Shares of Travis Perkins PLC (LON: TPK) tumbled more than 8% today after the UK-based construction giant witnessed its profit tumbling 81% for the first half of the year ending June 30.

Construction sites were closed in March and April amid the pandemic and lockdown measures. Sales took a dive by 20%, forcing the firm to slash 2,500 jobs and initiate a restructuring plan with an aim to save around 120 million pounds a year.

“Although our financial performance in the first half of 2020 was impacted by the Covid-19 pandemic, and we have had to undertake a restructuring programme in light of the challenging outlook for the group's end markets, we have made significant strategic and operational progress against the four strategic priorities we outlined at our full year results in March 2020.

Adjusted operating profit was reported at 42 million pounds, crashing from 220 million pounds a year earlier. Revenue was reportedly down 19% on a like-for-like basis to 2.78 billion pounds.

Earlier this month, Travis Perkins suspended the dividend payout due to “ongoing level of uncertainty in the U.K. economy and the group's end markets.”

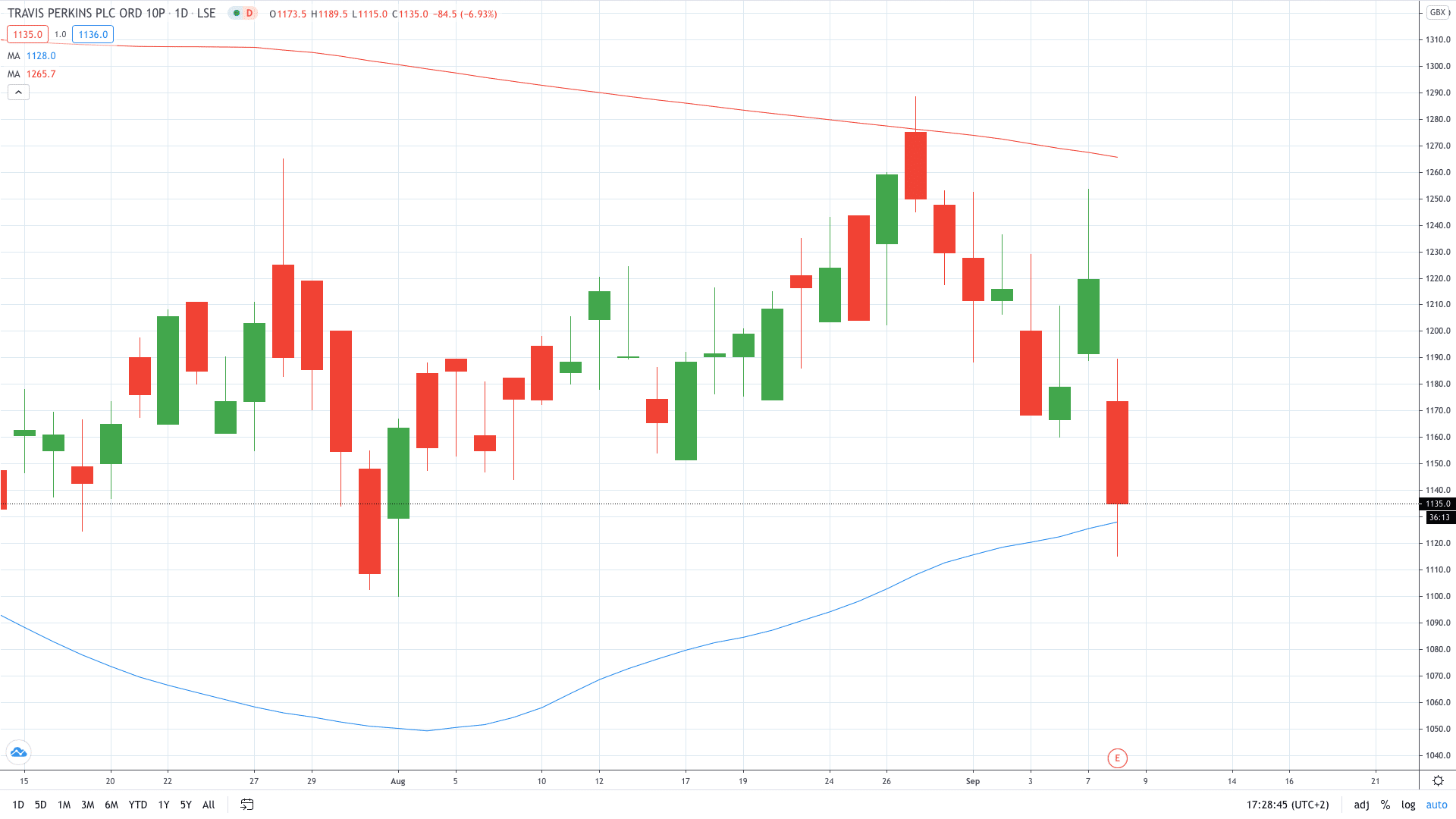

Travis Perkins share price plunged 9% to trade at the lowest levels recorded since the first week of August.

- PEOPLE WHO READ THIS ALSO VIEWED: HERE’S WHY FIRSTGROUP SHARE PRICE SOARED 18% TODAY

- Learn more on how to open a demo account

- Master trading with Bollinger Bands