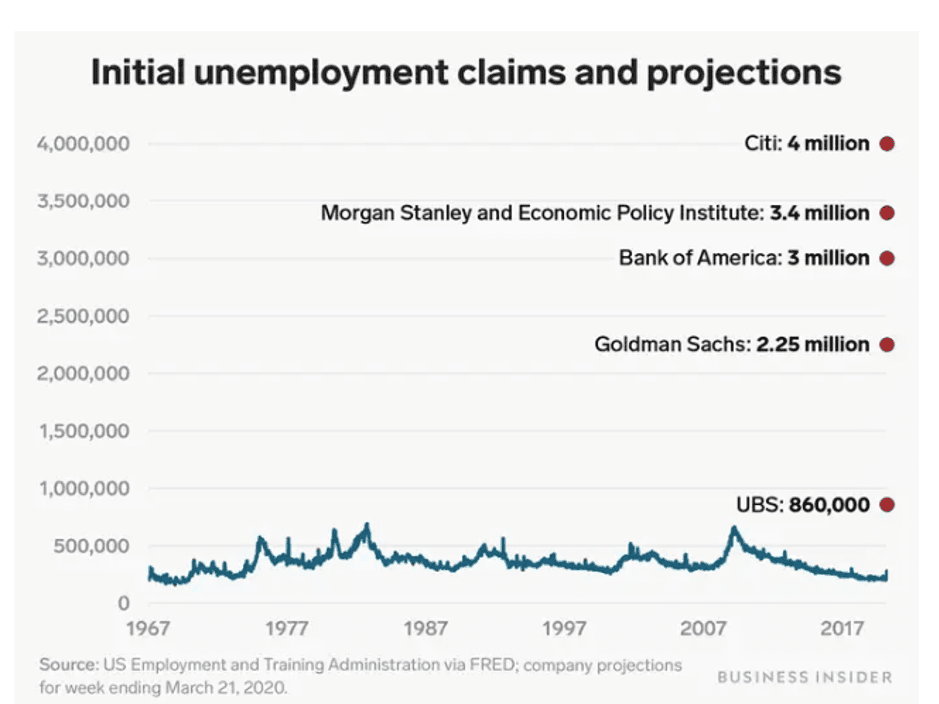

- Thursday saw the US release key Initial Jobless Claims data which confirmed unemployment has surged during the coronavirus pandemic.

- The number of new unemployment claims made in one week was a staggering and record-breaking 3,001,000.

- The build-up to the report saw analyst forecasts offer an alarmingly wide range of outcomes. Even the experts can’t agree.

- While the most extreme outcome was avoided the numbers were near the higher end of the range.

- When markets take such news in their stride and rally, it’s time to catch the trend to the upside.

US jobs data released on Thursday has broken all records. In the space of one week, over three million new claimants have submitted claims for benefits. The number of claims made in the previous week, which was also a time of increased concern about Covid-19, was 282,000. The coronavirus disease is shutting down the US economy and breaking up its workforce. At the same time, and possibly paradoxically, equity markets have rallied.

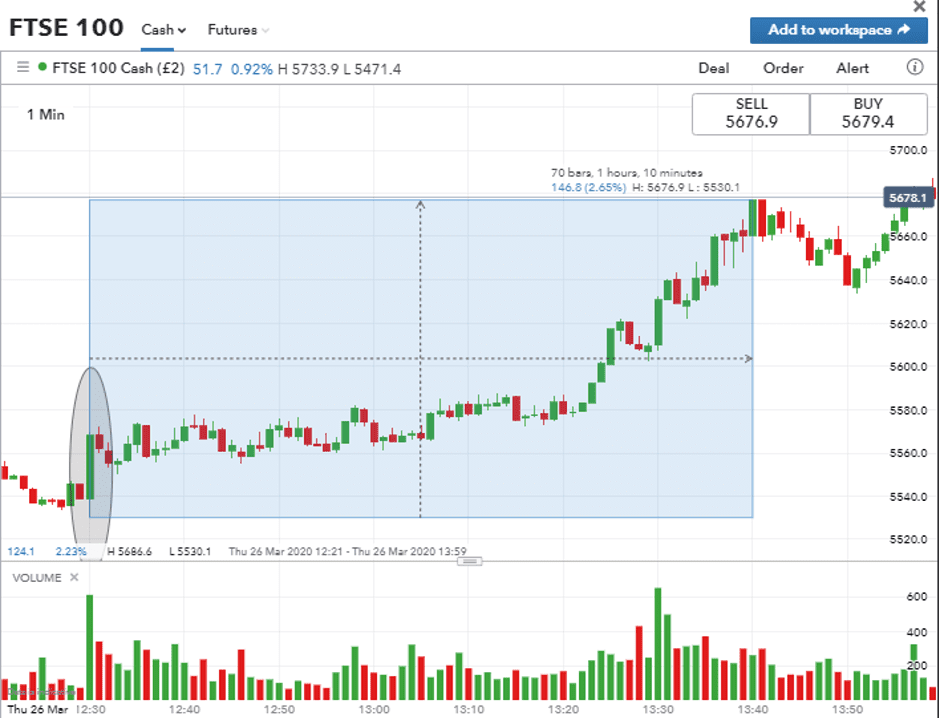

The one-minute price chart for the FTSE100 index shows the break-out following the job data release at 12:30 UTC. In the space of 70 minutes, the index rose 2.65% in value.

FTSE100 – 1m Candles – intra-day 26th March

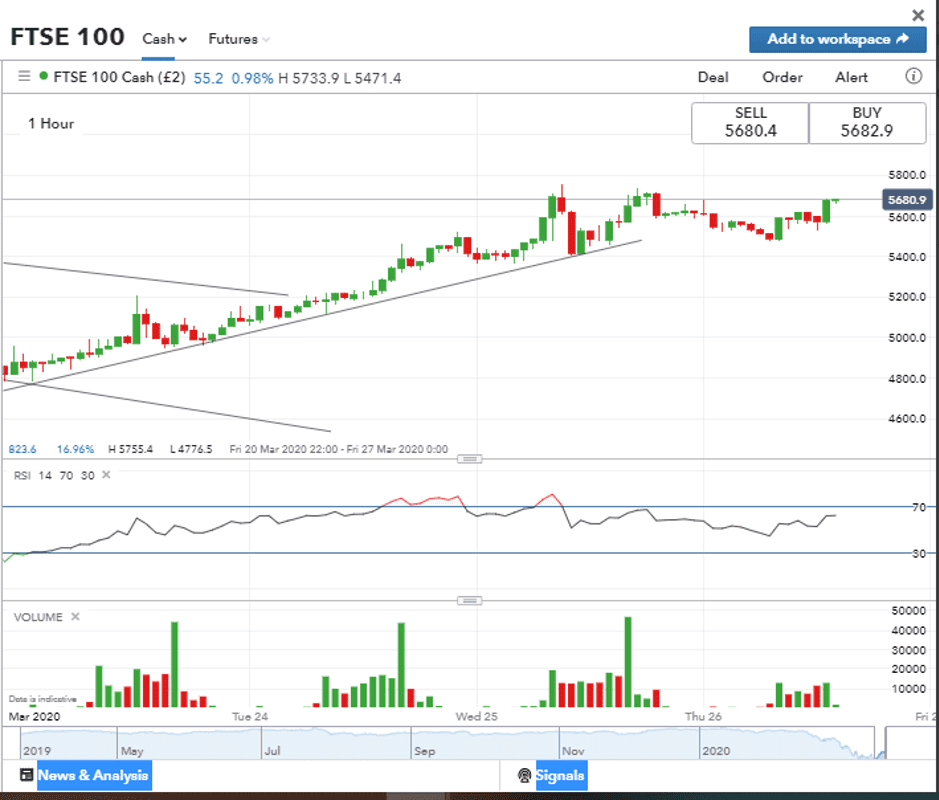

The hourly candle chart for the FTSE100 shows the RSI at low enough levels to allow for further price increases. Trade volumes have also dropped, suggesting we may be entering a calmer period. With selling pressure falling away, buyers would be more inclined to ease themselves back into positions.

The rally needs to be put into context. In the run-up to the jobs data, Martha Gimbel, an economist at Schmidt Futures, told Business Insider: “The numbers are literally unbelievable”. Estimates ranging from below 860,000 to 4mn were made by analyst teams at esteemed banks, the professionals who are paid handsomely to get close to the actual number. Describing how the finance industry was struggling to get to grips with monitoring the situation. Gimbel said: “This is happening at a pace and a scale that our brains can't comprehend”.

Source: Business Insider

It turns out that the Bank of America was closest to the actual figure. Something to note and potentially profit from when the next data release is due.

The bounce

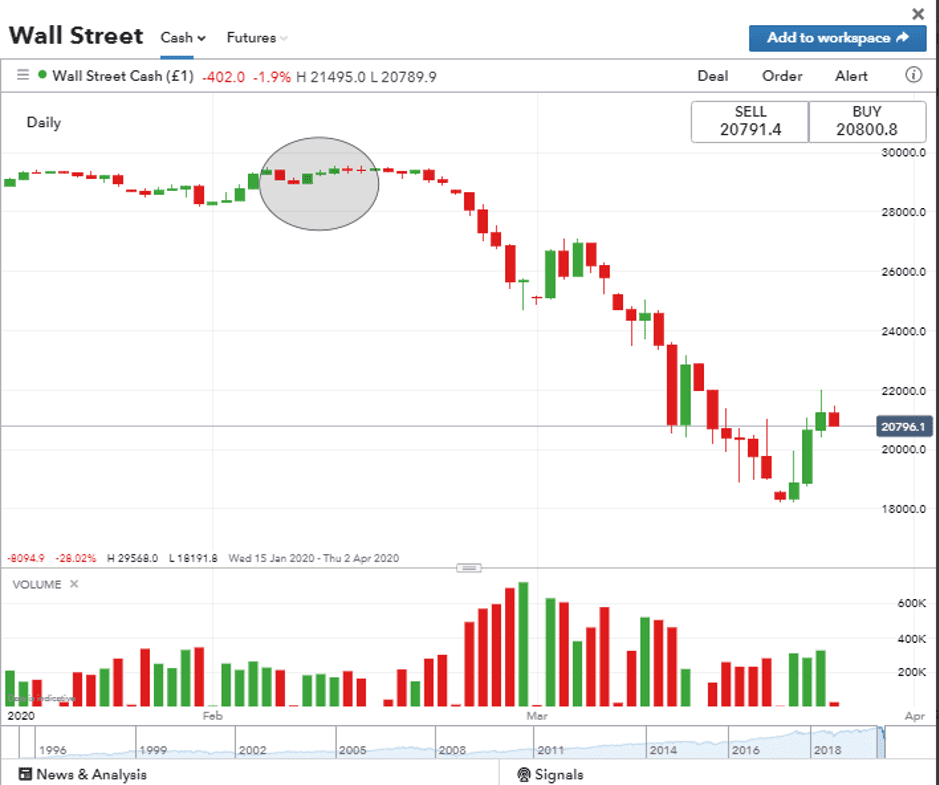

It’s clear that a lot of investors and traders are seeing this as ‘the bounce’. The last time that Wall Street equity indices posted two consecutive up-days was back in February. The chart taken from IG shows the three green candles in a row on the 10th, 11th and 12th Feb. It also shows the recent rally over a longer time scale and this week’s rally could potentially be seen as more of a retracement against the long-term downward trend.

Wall Street – Daily candles – 14th Jan 26th Mar 2020

Big ‘up’ days are as much a feature of volatile bear markets as are big ‘down’ days. Many maintain that this might not necessarily represent the bottom of the market.

Equity indices

One of the straightforward ways to play an uplift such as this is going long on one of the global equity indices. Broking platforms allow traders to buy a basket of equities in one single wrapper and minimise single stock risk. Another attraction of the indices is they trade on an almost 24/5 basis. Given the extra volatility in the markets it’s appealing for many to hold a position in an instrument that has less exposure to gap risk. Due to the liquidity in the markets, they often have tight bid-offer spreads.

Is this the bottom?

What is most encouraging for the bulls is the apparent disconnect between fundamental data and market prices. This is, they say, the reverse of the process of last week when the dash-for-cash meant all assets fell in price as traders scrambled to safer and more liquid assets. The job numbers couldn’t have been much worse but serious amounts of cash are now returning into riskier asset groups. It looks like the tide, for now at least, has turned.

Another reason for adopting a bullish outlook is that the current rally was triggered by emergency measures which finally worked. Attempts to support the markets were drip-fed in through the first half of March. The US Fed’s double-whammy of two emergency rate cuts on 3rd and 15th March only fuelled the sell-off, but at the level of 18,000, the government intervention has led to increased buying pressure.

Veteran investor Bill Ackman, who heads up the listed fund Pershing Square Holdings Ltd (PSH.AS), wrote to his investors on Wednesday. He reported P&L of $2.6bn as of March 23rd. Explaining the positions that allowed him to profit from the market collapse he said “subsequent market falls” had made him more positive on the outlook. This looks like he thinks prices found a floor. The catalyst for him now shifting from short to long positions is the steps taken by US state governments to limit the spread of the disease and the $2tn US aid package.

Ackman said: “We became increasingly positive on equity and credit markets last week, and began the process of unwinding our hedges and redeploying our capital in companies we love at bargain prices that are built to withstand this crisis, and which we believe will flourish long term.”

Source: Reuters

More hands-off traders or those who don’t have the resources or time to study individual stock names in the way Ackman does can still profit from the uplift. It won’t be plain sailing though and prices at these levels may encourage short sellers to move back into the market.

Not out of the woods yet

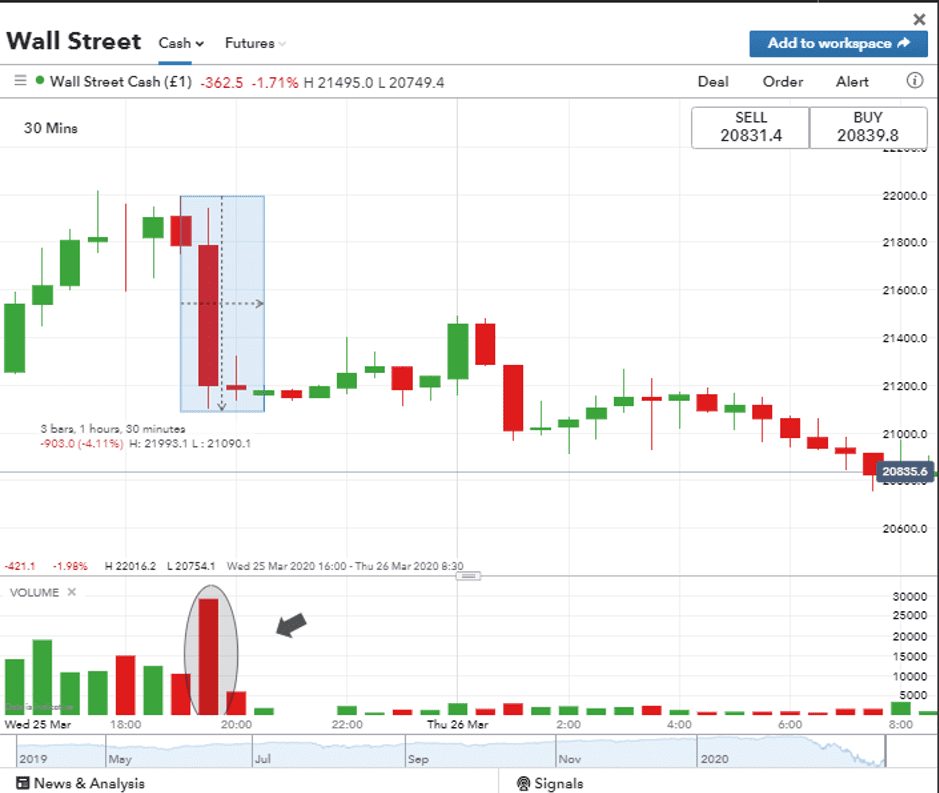

Wall Street on Wednesday saw a significant downturn as the markets headed to the close. In the space of one hour, the Dow Jones index fell by more than 4%. A move associated with extra trading volumes as the bears came out in force.

Wall Street – 30min candles – 25th – 26th March

Speaking with the BBC on Thursday, Laura Lambie, senior investment director at Investec Wealth Management, explained the reasons to not take the recent rally as a sign that markets are out of the woods, saying: “I suspect we’re going to see continued volatility in the markets until we see a peak in the virus occurring in the US… I can’t see that we’re going to get a raging bull market until we can see exactly what is happening in terms of company earnings going forward over the next month or two.”

Source: BBC News

One other thing to consider is that the jobs data number doesn’t tell the whole picture. Business Insider noted that: “Gimbel says weekly claims are actually an undercount of economic pain, because not everyone qualifies for unemployment. They also don't include workers who have had hours cut due to the coronavirus-induced slowdown, people who are self-employed, and even those unable to file due to the unemployment website crashing from overuse.”

Source: Business Insider

Chaos theory

The timing of the US aid package might look like an astute piece of business by the country’s authorities. Holding off on making the announcement and allowing prices to fall even further has, of course, caught the eye of Ackman and others who have been looking for the bottom of the market. The problem with that theory is that the timing was a result of political bickering holding up its release rather than a decision to let the bears run out of steam. At a time of national distress, the US Congress and the White House only came to an agreement due to the political risk associated with them appearing impotent in the face of eye-popping unemployment numbers.

Napoleon famously preferred his generals to be “lucky rather than clever” and it looks like the leaders of the US political parties may have lucked out.

Next steps, G-20

With the jobs data now out in the open and considered ‘priced in’, there is time to map out the next key news events. Thursday also sees the G-20 countries hold a virtual meeting. World leaders will hook up on a call to discuss the global approach to the pandemic. The timing is unfortunate as the US, in particular, is subject to partisan political infighting which might spill over into worsening international relations.

The world’s two major economies might need to be left to fight it out before calling a truce, but negative news coming out of the G-20 meeting will further spook markets.

Frank Lavin, the former US Ambassador to Singapore and the CEO of Export Now in Singapore was speaking with CNBC on the subject. Lavin said China’s foreign ministry spokesman used “extraordinarily bad judgement” when he suggested the coronavirus may have been brought to China by the US military.

His analysis of the US response to the disease used the terms “chaotic” and “almost insane”.

“For a nation that has typically been viewed as a leading international body and generous collaborative partner — the US is viewed as a day late and dollar short”, Lavin said.

Source: CNBC

Lavin’s comments may appear to be ‘undiplomatic’. Equally damming though are the more measured words of James Crabtree an associate professor at the Lee Kuan Yew School of Public Policy in Singapore. Demonstrating his mastery of the art of understatement Crabtree said: “It is very hard to imagine that US – China relations are going to be better at the end of this crisis.”

Source: CNBC