Key points:

- Tricida stock is down 90% by the premarket tiocker

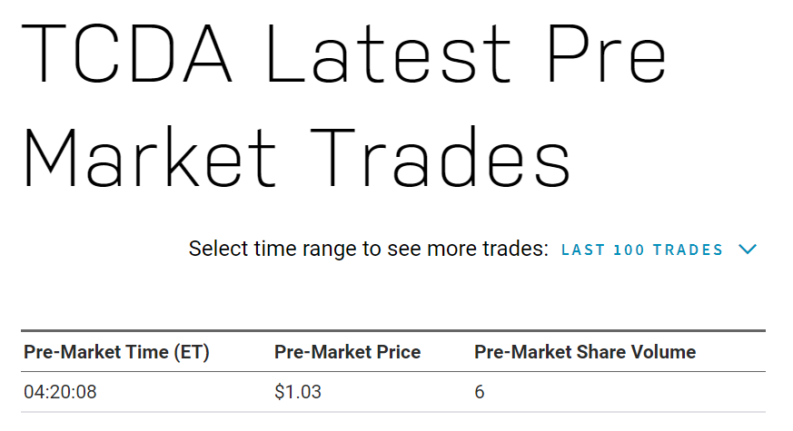

- This is the result of one, single, $6 trade

- This isn't a real price, it'll be impossible to trade in any volume

Tricida (NASDAQ: TCDA) stock is down 90% (OK, 89%) premarket on no notable news at all. This is really particularly odd as the already major owner, Venrock, has been topping up its holdings recently. A major stock owner topping up their holding does not normally presage the sort of disaster that causes a 90% fall in the stock price. Nor is there any other news of great import that would move the Tricida stock price this much.

What has actually happened is that in the very thin premarket trade there's one trade which has collapsed the reported price. This is something that the SEC should perhaps have a substantial look at as we report on such events quite regularly. The last one we talked about was Diebold a couple of weeks back. This could be just simple error but it's also possible that this is market manipulation.

Here the correct answer is to fill your boots with Tricida stock – but the ability to do so is going to be extremely limited. It's easy enough to sell stock wildly below market as has just happened at Tricida, easy enough to buy wildly above it (which is what happened to Deibold). What's very much more difficult is being able to buy in any quantity below market, or sell above it.

Also Read: 5 Best Pharmaceutial Stocks to Watch in 2022

For our purposes here it doesn't matter very much what Tricida does. In fact it's a pharma stock and an 80 or 90% change in price is just about believable for certain of those. An FDA refusal on the one and only drug in the development pipeline can indeed cause that sort of price move. However, that's not what we seem to be dealing with. Quite apart from the fact that we've seen the major holder, Venrock Health Care, top up its holding a couple of times recently, buying in the $8.80 to $9.50 range as it does so. If someone so closely related is buying at those prices a 90% fall to around a $ would be most, most, unusual.

The actual answer is a single trade in the thin overnight markets. It's actually a trade for 6 pieces of stock, a trade with a total value of perhaps $6.

It's possible that that's just a simple error but we'd assume that it's more likely an attempt at either a joke – hey, some people are weird – or an attempt at market manipulation. In this modern world it's possible trade contracts for difference, options and futures when the stock market itself is closed. In the very thin markets of early premarket timings it is – as here – possible for a tiny, tiny, trade to change the ticker reported price. It might – may, just possibly – be then possible to close out one of those speculative positions at that manipulated ticker price.

This isn't something that it will really be possible to trade in any volume. There are two lessons from it though – yes, markets do get manipulated. Secondly, this is perhaps something the SEC might want to have a look at.