ETFinance is a relatively new name in the industry although they are backed by the established Magnum FX, which is headquartered in Cyprus. Our team was very impressed with how quickly the firm has taken off.

The broker began operating in 2019 and is already regulated by the highly regarded Cyprus Securities and Exchange Commission (CySEC) within their home country of Cyprus and across Europe.

Besides being regulated, they are also award-winning and pride themselves on being able to provide commission-free trading on all accounts to traders in most countries around the world.

What can you trade?

ETFinance Forex Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €215 | Good | 1:30 | Low |

Their Forex offering has a wide and impressive range of instruments to trade. Traders have access to a total of 62 currency pairs for trading, which includes all of the major currency pairs like GBP/USD, EUR/USD. USD/JPY, the minor currency pairs and some exotic pairs.

The many currency pairs available to trade should provide you with plenty of flexibility when trading with this broker.

You also get very competitive rates and costs when trading forex pairs, which vary depending on your account type. Spreads on the top-tier platinum accounts start from as low as 0.03 pips, while the entry-level silver account offers spreads from 0.07 pips, which are still very competitive.

We were pleasantly surprised to discover that every account type offers commission-free trading, which is great for all its clients. Commissions can eat into your Forex trading profits, hence, commission-free trading can lower your trading costs significantly.

Traders get the standard 1:30 leverage mandated by the CySEC’s regulations, however, professional traders can have access to as much as 1:500 leverage since they are regarded as sophisticated investors. Traders with a professional account are allowed to take on more risk, which could lead to higher losses, which is a major drawback for most traders.

ETFinance CFD Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €215 | Good | 1:30 | Low |

Traders get access to hundreds of CFDs when trading with ETFinance across a wide range of assets classes. There are CFDs on stocks, metals, commodities, cryptos, indices, and ETFs among others, which you can easily trade.

We found that the transparent pricing offered in the Forex space by the firm was carried over to CFD trading where all costs are clearly outlined. The pricing structure should appeal to traders who are looking for a low-cost broker who offers very competitive pricing on all tradable assets.

Trading CFDs allows you to buy or sell the underlying assets without having to actually own the assets such as a stock or an index.

ETFinance Stocks Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €215 | Good | 1:5 | Low |

We had to mention the fact that traders have access to over 150 instruments under the stock CFDs category, which is quite impressive for such a young company.

There are no additional commissions charged on the stock CFD trades, except for the very competitive spreads offered by the firm. Traders based outside the US have access to a wide range of US stocks such as Facebook and Google, which they can easily trade as CFDs.

The huge number of stocks available to trade really sets the company apart from its competitors making it a great choice for most traders.

ETFinance ETFs Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €215 | 4 | 1:10 | Low |

For anyone interested in trading ETFs, there is certainly a diverse range of those available to choose from as well. You can invest in the likes of financial, industrial, or energy sector ETFs and they even offer access to the booming cannabis market via one ETF.

ETFs are a great option for those who wish to diversify their portfolio and trading experience, again at the best possible rates.

What did our traders think after reviewing the key criteria?

Fees

This is the part of our analysis where we felt that the firm excelled above many others in the sector.

Their dedication and commitment to providing a commission-free environment for traders is noticeable and quite rare in the industry, which is a huge win for you as a trader.

Our team felt strongly that the fees levied by the broker were both fair and very transparent across every market and account type. There very fees in place at all and those that are there are clearly outlined.

Account Types

There is a stellar choice of account options for you as a trader. Naturally, this starts with the demo account which is convenient and fast to open, giving you a taste of what is to come when trading with the broker.

Moving to live trading, we noted a selection of three distinct account types to choose from that is laid out in a tiered format. Starting with the Silver, then the Gold, and finally the Platinum level account.

This is the perfect combination to satisfy your trading needs at every level, with more benefits being unlocked as you progress through the account levels, particularly in relation to the spreads available.

Platforms

When it comes to the trading platforms available, you will be pleased to discover that you get access to the Metatrader platforms, which include the MT4 and MT5 platforms, and the bonus Webtrader.

Through this package, you not only get to trade using the most reliable and well-known trading platforms but you also get access to their advanced technical capabilities when it comes to creating professional trading tools and charting capabilities.

These are some of the core reasons why we are always glad to see the Metatrader platforms available, and why the platforms remain a mainstay in the industry used by the top forex traders.

With MT5 you get a top trading platform that can effortlessly handle CFD trading while ensuring that the process is extremely professional in terms of execution.

Usability

Usability and user experience are some things that our team considered very strongly when undertaking the review. We know that a certain level of intuitiveness is very valuable in saving time and easing the process of getting to understand a company’s services and this is exactly what the firm provides.

The website itself is extremely neat and simple in its white, minimalist design, which makes it very comfortable to navigate for new users. Many of the options, menus, and functions available to users are clearly laid out and easy to understand.

When you do click and follow the sub-menus, you are directed to your intended destination without delay. The fast loading speeds coupled with the detailed consideration for the end-users is uncommon and that was truly appreciated by our team.

Customer Support

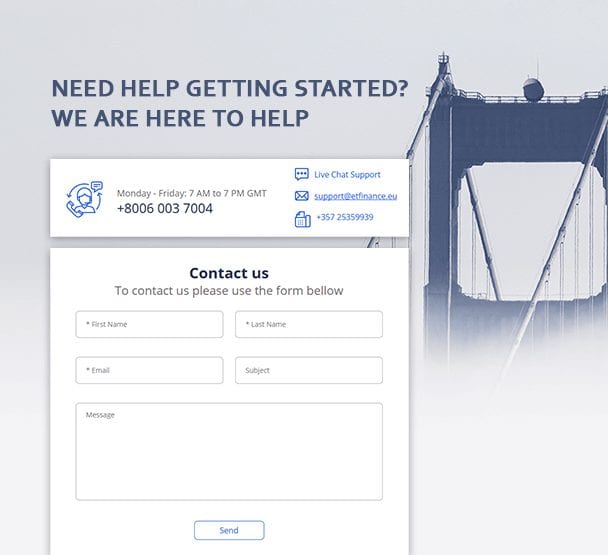

Customer support is always a key aspect for any firm and we had to dig in and see what was on offer. As a trader, you will find that support is readily available through a number of channels.

Telephone, email, and web-based live chat are all accessible methods via which you can receive customer support. These functions are available during the hours from 7 am-7 pm GMT beyond which the team will return their feedback only via email.

There is also a well-provisioned FAQ area on the website, from which you can get answers to many popular questions that you may have, often without having to contact the customer service team.

Payment Methods

This is an area of the company which our team felt could be slightly improved. Of course, you can use a couple of major funding methods to get your account up and running, which include via bank wire transfer and major credit or debit cards. There are also no fees associated with funding which is a positive, though you may want to check with your bank if they apply any fees on transfers.

There are a number of other deposit methods like Neteller, Skrill, and PayPal funding, which are unfortunately not available to traders at the moment, leaving only the major deposit methods highlighted above.

Best Offers

When it comes to bonus offerings, unfortunately, we could not find any kind of bonus available to traders.

A major factor in this is the firm’s availability only in the EU and the stringent regulations imposed by the CySEC, which does not allow firms to offer bonuses to EU clients. However, we view this as a positive factor since it demonstrates the company’s willingness to comply with regulations.

Regulation and Deposit Protection

This is another key area where our reviewers felt the broker performed very strongly. Even though they have only been in operation for a relatively short period, they are already very well regulated.

They are regulated by the CySEC, which is a respected regulator of forex brokers and CFD providers within the EU and globally. The regulator provides a solid and trusted framework that ensures your protection as a trader always is always the first priority.

Awards

Since ETFinance has only been operating for a relatively short period of time, our team understands that they have been focused on crafting the perfect trading environment rather than winning awards. The awards are likely to come in future.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Trade stocks with top-rated eToro

- Learn everything about Plus500 Withdrawal