UK Stock News

View All >US Stock News

View All >Latest News

Palo Alto Networks Adjusts AI Strategy Amid Market Concerns

Palo Alto Networks (NASDAQ: PANW), led by CEO Nikesh Arora, is revising its approach to artificial intelligence (AI) by focusing o

IonQ’s Stock (NYSE: IONQ) Continues Steady Gains off Recent Lows

IonQ's stock (NYSE: IONQ) is making higher lows, with the recent rally off $22 continuing a trend that has seen the price gain 25% since March 10th. Up 0.95% through this morning's pre-market, the bulls look to turn around wh

Barclays Shares (LON: BARC) Pause for Breath After Stellar Run

Barclays' shares (LON: BARC) have paused for breath in recent days, giving back 1.05% today, and 4.03% in the past 5 sessions after a breathtaking run over the past year. With the stock price having gained 57.9% over the past

Microvast’s Stock (MVST) Gives Back Some Gains Pre-Market

Microvast's stock price (NASDAQ: MVST) is down 7.1% through this morning's pre-market, giving back some of the impressive gains (+32.48%) seen through yesterday's session. The company, a global provider of next-generation bat

B&M Shares (LON: BME) Cut in Half, Bounce off Lows

B&M European Value Retail shares (LON: BME) have given holders little to smile about in recent times, as the FTSE 250 listed retailer has seen it's value halve over the last year. The recent bounce off 52-week lows howeve

Topps Tiles ‘Need the March Trends to Continue’

Topps Tiles (LON: TPT) reported a 4% increase in first-half revenue to £127.7 million, driven by strong trade and digital sales, but analysts caution that sustained growth is necessary to meet full-year targets.

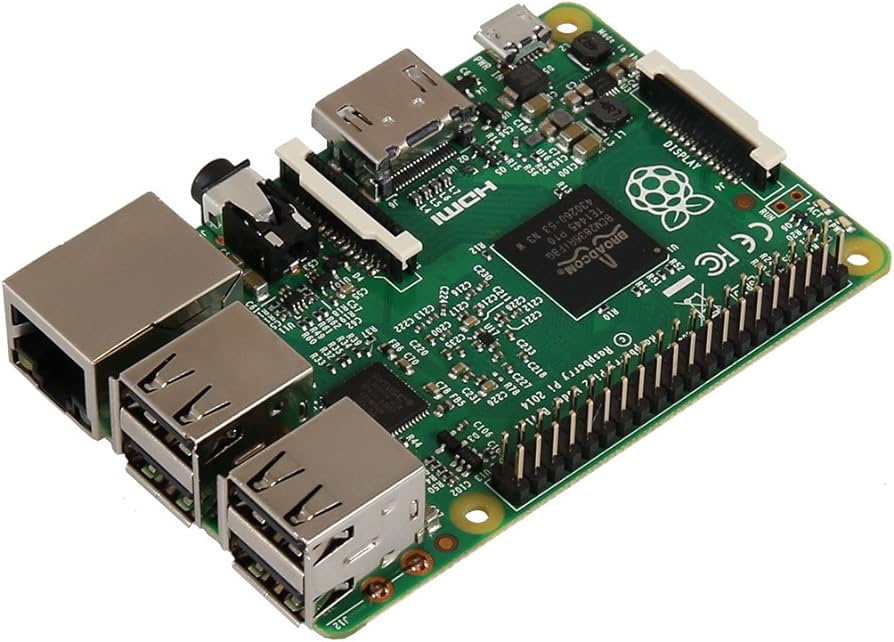

Raspberry Pi Shares Jump as ‘Medium-Term Fundamentals Remain Positive’

The Raspberry Pi (LON: RPI) share price rose on Wednesday, opening at 490p, up from Tuesday’s close of 470.8p, as the company expressed confidence in its long-term growth prospects despite reporting a decline in revenue and p

FTSE 100 Enjoys Positive Start to Q2 Having Recaptured 8,600

The FTSE 100 index ended the first day of Q2 in positive fashion, up 0.61% having recaptured the 8,600 level. Wh

AstraZeneca Shares (LON: AZN) Gain as Golden Cross Develops

AstraZeneca shares (LON: AZN) have gained 1.44% today, as the 50 day MA tests a cross of the 200 MA. This is a bullish technical development followed by chartists, comm

Sainsbury’s Shares Make 52 Week Lows as YTD Decline Stretches to 17%

J Sainsbury shares (LON: SBRY) are down 2.97% today, hitting fresh 52 week lows of 226p after coming under pressure that has brought the YTD decline to 17.26%. The company, a stalwart of the UK retail landscape, has also see

Microsoft Hits New 52-Week Low Amid Analyst Downgrade

Microsoft Corporation (NASDAQ:MSFT) recorded a new 52-week low of $367.24 in trading to kick start the week, as markets started the week risk-off, only to rally into the close. The new low of the year comes on the same day as

Barclays Reiterates Underweight for Rocket Companies

Barclays analyst Terry Ma has maintained an underweight rating for Rocket Companies Inc. (NYSE: RKT), keeping the price target steady at $10.00. Rocket Companies, known for its focus on the mortgage lending sector, has shown

BlackBerry Stock Price (NYSE: BB) Holding Steady With Earnings on Deck

BlackBerry's stock price (NYSE: BB) gave up the gains of the year in March, with the 1 month decline of 14.12% leaving BB back where it started the year. Trading up a little over 1% in this morning's pre-market, holders will

Lululemon Stock Drops Below 200 Day MA as YTD Decline Reaches 24%

Lululemon's stock price (NASDAQ: LULU) has come under increasing pressure since earnings, with the past 5 trading days (-17.48%) making up a significant portion of the year-to-date decline (-23.97%).

Greencore Group Shares Jump as Full-Year Profit Guidance Raised

The Greencore Group (LON: GNC) share price surged more than 7% on Tuesday morning after the UK convenience food manufacturer raised its full-year profit guidance. [stock_mark

Wise Has Long Runway to Continue Capturing Market Share

JPMorgan initiated coverage of Wise plc (LON: WISE) on Monday, assigning it an Overweight rating and a price target of 1,242p. The bank cited the company’s strong pos

Elon Musk’s xAI Acquires Social Media Platform X for $33 Billion

Elon Musk's artificial intelligence company xAI has acquired the

What is Happening to Wolfspeed’s Stock Price (NYSE: WOLF)

Wolfspeed's stock (NYSE:WOLF) plunged 51.86% during Friday's trading session, closing at a multi-decade low of $2.59 on exceptionally high volume of 175.9 million shares, significantly above its average of 22.7 million. This

FTSE 100 Starts Week Down 1% as Gold Continues To Hit Highs

The FTSE 100 index witnessed a significant decline at the opening, dropping by 1.09%, equivalent to almost 95 points, bringing the index down to 8,564 points.

US Stocks to Open Lower as Quarterly Win Streak Set to Break

U.S. markets are seemingly set to continue the downtrend into the new week, with pre-markets firmly negative this morning following three consecutive days of losses into Friday. Several factors are contributing to the negativ