FXTM (trading under ForexTime Limited) is a multi-award-winning, leading Forex and CFD broker. Regulated by several financial authorities, including the top-tier Financial Conduct Authority (FCA) in the UK, FXTM not only provides a safe and secure place to trade but an industry-leading experience for traders of all levels. In this FXTM broker review, we’ll be taking a look at everything you need to know about this broker, including account types, regulation, trading platforms and more.

What can you trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

FXTM offer 63 forex currency pairs you can trade and include all the major pairs with a solid selection of minor and emerging market pairs for more experienced traders.

The spreads for Forex are not the most competitive in the industry, with the EUR/USD spread at a minimum of 1.6 pips for the Standard account, with 1.9 pip typical. For the ECN account the minimum is a far more competitive 0.1 pips with typical 0.3 pips.

CFD

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

The overall offering of CFDs is not particularly impressive for a broker of FXTM’s stature. There are only 8 commodities to choose from; Silver quoted in two currencies, Gold in three currencies, Brent and Crude Oil and Natural Gas.

On the stock index side, there are the usual global indices, but these only number 11.

For individual stocks, there 123 US and 50 European stock CFDs, which again is far from an exhaustive list.

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:5 | Mid |

As highlighted above there are the typical global averages, but only 11 to trade.

On the individual stock side, there are 50 European stock CFDs and 123 from the US, which again is far from a comprehensive offering.

A dedicated FXTM shares CFD account is offered where you can focus only on stock trading.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

All non-UK clients can use FXTM Invest, a social trading service and this is an area where FXTM does provide a strong service. You can get involved either as an investor or as a strategy manager. From the investor side, you can start from as little as $200 and follow other successful FXTM traders on a professional and intuitively laid out system. Investors can copy Strategy Managers’ trades. You have the option to filter Strategy Managers based on various factors, including success rate, risk level and overall profit. Strategy Managers area able to earn commission on winning trades.

Crypto

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £10 | Many | 1:2 | Mid |

There are only four major cryptocurrencies available to trade with FXTM, all against the USD. These are Bitcoin, Ethereum, Ripple, and Litecoin and all are traded as CFDs.

Actual cryptocurrencies are not available to buy outright.

What did our traders think after reviewing the key criteria?

Trust and Regulation

FXTM offers a solid state of regulatory protection, which is regulated and licensed in several jurisdictions. This includes the top-tier FCA (Financial Conduct Authority) in the United Kingdom, making it a safe broker for Forex and CFD trading.

FXTM are also regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission of Mauritius (FSCA), plus licensed by Financial Sector Conduct Authority (FSCA) of South Africa

As with all brokers, these regulators require FXTM to follow strict capital requirements, fully segregate traders’ accounts from company funds, adhere to strict anti-money laundering requirements and comply with ‘know your client’ procedures, as well as a host of other stringent measures designed to protect traders. Overall, FXTM is considered a trustworthy and secure broker.

| Trust and regulation | FXTM |

| Regulated in how many countries | 4 |

| Year established | 2011 |

| Publicly traded | No |

Offering of Tradeable Products

The offering of tradeable products is not particularly impressive, given the strong position FXTM holds in the industry.

They offer 63 forex currency pairs, but only 8 commodities pairs, which actually number only two precious metals versus different currencies, Brent and Crude Oil plus Natural Gas.

There are the usual global stock indices, but only 11 to choose from and for individual stocks, there 173 US and European stock CFDs, which is far from an exhaustive list.

For cryptocurrencies there are only four available to trade with FXTM, Bitcoin, Ethereum, Ripple, and Litecoin CFDs.

| Product offering | FXTM |

| How many Forex Pairs offered | 63 |

| How many Stock Indices offered | 11 |

| How many Individual stocks offered | 173 |

| How many Bonds offered | 0 |

| How many Commodities offered | 8 |

| How many Crypto pairs offered | 4 |

Fees/Commissions

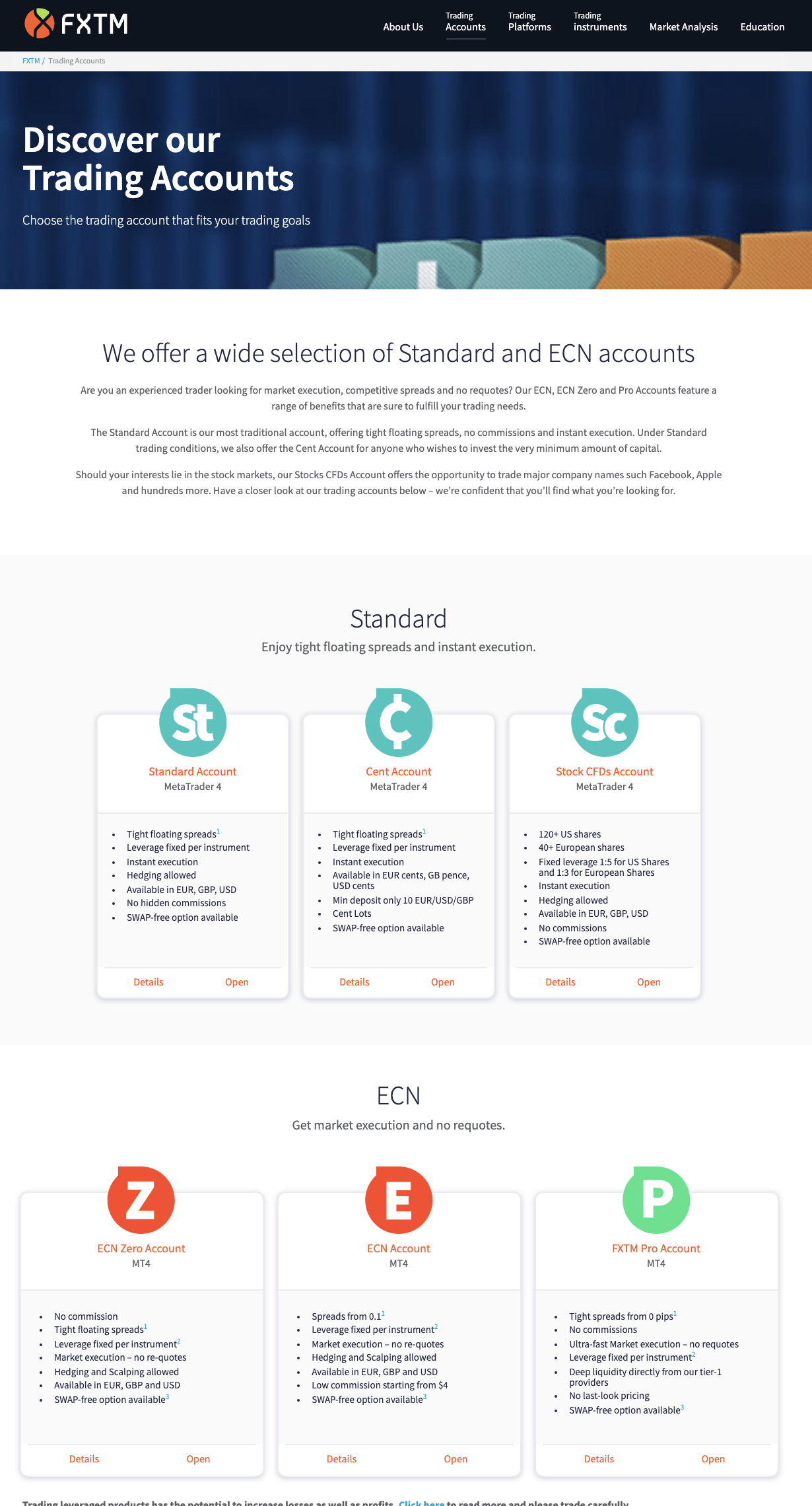

With regard to fees from FXTM, there are varying fees dependent on the type of trading account that you decide to open.

There are a number of different types of FXTM accounts to choose from, but generally speaking, these account types fall into two categories, the Standard Accounts and the ECN Accounts.

For the Standard account the spreads are wider than the industry standard, with the EUR/USD spread at a minimum of 1.6 pips, with 1.9 pips typical.

For the ECN account the minimum is a far more competitive 0.1 pips with typical 0.3 pips, but there is also a $2 per lot commission to factor in as well.

For more experienced traders, an FXTM Pro account is also available on the ECN side with a minimum deposit of $25,000 with no commission and spreads as tight as 0 pips.

Non-trading fees

FXTM has not insignificant non-trading fees. You will be charged $5 per month after six months of inactivity and most withdrawal methods also have a fee. However, the are no account or deposit fees.

| Fees/ Commissions | FXTM |

| EUR/USD average spread | 1.9 pips |

| EUR/USD minimum spread | 1.6 pips |

| Minimum account opening deposit | £200 |

| Withdrawal Fee | Yes |

| Inactivity Fee | Yes |

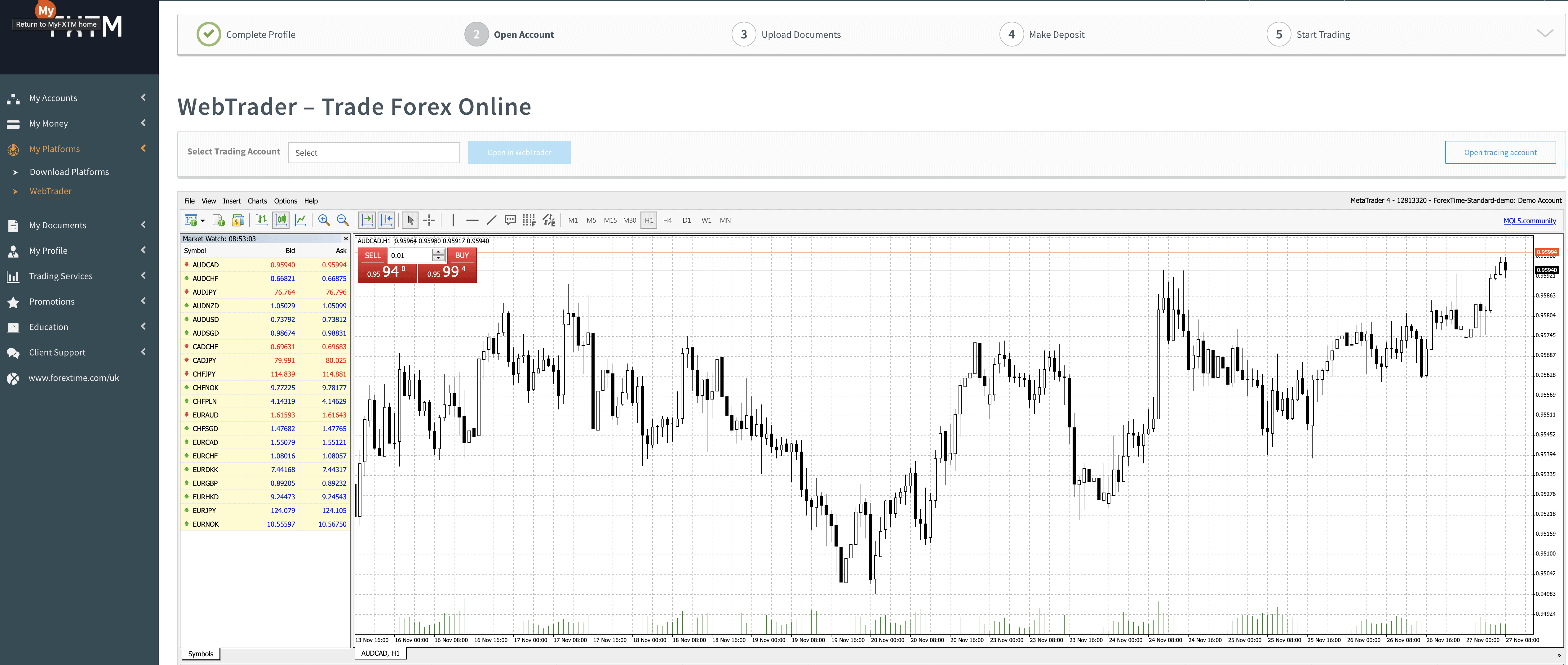

Trading Platform

When it comes to trading platforms, FXTM only offers the popular MetaTrader 4 platform. MT4 is available for PC and Mac, with desktop of web-based versions. The lack of support for MetaTrader 5 is definitely a mark against FXTM’s overall platform provision.

Furthermore, given the stature of FXTM in the broking industry, the absence of even a white labelled, in house trading platform is somewhat disappointing.

On the platform in the My FXTM area there are some useful trading tools. These include an orders indicator, pip value calculator, pivot points strategy amongst others.

| Platform feature | FXTM |

| Own platform | No |

| Demo account offered | Yes |

| MT4 | Yes |

| MT5 | No |

| cTrader | No |

| Chart Indicators | 53 |

| Chart drawing tools | 33 |

Mobile Offering

For mobile trading on-the-go FXTM do offer the FXTM Trader App; a mobile app available on both iOS and Android. From here you can trade, look at basic charts, look at you open position, pending and closed orders.

| Mobile feature | FXTM |

| Own Apple app | Yes |

| Own Android app | Yes |

| Third party app (MT4/MT5/other) | Yes |

Education

Financial markets and trading education is an area in which FXTM provides a robust and diverse experience for their clients.

At FXTM you can learn in the following ways:

- eBooks

- General educational videos

- Platform tutorial videos

- Webinars

- Educational articles

- A glossary

- Periodic Table of Investment

- Forex Trading Seminars

eBooks – FXTM offer five downloadable eBooks covering traders’ habits, crypto currency is, Elliot Wave theory, and two on Japanese candlesticks.

General educational videos – There are various educational videos on Forex and CFD trading, that would appeal to both beginner and intermediate-level traders.

Platform tutorial videos – There are various tutorial videos on how to use the MT4 trading platform.

Webinars – The team of analysts at FXTM run regular webinars in a variety of languages, covering current market events and views.

Educational articles – There are numerous written educational articles on Forex and CFD trading and technical analysis, from the basics up to intermediate-level concepts.

A glossary – There is an extremely comprehensive glossary of financial markets and trading terminology covering hundreds of different terms and concepts.

Periodic Table of Investment – This is a snazzy way of showing the glossary terms as an interactive infographic.

Forex Trading Seminars – FXTM also run live seminars and events that you can physically attend, though these were on hold at the time of writing this review during COVID-19.

Overall, we were very impressed by the FXTM educational offering.

| Education feature | FXTM |

| Webinars | Yes |

| Videos | Yes |

| Community Forums | No |

| Education Organized by Experience Level | Yes |

| Education Organized by Topic | Yes |

| Education Organized by Type | Yes |

| Has Education – Forex | Yes |

| Has Education – Stock Indices | Yes |

| Has Education – Individual Stocks | No |

| Has Education – Bonds | No |

| Has Education – Commodities | Yes |

| Has Education – Crypto | Yes |

| Investor Dictionary/ Glossary | Yes |

Research

The FXTM research offering is solid, producing 2-3 daily written articles on current market analysis. This research offers macroeconomic and geopolitical opinions on what is impacting markets and also some technical analysis. There are also market analysis videos published a couple of times a week. FXTM also produce monthly market outlook video reports and there is an economic calendar, alongside a scrolling Forex News Timeline.

Overall, the FXTM research offering is probably above the industry standard, though we would like to see more regular videos and written content, maybe with a dedicated focus on technical analysis.

| Research feature | FXTM |

| Research Organized by Experience Level | No |

| Research Organized by Topic | No |

| Research Organized by Type | Yes |

| Has Research – Forex | Yes |

| Has Research – Stock Indices | Yes |

| Has Research – Individual Stocks | No |

| Has Research – Bonds | No |

| Has Research – Commodities | Yes |

| Has Research – Crypto | Yes |

Customer Support

The customer service team offers support in 18 languages, is available 24/5 and there is also personalised support from an Account Service Manager. Contact is via email and phone, plus live chat, alongside other media channels. It would, however, be good to be able to make contact at the weekend too.

FXTM supports multiple languages, including Arabic, Czech, Chinese, English, Farsi, French, Hindi, Indonesian, Italian, Korean, Malaysian, Polish, Russian, Spanish, Urdu and Vietnamese.

There live chat feature, plus you can contact the ream vias popular channels such as WhatsApp, Telegram, Viber and Facebook Messenger.

| Customer support | FXTM |

| Customer call support Mon-Fri over 8 hours | Yes |

| Customer call support Mon-Fri 24 hours | Yes |

| Customer call support Saturday all day | No |

| Customer call support Saturday part day | No |

| Customer call support Sunday all day | No |

| Customer call support Sunday part day | No |

| Web Chat | Yes |

Overview

On the plus side, we found FXTM to have solid global regulation and an impressive number of different account types. However, we were a little disappointed that they do not offer their own trading platform and you are confined to using MT4, plus trading spreads are not particularly competitive. But the education offering is very strong, whilst the research offered is above industry standard. For a beginner, FXTM is a good broker to start with.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Trade stocks with top-rated eToro

- Learn everything about Plus500 Withdrawal