- While the coronavirus outbreak continues to dominate the headlines other reports are trickling into the market and revealing trading opportunities.

- Reports on business sentiment and confidence might not usually move the markets to any great extent but this week they have been seen to shift global equity indices by as much as 2%.

- The data due this week will offer some of the first insights into quite how bad things are.

- It could also signal a shift in terms of which of the global markets traders should be buying at this time.

- China, the country which was at the forefront of the outbreak looks poised to be the first to bounce back.

Wey Fook Hou, chief investment officer at DBS Bank:

“We believe a lot of negatives have been priced in. In particular, we see value in China and Singapore markets, as they trade near/at GFC levels.”

Source: CNBC

The rollercoaster ride being endured by the global markets has slowed slightly. As markets adopt a more sideways pattern, analysts and traders are increasingly giving time to economic data reports which are more ‘standard’ in nature. Several reports are due for release on subjects such as business confidence and consumer sentiment. They offer an insight into what and where dip-buyers should be focussing their attention. It looks like they could also have a disproportionate effect on asset prices.

During the peak of the crash Business Sentiment reports and the like were largely dismissed as being backdated too far. There was little benefit to be gained from ‘old news’ generated before COVID-19 reached pandemic status.

The statements due this week will be more up to date and will offer a first glimpse of how the business community and consumers are coping with the lockdown. The first of the releases was on Tuesday when better than expected China PMI data triggered a global stock market surge. The EU Stocks 50 index (IG: EU Stocks 50) increased in value by 2.8% in the space of four hours. There was also a nice uptick in trading volumes as it looked like cash was taking this as a sign that there is light at the end of the tunnel.

EU Stocks 50 – 1H candle – 27th March – 1st April 2020

Looked at from a higher level, the rally during the European morning session looks like more of a blip. The move may have petered out but a price shift of more than 100 points offers traders a chance to make substantial profits. Unlike the COVID-19 news flow, the data reports are scheduled in a pre-determined calendar.

Data Mining

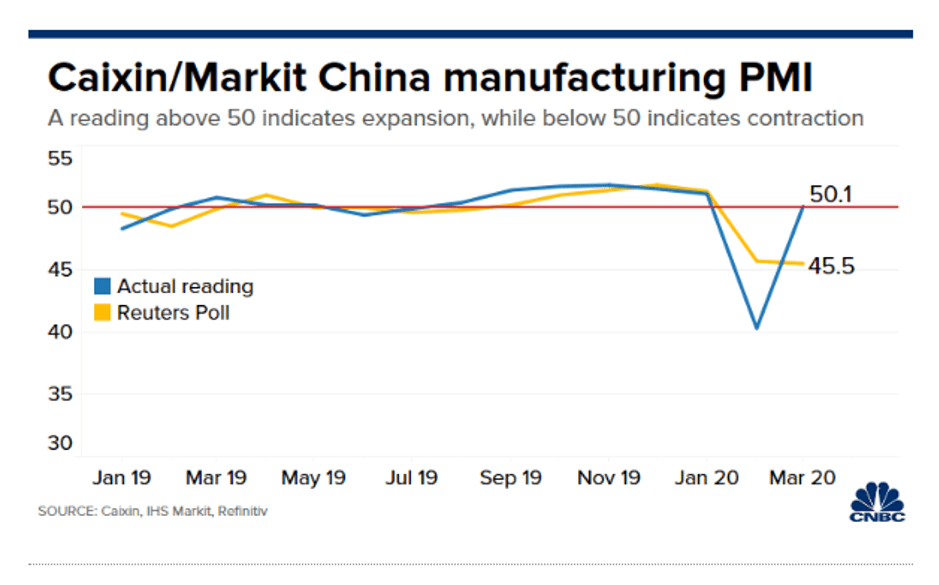

The China manufacturing purchasing managers’ index (PMI) jumped to 52.0 for March, up from 35.7, and the services PMI rose to 52.3 from 29.6. It’s always wise to take China data releases with a pinch of salt but the news that the recovery in manufacturing had exceeded expectations had repercussions for global markets. The news was taken as a sign that the recovery in China might be ‘V’ shaped and as a result it became a buy signal for equities across the world. Sebastien Galy, the senior macro strategist at Nordea Asset Management, said:

“We continue to believe in a China led economic rebound and this process is in its early phases and should amplify helped by some pent-up consumer demand.”

Source: Market Watch

Timing

No-one knows if the next market move will be up or down. There’s a strong case for both arguments. Those committed to scaling up into riskier assets would do well to consider the diverse timeframes of different markets.

While China was reporting business getting back to normal the news in the US demonstrated the time lag between the two countries. US President Donald Trump addressed the nation on Tuesday and adopted a grave tone when saying, “this is going to be a very, very painful two weeks”.

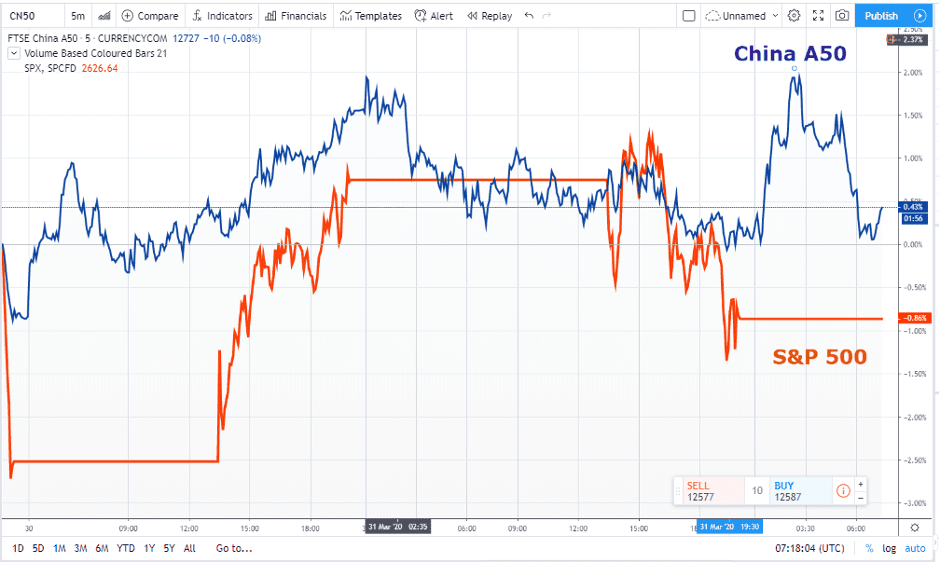

The charts of China and US equities currently show a similar pattern. Those taking the view that this is going to change over the next week would look to be overweight with the China A50 and underweight with US indices such as the Dow Jones, S&P 500 and Nasdaq.

The chart comparing the China A50 and the S&P 500 over the last three days shows the beginning of a divergence. If the news flow from the respective countries carries on as it is then this could well become something of a trend.

China A50 vs S&P 500 – Three-day price chart – 30th March – 1st April 2020

Even a slightly longer time frame – the five-day comparison shows that until now the view appears to have been that China is still suffering a month-long lockdown and we don’t know how bad things will be in the US. That situation has changed.

China A50 vs S&P 500 – Three-day price chart – 30th March – 1st April 2020

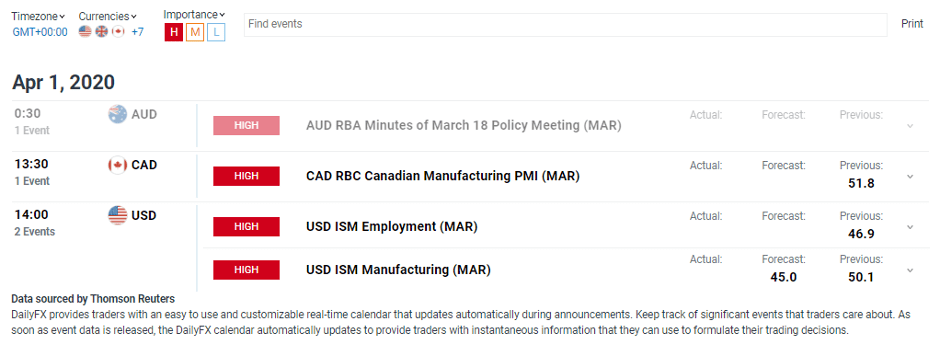

The timeline of data releases will offer traders an opportunity to have their strategy plans confirmed. The US Institute of Supply Management (ISM) data for March is due out on the 1st of April. The forecast for Manufacturing ISM is 45.0. This already marks a significant drop from the previous month’s number of 50.1. Anything below 45.0 could well cause a sell-off in the US and markets may already show some nervous characteristics in the run-up to the release.

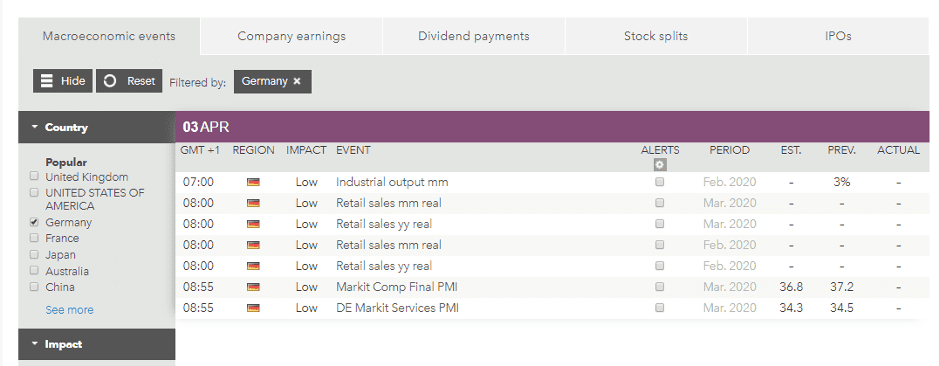

Eurozone countries also release PMI data this week. On Friday, a range of consumer, service sector and manufacturing surveys will hit the markets. The reports are usually categorized as ‘low’ significance but the interest already being shown in them flags up that this set of data might offer an insight into how economies are holding up.

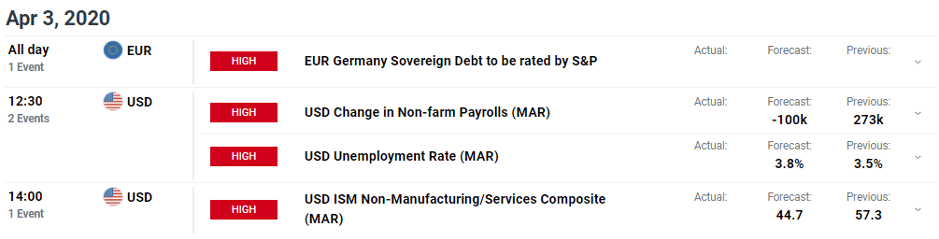

The other big number due this week will be released on Friday. It could provide another trigger and entry point into trades which are long China and short USA. The non-farm payroll job numbers are always keenly anticipated, however, with the US economy experiencing a shut-down it’s likely the actual and forecast numbers could differ greatly. The analyst forecast for monthly change is a suspiciously round number. The estimated cut of 100,000 jobs looks like guesswork. That isn’t surprising given the underlying situation but it does open the door for price volatility when the real number is announced.

Trading the China A50 index mitigates single stock risk. Given the current situation, risk-management is, of course, a major concern. Those with a more aggressive approach to risk-reward might be looking to buy Chinese equities. These have become much more mainstream over recent years. The market which was once closed off to outsiders now allows international investors to trade the well-known global brands.

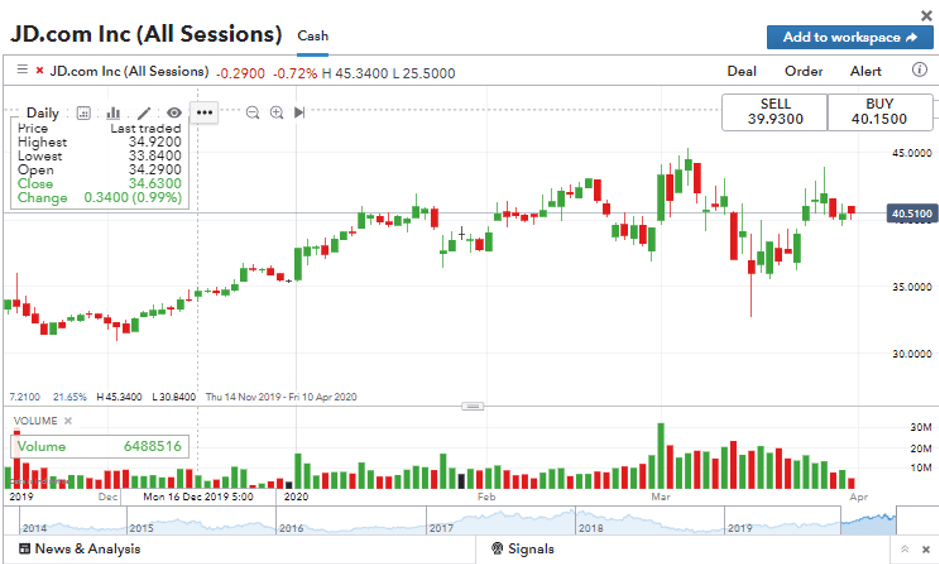

E-commerce giant JD.com Inc has a listing in New York (JD) and the share price has held up relatively well during the COVID-19 crisis. Offering a signal that it is primed for further recovery it announced an aggressive marketing campaign on 25th March. It has already rolled out a plan which involves giving 1.5bn yuan ($212mn) worth of coupons for branded goods in categories including electronics.

Investor Place is positive about the prospects for JD. Luke Lango wrote:

“Even though consumer spending trends in China got whacked in the first two months of the year, JD.com management said in early March that they still expect the company’s revenues to grow by 10% or more in the first quarter of 2020. That’s pretty impressive.”

Source: Nasdaq

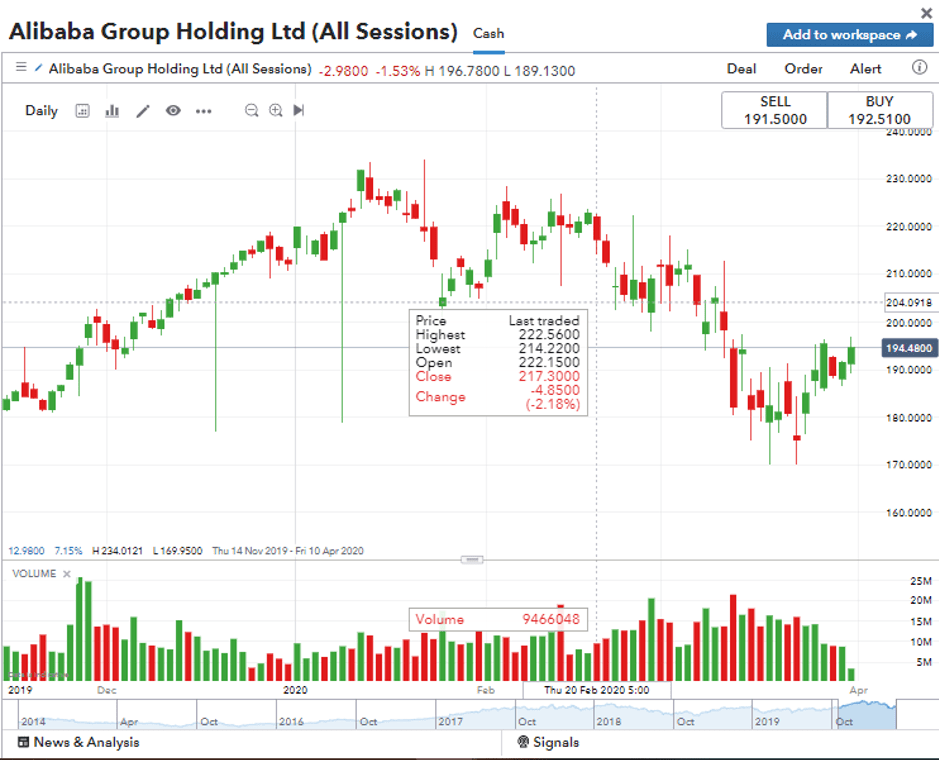

Alibaba is also listed in New York (BABA). The daily price chart has longer tails on the candles suggesting investors could be in for a bumpier ride than if they bought into JD. This might suit shorter-term trades looking to take advantage of the extra price volatility. Those considering holding a position for a longer time frame might want to consider the views of Lango:

“The best Chinese stock to buy for a second-half rebound is Chinese e-commerce and cloud giant Alibaba.”

Source: Nasdaq

Of the analysts which cover GSX Techedu Inc (GSX), 10 out of 12 have tipped it as a ‘buy’ or ‘strong buy’.

The stock price shows how the online-learning firm has benefited from populations across the world being put into lockdown.

The pandemic is still the major driver of markets. Investors are desperate for clarity on when the peak of the event might be due. Establishing that could encourage them back into the markets on a massive scale.

The reaction of the markets to the China PMI data released on Tuesday opens the door to more traditional price-triggers. Given the reputation that China has for massaging the numbers, the underlying theme could well be a recovery in Asia and negativity in the US.

The advice given by Wey Fook Hou, the chief investment officer at DBS Bank, is valuable to traders operating under all time-horizons:

“We do not know how long the pandemic will last so it will be prudent to spread out your dry powder over a longer period than to invest 100% of your cash at one go.”

Source: CNBC