Price swings in the global currency markets continue to provide opportunities for Canadian forex traders to make profits. Getting on the right side of a trade can't be guaranteed, but the ever-changing geopolitical environment keeps causing moves in the price of forex pairs.

Getting the entry and exit point right on trades is part of the process of making a profit. However, equally as important is choosing the right broker for your transactions. Choosing the right platform for your kind of forex trading can help tilt the odds in your favour. This review of the best forex brokers in Canada is a shortlist of safe candidates that might be ideal for your needs.

#1AvaTrade

What We Liked

What We Liked

- A global broker with a reputation for integrity and fairness.

- Good for novices, intermediate-level traders, and professional traders.

- Operating since 2006, but still has an appetite to continue innovating to improve client services.

- Winner of the #1 Innovation Award at the 2021 Forex Broker Awards.

- High quality multi-lingual customer service available 24/5.

- Free demo account.

- Low minimum account balance.

- Regulated by IIROC.

- Access to global forex markets.

- Great educational tools.

- Ideal for entry-level traders.

- MT4, MT5 and in-house platforms, AvaTradeGo, AvaSocial and, AvaOptions to choose from.

- Competitive spread and leverage offering.

- More than 1,250 markets available in indices, commodities, shares, forex, cryptocurrency, bonds, vanilla options and exchange-traded funds (ETFs).

- A 4.8 / 5.0 rating on Trustpilot.

- Great mobile app. Winner of the Best Forex Trading App award at the 2020 Global Forex Awards.

AvaTrade has been operating for more than 14 years and in that time, it’s built a reputation for being a great broker for beginners. The research and learning tools are designed to help you develop your own strategies, but there are also other features that explain the basics of how the forex markets work.

It also offers access to copy trading where you can take on the ideas of other more experienced traders. This doesn’t take the risk out of trading, even experienced investor accounts lose money, but it can be an alternative to self-trading.

Broker Fees

There’s more to AvaTrade than just low fees. It offers a range of other services designed to develop trading skills and set you up with the best chance of making a profit. That doesn’t mean that AvaTrade is expensive. In fact, its pricing is in line with its peer group, meaning the broker offers a combination of value and expertise.

Trading Limit

Margin terms vary according to which currency pair is being traded. Canadian regulatory authorities have set the maximum leverage in forex markets at 1:50.

Features

- Copy trading using the ZuluTrade and DupliTrade services.

- Extensive range of educational materials in a format to suit you.

- More than 50 currency markets to choose from and 1,250 instruments in total.

Regulation

To be a regulated forex broker in Canada requires registering and complying with the terms set out by the IIROC. The good news for those considering using AvaTrade is that the broker has ticked that particular box. In fact, AvaTrade’s status as a ‘safe’ broker is supported by the fact that it is regulated across five different continents.

AvaTrade is one of the best-regulated brokers in the market and operates globally under license from Tier-1 authorities including FSRA (Abu Dhabi), FSCA (South Africa), the FSA in Japan and the Central Bank of Ireland.

Platform

AvaTrade offers its clients a choice of two proprietary platforms, AvaTradeGO and AvaOptions. It also provides MetaTrader’s MT4 platform and the ZuluTrade and DupliTrade copy trading platforms.

If automated trading is something you want to try, the good news is that AvaTrade platforms are equipped to host algorithmic models.

Customer Support

The award-winning AvaTrade customer services team can be contacted via telephone, live chat or email. You can also reach the team on social media platforms, including Twitter.

#2Vantage FX

What We Liked

What We Liked

- Trade a wide range of asset groups, including forex, commodities, crypto, shares and indices.

- Free demo account and easy to use platform.

- Super-tight spreads including 0.0 pips trading on RAW ECN accounts.

- Impressive trade execution infrastructure to ensure you get the best price in the market.

- Exclusive FX promotions and affiliation schemes.

- MetaTrader4 and MetaTrader5 platforms.

- Access to liquidity pools at big banks.

Vantage FX has been operating for over 10 years and has a ‘new kid on the block’ feel. It is a neat blend of user-friendly functionality and high-level trading tools, which makes it ideal for beginners and experienced traders. The platform has been designed to help its clients be successful and offers low trading costs and neat additional extras.

The broker has won a significant number of industry awards in a relatively short period of time and continues to expand its client base. It does the simple things well, but also provides support services to take your trading to the next level.

Source: Vantage FX

To experience the Vantage FX difference, we recommend taking a few moments to set up a free demo account. It will give you a taste of how the broker is changing what brokers offer their clients. VantageFX.com also runs promotions for new clients who are setting up a live account and these can include a 50% welcome bonus.

Broker Fees

Vantage FX’s aggressive approach to pricing starts with its RAW ECN account, which has spreads as low as 0.0 pips and just a $3 commission. All the other accounts also come with market-leading T&Cs.

Vantage FX backs up its budget pricing with high-quality trading infrastructure. Trade execution is reliable and fast as well as cost-effective. The broker has access to deep pools of market liquidity thanks to its relationships with big banks, including JP Morgan, Citibank and Goldman Sachs.

Source: Vantage FX

Trading Limit

Vantage FX offers clients leverage in line with regulatory guidelines. Forex leverage at VantageFX.com is up to 500:1.

Source: Vantage FX

Features

- Functionality that is ideal for beginners but a trading platform that is institutional-grade.

- Excellent promotional offers — particularly the welcome bonus of 50%.

Regulation

As stated on the Vantage FX website:

“Vantage Global Limited is authorised and regulated by the VFSC under Section 4 of the Financial Dealers Licensing Act [CAP 70] (Reg. No. 700271) and is registered at iCount Building, Kumul Highway, Port Vila, Vanuatu… Clients’ funds are held in a segregated account with Australia’s AA rated National Australia Bank (NAB).”

(Source: Vantage FX)

Source: Vantage FX

Platform

Vantage FX offers both of the award-winning MetaTrader platforms, MT4 and MT5. They can be downloaded onto desktop machines, PC and Mac and are also available in WebTrader format.

The Vantage FX trading experience is very much about having access to your account when you need it. The broker’s mobile apps are available on iOS and Android devices, which go a long way to making sure Vantage FX clients feel in control.

There are several third-party platforms on offer, ZuluTrade, DupliTrade, MyFXBook and Autotrade. Each of them offers a slightly different route into trading. Whether you want to have access to impressive research tools or get involved in social trading and copy trading, Vantage FX has the right platform for you.

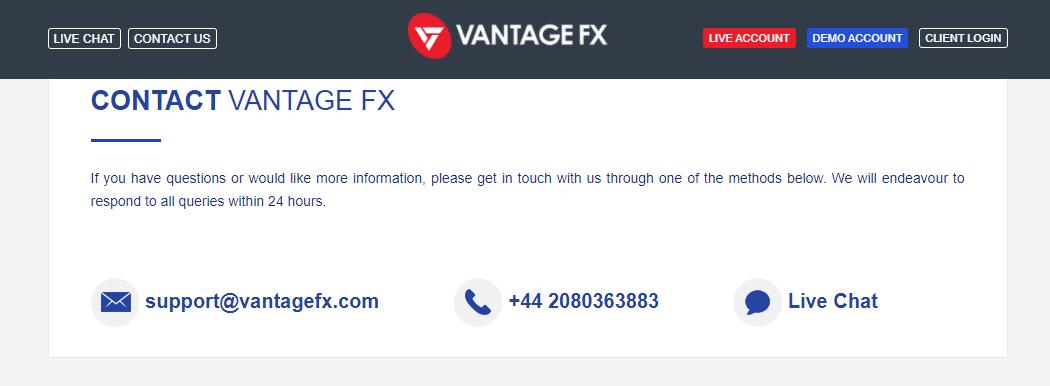

Customer Support

The award-winning Vantage FX customer support team can be contacted around the clock by telephone, live chat and email. The broker’s customer support team is multi-lingual and available to clients on a 24/5 basis.

Source: Vantage FX

#3FOREX.COM

What We Liked

What We Liked

- IIROC regulated forex broker

- Market-leading trading platform

- Excellent research and analysis tools

- Caters to all forex traders – from beginners to intermediate and advanced

- DMA trading

- Free demo account

Any shortlist of Canadian forex brokers has to include Forex.com. The firm has established itself as a significant global player and its high levels of service make it a challenger for the title of best forex broker in Canada.

Broker Fees

Forex.com has spent over a decade investing in technology and building a deep network of liquidity partners. This access to the heart of the markets means it consistently quotes tight spreads in most market conditions.

If the market moves in your favour between the time you execute and are filled on a trade, Forex.com automatically passes the savings on to you.

Trading Limit

Canadian forex traders can take leverage up to 1:33 (CAD/CHF).

Features

- A global broker offering a state-of-the-art trading platform

- Extensive research and analysis tools to help develop your trading skills

Regulation

Forex brokers that accept Canadian clients must be authorised by the Investment Industry Regulatory Organization of Canada (IIROC). The IIROC is the regulatory body that oversees investing to control Canada’s economic activity in the financial markets.

GAIN Capital – FOREX.com Canada Ltd. was admitted to membership in the Investment Industry Regulatory Organization of Canada, effective 10th May 2012.

Platform

Forex.com offers clients the choice of three different trading dashboards. The MT4 and Webmaster versions are top quality services, but the Advanced trading platform is one of Canada’s best forex trading platforms.

It’s highly customisable and comes with more than 80 technical indicators. The charting tools are industry-leading with 100s of predefined templates from which to choose.

Customer Support

Forex.com staff are on hand to assist you with queries 24 hours a day from 10am ET Sunday to 5pm ET Friday.

#4FP Markets

What We Liked

What We Liked

- Low-cost trading

- Impressive execution framework ensuring fast execution

- VPS and ECN connectivity

- Low minimum deposit required

- Micro-lot trading

- Free demo account

- 24/5 customer support

FP Markets is regarded as one of the ‘go-to’ brokers for forex trading. While it offers some other services such as commodity futures, forex is its core product. Canadian traders can access more than 60 currency pairs on a 24/5 basis.

This is an ideal entry-level broker offering a wide range of learning materials, which explain how to start trading forex in Canada. That resource is backed up by award-winning multilingual customer support.

The beauty of FP Markets is the support for intermediate and advanced grade trading. Once you’re set-up, it’s a broker that can help you develop your trading skills.

Broker Fees

There’s stiff competition among Canadian forex brokers and FP Markets has stepped up to offer 0.0 pips trading spreads in some markets. The broker is known for providing some of the most cost-effective trading in the industry. That policy extends across major, minor and exotic currency pairs.

There is a range of different accounts to choose from, so the service can be set up according to your trading profile and aims. The T&Cs improve as you work up that ladder and one indication of pricing is that RAW accounts charge commissions as low as $3 each way.

Trading Limit

Forex trading in Canada complies with IIROC regulations, which means maximum leverage is set to 1:50.

Features

- ECN and VPS services ensure access to the best liquidity pools

- User-friendly entry-level accounts and support to scale up to more advanced strategies

Regulation

FP Markets is an established firm with a track record dating back to 2005. It is a global firm headquartered in Australia where FP Markets Pty Ltd, which is fully regulated by the Australian Securities and Investments Commission (ASIC). The firm operates under an Australian Financial Services Licence (AFSL) 286354. As a regulated forex broker, FP Markets is regarded as safe for users. Canadian residents can use the platform.

Platform

FP Markets provides clients with the most popular retail forex trading platform in the world, MetaTrader’s MT4. Forex markets can be analysed using upwards of 30 built-in indicators and dozens of custom indicators. The MT4 community is an online meeting place where forex traders worldwide share ideas and software innovations.

One of the significant advantages of MT4 is its Expert Advisors (EA) service. The currency markets can be a happy hunting ground for traders who use algorithmic models to identify price moves. EA makes it easy for traders to bolt-on their own automated models, and EA’s access makes MT4 and FP Markets one of Canada’s best forex trading platforms.

There are two other platforms to consider, MT5 and Webtrader, which can be accessed in desktop, tablet and mobile devices. There is also a range of other third-party research services that you can access when you open an FP Market account. Two that stand out are AutoChartist and Myfxbook.

Customer Support

The award-winning FP Markets customer services team is contactable on a 24/5 basis. The team can be reached via live chat, telephone and call back services. Those who trade on the move can also use mobile apps such as WhatsApp, Messenger, and Telegram to contact the broker.