Trading forex is increasingly popular in Pakistan and dramatic price moves in the currency markets have resulted in some traders making significant profits. Nothing can be guaranteed though, and there is always a risk that you can lose money, but opening an account with a regulated broker is a good first step. The brokers offering forex trading in Pakistan operate in a very competitive environment. As a result, you will find brokers offering top-quality trading platforms, free research, customer support and competitive fees.

Setting up a trading account takes minutes to do and trying out a demo account first is also recommended. Using a demo account, you can practise trading using virtual funds, and there is no commitment to stay with a particular broker. By reading this report and by accessing a variety of demo accounts, this will help you learn more about trading. It will also give you an insight into the extent to which the brokers compete to be known as the best forex broker in Pakistan.

#1HFM (HF Markets)

What We Liked:

What We Liked:

- Trade with leverage of up to 1:2000

- Zero commissions

- High-spec research and analysis tools including Autochartist

- Swap-free / Islamic trading accounts

- Multilingual customer support 24/5 via phone, email, and Live Chat

- Multiple trading platforms to choose from

- New Advanced Insight analysis tool which uses AI

- Award-winning, earning more than 60 industry awards

Founded in 2010, the award-winning broker HF Markets (HFM), formerly HotForex, has grown to have more than 3.5m client accounts. Its success has been based on offering a user-friendly way of using cutting-edge software tools to give its clients an edge. HFM removes many of the traditional barriers to entry faced by traders; for example, the Premium and Zero accounts have no minimum account balance requirement. For those just starting out, there is a multilingual customer services team that can support clients in more than 27 languages. While for those with more experience, there is an opportunity to tap into an impressive maximum leverage rate of up to 1:2000.

Broker Fees

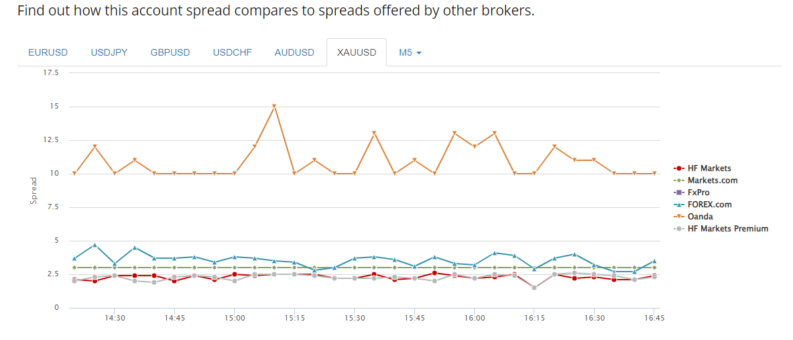

HFM attracts clients by offering an impressive range of additional trading and research services, but while the broker is not set out as a budget operator, the terms and conditions ensure clients can enjoy cost-effective trading. Spreads on some currency pairs are as low as zero pips, and stock spreads start at 0.01 pips. With spreads being variable rather than fixed, they can widen during times when trade volumes are low, but the unique spread comparison tool allows clients to check and ensure what real-time trading conditions are like.

No charges are applied on cash deposits and withdrawals.

Regulation

HF Markets (SV) Ltd is registered in St. Vincent and the Grenadines as an International Business Company with registration number 22747 IBC 2015.

Platform

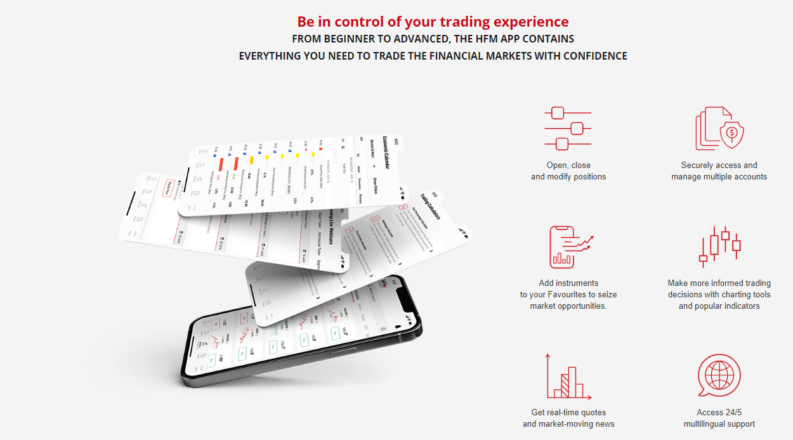

HFM clients can choose from one of three different trading platforms. The proprietary HFM Platform is unique to the broker and has pleasing aesthetics that make trading easy. In addition, it is possible to take full advantage of the wide range of services offered by MetaTrader’s MT4 and MT5 trading platforms.

Customer Support

HF Markets customer support is available around the clock on a 24/5 basis. Clients can make contact via phone, email, or Live Chat, and the range of options ensures they can get the help they need in a format which suits them at a time of their choosing.

#2Tickmill

What We Liked

What We Liked

- Low-cost trading with a reliable broker

- Research tools designed to help clients spot trades

- User-friendly website – ideal for beginners

- Free to use demo account

- Low minimum opening account balance of $25

The forex broker Tickmill is an ideal option if you want to start currency trading in Pakistan but don’t have too much cash to invest. The minimum account opening balance is $25, which compares well to most other firms. You do still get access to a fully functioning trading account on a user-friendly regulated platform.

Tickmill offers super-fast trading, some of the lowest costs in the industry, and high-quality customer support. It’s a great platform for beginners but has enough substance to support those who go on to trade more advanced strategies.

The demo account is easy to set up and unlike those at some other brokers, the one at Tickmill doesn’t have a time limit on it. This can be an underappreciated feature as, while most traders want to get on with trading live accounts, a demo account will continue to be a good resource if you want to try out new strategy ideas in a risk-free environment.

Tickmill has won a host of industry awards. These include International Business Magazine’s Best CFD Broker Asia, the Online Personal Wealth Awards Best Forex CFD Provider, the Forex Awards Most Transparent Broker and CFI.co Awards Best Forex Execution Broker.

Broker Fees

Trading fees can be an obstacle to those in Pakistan who are using forex trading to earn money. Tickmill does a very good job of supporting its clients by keeping costs down. The spreads for the Pro and VIP accounts begin at 0.0 pips – and Tickmill’s rivals will tell you it’s hard to compete with zero.

- The Classic account and ECN Pro accounts have an average execution speed of 0.2 seconds.

- The VIP account offers an incredibly low commission of $1.6 per lot per side, which is considered among the lowest of all brokers.

Tickmill also does well on other costs. There aren’t many forex brokers in Pakistan that don’t charge account administration fees, trade inactivity fees or cash deposit and withdrawal fees.

Trading Limit

Leverage can be set according to your preference and it’s recommended beginners avoid using it. For more experienced traders, leverage rates go as high as 1:500 for some forex pairs.

Features

- ECN and VPS services provide access to the best liquidity pools in the market

- Low-cost and user-friendly

Regulation

Tickmill is a global broker, which is licensed by a range of regulatory bodies including the Seychelles Financial Services Authority (FSA). Tickmill Ltd is regulated as a Securities Dealer by the Seychelles Financial Services Authority with Licence number: SD008

The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in Seychelles through a solid regulatory regime.

Platform

Tickmill provides its clients with access to the most popular retail forex trading platform in the world, MetaTrader’s MT4. The platform is the ‘go-to’ platform for those looking to trade the forex markets. Its default setting includes 30 built-in indicators to help clients identify trading opportunities but there is the option to bolt on dozens more custom indicators developed by third-parties.

MetaTrader 4 can operate on Mac, Windows, Android and iOS devices. It is also available in a web-based version, which means you can monitor your account while on the move.

The Expert Advisors (EA) service allows you to use algorithmic models and let computer models do your trading for you. If you don’t want to develop your own then the MT4 community is an online meeting place where forex traders from across the world share ideas and trading models.

Other features that make MT4 really stand-out include, AutoChartist, Myfxbook, One-click trading, VPS hosting and Pelican trading.

Tickmill offers Clients of Muslim faith the option to use a swap-free Islamic Account. This is 100% compliant with Shariah law.

Customer Support

Multi-lingual customer service is available on +852 5808 7849 and client support hours are Mon-Fri 8:00–17:00 MST.

If you email [email protected], you’ll get a response within 24 hours on business days.

#3AvaTrade

What We Liked

What We Liked

- A global broker with a reputation for integrity and fairness.

- High quality multi-lingual customer service available around the clock.

- User-friendly — ideal for beginners.

- Low minimum account balance — just $100.

- Free demo account

- Wide range of asset classes — markets available in indices, commodities, shares, forex, cryptocurrency, bonds, vanilla options and exchange traded funds.

- Has been in business since 2006.

- Has recently upgraded its educational and research materials.

AvaTrade has been operating for more than 14 years and in that time has built a strong reputation in the trading community. It has a strong focus on regulatory compliance and is licensed by seven different global regulators. This is a sure sign that it aims to ensure users feel they are signing up to a trustworthy platform.

The research and learning tools have recently been upgraded and cover entry level topics such as ‘How to trade Forex’ but also have hints and tips relating to more complex strategies.

AvaTrade also offers its clients access to copy trading where they can take on the ideas of other traders. This doesn’t take the risk out of trading, even experienced investors can lose money, but it is a type of trading that is popular with beginners.

Broker Fees

AvaTrade holds a comfortable position in the sector in terms of the fees it charges clients. It isn’t a no-frills broker, but instead attracts and retains clients thanks to the range of other services it offers, but that doesn’t mean that AvaTrade is expensive.

Inactivity fees are something to watch out for. They are $50 per quarter and kick in after only three months of trading inactivity

Trading Limit

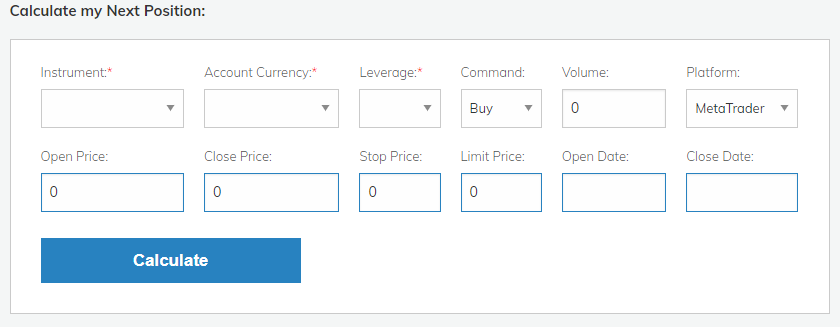

Margin terms vary according to which currency pair is being traded and are in line with other regulated brokers. One nice-to-have feature is the Trade Calculator, which allows you to review leverage terms and costs prior to putting a trade on.

Features

- Copy trading using the ZuluTrade and DupliTrade services.

- Really neat, advanced research tools.

- More than 50 currency markets to choose from and over 1,250 instruments in total.

- Supports those wishing to trade using an account that complies with Shariah rules.

- AvaProtect is a new revolutionary risk management tool, which offers up to $1m in protection.

Regulation

AvaTrade has recently upgraded some parts of its platform, but its regulatory structure has always been particularly strong.

All client funds are segregated from those of the broker, meaning if they fail, your money is protected. Clients who register accounts protected by the regulator have their funds held at Barclays bank.

Platform

AvaTrade offers its clients a choice of two proprietary platforms — AvaTradeGO and AvaOptions. It also provides MetaTrader’s MT4 platform and ZuluTrade.

If automated trading is something you want to consider, the good news is that AvaTrade is fully prepared to host algorithmic models you develop or buy from others.

Customer Support

The award-winning AvaTrade customer services team can be contacted via telephone, live chat or email. You can also reach the team on social media platforms including Twitter. The customer support telephone service is offered in languages across seven continents.

#4FXTM

What We Liked

What We Liked

- A global leader in online trading and investment.

- Three different account types including the beginner-friendly Cent account, which allows newbies to trade in small size.

- Over 2 million clients.

- Fast reliable trade execution and VPS hosting.

- Winner of the World Finance, Best Trading Experience award, 2020.

- Market-leading platform and award-winning mobile apps for those who trade on the go.

- Extensive trade analysis tools including FXTM Pivot Point Strategy and Trading Signals.

- Multilingual customer services and friendly personal account managers.

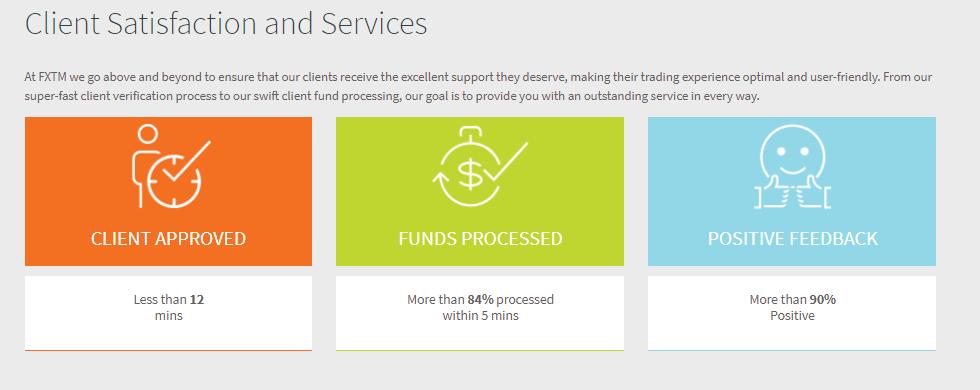

FXTM is a multi-award-winning broker, which has been operating for more than 10 years. Its success is partly based on its innovative approach and track-record of introducing new client-pleasing services. The reporting of its own service levels is just one example of the high degrees of transparency the broker provides. There is definitely a feeling that FXTM knows what its clients want and is intent on providing it for them.

Another way FXTM get things just right is the Cent account, which is ideal for beginners. This allows traders to trade real money, but in very small size. This bridges the gap between demo account and live trading, and gives clients room to make some newbie errors without blowing up their cash pile.

Broker Fees

FXTM offers a range of account types so that clients can find a best fit. The T&Cs vary across the accounts, but are very competitive.

- EURUSD as low as 0.1pips

- EURUSDStandard spread: 1.9 pips

- EURUSD Average RAW spread: Standard spread 0.6 pips

- GBPUSD Average RAW spread: Standard spread 0.5 pips

- Commissions USD: $2

Trading Limit

In line with most forex brokers in Pakistan, leverage terms extend up to 1:300.

- FXTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard and Stock accounts.

- Maximum number of orders: 100.

Features

- A well-established broker with an appetite for introducing innovative new features.

- One of the lowest minimum account balance requirements in the sector.

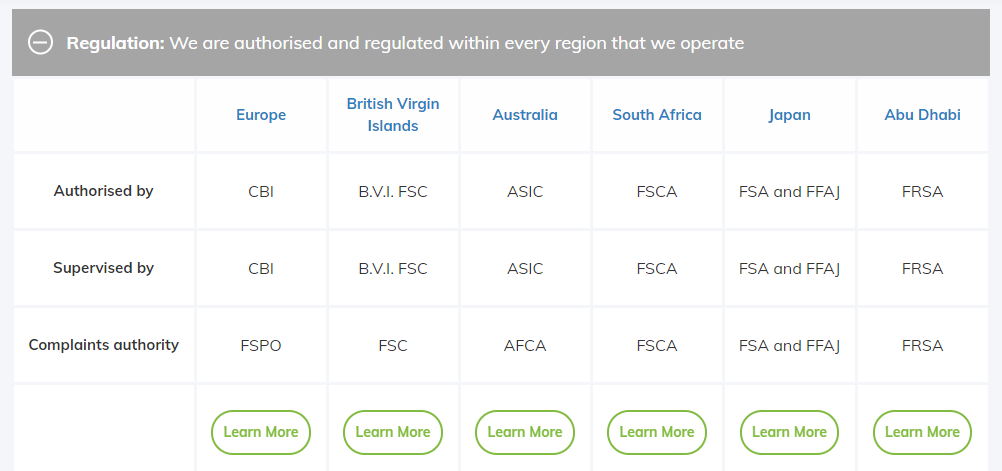

Regulation

ForexTime Limited is regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, and licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614.

Platform

There are two trading platforms on offer at FXTM. The MetaTrader MT4 platform is the most popular platform in the retail forex trading community. It is available in desktop format and comes packed full of professional grade analytics tools and advanced charting tools, which are ideal to help traders develop integrated trading strategies

The free VPS hosting service is a big plus point and ensures clients can improve on their trade execution speed and reliability by having their programs hosted close to exchanges.

The FXTM mobile trading a pp is free to use and allows those who like to trade on the move keep in touch with the markets.

Customer Support

FXTM was awarded Best Trading Experience and Best Trading Condition awards at the World Finance Awards in 2020. Customer support is available in 18 languages and the dedicated account managers are also multilingual.

#5XM

What We Liked

What We Liked

- A global broker offering 16 different trading platforms

- More than 30 languages supported

- User-friendly website – ideal for beginners

- Demo account

- 3.5 million clients from 196 countries and countless industry awards

XM is a global broker with a personal approach. It aims to make its clients successful traders and the XM management team has visited more than 120 cities around the world to meet its clients.

The firm was established in 2009 and continues to grow by introducing a range of neat innovations. A quick rundown of the awards the firm won in 2020 backs up its claim to be the best online trading platform in Pakistan.

- Awarded as Global Forex Broker of the Year by Global Forex Awards 2020

- Awarded as Most Reliable Broker – Global by CFI.co (Capital Finance International)

- Awarded as Most Transparent Broker – Global by CFI.co (Capital Finance International)

- Awarded as Best Online CFD & FX Trading Broker – Global by Global Business Awards 2020

- Awarded as Best Customer Service Experience – Global by Global Business Awards 2020

- Awarded as Best FX Broker, Europe by World Finance Awards 2020

Broker Fees

The XM Zero account features ultra-thin spreads as low as 0.0 pips. It’s also backed up by XM’s no re-quotes execution policy, which means you have greater trade security. The broker’s appetite to keep trading costs down is also demonstrated by it taking pricing terms to five decimal points rather than the industry standard of four.

Trading Limit

Leverage can be set according to your preference. Accounts set up in base currencies EUR, JPY or USD can access up to 1;30 leverage rates on forex pairs.

Features

- All the tools you need for professional-grade trading – VPS, fractional pip pricing, zero spreads

- The firm maintains a personal approach with dedicated support for traders to help them develop the skills needed to be successful

- Low-cost and user-friendly – ideal for beginners

Regulation

XM is regulated by a range of regulatory bodies including CySEC, ASIC and DFSA.

The broker is also regulated by the International Financial Services Commission, Belize, where XM Global Limited operates under license number 000261/106.

Platform

XM provides its clients with access to MetaTrader’s MT4 and MT5 platforms. The latter is a second-generation platform, which covers more markets and offers entry-level coding of trading programs.

Both platforms operate on Mac, Windows, Android and iOS devices. They are also available in a web-based version, which means you can easily access your account at all times.

XM’s forex Islamic accounts – also known as swap-free accounts – have no swap or rollover interest on overnight positions. This is against Islamic faith. There are three easy steps to set your account to be compliant with Shariah law.

Customer Support

The XM customer services team offer support in 25 different languages. They can be contacted via telephone during working hours (05:00 – 19:00 GMT) on +357 25029933 and +357 25345225

or via email at [email protected]