Key points:

- Upwork shares plunged last week following its Q2 earnings report

- Demand metrics are strong

- However, signs of easing and competition from LinkedIn are potential headwinds

Upwork (NASDAQ: UPWK) shares tumbled following its second-quarter earnings results last week, despite topping expectations as investors' concerns emerge about a potential slowdown.

Even though it beat analyst estimates, with revenue rising 26% to $156.9 million, the freelance marketplace company saw signs of softening growth, with the pace of its revenue growth slowing compared to the previous year. In addition, active clients grew to 807,000 from 725,000 last year, but again, the pace has eased to 11% from 27% the previous year.

Gross Services Volume in Q2 was just over $1 billion, with year-over-year growth of 19%.

All things considered, there was always going to be a slowdown compared to last year when many people were still in some sort of lockdown, and working from home was still very much encouraged.

Overall, I still like the stock, but some slight concerns are emerging. Here is what I will be watching for signs of a demand downturn:

Competition

Upwork is one of the biggest freelancer platforms and reportedly has over 12 million registered clients. However, the competition is strong, with the likes of Fiverr and Freelancer.com competing for dominance in the space.

Furthermore, LinkedIn is a new entrant to the space, recently rolling out its freelance service globally after gaining 2 million users in a smaller US beta test.

Also Read: Biggest Winners From Early Q2 Earnings Reports

With its already formidable presence as the go-to social network for professionals, LinkedIn could represent a significant challenge to Upwork as the premium freelance marketplace. It is something I will be keeping an eye on.

Web Data

Considering Upwork is a web-based platform, analyzing traffic to its website is prudent.

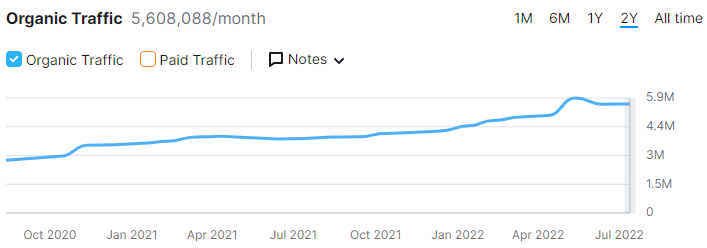

From the Semrush chart above, we can see web traffic stats for Upwork.com, with the top chart showing the past two years and the bottom showing traffic since 2015. Unsurprisingly there has been a significant rise over the last few years.

However, it has slightly tailed off in the last couple of months, and while it is by no means anything to be concerned about just yet, I'll be watching where it heads from here as a continued decline will represent a potential fall in demand.

Google Trends

Another metric used to analyse demand is Google Search Trends.

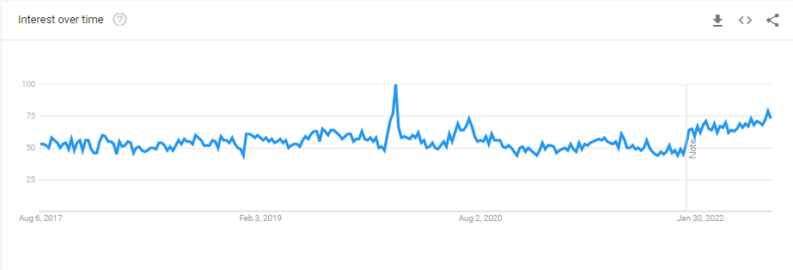

When looking at Google searches for “freelance jobs,” It is somewhat surprising that the pandemic didn't result in a more substantial rise in search intent, although there was an initial spike. However, since the end of 2021, there has been a sustained increase.

Alternatively, searches for “freelancing” have surged and show no sign of a turnaround. We will keep an eye on these search trends as a sign of a potential decline in the overall market.

Bottom Line

While there are emerging concerns for Upwork, the overall demand picture is still relatively solid. In addition, there are increasingly more companies using freelance workers to fill gaps or add expertise on a short-term basis. With the current rise in lay-offs and the pace of hiring decreasing, we could see demand for freelance, short-term workers increase.

Even so, the recent slowdown for Upwork and the emergence of LinkedIn as a potential competitor can't be ignored. I'll be keeping an eye on any signs of a more significant decline in demand for Upwork's platform.