In the early 1980s, commodities traders William Eckhardt and Richard Dennis often discussed ways to prove that anyone could learn how to effectively trade in the financial markets. At the time, both traders were widely renowned in the trading world for their phenomenal abilities with investments. Richard Dennis alone was known for turning a $5,000 trading account into over $100 million and his lively discussions with William Eckhardt revolved around the factors that led to success or failure with new traders.

Essentially, Dennis believed anybody could be taught to master the futures markets but Eckhardt was much more skeptical. Instead, Eckhardt argued that Dennis had years of training and experience that enabled him to beat the market and profit from his approach to trading. As a result, Dennis devised an experiment that could be used to test his hypothesis and prove that even a complete novice is capable of learning the strategies needed to master the market make consistent gains through trading. So what is the Turtle Trading strategy?

Turtle Trading Experiment

To settle this classic debate, Richard Dennis found a group of people with no experience in the world of finance. Using his own money, Dennis opened large trading accounts for each person and began teaching his basic rules to beat the market. Needless to say, this type of experiment was largely unprecedented given the significant monetary risks involved when trading with real money. However, Dennis firmly believed in his ideas and he was willing to put this money at risk in order to prove his point.

The training sessions conducted by Richard Dennis would last for just two weeks but each person in the could repeat the lessons as many times as they wanted. He referred to his students as his “turtles,” which was an allusion to the turtle farms Dennis visited previously in Singapore. This affectionate name also referenced the fact that Dennis believed he could help his trading teams grow quickly and efficiently, just like the farm grown turtles he encountered in Singapore.

To find his team of Turtles (and settle his bet with Eckhardt), Dennis bought advertising space in the popular financial newspaper The Wall Street Journal. Thousands of people applied with the hope of learning how to trade from one of the world’s most widely acknowledged masters of commodities trading. From the list, just 14 traders made the cut and were accepted into the first Turtle Trading program.

Unfortunately, nobody knows the exact personal criteria that were used by Dennis to select his applicants. However, we do know that the process involved a series of true/false questions which included:

- In trading, most of the money is made when an investor can buy an asset when prices hit their lows following a large downtrend.

- It’s unproductive to monitor every price quote in the markets traded by an investor.

- It’s productive to follow the market opinions of other traders.

- If a trader has a trading account size of $10,000, each trade should risk $2,500.

- Once a trade position is established, investors must know the precise price location to start liquidating if losses are encountered.

How did you score on the quiz? Of course, some of these questions are clearly opinion-based and open to interpretation. However, according to the Turtle Trading method, questions one and three are false.

Questions two, four, and five are true.

Turtle Trading Rules

Richard Dennis specifically instructed the first group of Turtle Traders to utilize trend-following investment strategies. Essentially, the Turtle Trading system firmly believed that “the trend is your friend, you should ride it until the end.”

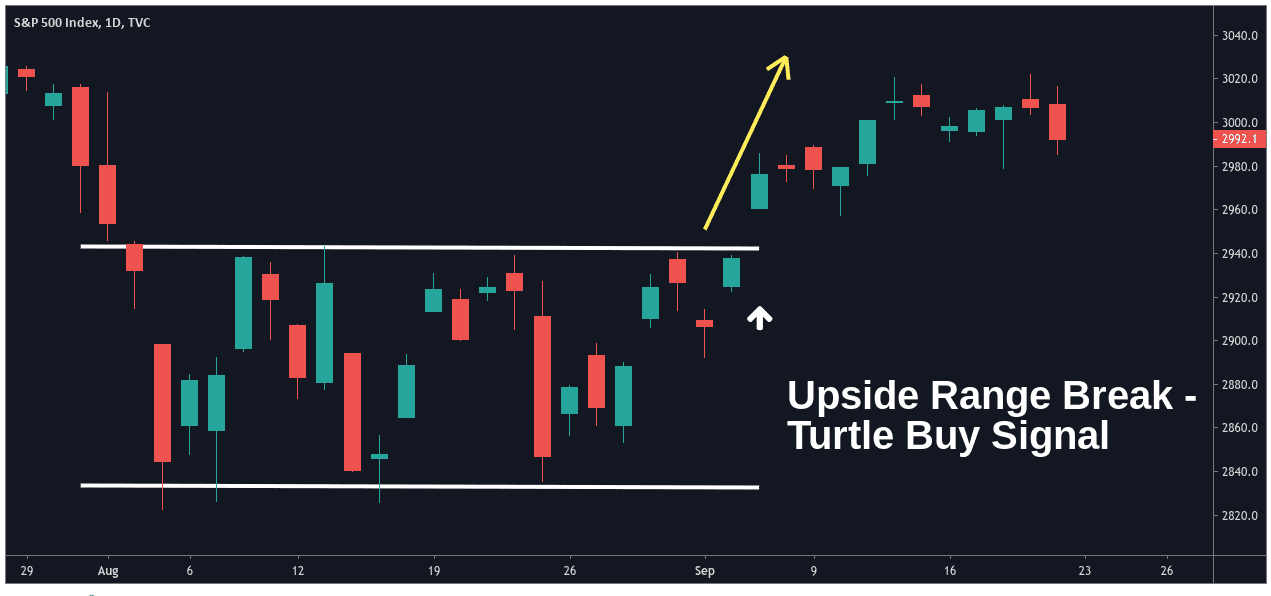

To identify these trends in their earliest phases, investors were instructed to find trading ranges in the market and buy futures contracts that are making a breakout move higher.

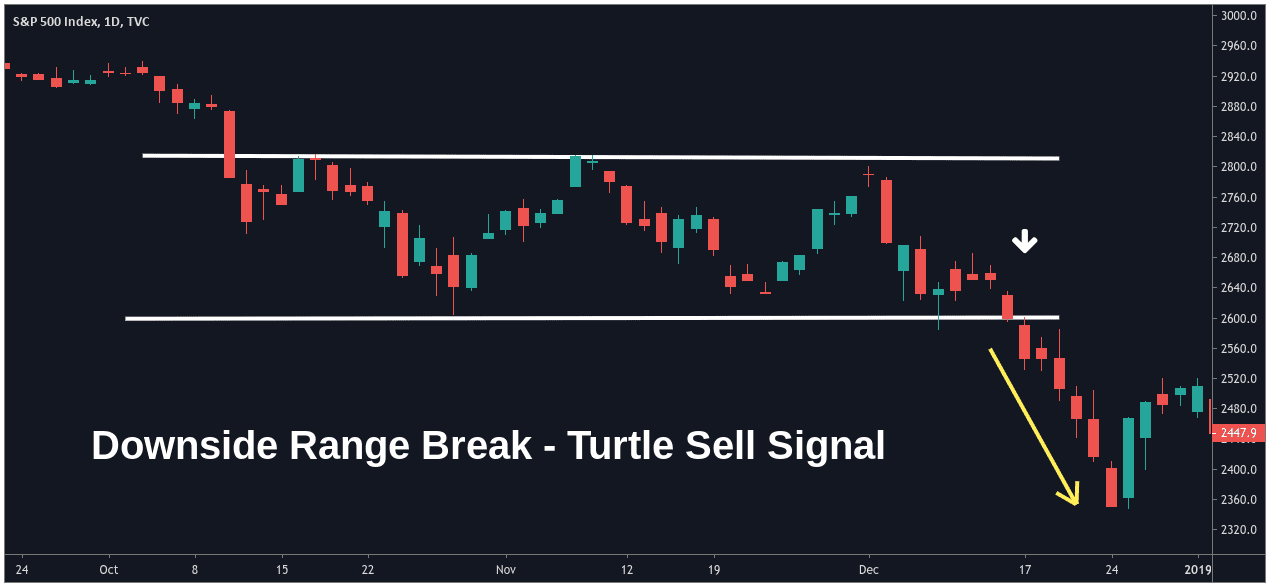

Conversely, investors were instructed to sell short futures contracts after they fall through support levels (in a breakout to the downside).

In his instructions, Richard Dennis informed his group of Turtle Traders to avoid relying on information from the newspaper or television. Instead, the group was instructed to solely watch prices. Clearly, the Turtle Trading strategy relied on technical analysis strategies (rather than fundamental analysis of the market.

Dennis also established additional parameters, which included:

- Buying futures as they reached a 40-day high and then exiting the position if prices fell below the 20-day low.

- Planning exits at the same time trade entries are planned. In other words, traders should always know when to take profits and when to cut losses.

- Calculate market volatility using the Average True Range (ATR) and use these indicator readings to adjust position sizes.

- Establish larger trading positions in markets characterized by lower volatility levels and reduce position sizes when market volatility rises.

- Be prepared to carry trades through significant drawdown periods, as this is the only way to exercise the patience needed to capture substantial returns.

- Exercise flexibility with the parameters that are set for all buy/sell signals. Be willing to test different value parameters for different assets and find the levels that work best in each market.

- On any single trade, never risk more than 2% of the total account size.

Success Rates – Did the Turtle Trading Strategy Actually Work?

According to published accounts by former Trading Turtle Russell Sands, the two groups of Trading Turtles that were trained personally by Richard Dennis earned over $175 million in just five years’ time. As a result, Dennis was able to prove beyond any doubt that beginner traders are fully capable of successfully mastering the market. Sands explained that the system’s strategies still work and tend to perform best in markets that are trending strongly.

However, even without the help and instruction of market masters like Richard Dennis, it’s still possible to follow the basic tenets of Turtle Trading on an individual basis. The general ideas of the system involve buying upside breakouts and selling downside breakouts once a trading range has been overcome by the market. Once the position is open, Turtle Traders watch for periods of consolidation or reversal as a signal to close the trade. Essentially, any time frame can be used when viewing the market and placing trades. However, broader time frames (i.e. daily charts) tend to produce the best signals and exit signals must utilize shorter time frames in order to capture maximum profits.

Despite the initial successes of the Turtle Trading system, it must be noted that the potential downsides could be as large as its upside. Specifically, the typical drawdowns that might be expected with a simple trend-following trading system can be substantial in some cases. Trend-following systems work well in some market scenarios but can sometimes fail miserably in cases where price volatility reaches heightened levels. This is largely due to the fact that many price breakouts ultimately turn out to be false market moves, and this can quickly result in a significant number of negative (losing) trades.

Turtle Trading Still Has Its Advantages

Overall, the Turtle Trading story remains one of the stock market’s greatest legends. While many analysts have attempted to debunk the processes outlined by the trading strategy, the moral of the story is that anybody can learn to successfully trade the financial markets in a relatively short period of time. All that is required is some initial research, the establishment of a trading plan, and the internal fortitude to stick to that plan even in cases where the market is working against a position. Essentially, the Turtle Trading story shows us that a group of novice traders were able to master the markets and generate substantial profits in the process.

Of course, this doesn’t necessarily mean traders should rely on any single strategy for all market environments. Historical backtesting results tend to show that trend-following systems tend to be correct in only 40-50% of all market environments. Some analysts would argue that this trading probability is no better than flipping a coin and that trend-following strategies should be abandoned altogether. This is because traders can expect to experience significant drawdowns that might fall outside of the risk tolerance levels that are suitable for many investment portfolios.

SUMMARY

- The Turtle Trading experiment is one of the great success stories in the history of the financial markets.

- The Turtle Trading strategy was developed by Richard Dennis in order to prove that even the most inexperienced traders were capable of mastering the financial markets and becoming profitable investors.

- The trading system developed by Dennis utilized trend-following strategies that enabled a group of novice traders to generate returns of roughly $175 million in just five years.

- Most of these gains were accumulated in market environments which were characterized by strong momentum and clearly defined price trends.

- Some analysts have criticized the system, saying that it can only provide accurate signals in 40-50% of all market environments.

- However, the successes of the initial trading groups show that any investor can start trading in the market (even with very little experience) and still find ways to accumulate significant profits when following a well-structured investment system.

People Who Read This Also Viewed: