Key points:

- USG is the US Natural Gas ETF

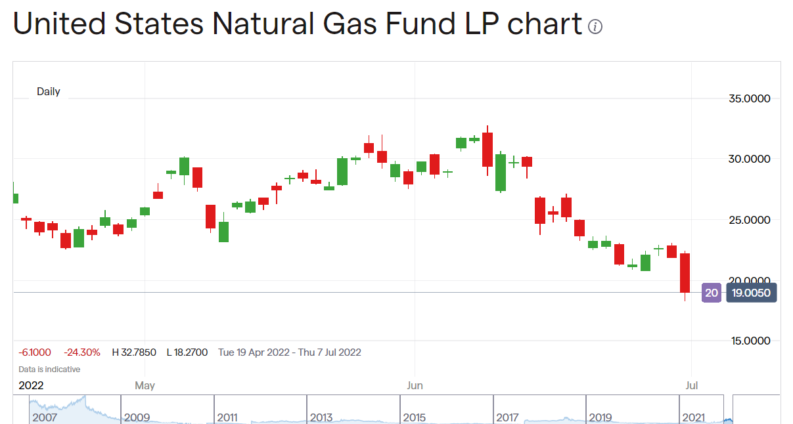

- It dropped 13% yesterday on news about the delay to the Freeport LNG plant reopening

- For a likely number of months that Freeport plant is going to be the probable USG price determinant

Does the United States Natural Gas ETF (NYSEARCA: UNG) stock price really depend entirely upon the issues at Freeport in TX? The answer is that, in the short to medium term, yes. Because the US natural gas price largely depends upon that liquefied natural gas plant as well, therefore the ETF does. It's exactly why the UNG stock price fell 13% yesterday, with a small recovery today. Because the natural gas price fell 16% on the back of news about Freeport.

The issue is that natural gas markets are geographically separated. Gas is a difficult thing to transport, requiring either a pipeline or LNG plants at both ends of a sea trip. This is why the European gas prices (there are several of them, even Europe is not just the one market) are multiples of the American natural gas price. The background there being that the US allowed fracking for natural gas, most of Europe does not. Thus the Henry Hub (the main US benchmark price) is markedly lower than those European prices.

We know what happens next. People try to export from an area of low prices to one of high prices. Which is what that Freeport plant does. As with others as well. However, there aren't enough plants to handle the entire potential flow of gas from the US to Europe. Therefore gas prices have not moved toward each other so as to be the same.

Also Read: What Are Exchange Traded Funds?

The theoretical background here is from David Ricardo who published in 1817 – enough time for everyone to grasp it. The price of tradeable goods will be the same everywhere – after we account for transport costs. The reason is that if the price is lower in one place then people will buy, ship, sell and make a profit. The US natural gas price has been lower than that in Europe as a result of fracking. But there's no pipeline to Europe and there were few LNG plants. As more plants were built then more gas was shipped.

But the Freeport plant – which handled some 17% of the trade – recently was damaged and now is closed. This means that some portion of exports cannot happen, pushing down US gas prices. Then yesterday came the news that the regulators had found unsafe conditions at the Freeport plant and wouldn't allow it to reopen. That means more gas backing up in the US, unable to be exported, pushing US natural gas prices down.

That price drop will reverse when one of three things happens. The first, and the one that will take longest, is that US consumption of natural gas rises as a result of the lower prices. That's a years long process. The second would be that gas production declines – but a fracking well tends to produce at volume for 18 months before declining. So production for that next year or so is pretty much already baked into the system. The third is when Freeport opens again – or other similarly large LNG export plants come online. And as that's the shortest timescale of the available three then yes, the UNG stock price does rather depend upon what happens at Freeport.