ForexTB is a fully regulated European online broker. Founded in 2015, the brokerage provides a range of financial instruments as contracts for difference (CFDs), including forex, stocks, indices, and cryptocurrencies. ForexTB is based in Nicosia, Cyprus and is fully licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC).

The firm operates throughout the EU (with the exception of Belgium) and in Switzerland. There are some regional restrictions, including some limitations on clients from the UK since the country’s separation from the EU.

ForexTB operates a no-commission trading model, with no deposit fees, and all clients are assigned a dedicated account manager. Opening an account is a quick and easy process that can be done online from any of the countries served by the broker. Depositing funds into your account is easy, and there is a variety of payment methods available.

The broker offers MetaTrader 4 (MT4) trading and its own proprietary WebTrader platform. There is a good choice of account types, allowing clients to pick an account that suits their trading needs and their budget.

What can you trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $250 | Good | 1:30 | High |

Trading forex with ForexTB is easy and convenient. The broker offers a wide range of currency pairs, with floating spreads, which will depend on the account type you open. Leverage of up to 1:30 is offered. The minimum deposit required also depends on the account type but starts at €250 on the basic account. Spreads available for each pair, and for each account type, are displayed on the website. Spreads on the EUR/USD start at 1.8 pips on the VIP account, but 3.2 pips on the Basic account. Over 50 forex pairs are available to trade.

CFD

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $250 | Good | 1:30 | Mid |

ForexTB offers CFD trading with access to various different assets and instruments. Leverage will depend on the instrument you are trading, and there may be some restrictions, depending on where you are resident. For example, the broker does not currently offer CFDs on cryptocurrencies for UK residents. CFD trading is a form of derivative trading, and is a potentially complex and high-risk type of trading. All traders should be aware of the following risk warning, as stated on the ForexTB website:

“CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.15% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.”

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $250 | Good | 1:10 | Low |

ForexTB offers trading in both single stocks and indices, with a wide variety of stocks in major corporations from around the globe available to trade. You can choose whether to go long or short (that is, whether to buy or sell) and easily place trades from your device, wherever you are. There is also a variety of stock indices offered as CFDs, allowing traders to speculate on the price movements of a financial index such as the FTSE 100 or DAX 30. You can choose to follow the stocks and indices you are interested in via the ForexTB platform.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $250 | Good | 1:30 | Low |

ForexTB clients can easily access Trading Central, which provides both free and commercial signals, with all signal providers sorted by their trading results, and the most successful traders shown first. To copy successful traders, simply select a signal provider, and subscribe to their signal to start copying their trades.

Crypto

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $250 | Regular | 1:2 | Mid |

ForexTB provides trading in digital currencies, and, depending on where you reside, may even offer cryptocurrency trading via CFDs, which many of its competitors do not. Various cryptocurrencies are available to buy and sell via the platform, including Bitcoin, Litecoin, Ethereum, and Ripple. UK clients will not be offered leverage to trade digital currencies as CFDs at this time.

What did our traders think after reviewing the key criteria?

ForexTB Fees

ForexTB trading fees are competitive, with no trading commissions levied on any of its retail accounts. As always, when a broker offers a commission-free trading model, this means that broker profits are taken from the spreads, so this will be your main area of focus when calculating the cost of each trade. The broker offers floating spreads that start at 1.8 pips on some instruments. The spreads you are offered will depend on the instrument you are trading and the account type you open, which will in turn depend on the funds you have to deposit.

As an example, spreads start from 1.8 pips on the EUR/USD for VIP account holders, but at 3.2 pips for the same pair when trading with the Basic account. As you might expect, spreads are higher at ForexTB than at some of its competitors as it offers 0% transaction fees.

Pricing is transparent and details of the spreads you will be offered are found on the ForexTB platform. ForexTB does not appear to have a lot of hidden extra fees. Deposits are free of any broker-levied fees, though it is always possible that your payment processor may charge a fee for transferring funds into your trading account.

Each account type offers a different number of free withdrawals, after which withdrawal fees will apply, the exception being the VIP account, which offers unlimited free withdrawals. There is a monthly inactivity fee of 80 euros charged on dormant accounts. There are also swap or rollover fees, which will depend on the type of contract being traded.

All fees are laid out in the broker’s ‘General Fees’ documentation, which can be found in the legal section of the website. Be aware that with any broker, it is possible for fees and charges to change, sometimes at short notice, so there may be fees that apply to you that are not mentioned in this ForexTB broker review.

Account types

ForexTB offers clients a choice of four account types. The account you qualify for will depend on the funds you have available to deposit and will influence the spreads you can access. The Basic account requires a minimum deposit of 250 euros, and spreads start at 3.2 pips. The Gold account can be opened with a deposit of at least 25,000 euros and spreads start at 2.9 pips. Those with 100,000 euros to invest can access the Platinum account, with spreads of 2.3 pips and upwards. The VIP account requires a substantial minimum deposit of 250,000 euros and provides access to much tighter spreads, starting at 1.8 pips. All retail accounts give traders access to all instruments and allow for trading with no separate transaction fees or commissions.

All retail accounts also provide clients with leverage of up to 1:30 when trading CFDs, though the actual leverage offered may vary according to the instrument being traded. Professional clients can access leverage of up to 1:400. As highlighted, all account holders have full access to Trading Central, which offers a variety of features, including Analyst Views, Daily Market Analysis and Web TV.

Basic account holders get one free withdrawal, but will be subject to fees after that. Gold account holders get one free monthly withdrawal, and Platinum account holders get three free monthly withdrawals. There are no withdrawal fees on the VIP account. All account holders also have access to Trading Central’s Market Buzz, a revolutionary AI newsdesk that uses artificial intelligence solutions to compile and simplify the vast amount of trading-related information available to online investors.

Platforms

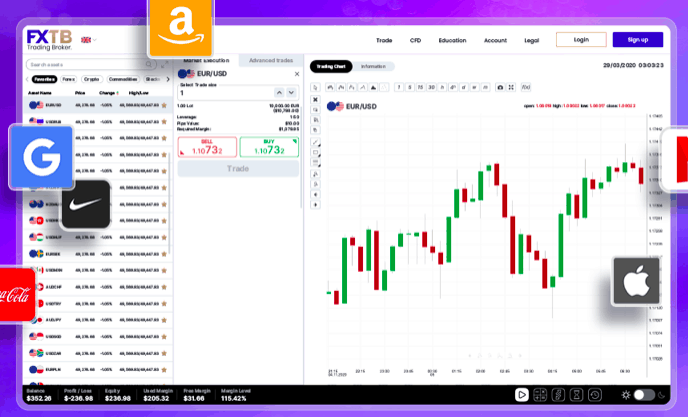

ForexTB offers a choice of platforms for its clients. These are available for desktop, web and mobile. The broker’s own proprietary platform is the simple, straightforward and intuitive WebTrader platform, which is fully responsive and can be used from any device using any compatible browser. The platform can be accessed directly from the broker’s website, and incorporates a number of different chart types, graphing tools and technical indicators. The interface is very clear and easy to navigate. The main disadvantage of this platform is that it has a limited number of options for customisation, but is a very easy option for use, especially for new or less experienced traders.

More experienced traders, and those used to MT4 software, will no doubt choose to use this option at ForexTB. As MT4 enthusiasts are aware, the platform is a very efficient and intuitive choice, popular with forex traders all over the world, and has a range of advanced features, including a wide variety of integrated technical indicators, charting tools, and back-testing facilities. The platform allows for flexible, customisable automated trading via Expert Advisors. A major advantage of MT4 is that it is highly customisable, allowing for the creation of personalised watchlists and trading alerts, providing good compatibility with many third-party applications and plug-ins.

When it comes to mobile trading, clients can download MT4 mobile apps to facilitate easy, convenient trading on the go, or, of course, choose to use the mobile responsive, browser-based WebTrader platform from any device with a reliable internet connection. Mobile apps are available for both iOS and Android devices, and can be downloaded free from the Apple App Store and Google Play. They are generally very quick and easy to install and offer an intuitive interface that is fairly easy to find your way around.

Usability

The ForexTB website is well-designed, clear and very intuitive to navigate, with a focus on providing an easy and stress-free user experience. The website includes all important legal information, including full terms of use, a risk disclaimer, and complaints procedures. Navigation around the website and the platforms is fairly straightforward. There is a simple top-bar menu from which clients can access the main website sections, with drop-down menus to aid further navigation. There is also a menu in the footer of the website, leading to other useful pages on the site, such as an FAQ section and contact page. The WebTrader platform can be accessed from the website and is generally well laid out and user-friendly. The MT4 platform is slightly more complicated, but is also highly intuitive, with most MT4 traders agreeing that the platform has excellent overall usability.

Customer Support

The broker offers a number of customer support channels, including a dedicated customer service phone line, an email system, and a live chat facility. Support channels are open 24/5, and each account holder is also assigned a dedicated account manager. The live chat option can be found in the lower right-hand corner of many pages on the website, or you can go to the contact page and select ‘Chat Now’. The contact page is also where you will find the phone (+357 2 222 2353) and email details ([email protected]) for customer service. Support staff are available to both potential and existing customers.

ForexTB also provides its clients with a very useful FAQ section, which can be accessed via the link in the footer of any page on the website. The FAQ page is split into sections and is easy to navigate, though it does not have a search function, which would be a useful addition. The broker also provides an education portal, accessed via the top bar menu. This has a variety of tools to help both new and experienced traders, including eBooks, webinars and guides, along with resources such as an economic calendar and a glossary.

Payment Methods

ForexTB offers a range of options when it comes to making payments into your account or withdrawing funds:

Card payments

Card payments are accepted. You may be asked to verify your payment method, and in the case of card payments, this means that you will need to send images of the front and back sides of your card with the first 12 digits and CVV code covered (that is, showing the last four digits of your card number). Card payments are usually instant.

Bank Wire Transfer

Wire transfers are accepted. Depending on your bank, it may take a few days for these transfers to arrive in your trading account. You may be asked to verify your payment method, and in the case of a bank wire transfer, this can be a copy of the confirmation of the transaction from your bank.

E-wallets

Payments via e-wallets are accepted, but may depend on what is available in your region. Again, you may be asked to verify your payment method. In the case of e-wallet deposits, you will need to provide the broker with a screenshot of your e-wallet account with your full name, email address and e-wallet number visible.

Best Offers

ForexTB is certainly a broker with a lot to offer. The firm has an excellent choice of account types, Trading Central, MT4 trading, Market Buzz and Daily Market Analysis. The education portal has a wealth of valuable resources for traders at all levels.

The proprietary platform is particularly straightforward and intuitive to use, and can be accessed via your web browser from almost any device. It is possible to trade a good range of instruments, mostly as CFDs with reasonable leverage, and there are over 50 forex pairs to choose from as well as a number of digital currencies. There are, however, no bonuses available due to CySEC rules and restrictions.

Regulation and Deposit Protection

ForexTB is fully regulated in the EEA by the Cyprus Securities and Exchange Commission (CySEC). The extent of consumer protections may differ for firms that are located in the UK, due to the country’s separation from the EU. However, the firm is deemed authorised and regulated by the Financial Conduct Authority (FCA), and is currently governed by the Temporary Permissions Regime. The broker is a member of the Investor Compensation Fund (ICF). Client funds are fully segregated and all relevant legal documentation can be viewed at the website.

Awards

In 2020, ForexTB was given the title of ‘Fastest Growing CFD Broker in Europe’, awarded by Global Brands Magazine. The MT4 platform, available to all ForexTB traders, has also won various awards previously, including ‘Best FX Trading Platform’ and ‘Best Multi-Asset Trading Platform’ at the Finance Magnates London Summit Awards.