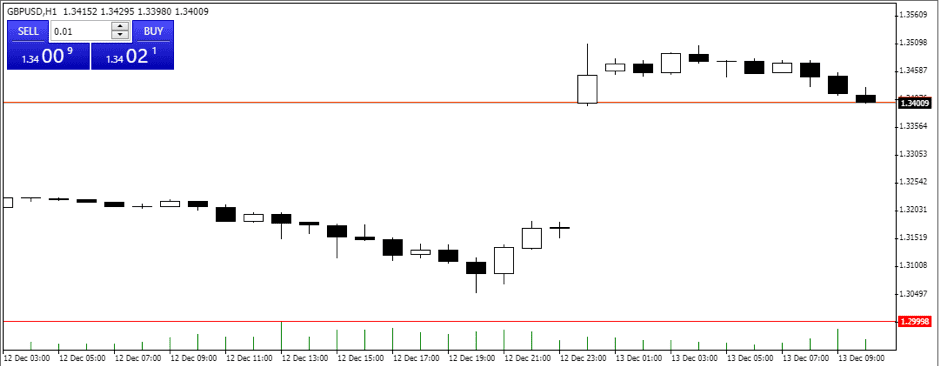

GBPUSD — 1H 12th December–13th December 2019:

After touching the $1.35 level, it has on Friday morning drifted back to the $1.34 area. After a period of strength, GBPUSD might benefit from some price action consolidation. In addition, there’s not too much of a consensus of what the next realistic target for cable is. The $1.35 number has been seen as where the pound might trade as a result of a large Tory majority. However, some have perhaps been tempted to short at that level based on the ‘next steps’ for Brexit.

Indeed, the size of the Tory majority will encourage some with a longer-term investment horizon to work themselves into long positions as early as possible.

GBPUSD — Five-day price chart

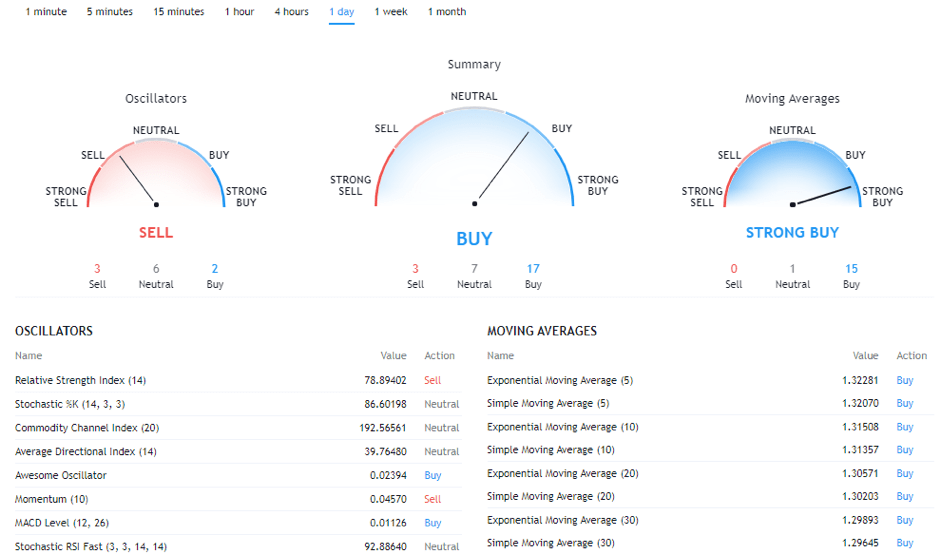

GBPUSD — technicals:

The index of UK large-cap equities also welcomed the election news. Investors always react well to increased political certainty, and the FTSE 100 moved up 1.90% from Thursday’s close. This was despite the index typically benefitting from a weaker pound due to the large number of index constituents who post earnings on non-sterling currencies but profits in pounds and pennies.

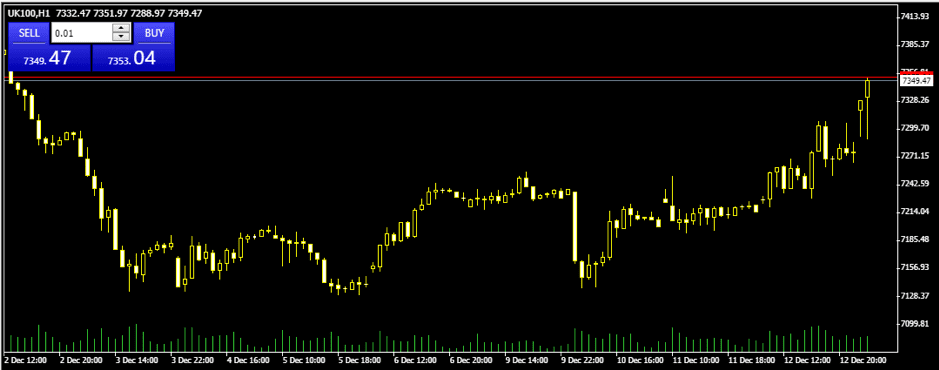

UK100 — 1H 2nd December–13th December 2019:

The size of the Tory majority means there is room for Boris Johnson to show a magnanimous approach to his defeated rivals. That is, once the Labour party and Liberal Democrats have finished conducting their own self-autopsies.

The street-level speeches made by incoming Tory PMs are typically drowned out by anti-government protestors in the nearby streets. Analysts who can’t hear him speak may have to ask for a transcript of Johnson’s speech, but it would be worth reviewing. If the tone is conciliatory, then the passage of Brexit may be even smoother than current price levels suggest.

Such a move would be the cherry on the top of the cake. With sterling strengthening by as much as 2.5% against the dollar, the markets have signalled their approval of the political developments. Dean Turner, economist at UBS Wealth Management, said:

“Just as Boris Johnson was desperately seeking his majority, this result would give the markets their ultimate wish: clarity.”

Source: Reuters