The history of ETX Capital dates all the way back to 1965 when it was operating under Monecor London Limited, and has been regulated by the UK’s Financial Conduct Authority (FCA) since 1995. It was in 2007 that their current offering came to market, having been formerly known asTradingdex. Traders have access to more than 6,000 different trading instruments across 23 different stock exchanges, as well as over 60 currency pairs.

This review looks at all of the various aspects that make this company tick including what they do well and where they might be lacking.

What can you trade?

ETX Capital Forex Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Mid | 1:30 | Mid |

The firm has a lot of experience in the world of trading. For many years it has offered clients a wide variety of investment opportunities especially access to more traditional markets, such as trading stocks and indices. There are also trading opportunities for Forex, commodities, cryptocurrencies and even spread betting.

For their Forex offering, there are over 60 currency pairs on offer with instant execution being available along with tight spreads. This is a nice selection of currency pairs, something you will not find in many other brokers.

ETX Capital CFDs Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Mid | 1:30 | Low |

There are more than 20 global indices that you can trade as CFDs, as well as thousands of different shares from over 20 countries. You can even speculate on IPO shares if you wish to do so. All the major tradable commodities are catered for through their CFD offering.

There are extensive analysis options available for traders to use coupled with instant execution of trades. Generally, the spreads are pretty low, even for the more niche types of CFDs.

ETX Capital Crypto Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Few | 1:2 | Mid |

There are a number of major cryptocurrencies like Bitcoin, Ethereum, Litecoin and Ripple catered for in CFD form. Their crypto offering is one of the best in the online brokerage space today when you disregard the platforms that solely focus on crypto trading.

All trading is tax-efficient and you can take advantage of price movements in cryptocurrencies without having to use exchanges and actually owning the tokens themselves. You also have access to market updates and can bet on the price rising or falling.

ETX Capital Spread Betting Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:30 | Mid |

You also have access to a massive array of spread betting options if this is your cup of tea. These derivatives allow you to bet on the movements of the price of an asset without having to actually hold the asset. There are thousands of different markets you can spread bet on, so you have endless opportunities in this regard.

For those with a spread betting account, you will be assigned your own account manager. You also have instant execution of bets and a lot of advanced risk management tools. This is certainly a great spread betting offering.

What did our traders think after reviewing the key criteria?

Fees

The charges you incur will vary based on the trading platform you are using. The commission and spreads offered by the firm are dependent on the current market conditions. In general, the average spread for currency pairs is at the 1.5 pips mark, rising to about 3 pips for commodities. For indices and shares, you will be looking at fees of about 0.08%. Generally, the fee structure charged by the company is about average as compared to the rest of the sector.

For those who want to trade using leverage, the max you can get is 1:10 for commodities and 1:30 for Forex trading through the MetaTrader 4 platform, which is similar to that offered by its peers.

There are monthly inactivity charges for accounts that have had no trades made in the previous six months. The £25 fee is charged on a monthly basis, but if you start trading again, the inactivity charges for the past three months will be refunded back into your account.

Account Types

Currently, there is only one type of account that you can sign up for with the firm. This is unlike other companies in the sector, which normally have a number of options. You simply need to make a deposit of at least £100 to start trading on your new account.

You can also open a demo account if you wish, which is ideal for beginners who are learning the ins and outs of trading. More experienced traders who are testing different trading strategies and do not want to risk their real money while doing so may benefit from demo trading too. While you cannot choose your base account, you have a selection of different trading platforms, each with its own characteristics.

Platforms

You have access to a number of different trading platforms that are very intuitive and easy to use. The ETX Trader Pro platform is the main trading channel and is the most popular of the available options. There is a wide selection of indicators, charts and tools that you can use while benefitting from the lowest spreads offered by the firm. The charts can be completely customized, and it is also available for download on iOS and Android devices, which gives you the ability to trade on the go.

There is also the industry standard MetaTrader 4 platform, which should be familiar to most traders who have traded with other firms in the past. It is a solid way to make trades, with a decent selection of analysis and trading tools. You can even automate your trading via MT4, as well as get advice from multiple advisors.

Finally, there is the TX Binary trading platform. As the name suggests, this system is tailored to meet the needs of binary options traders. It is ideal for those looking to place fast-moving trades through short-term contracts. Some of its key features include making 60-second trades and having single-click trading.

Usability

The firm’s website is very modern, allowing for speedy and easy navigation. The colour scheme is classy yet clear, with the black and white contrast allowing the text to really pop out from the page. Images are used instead of text in a lot of places, which makes it a lot easier to see what is on offer without having to go through pages and pages of text.

There are many tools and indicators that are neatly listed, waiting for you to use them as you please. You will be pleasantly surprised at just how easy it is to use this platform when compared to a lot of other companies in the sector.

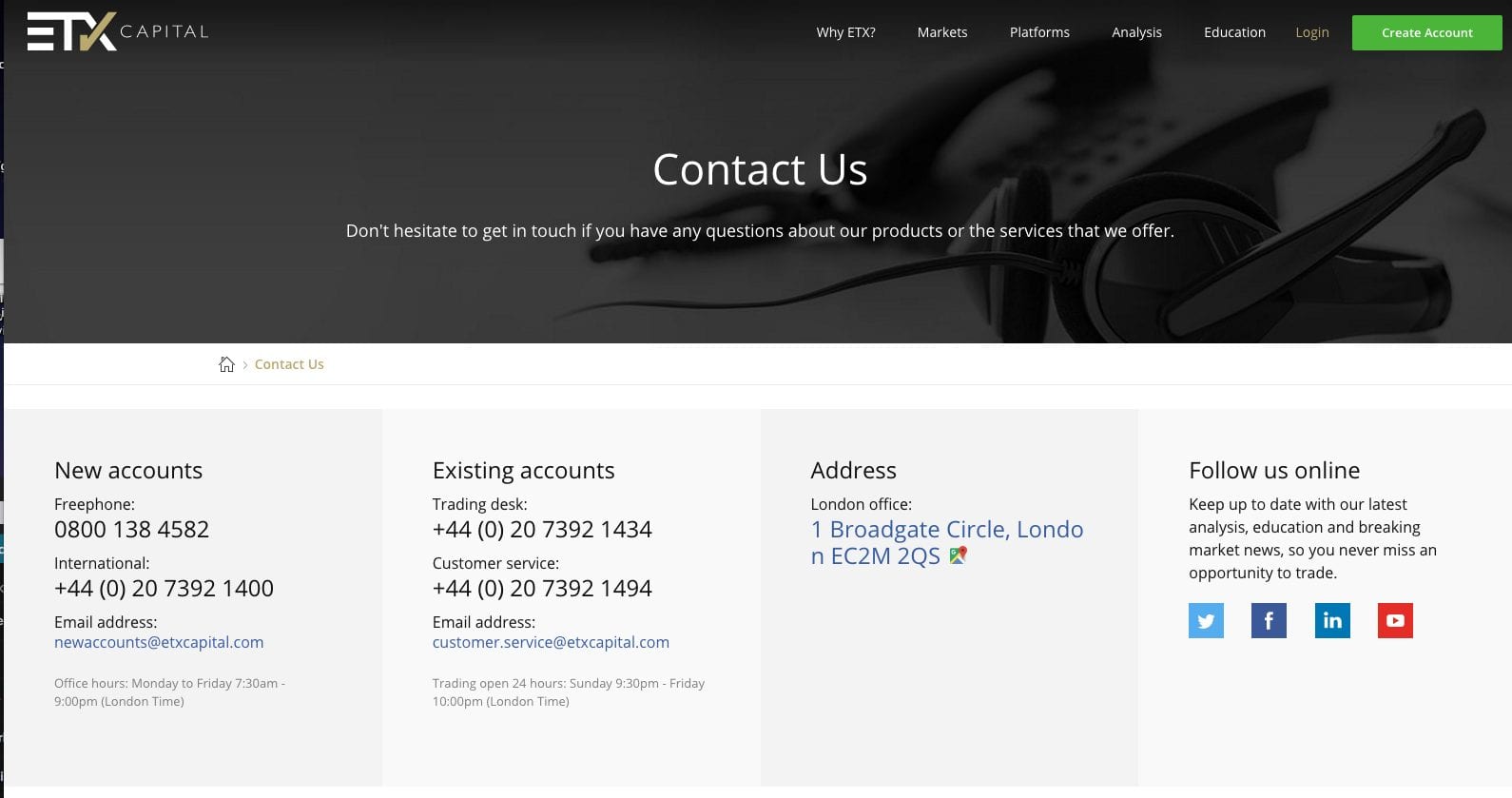

Customer Support

You have a number of different choices when it comes to the customer support offering at ETX Capital. Your first port of call will be sending an email or by picking up the telephone to give the team a call. The customer support team can only be contacted on weekdays from 7:30 AM until 9 PM GMT. Naturally, ringing the support team will be the fastest way for you to get an issue resolved as there is currently no live chat feature in place.

The lack of live chat is disappointing especially as this a staple of most broker’s support offerings. For old school people, you can send them a letter by post. There are separate phone numbers depending on if you are opening a new account, want to get an issue resolved or you want to reach the trading desk.

Payment Methods

There are a few payment methods that you can choose from when trading with the firm. There may be some charges when depositing using some of the methods, such as the bank charging you a fee to make a wire transfer.

If you are making an online bank transfer, you can deposit using 17 different currencies. Your other deposit options include using one of the major credit or debit card providers, which will see your funds processed instantly and credited to your account. Currently, you have nine different currency options when using a card.

You can also use the likes of China Union Pay, Neteller and Skrill as payment options. If you are based in the UK, a card withdrawal can take 2-5 business days for your funds to reach you. A bank transfer takes 24 hours, which is the same for the e-wallet options. If you place a withdrawal request before 2 PM GMT, then this will be processed the same business day, which is ideal.

Best Offers

There are other aspects of the firm’s offering that can greatly help you. For example, the education segment gives you access to some great training, particularly if you are just starting out on your trading journey.

There is a dedicated section for educating traders, which gives you access to things like weekly webinars, ebooks written by experienced traders, guides that explain to you how to use the trading platforms in the best way possible.

You can also select from seven different training courses, allowing you to learn how to trade instruments such as CFDs, Forex, indices, shares, commodities, cryptocurrencies and margin trading.

There is also a section dedicated to the analysis of potential trading opportunities where you get access to brief market analysis including reactions to major market news, otherwise, this section is a bit sparse. However, there are a lot of resources and tools that are built into the trading software to help you conduct your trading analysis in a successful manner.

Regulation & Deposit Protection

The company has a license with the FCA in the UK, which is one of the most respected regulators in Europe. This will give you peace of mind that your funds will be kept safe from nefarious practices. All client funds are kept segregated in major banks, meaning that the firm’s creditors cannot access client funds if the broker falls into financial troubles.

Residents of certain regions are not allowed to trade with the company due to some regulations. However, there are no such restrictions for those who are in the UK. Traders are also protected by MiFID II and deposits of up to £50,000 are insured.

In terms of the website’s security, the SSL encryption deployed on the site helps to keep your personal and financial data safe and sound from prying eyes.

Awards

Over the course of many years, the broker has accumulated numerous awards. These demonstrate that they are doing better than other companies in the same space, often highlighting certain areas where they are performing particularly well.

ETX Capital does not prominently display the awards has won, but it has been the recipient of a number of different awards in recent years. These include:

- Best Trading Platform 2018 – Online Personal Wealth

- Best Education Offering 2018 – Online Personal Wealth

- Best Educational Tools & Resources 2017 – UK Forex Awards

- Best Forex Trading Tools and Software 2013 – UK Forex Awards

There are many more awards and nominations that broker has received for its efforts over the past decade or more in the broker space.