As we get into a time where information could be gathered quickly, stocks become an investment vehicle for people to preserve their wealth or grow it. For Malaysians, we’re not short of options when it comes to buying shares. In investing, there’s no certainty in a guaranteed profitable investment. However, it is essential to select a suitable stockbroker to give you the security to rely on to secure your profits.

#1Tickmill

What We Liked

What We Liked

- Low-cost trading.

- Award winning 24/5 customer service — ideal for beginners.

- Powerful research tools that help traders identify trade entry and exit points.

- User-friendly website.

- Free demo account with no time-limit.

- Low minimum opening account balance of just $25.

- Regulated by Labuan Financial Services Authority (Labuan FSA).

- Promotional offers including cash-prize demo account competition and a $30 welcome account offer where the broker gives you real cash to trade with.

- Islamic Account for Shariah-compliant trading.

Source: Tickmill

Tickmill is an ideal option for beginners. Registering for an account is made easy and those still considering their options can practise using the free demo account on offer. If you want to start trading real cash straight away, the minimum account opening balance is only $25.

Once set up, you’ll soon discover why Tickmill keeps picking up new clients. The platform provides access to a wide range of asset groups and financial markets across the world. Client protection is a key consideration and the good news is that Tickmill is regulated by Tier-1 authorities.

It’s little surprise that Tickmill has won a host of industry awards, which include:

- International Business Magazine’s Best CFD Broker Asia

- Forex Awards Most Transparent Broker

- Online Personal Wealth Awards’ Most Reliable Broker

- co Awards Best Forex Execution Broker

Tickmill is a great place to start trading. It’s a trusted broker with a track-record of introducing innovative features, and you can head here to try it out.

Broker Fees

Trading costs at Tickmill are incredibly low. There are three different trading accounts to choose from, but each has very impressive T&Cs.

The spreads for the Pro and VIP accounts stand out because they begin at 0.0 pips. Those who trade using the VIP account will find those tight spreads are then backed up by trading commissions as low as $1 per lot, per side.

Source: Tickmill

Trading Limit

Maximum leverage settings are in line with the regulatory restrictions of Labuan Financial Services Authority (Labuan FSA). Traders can adjust leverage to suit them and the maximum leverage is 1:500.

There are no restrictions on types of trading strategy, which means scalping and hedging are allowed.

Features

- High-grade trade infrastructure, including ECN and VPS services.

- Fast, reliable, cost-effective trading.

- Tickmill offers a range of special offers and the $30 welcome offer is well worth checking out.

Regulation

The Tickmill group of companies is a serious operation. It employs more than 200 people worldwide.

The firm’s office in Malaysia can be found at Office No. 5, Unit 25,1st Floor Paragon Labuan, Jalan Tun Mustapha, 87007 Labuan F.T.

The different Tickmill entities are regulated in some of the world’s most reputable financial jurisdictions, including FCA, CySEC, FSA and FSCA.

Clients in Malaysia register for accounts with Tickmill Asia Ltd, which is authorised and regulated by the Labuan Financial Services Authority. The firm has licence number: MB/18/0028

Source: Tickmill

As the Tickmill site states: “Labuan FSA acts as the central regulatory, supervisory and enforcement authority of the international business and financial services industry in Labuan. The authority plays a vital role in ensuring all entities operating under Labuan IBFC abide by the highest financial standards”. (Source: Tickmill)

Platform

Designed specifically for traders, the MetaTrader 4 platform is a user-friendly and powerful trading dashboard. It is packed full of sophisticated order management tools which help you control your positions quickly and efficiently.

Combining MT4 with Tickmill’s enhanced trading conditions, you’re able to use a trusted trading platform to access spreads as low as 0 pips and execution times of 0.20s.

An impressive list of additional services is also on offer. AutoChartist, Myfxbook and Pelican trading provide the ideal support for both beginner and experienced traders.

Source: Tickmill

Customer Support

Tickmill provides its clients with a wide range of educational materials. Choose from ebooks, video tutorials, infographics and specialists sections focussing on technical and fundamental analysis.

If you find you need to contact the multi-lingual Tickmill customer service, that can be done via telephone, email and live chat.

#2IG

What We Liked:

What We Liked:

- More than 17,000 instruments available to trade

- Wide range of asset groups to suit both traders and investors

- High-quality research and analysis tools

- Strong reputation – founded in 1974

- Well-regulated with licenses from Tier-1 authorities

- Platform designed to cater to beginners and advanced traders

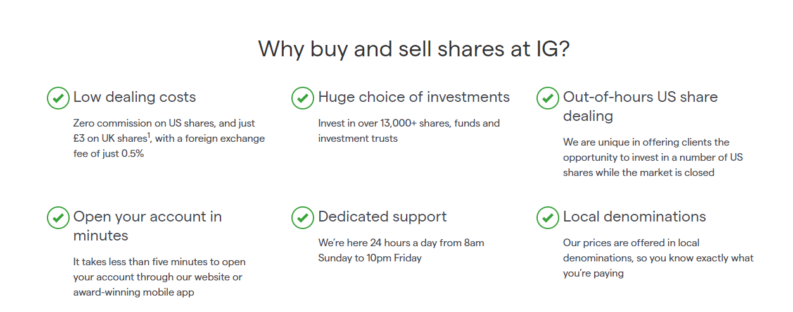

IG is one of the big players in the investment industry. It’s a genuine multi-asset broker which supports those looking to trade short-term strategies or build a portfolio for long-term gains. The range of markets available means that whether you’re looking to trade forex, crypto or commodities or invest in stocks, bonds, options, futures, and ETFs, the user-friendly functionality will help you meet your investment aims. Founded in 1974, this award-winning broker has had sufficient time to develop an impressive all-round trading service which gives its clients an edge.

BROKER FEES

IG is a high-quality rather than a low-cost broker, but the T&Cs remain in line with the rest of the sector. The different CFD, spread betting, share dealing, and ISA accounts have slightly different terms, and there is a lot of information to work through when performing a cost comparison. However, the information is presented in a transparent manner reflecting the broker’s confidence in its approach.

- Zero commissions on US stock dealing

- Variable spreads on forex markets

- Inactivity fee only applies after two years of not trading

Source: IG

TRADING LIMIT

In line with standard regulations, IG offers leverage of up to 1:30. The rate varies across different asset groups, and trading in cryptocurrencies is only available to certain clients and is not available in CFD format.

- The range of instruments to trade at IG is particularly appealing to some investors. There are more than 17,000 stocks from different exchanges worldwide, 80+ forex pairs, more than 35 soft and hard commodities, 5,000+ ETFs, and bonds, options, indices, and cryptocurrencies to trade.

- Those using debit/credit cards and PayPal to fund their account will find the minimum initial deposit requirement at IG is £250. There is no minimum deposit requirement when opening an account using bank transfers.

FEATURES

- CFD, spread betting, share dealing, and ISA accounts

- One-stop-shop service offering a variety of ways to get exposure to the financial markets

REGULATION

The IG group of companies spans the globe, and regulatory protection depends on each individual’s place of domicile. In the UK, IG Markets Ltd (Register number 195355), IG Index Ltd (Register number 114059) and IG Trading and Investments Ltd (Register number 944492) are authorised and regulated by the Financial Conduct Authority.

Source: IG

PLATFORM

The impressive in-house designed platform offers reliable and cost-effective trade execution and all the charting tools needed to carry out technical analysis. Research and analysis materials go into granular detail to ensure clients can thoroughly evaluate trading strategies before implementation.

Source: IG

CUSTOMER SUPPORT

Client support is an area where IG stands out from the rest of the sector. The multilingual team is available from 8 am Saturday to 10 pm Friday and is contactable by phone, LiveChat, and email. That availability ensures those looking to take their trading to the next level can draw on the support they need throughout the day and into the evening.

The FAQs section is well thought out and reflects that the firm has been operating for decades. In that time, it has built up a library of valuable hints and tips on all features of the financial markets. Articles cover topics ranging from how things work in trading to ways to design a successful portfolio, and the IGTV channel streams live market news so that traders can keep fully up to date.

Source: IG

#3FXGT

What We Liked

What We Liked

- Low Trading Costs

- Hassle-free account opening

- Cryptocurrency-friendly

- Spreads as tight as zero pips

#4FXTM

What We Liked

What We Liked

- Tried and trusted with more than 2 million existing clients.

- Beginner-friendly ‘Cent’ account allows new traders to try out trading in small size.

- $10 minimum opening balance (Cent account).

- Competitive pricing with no commissions on ECN accounts.

- Institution-grade infrastructure ensures reliable and fast trade execution.

- Winner of the World Finance Best Trading Experience award 2020.

- User-friendly mobile apps, perfect for those who want to trade on the move.

- 24-hour customer support available in 18 different languages.

- Islamic Account for Shariah-compliant trading.

- Free demo account.

- Lots of additional extras including Trading Signals and FXTM Pivot Point Strategy.

FXTM is a leading online broker. It uses ground-breaking technology to give clients a competitive edge when trading the markets. The platform is well designed and packed full of innovative features. The FXTM trading experience is a combination of user-friendly functionality and powerful software tools. It’s no surprise the broker has been picking up a heap of industry awards.

Source: FXTM

FXTM is different and in a good way. Many of the features on offer have been developed in-house and are unique to the broker.

Visiting the platform to try out its service using a demo account is highly recommended. There’s no charge for signing up and practicing trading using virtual funds is always to be recommended.

One of the best examples of how FXTM is reshaping the sector is the Cent account. You can start trading with as little as $10 and minimise the risk of blowing up your account as you take the step-up from virtual to live trading.

There is a difference between trading virtual and real funds and the Cent account helps FXTM clients develop an effective trading psychology.

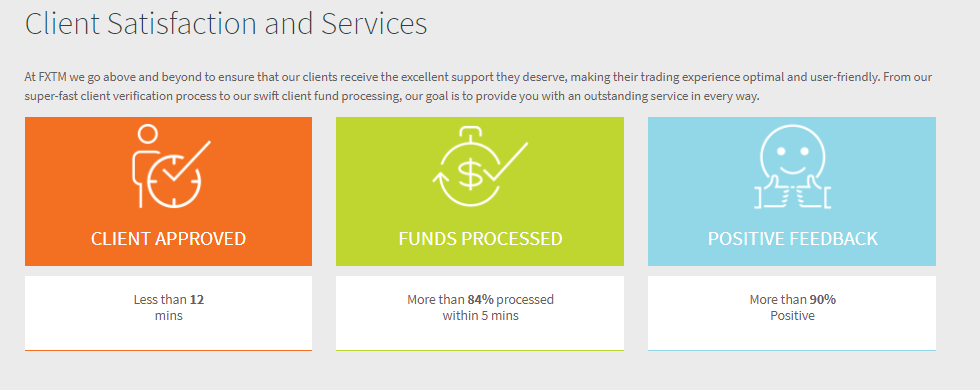

FXTM also has a market-leading approach to transparency of reporting. The broker provides a range of data on how effective its own processes are. This is a neat feature that confirms the broker is on the same side as its clients and confident that it is doing a good job.

Broker Fees

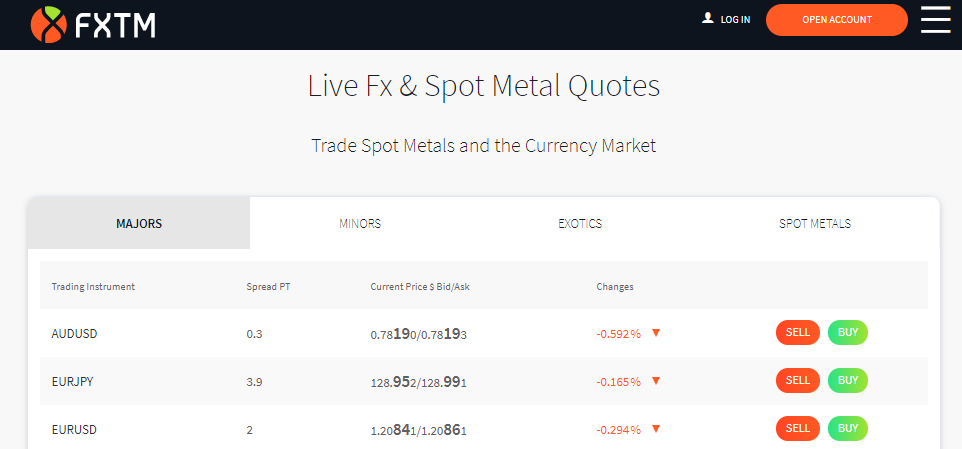

FXTM offers four types of account types, Standard, Shares, ECN Zero and Cent. Each offers slightly different T&Cs, but all are super-competitive.

- EURUSD as low as 0.1pips

- EURUSDstandard spread: 1.9 pips

- EURUSD average RAW spread:Standard spread 0.6 pips

- GBPUSD average RAW spread:Standard spread 0.5 pips

- Commissions USD:$2

Source: FXTM

Trading Limit

FXTM offers floating leverage, which means clients can set their own trading limits. In line with the rules set out by the regulatory body that oversees FXTM’s operations, the maximum leverage terms for FXTM clients in Malaysia is 1:30.

- FXTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds.

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard, Stock and FXTM copy trading accounts.

- Maximum number of orders: 100.

Source: FXTM

Features

- A trusted broker offering client-friendly features that other brokers just don’t have.

- The Cent account is ideal for beginners and has one of the lowest minimum balance requirements in the industry, $10.

Regulation

Exinity Limited (www.forextime.com) is regulated by the Financial Services Commission (FSC) of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295.

Platform

Clients of FXTM are provided with a choice of two of the world’s most popular retail trading platforms, MetaTrader4 (MT4) and its sister platform MT5. Both are available in desktop, WebTrader and mobile app format, which means FXTM clients can keep in touch with the markets 24/7.

MT4 is packed full of powerful software tools that take trading up to another level. It comes with a default offering of 30 indicators and the razor-sharp graphics are ideal for spotting trade entry points.

Source: FXTM

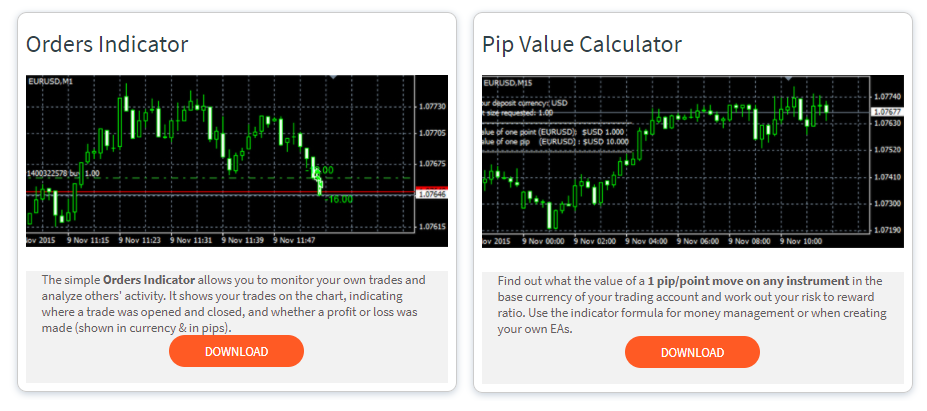

Other indicators are available from third-parties. Many are free of charge and tapping into the MetaTrader online community is a great way for traders to share ideas on strategies and markets.

The MetaTrader 5 platform has eight more indicators than MT4, more time-frame settings and an economic calendar. It also supports multiple-thread optimisation modes, but the MT4 and MT5 platforms, in truth, complement rather than compete with each other.

Deciding between two high-spec platforms like MT4 and MT5 comes down to personal preference and FXTM has a dedicated page on its website where it outlines the relative strengths of the two. The good news is that the demo account of both platforms is free of charge and easy to set up.

The MT platforms form the user-interface for FXTM clients, but a lot of the good things about FXTM go on behind the scenes.

- Free VPS hosting ensures trades executed on FXTM servers are physically close to the major global exchanges. This results in improved trade efficiency and better pricing.

- ECN (Electronic Communications Network) trading infrastructure provides a direct connection to the markets, which removes the risk of price moving away from you before your trade is filled.

- ECN Zero account has no commission charges.

- The MT platforms are very popular with those looking to use the Expert Advisors service and apply trading signals from third-parties.

The FXTM Invest Copy Trading service offers a different approach to trading. It’s popular with beginners and those who don’t have the time to develop and manage their own strategies. Instead, you can copy the trading activity of other trading strategies and there are over 5,000 to choose from. The minimum opening balance for copy trading is only $100 and the best bit is that you only pay commissions on profitable trades.

Customer Support

FXTM invests heavily in client support and was awarded the Best Trading Experience accolade at the World Finance Awards in 2020.

The broker also provides free of charge online trading courses and a range of seminars and webinars with in-house experts.

The FXTM customer support team provides its service in 18 languages and can be contacted 24 hours a day. Clients can also take advantage of having a dedicated account manager, which helps individuals get the most from their trading. It’s possible to contact them via email, telephone and live chat.

#5Vantage FX

What We Liked

What We Liked

- Trade 300+ markets in forex, commodities, crypto, shares and indices.

- Free demo account.

- Islamic Account for Shariah-compliant trading.

- Super-tight spreads including 0.0 pips trading on RAW ECN accounts.

- Institution-grade trade execution infrastructure.

- User-friendly platform.

- Exclusive FX promotions and affiliation schemes.

- Choose from two market-leading platforms.

Vantage FX has been operating for over 10 years. It has enough of a track record to be trusted and an appetite for upgrading what brokers offer their clients. It is a neat blend of user-friendly functionality and high-level trading tools. The platform has been designed by traders for traders and has everything needed for its clients to be successful.

In only a relatively short period of time, the broker has picked up a whole list of industry awards. It does the simple things well but has a track record of bringing in new innovative features to improve the quality of service to its clients.

Source: Vantage FX

One way to try out the Vantage FX trading experience is to take a few moments to set up a free demo account. It takes moments to do and will give you a first-hand insight into how the broker is pushing the boundaries of what can be offered to clients.

Another really neat feature is that when it comes to setting up a live account and trading real cash, Vantage FX offers new clients a 50% welcome bonus.

Source: Vantage FX

Broker Fees

Vantage FX’s super-aggressive approach to pricing is best demonstrated by its RAW ECN account, which has spreads as low as 0.0 pips and just a $3 commission. All the other accounts have similarly competitive T&Cs.

Trading with Vantage FX is about more than low prices. The quality of trade flow is backed up by the broker having access to deep pools of market liquidity and offering VPS hosting. All this adds up to the broker providing a high-grade and cost-effective way to trade the markets.

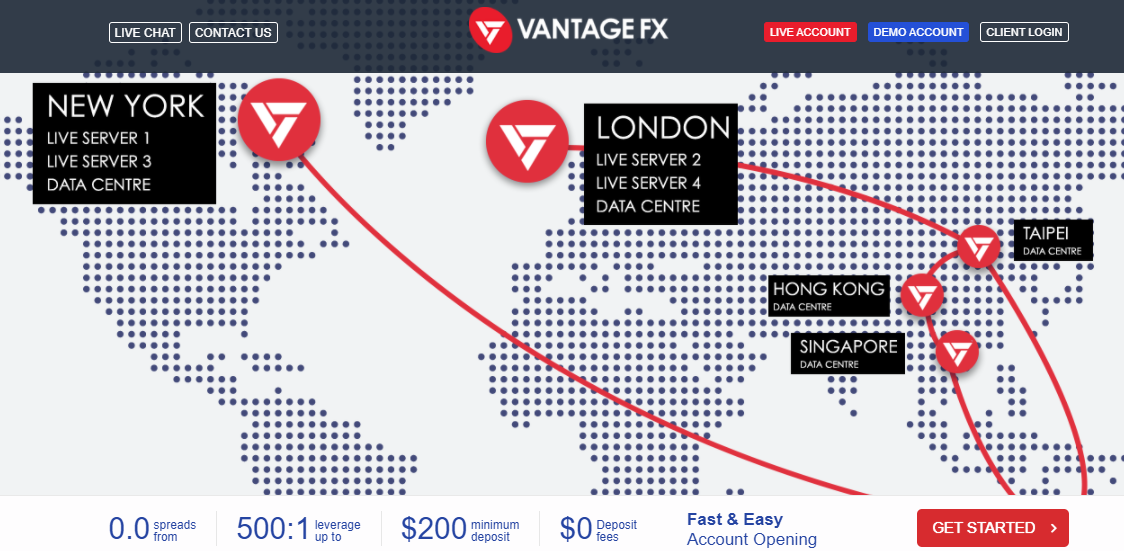

Source: Vantage FX

Trading Limit

Malaysian clients of Vantage FX’s have accounts set with a default maximum leverage of 100:1. Those running more aggressive strategies can apply to scale this up to as high as 1:500.

Source: Vantage FX

Features

- Functionality ideal for beginners, but a trading platform that is institutional grade.

- Excellent promotional offers — particularly the welcome bonus of 50%.

Regulation

The broker operates under license from a range of global regulators, including the FCA, ASIC and CIMA.

Vantage Global Limited is authorised and regulated by the VFSC under Section 4 of the Financial Dealers Licensing Act [CAP 70] (Reg. No. 700271) and is registered at iCount Building, Kumul Highway, Port Vila, Vanuatu.

Clients’ funds are held in a segregated account with Australia’s AA rated National Australia Bank (NAB).

Source: Vantage FX

Platform

The industry-leading MetaTrader4 and MetaTrader5 platforms, which are ideal for beginner and experienced traders alike, are both available at Vantage FX. The Vantage FX trading experience is very much about having access to your account anywhere, anytime.

The MT4 and MT5 Apps by MetaQuotes are fast, reliable and compatible with both Android and iOS devices. All Vantage FX clients can experience the same trading functionality on their mobile device as they do on their desktop machines. Features include one touch trading, a variety of order types and instant access to over 300 markets.

There are three more third-party platforms on offer, ZuluTrade, DupliTrade and MyFXBook Autotrade. Each offers a different way of investing in the markets and provides support for those looking to use the ideas of others and take part in social trading and copy trading.

Customer Support

Education and learning are hot topics at Vantage FX. If you’re looking to develop your trading skills, then the broker offers a dedicated section for those looking to learn how to spot trading opportunities.

The award-winning Vantage FX customer support team can be contacted around the clock by phone, live chat and email. The team is are multi-lingual and available to clients on a 24/5 basis.

#6BlackBull Markets

What We Liked:

What We Liked:

- More than 26,000 instruments to trade

- Leverage of up to 1:500

- Spreads as low as 0.00 pips

- High-tech trading infrastructure

- Innovative features

- Focus on ensuring a high-grade trading experience

- User-friendly platform

- 24/7 customer support

- Minimum deposit requirement of $0

BlackBull Markets does things differently, in a good way. Established in New Zealand in 2014, the firm continues to attract traders by introducing innovative features which reflect the founders’ passion for using new technology to improve the trading experience.

Now available to a global audience, the broker offers market-beating leverage terms, reliable and cost-effective trading and around-the-clock customer support. The T&Cs and ‘feel’ of the BlackBull platform show the broker has developed a solid reputation among the trading community, and industry experts continue to credit it with awards.

Source: BlackBull

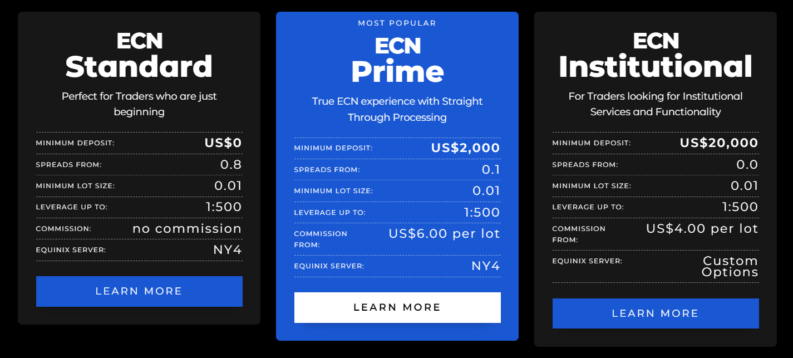

BROKER FEES

Trading spreads are variable, so they fluctuate with market conditions but can be as low as zero pips. Commission rates vary across the Standard, Prime, and Institutional accounts. Whatever your trading approach, finding a cost-effective way to trade your chosen markets is possible.

- Prime account – spreads from 0.1 pips and commissions of $6 per lot

- Standard account – spreads from 0.8 pips and zero commission fees

- Institutional account – spreads from 0.00 pips and commissions of $4 per lot

- No charges on cash deposits and withdrawals

- No inactivity fees

Source: BlackBull Markets

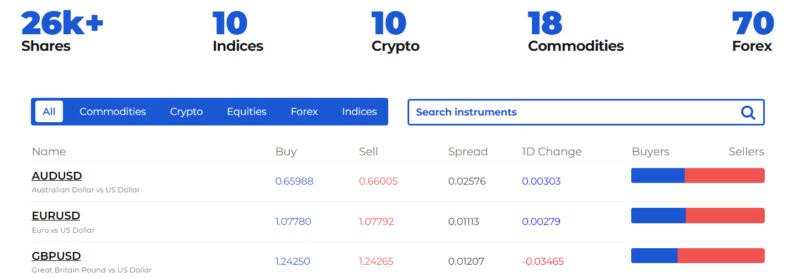

TRADING LIMIT

Trading at BlackBull is carried out in line with the regulatory protocols of the Financial Services Authority in Seychelles (“FSA”), allowing leverage of up to 1:500. Leverage magnifies losses and profits, so it needs to be treated with caution. Still, for many, those margin terms are one of the main reasons to sign up for a BlackBull account.

- There are +26,000 stocks to trade, ensuring investors can gain exposure to various sectors and regions.

- Clients can trade 70 forex markets, 10 stock indices, 18 commodities, and 10 cryptocurrencies.

Source: BlackBull Markets

FEATURES

- Fast, low-cost trading in CFDs covering various asset groups

- High-leverage trading using the latest technology

- Passion for introducing new features to enhance the trading experience

REGULATION

BlackBull Markets is the trading name of BBG Limited Markets which is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. The company is authorised and regulated by the Financial Services Authority in Seychelles (“FSA”) under licence number SD045 for the provision of investment services.

PLATFORM

Trading at BlackBull markets is carried out using the ever-popular MetaTrader MT4 and MT5 platforms. These are tried-and-tested, high-quality dashboards ideal for those using strategies based on technical analysis or charting techniques. They also facilitate using the Expert Advisors copy trading and automated trading services.

Trading View, Myfxbook, Autochartist, and ZuluTrade, are third-party services offered to BlackBull clients. These bolt-ons provide different ways to trade the markets, and those looking to trade at the heart of the market can opt to use the BlackBull VPS platform.

Source: BlackBull Markets

CUSTOMER SUPPORT

Looking to check an item on your trading account, or perhaps you want to learn more about how to get the most out of the BlackBull platforms? If so, the company’s customer support team are on hand 24/7. The staff can be contacted by phone, email, or LiveChat and are broken down into specialist groups to ensure expert advice is on hand, whatever your query.

Source: BlackBull Markets