Volatility in the currency markets might be troublesome for some. However, for Indonesian traders the price moves are an opportunity to put on forex positions and profit from the price swings. One of the most important factors to consider is the quality and reliability of your broker. Getting the direction of the trade right is one thing, making sure your broker won't disappear overnight is another.

This review of the best forex brokers in Indonesia will consider some of the best-regulated brokers. Our research team of experienced traders will also give tips on what to look for in a broker. If you want to trade forex in Indonesia, the firms detailed below are definite contenders for your candidates' shortlist.

#1FXGT

What We Liked:

What We Liked:

- Nice range of innovative tools and markets

- Emphasis on ease of use

- Impressive industry awards

- Spreads as tight as zero pips

#2TICKMILL

What We Liked

What We Liked

- One of the lowest-cost forex brokers in the industry

- Excellent 24/5 customer service

- Great research tools

- Easy to navigate website – ideal for beginners

- Free to use demo account with no time-limit

- Low minimum opening account balance of $25

Tickmill is an ideal option if you want to set up quickly and don’t have too much cash to invest. The minimum account opening balance is only $25. The broker has a global presence, provides its clients with the world’s most popular trading platform and is well regulated.

The demo account is free to use and doesn’t have a time limit. That is convenient because you can return to use it later and won’t lose any experimental strategies you’re running. Once you’re up and running on the platform, you’ll find Tickmill combines super-fast trading with some of the most competitive pricing in the sector.

Tickmill has won a host of industry awards including International Business Magazine’s Best CFD Broker Asia, the Forex Awards’ Most Transparent Broker, the Online Personal Wealth Awards Best Forex CFD Broker and CFI.co Awards Best Forex Execution Broker.

Depending on where you live, you might also be able to take advantage of promotions such as the $30 Welcome Account offer.

Broker Fees

Tickmill offers three different trading accounts. The spreads for the Pro and VIP accounts begin at 0.0 pips, while that of the classic version is 1.6 pips.

- The Classic account and ECN Pro accounts have an average execution speed of 0.2 seconds

- The VIP account offers a low commission of $1.6 per lot per side, among the lowest of all brokers

Trading Limit

Leverage can be set according to your preference. Rates start at 1:1 and go as high as 1:500 for major forex pairs.

Features

- ECN and VPS services ensure access to the best liquidity pools

- User-friendly entry-level accounts and support to scale up to more advanced strategies

Regulation

Tickmill is a global broker regulated by a range of authorities. Its Asian operations are run out of its offices in Malaysia. The registered address is Office No. 5, Unit 25,1st floor Paragon Labuan, Jalan Tun Mustapha, 87007 Labuan FT, Malaysia

That entity is regulated by the Financial Services Authority of Labuan Malaysia and has licence number MB/18/0028

Platform

Tickmill provides clients with access to the most popular retail forex trading platform in the world, MetaTrader’s MT4. The platform is specifically designed to trade the forex markets and comes with 30 built-in indicators and the option to bolt-on dozens of custom indicators.

MT4 can be installed on Mac, Windows, Android and iOS devices. It is also available in a web-based version. The Expert Advisors (EA) service allows you to use algorithmic models and to try automated trading.

The MT4 community is an online meeting place where forex traders worldwide share ideas and software innovations. The forex markets are particularly well suited to automated trading and it can be a way to trade the markets without having to monitor them all day.

Other features which make MT4 stand-out include, AutoChartist, Myfxbook, One-click trading, VPS hosting and Pelican trading.

Tickmill also provides clients that are of the Muslim faith with a swap-free Islamic Account. It is 100% compliant with Shariah law.

Customer Support

Multilingual customer service is available on +6 087-504 565 and client support hours are Mon-Fri 8:00 – 17:00 MST

If you email support@tickmill.com on business days, you’ll get a response within 24 hours.

#3FXTM

What We Liked

What We Liked

- An ever-increasing number of clients. Currently, more than 2 million customers across the world

- Three different account types including the stand-out Cent account, which allows clients to trade in small size

- Minimum account opening deposits as low as $10

- Fast, reliable trade execution thanks to VPS hosting

- Winner of the World Finance, Best Trading Experience award, 2020

- Award-winning mobile apps, perfect for those who want to trade on the move

- Free to use specialist analysis tools including FXTM Pivot Point Strategy and Trading Signals

- Customer support in 18 different languages — available 24 hours a day

- Islamic account for Shariah-compliant trading

FXTM is an increasingly popular trading platform, which is packed full of neat and innovative features specifically designed to make trading easy. The broker continues to pick up heaps of awards thanks to this approach of providing clients with just what they need to trade. A lot of the features are unique to FXTM and visiting the platform to try out its services is highly recommended.

Some of the upgrades appear no-brainers and raise the questions why other brokers don’t offer them. The Cent account, for example, is ideal for beginners. With a low minimum deposit of $10, this account allows traders to take the step up from trading in a demo account and into live trading without the risk of burning through their entire cash pile.

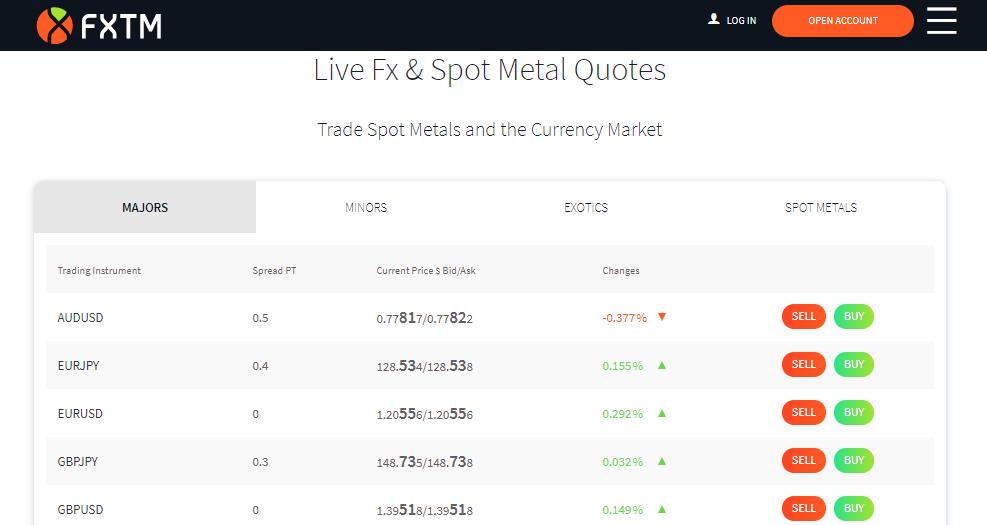

The firm also stands out in terms of the information it provides clients about the operational efficiency of the site. The levels of transparency are as high as you are likely to find in the broker sector, with tools and reports sharing how well the broker is meeting the demands of clients. This oozes confidence, showing the broker is obviously comfortable that it is doing a good job.

Broker Fees

FXTM offers three types of account types, Standard, Shares and Cent, so that clients can find a best fit. The T&Cs vary across the accounts, but all are very competitive.

- EURUSD: as low as 0.1pips

- EURUSD Standard spread: 1.9 pips

- EURUSD Average RAW spread: Standard spread 0.6 pips

- GBPUSD Average RAW spread: Standard spread 0.5 pips

- Commissions USD: $2

Trading Limit

Leverage terms are flexible and can even be adjusted on a trade-by-trade basis. FXTM clients that open accounts are covered by the Mauritius regulator FSC and can access leverage up to 1:300.

- FXTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard, Stock and FXTM copy trading accounts.

- Maximum number of orders: 100 (300, Cent account)

Features

- A trusted broker with a refreshing approach to innovation

- The Cent account is a great introduction level account as it eases clients into live trading

Regulation

Exinity Limited is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295.

Platform

FXTM offers its clients the world’s most popular retail trading platform MetaTrader MT4 and its sister platform MT5. Available in desktop, WebTrader and mobile app format, clients can take confidence in never being far away from the markets.

MT4 has user-friendly functionality but is packed full of powerful charting and analytical tools. It’s an ideal platform for those starting out in trading with the MT4 online community and a great place for beginners to seek out the ideas of other more experienced traders.

The second platform on offer is the second-generation MetaTrader5 product, which has more indicators and time-frame settings and offers a slightly different way of doing things. Many across the globe stick with using MT4 as it is still the benchmark other platforms measure themselves by and confirms the old adage, that ‘if it’s not broken, don’t fix it’.

FXTM’s free VPS hosting service is a big plus point as it ensures your trades get filled at the best price. There’s nothing more frustrating than picking a good trade entry point but finding market price moves before you have a chance to get into it. Having your trade execution platform hosted in close-proximity to exchanges can improve trade execution speeds and reliability.

FXTM Invest is a copy trading service that offers another way to get exposure to the financial markets. This suits beginners and those who don’t have the experience or time to develop their own strategies. This service benefits from another one of FXTM’s neat client-friendly ideas — you only pay copy trading fees on profitable trades. There are in excess of 5,000 traders to choose from and the minimum opening balance is only $100.

Customer Support

FXTM was awarded Best Trading Experience and Best Trading Condition awards at the World Finance Awards in 2020. Customer support is available in 18 languages and the easy to reach dedicated account managers are also multilingual. FXTM customer services can be contacted via email, telephone and live chat and are available around the clock.

#4Vantage FX

What We Liked

What We Liked

- Easy to use platform

- Trade forex, commodities, crypto, shares and indices

- Free demo account

- Islamic Account for Shariah-compliant trading

- 0.0 pips trading on ECN accounts

- Super-strong trade execution infrastructure to ensure you get the best price

- Exclusive FX promotions

Vantage FX was founded in 2009 but has recently been building considerable momentum. The great news for clients is the broker has taken the time to find out what traders really want and then ensured it’s provided.

The multi-award-winning broker has gained recognition in the trading community and from industry experts by getting the basics right and laying on top of that base a range of client-friendly additional features.

From providing market-leading platforms to offering special promotional offers, Vantage FX has come up with a well-thought-out plan. This win-win situation has led to the number of users really take off. Setting up a free demo account takes very little time and will offer you the chance to experience trading with a broker at the cutting edge of the industry.

Broker Fees

It’s hard to compete with zero and that is just what Vantage FX offers on its RAW ECN account — 0.0 pips. The other accounts are also super-competitive and pricing terms are a particular strength of Vantage FX. There are no fees charged on cash deposits.

Trading Limit

Vantage FX’s standard forex leverage starts at 100:1. The maximum leverage Vantage FX may offer is up to 500:1 but to step up to this level of margin, clients need to satisfy certain requirements.

Features

- Ideal for beginners but with lots of room to grow

- Very strong trading infrastructure

Regulation

Vantage Global Limited is authorised and regulated by the VFSC under Section 4 of the Financial Dealers Licensing Act [CAP 70] (Reg. No. 700271) and is registered at iCount Building, Kumul Highway, Port Vila, Vanuatu.

Clients’ funds are held in a segregated account with Australia’s AA rated National Australia Bank (NAB)

Platform

The industry-leading MT4 and MT5 platforms can be accessed on your PC, Mac, iOS and Android devices. Their strengths are well known and Vantage FX do well to offer their clients both versions of the MetaTrader service.

There are three more platforms available, each offering their own take on social trading and copy trading. ZuluTrade, DupliTrade and MyFXBook Autotrade are all well regarded in the market and offer clients the chance to benefit from the ideas of others.

Customer Support

The award-winning Vantage FX customer support team can be contacted by phone, live chat and email on a 24/5 basis.