The outbreak of Covid-19 has seen an enormous impact on the way we work and socialise, but there is also the argument that we will see a permanent change to forex markets as a result of the pandemic.

One of the most significant impacts we have seen is the flight to safe haven currencies…

Of course, during times of increased uncertainty, that is what we should expect, but one safe haven stood out from the crowd this time and seemed to be the only currency investors wanted to hold. I am obviously talking about the U.S. dollar, or ‘King Dollar' as it's otherwise known.

If we take a look at the DXY (dollar index) chart below, we can see that since early March (when coronavirus cases really started to ramp up) the U.S. dollar made significant gains.

Now, take a look at the USDJPY chart where the dollar increased significantly against the usual safe haven of choice for most investors.

Why is this important?…

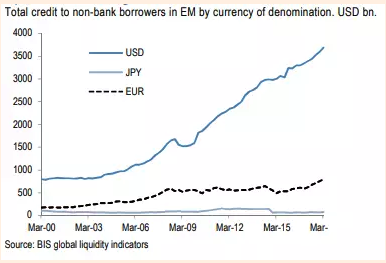

Well, countries such as Turkey, Iran, Russia, Argentina, South Africa, Chile and even China are sitting on enormous amounts of U.S. dollar-denominated debt.

Many of these emerging market economies were able to accumulate vast amounts of U.S dollar-denominated debt to kickstart their economies back in the 1990s.

And, because their own currencies were stable, there wasn't too much risk associated with the borrowing.

But, with the dollar surging, it has become increasingly harder for these countries to pay their debts, and with market risks not looking like they will go away anytime soon this debt bubble could quickly burst.

These countries simply don't have enough foreign cash reserves to repay their debts.

So, where do we go from here?

Well, I started off by talking about the COVID-19 impact on currency markets, and I want to circle back around.

The pandemic has brought about change, as mentioned, and I think that change will also come about in the form of the monetary system.

The emergence of cryptocurrencies has seen countries begin to develop their own Central Bank Digital Currencies (CBDC).

I believe they will use the threat of the coronavirus spreading on surfaces (I.E. cash) to push for CBDC's, but that's not all…

By changing the monetary system and moving from cash to digital currencies, which by the way won't work like Bitcoin or other cryptos as they will make sure they still have centralised control over it…

…Central banks will be able to devalue that all-important U.S. dollar-denominated debt we spoke about.

Meaning those countries will again be able to afford to repay those debts and not default.

And, the central banks also get the added bonus of preventing bank runs in future and a greater ability to oversee payments and transactions. A win-win for them.

So, while I believe we will see some change in the way we work and interact in the future, I think the most significant change will come in the forex markets and more specifically the monetary system, where the coronavirus pandemic could change everything.