Key points:

- Upwork shares continue to slide following Q3 earnings

- The company beat profit expectations but missed revenue estimates

- The current macro environment is weighing on Upwork shares, despite positive demand metrics

Freelance marketplace platform UpWork (NASDAQ: UPWK) recently reported third-quarter earnings, topping earnings estimates but falling short of revenue expectations.

The company reported a loss per share of $0.04 on revenue of $156.9 million. Its loss per share was above analyst consensus expectations of a loss per share of $0.09, while revenue missed, with analysts expecting $157.34 million.

Upwork is a stock that did particularly well during the pandemic, rising from around $5.50 per share in April 2020 to a high of $63.88 in February 2021. However, it has tumbled significantly in the last year or more, down over 64% in 2022 and 75% in the last 12 months.

Still, demand for the company’s platform has grown substantially over the last few years, boosted by lockdown restrictions. While that, of course, wasn’t going to last forever, there has been a switch in working environment behaviour with people and, in some instances, businesses looking for more flexibility and less commitment. We spoke about the demand for Upwork's platform and services earlier in the year, and it has remained strong, despite the company's shares continuing to fall.

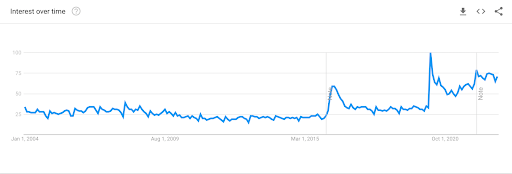

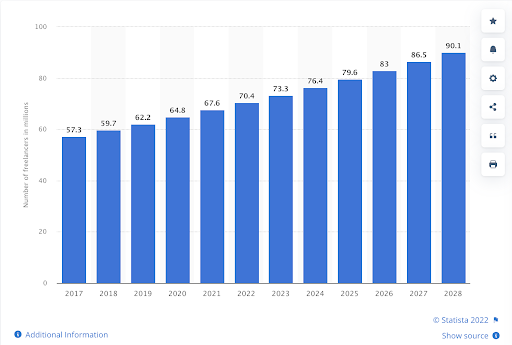

Take a look at Google Trends search interest for work-from-home jobs (something Upwork’s platform has in abundance) over the past five or more years, and we can see the strong upswing, which has only slightly declined since the March 2020 spike. After a slight dip, it looks to be continuing higher. In addition, the freelance job market is forecast to continue its growth over the next few years, providing a reason to be positive about the long-term demand for Upwork’s platform.

Upwork itself said as much in its Q3 shareholder letter, stating that the “sea change is illustrated by the fact that one-fourth of American workers are now working remote-first or mostly remote, while 71% of companies expect remote work to be part of their standard operations moving forward.”

“Our solution satisfies the tight budgets that many organizations are implementing amid economic uncertainty,” they added, pointing to brands such as Anheuser-Busch InBev (AB InBev), Constellation Brands, Cushman & Wakefield, iCIMS, and Marriott International, as companies that joined Upwork during the quarter.

However, the current economic climate means investors should, of course, be wary at this current time.

Following its third-quarter release, Piper Sandler analyst Matt Farrell told investors in a note that he remains optimistic about Upwork’s ability to execute, especially due to the cost savings opportunity the company’s platform offers clients in the uncertain environment. Still, he noted that management forecasted macro headwinds to remain, but the majority of weakness comes from Europe and SMBs. Farrell cut the firm’s price target on the stock to $18 from $33, maintaining an Outperform rating.

Elsewhere, JMP Securities analyst Andrew Boone lowered the firm's price target on Upwork to $18 from $33, keeping an Outperform rating on the stock after its Q3 results. Boone commented in a note to investors that the company highlighted weakness in small-medium businesses and Europe during the quarter but also saw demand stabilize.

Overall, out of eight ratings noted by TipRanks, seven Wall Street analysts have a Buy rating on Upwork shares, while one has a Hold rating on the stock, with the average price target at $20.75, representing a potential 69.5% upside in the stock.

While the current macro environment means I am on the sidelines, based on demand metrics, Upwork is a stock that, over the long-term, I like.