How can you tell if a UK forex broker is good? The basics

This report will discuss the metrics used to measure broker performance and the brokers who stand out from the crowd.

The competition between brokers is so fierce that no one broker tops each category. There are some that do well across all of the metrics and some that specialise in one. The trick is finding the best for your type of trading.

Before exploring the functionality of the brokers and their online platforms, it’s worth covering some basic principles and ways to measure a broker.

Track Record – How long has a broker been operating? A track record of 10 years or more is a sign of success. If the firm is a new entrant, it might have an innovative approach.

Crowd Sourcing – Draw on the comments and advice of the millions of traders around the world. The trading community is very willing to offer online feedback on brokers.

Reviews – It’s relatively easy to find reviews such as this one, which offer a summary of broker strengths.

Regulation – Dismiss any broker that is not regulated by at least one tier-1 authority. These include the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

The trading platform you use will need to be a good fit for your style of trading.

Most sites do a more than an average job of providing clients with an extensive range of tools. The skill is offering powerful software indicators, but not letting them get in the way of trading. Forex markets are fast-moving, so you need all the support you can get but also clear access to trading.

A lot of brokers offer one trading platform but providing a choice of inhouse and third-party platforms is a major positive. These brokers offer at least two high-quality trading platforms: IG, Pepperstone, Admiral Markets.

The good thing about having such a range of brokers is that there really is something for everyone. If you’re looking for a good broker, but prefer a streamlined platform, then it’s possible to find one with a ‘less is more’ approach.

Best Forex Broker UK – Customer support

Customer service is one area where broker ratings can vary quite widely. Most brokers offer enough information and support to ensure you can get online and trading. Some offer support over extended hours, in more languages and have better-trained staff.

Source: Pepperstone

For traders, being able to access quality trade support can be the difference between making a profit or a loss. The below brokers all stand out in some way and deserve a mention for their efforts in this category.

- FXTM – Dedicated customer support in 18 different languages

- Plus500 (CFD provider: offer CFD service only) – Multilingual support on 24/7 basis

- ATFX – 24/5 customer support via live chat, phone or email

- Pepperstone – Picked up the ‘Best Forex Trading Support – Europe’ award at the Global Forex Awards 2019

- IG – A long-established reputation for providing excellent and friendly customer support is backed up by it being provided 24 hours a day from 8am Saturday to 10pm Friday

- Admiral Markets – Adds something else to the equation by providing extensive research and learning materials.

Best Forex Broker UK – Pricing

For some, trading costs will be the top priority. For others, it’s part of the process, but not a deal-breaker.

It’s certainly true that when it comes to choosing brokers you get what you pay for. A no-frills broker that has super tight trading spreads will, very likely, offer little else in terms of research or customer support.

Source: XM

It’s hard to compete with zero. These brokers are on the record as providing zero pips spreads on some currency pairs:

XM – Prides itself on its zero spreads. Rates are variable, so will widen during times of lower liquidity, but the zero pricing covers a range of forex pairs, not just EURUSD.

FXTM – Deep pools of liquidity and super-tight spreads in a range of major forex markets.

Tickmill – Zero spreads and a clear emphasis on driving costs down. It provides a dedicated monitor, which gives real-time updates on how tight its spreads are.

Source: Tickmill

The cheapest pairs to trade are the major currencies such as EURUSD. The markets also need to be at peak liquidity, but zero pips anywhere is a good indication you’ve found a low-cost broker.

Do watch out for financing costs and other trading commissions. Even the zero pips brokers might not be top of the group on overnight fees or they might have punitive inactivity or wire transfer fees.

It is a case of devoting some time to digging through the T&Cs, working out what your personal trading profile will look like and what the associated costs will be at different brokers.

Best Forex Broker UK – Trade execution

At the moment of pulling the trigger on a trade, you need to know your broker’s execution interface is reliable, accurate and uncluttered.

These brokers have execution interface monitors that do a good job of laying out more complex order building tools.

- FXPro – Takes execution very seriously. Most trades on its platform are filled in under 10 milliseconds, with up to 2,000 trades executed per second. That kind of commitment to this crucial part of the trading experience won it the ‘Best Execution Broker – Global’ award at the Global Brands Magazine awards in 2017.

- FPMarkets – Offers high-speed trade execution from Equinix servers. It’s also possible to access to pre-open price action and gauge market direction with cutting-edge tools

Stop-losses, take-profits, trailing stops are all important parts of the trading process. With forex markets moving at the speed they do, these execution tools need to be close to hand and well laid-out.

The innovative AvaProtect product, which has been recently released by AvaTrade, means that broker deserves a special mention. AvaProtect is a clear demonstration of a broker understanding what traders need to incorporate effective risk management into their trading.

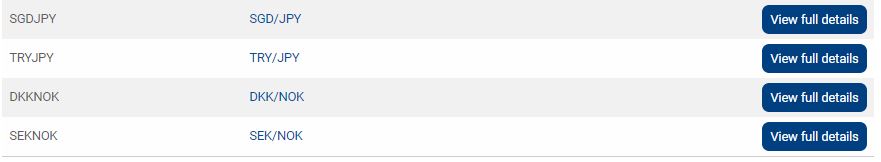

Best Forex Broker UK – Markets Available

The majors are where the majority of trade flow and news events are. But being prepared to trade other markets can help you avoid ‘forcing’ trades which aren’t really set up correctly.

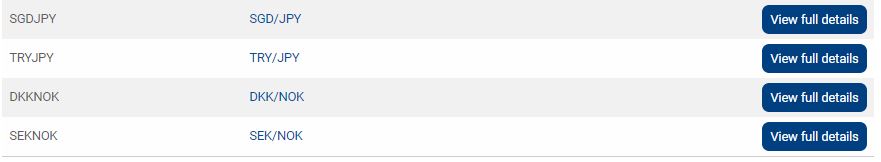

If your current forex broker doesn’t offer the major and minor currency pairs then you need to find a new broker.

- Major Pairs – EUR/USD, USD/JPY, GBP/USD USD/CHF, AUD/USD, USD/CAD and NZD/USD.

- Minor Pairs – EUR/GBP, CAD/JPY GBP/AUD, GBP/JPY, EUR/JPY, EUR/NZD, EUR/AUD, EUR/CHF, EUR/CAD, CHF/JPY, AUD/JPY, NZD/JPY, GBP/CHF AND GBP/CAD

- Exotic – Includes USD/HKD, USD/SGD, EUR/TRY AND USD/SEK

You might not initially think you want to trade euro-lira, but it’s always good to have the option to trade a variety of markets. As trading knowledge and skills develop, some of the minor and exotic markets might be a good fit for your strategy, so these brokers gain points for offering an extensive range of markets.

Source: Plus500

All of the below brokers offer 50 or more forex markets, ensuring you are able to trade the one that give you the best chance of making a profit.

IG – Provides its clients with more than 17,000 markets.

Plus 500 (CFD provider: offer CFD service only)– Another broker offering thousands of markets in total and extensive coverage of forex markets.

Tickmill – Offers trading in 62 currency pairs

Final Thoughts

A broker that is ‘best’ for one type of trader or strategy might not be a good fit for another. The aim is to find a platform that gives you everything you need, but nothing that you don’t.

Fortunately, all good brokers offer free demo accounts for you to use to develop your trading skills. Another positive result of setting up demo accounts is that you can really test the functionality of the different brokers and find a good match.

One important feature of any broker site is the level of transparency. Hidden costs can be frustrating and any broker that lays information out clearly is usually doing so as they are confident about their position in the market.

If transaction costs are hard to understand, it might be because a clear knowledge of them might put you off using a broker. All the brokers in this list provide the information you need in a clear and straight forward way.

Source: IG

You want a broker such as IG that is willing and able to share the information you need to make an informed decision.

People who read this also read: