Personal Capital is an American company founded by Bill Harris, Rob Foregger, Louie Gasparini, and Paul Bergholm in 2009, formerly known as SafeCorp Financial Corp, also is an online financial advisor and personal wealth management company headquartered in Redwood Shores, California, Personal Capital has offices located in San Francisco, California, Dallas, Texas, Atlanta, Georgia, and Denver, Colorado.

Their free version is used by nearly two million people, but the wealth management service has about 18,000 clients who have more than $8 billion in assets under management.

The name changed in 2010 and publicly launched on September 9, 2011. Since 2012, has been registered with the U.S. Securities and Exchange Commission (SEC) as an investment advisor.

The key question is: Is it the right broker for you? This article would be providing an insight and aims to help you decide if its the right partner to carter for your investing needs.

What can you trade?

Personal Capital Robo-advisor Review

| Max Leverage | Trading Fees |

| 1:30 | Mid |

Personal Capital is similar to Robo advisors; which determines investor’s risk tolerance, investment goals, and time frame. They also take into account any investor’s personal preferences in building an investor’s portfolio. Also invests in multiple asset classes for portfolio diversification. They rebalance portfolios regularly to maintain target asset allocation.

Investor portfolio is invested in six asset classes:

- International stocks

- International bonds

- U.S. stocks

- U.S. bonds

- Alternative investments include real estate investments, gold, and energy.

- Cash

What did our traders think after reviewing the key criteria?

fees

The fees for Personal Capital are dedicated to the dollar value of the assets you hold with them. There are three levels of the assets you hold with them. There are three levels of asset management. The lowest tier, investment service, is for those with $100,000 to $200,000 in assets; portfolios consist of ETFs and you will be given access to priority support services. The middle tier is called wealth management, which is for those with $200,000 to $1,000,000. These clients get two dedicated financial advisors and a much more flexible portfolio design that includes individual stocks and tax-loss harvesting, along with other benefits.

To qualify for the highest tier of services, Private Client, you’ll need to start with $1,000,000 or more in assets. The Private client portfolio can contain individual bonds and private equity investments. The Private Client tier directly competes with established wealth management firms, with fees that start at 0.79% and range down to 0.49% (for assets over $10 million) per year for assets under a manager. These are much lower than the fees high net worth clients would usually be faced with a traditional wealth management firm.

Account types

The account types of Personal Capital services have four levels:

Free

provides a financial dashboard for free accounts; users can test investment strategies in a free account.

Investment Service

This is for investors with a net worth of $100,000 to $20,000, investors in this plan have access to the financial advisory team, tax-efficient ETF portfolio, tactical weighting, 401(k)s advice and 24/7 phone call support are available for this account type.

Wealth management service

This service is for investors with a net worth of $200,000 to $1 million, two dedicated financial advisors are assigned to this account with regular portfolio reviews, a customizable portfolio with access to individual stocks, a full retirement plan, college savings and 529 planning, tax-loss harvesting and financial decision support are available for this account type.

Private client

This plan is for investors with over $1 million in investment, two dedicated financial advisors are assigned to an investor’s account with regular portfolio reviews, a full financial and investment plan, college savings and 529 planning, priority access to specialist, customized portfolio with ETFs and individual stocks and bonds, private banking, private equity, and hedge fund investment review, deferred compensation plan advice, estate attorney CPA collaboration are available with this account type.

Platforms

Dynamic portfolio allocation

Personal Capital creates a portfolio out of bonds, stocks, funds, alternative investment, and cash. Personal Capital can add private equity investments to portfolios of qualified investors. A portfolio can be diversified beyond match made through an investor’s profile. Financial advisors can make transactions for individual stocks or ETFs at the investor’s request.

Goal setting

Goal-setting tool helps investors to plan for retirement, questions are asked by assigned financial advisors to determine what an investor is expected to spend after retirement. Retirement planning includes its proprietary Smart withdrawal tool designed to maximize retirement income by breaking out taxable, tax-deferred and tax-free income. Investors can also add non-retirement goals on the platform.

Account services

Investors can set up automatic deposits to fund personal accounts, there is no margin available on personal capital but they launched personal Capital Cash in June 2019. Personal Capital Cash is a high-yield account with aggregated FDIC insurance covering up to $1.25 million. There is no minimum amount to open a Cash account.

Usability

Personal Capital is clean, lightweight but difficult to navigate, the website is updated regularly to reflect the latest market news, announcements and new tax planning and investment features. The font of the website is bold and easy to view to the eye. The homepage reflects a company whose headquarter is located in a tech city.

The homepage features a drop-down menu for mobile (Android and iOS) which are available through links on the website homepage, an internet user can understand the investment strategist of the company by reading through the FAQ page and what is necessary to understand before using their services.

The about page features some well-detailed information about the leaders of the company and their backgrounds but contains a little information about the company itself, it is very difficult to understand the company fully well at the about page. The major information can be found on the homepage and other pages located on the website.

The guide page provides a lot of free articles that provide details about investment strategies, tax planning, tax-loss harvesting, equity compensation and other information needed about investment and investment strategies

However, there is still room for improvement as the about page coveys very less information about the site itself, too many navigation links are located on the website which may make it difficult for a new user to understand all the information written on the website at a glance.

Customer support

Personal capital does not offer live chat support but they offer 24/7 phone support, Personal Capital ensures that an advisor is assigned to the user’s account. There is no generic customer services line to call once your account is established because you can contact your advisor directly. Personal Capital phone support is fast and questions are answered by helpful, knowledgeable and seasoned professionals.

Payment methods

According to Personal Capital official website, the only payment method available through the platform is through bank transfer, the account number for deposit can be found through the user’s dashboard. Once a user deposits funds into his account there is a 3-day hold before a withdrawal can be initiated from user’s cash account to the bank account. Broker doesn’t charge for withdrawals but receiving institutions may charge a fee for wire transfers.

Support outgoing wire transfers over $10,000 Monday through Friday from 9:30AM-2:30 PM Pacific Time by calling a phone number listed on their support page. The account details for account deposit are available to customers via the support page and dashboard.

Best offers

Personal capital offers both free and paid wealth management products.

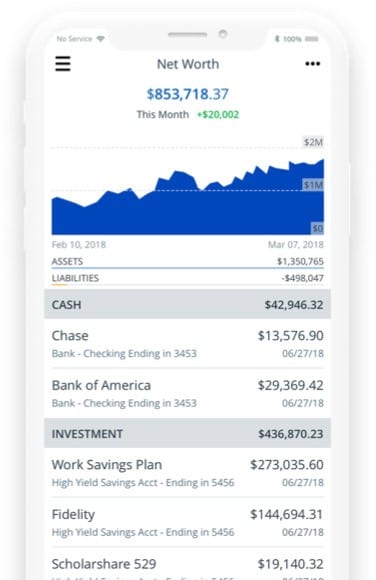

Free registration has included a digital overview of user’s finances along with access to financial analytic planning tools. Uses link their banks, Brokerages, mortgages, 401(k), loans and credit cards. Analytics and planning advice is automated through a 401(k)s free analyzer, retirement planner, mutual fund analyzer, an investment checkup, and cash flow tool. A free application is also available for Android and iOS users with the same analytic, monitoring analytic and planning functionalities as the web version.

Managed accounts have been an available option for clients with a minimum of $100,000 in assets and include a team of financial advisors assigned to each account in exchange for a fee.

Training Materials

Their website contains articles and guides for goal planning. The articles tend to be comprehensive and sometimes complex, but they are also excellent in terms of the quality of the content. Users are expected to be equipped with various investment methods after going through a dozen of those articles. They have a daily blog that is always updated with market news and developments.

Personal Capital bug bounty program & Encryption technology

Personal Capital takes security very seriously, even engaging in a bug bounty program to ensure that there are no loopholes in the entire system. Also encrypts all the data with AES-256 multi-layer key management and has strict internal controls on client data. Of all the robo-advisories reviewed, Broker has one of the most comprehensive security and data protection regimes.

Regulation and deposit protection

Personal Capital is protected by U.S. Securities and Exchange Commission (SEC), SEC has a three-part mission: to protect investors; maintain fair, orderly and efficient markets; and facilitate capital formation.

To achieve its mandate, the SEC enforces statutory requirement that public companies and other regulated companies submit quarterly and annual reports, as well as other periodic reports. In addition to annual financial reports, company executives must provide a narrative account, called the management discussion and analysis (MD&A) that outlines the previous year of operation and explains how the company fared in that period. MD&A will also touch the upcoming year, outlining future goals and approaches to new projects. In an attempt to the level playing field for all investors, the SEC maintains an online database called EDGAR (the Electronic Data Gathering, Analysis, and Retrieval System) online from which investors can access this and other information filed with the agency.

Quarterly and semiannual reports from public companies are crucial for investors to make sound decisions when investing in the capital markets. Mandatory disclosure of financial and other information about the issuer and the security itself gives private individuals as well as large institutions the same basic facts about the public companies they invest in, thereby increasing public scrutiny while reducing insider trading fraud.

The SEC makes reports available to the public through the EDGAR system. The SEC also offers publications on investment-related topics for public education. The same online system also takes tips and complaints from investors to help the SEC track down violators of the securities laws. The SEC adheres to a strict policy of never commenting on the existence or status of an ongoing investigation.

Also their investors have up to $250,000 (including principal and interest) deposit protection. The cash balance for users place though the program is swept to one or more program banks where it earns a variable rate of interest and eligible for FDIC insurance. If the number of program bank changes, the aggregate amount of available FDIC insurance could be higher or lower. If a user deposits at a program bank, a user is advised not to use that bank by following the opt-out instructions provided by Personal Capital. If a user uses a program bank for deposit, the amount available for FDIC insurance will be lower. If a user uses his program bank for this program, the funds in the program bank and broker will be combined for deposit protection.

Personal Capital partnered with Yodlee interactive to store and secure customer brokerage credentials.

Awards

In both 2014 and 2015, was named CNBC Disruptor 50 list. In June 2015, Personal Capital had over 1.5 Billion in assets under management. In September 2015, 800,000 people were using Personal Capital’s free investing tools to monitor $150 billion in assets.

In June 2016, National Basketball Players Association (NBPA) teamed up with personal Capital through a financial education program.

In December 2016, Personal Capital raised $25 million in Series E funding from IGM Financial, closing the round at $75 million.

PEOPLE WHO READ THIS ALSO VIEWED: