With RBA interest rates as low as they are, many Australians looking for ways to protect and grow their wealth are taking matters into their own hands. The best online broker platforms in Australia offer a route to gaining user-friendly, low-cost access to the financial markets. If you do a little bit of homework, you can find one regulated by a top-grade regulator such as ASIC.

#1eToro

What We Liked

What We Liked

- A platform designed to make trading easy

- Functionality that is ideal for beginners, but with expert help on hand

- Market leader in copy trading and social trading

- A global broker regulated by Tier-1 authorities

- Trade and invest in a wide range of asset groups and from the same account

- Free demo account

The simplest way to explain eToro’s appeal is that it adds more new clients each year than most other brokers have in total. The user-friendly platform now has more than 13 million clients from across the globe — all of them drawn to the ability to engage in self-trading and copy trading from the same account.

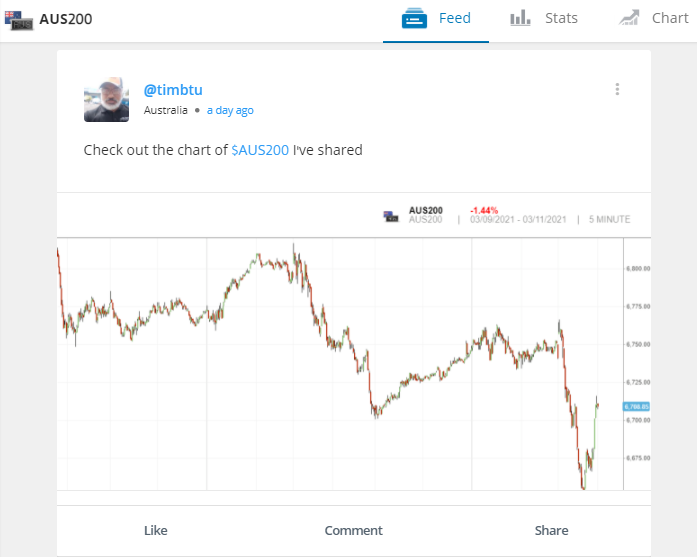

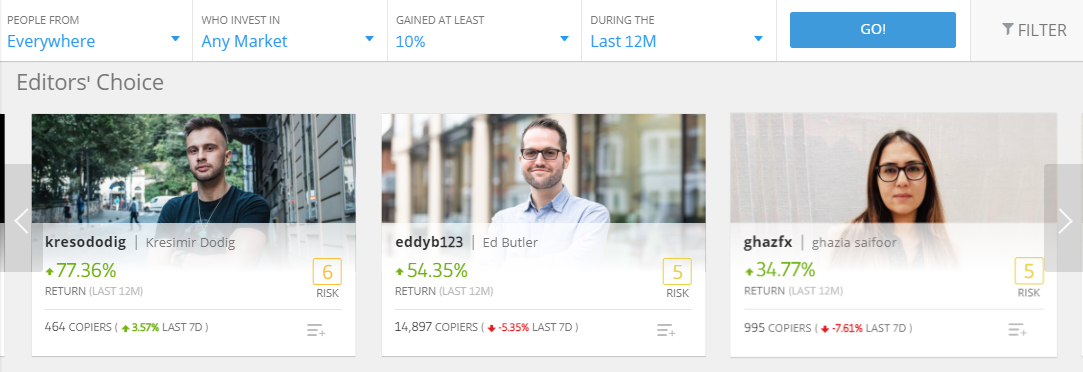

Copy trading allows you to take the trading signals of others and apply them to your account. You can allocate as little as $50 to a copy trading strategy and your account will follow their trading decisions. Your money stays safely under your control, you can end the relationship at any time and there are no extra fees for the service. You have to make a prudent selection in terms of who to follow, but if you get it right, that person will be doing all the research and trade management whilst you’ll be able to monitor progress.

Source: eToro

Managing your account is incredibly easy to do. The site is incredibly easy to navigate. Paying money in and out of your trading account is as easy as any other online purchase and the process for registering for an account is as streamlined as you’ll find in the market.

If you haven’t tried copy trading before, it’s possible to test it out using the free eToro demo account. This takes less than 20 seconds to set up and you can allocate $100,000 virtual dollars to different lead traders, and even put on some of your own trading ideas, and then sit back and study its performance.

Source: eToro

Broker Fees

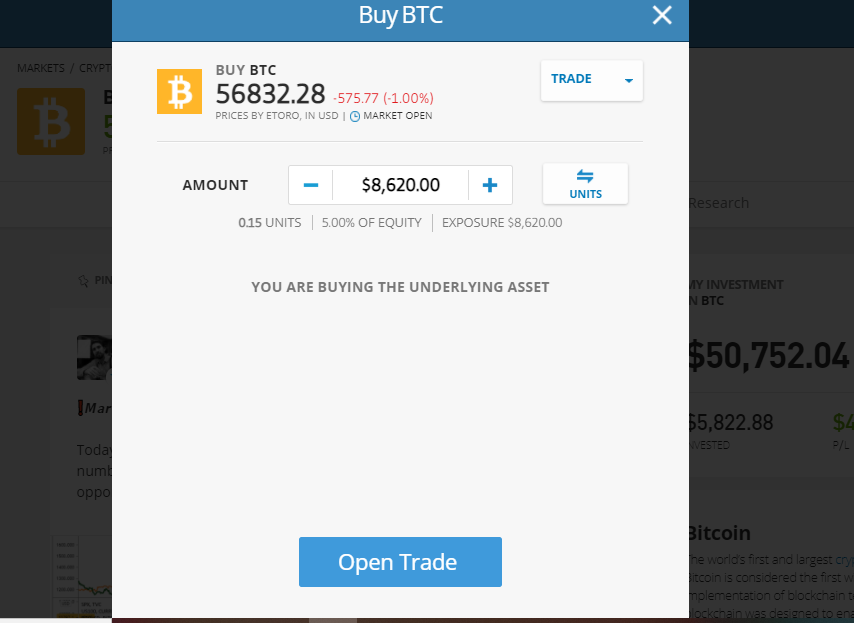

eToro offers markets in a wide range of global asset groups. You can trade stocks, ETFs and crypto.

One neat feature for beginners is that eToro doesn’t charge additional trading commissions, even for copy trading. Instead, they make their money on the difference between buy and sell prices in markets — the bid-offer spread.

This transparent approach to pricing is to be welcomed as it takes away the need to look through statements to establish what the fees are. Despite not charging extra commissions, eToro spreads are still extremely competitive. Due to its millions of clients, eToro is a big player in the market and that helps it keep trading spreads tight. Some forex pairs spreads are as low as one pip.

Source: eToro

If you trade using leverage, there will be overnight financing fees to reflect you have effectively borrowed funds from the broker to scale up your positions. There is also a $5 charge on each cash withdrawal you make.

Trading Limit

eToro sets client trading limits in line with the regulatory terms of each country it operates in.

The maximum number of open trades is 2,000.

The minimum account opening balance is $200.

Features

- Copy trading — eToro made its reputation in this area and is still the market leader. There are thousands of lead traders to choose from and easy ways to filter the group to find the ones for you.

- eToro also offers ‘basket-style’ products such as copy portfolios, which are a neat way to buy into particular sectors, such as solar power or US tech, without having to buy each individual stock.

Regulation

As quoted on its site, Australian clients sign up with “eToro AUS Capital Pty Ltd. (‘eToro Australia’), ABN 66 612 791 803, which is the holder of an Australian Financial Services Licence (AFSL) 491139 issued by the Australian Securities and Investments Commission (ASIC), and regulated under the Corporations Act (Commonwealth). eToro Australia arranges for its clients to be provided services by eToro Europe”. (Source: eToro)

Client funds are held in a separate, segregated account. In the unlikely event eToro goes bust, your funds will be safe.

Australian clients are eligible for the free insurance up to 1 million AUD. The insurance covers cash and securities in the event that the broker becomes insolvent. As with all policies, there are T&Cs to make yourself aware of, and more information can be found here.

Source: eToro

Platform

The eToro platform is unique to the broker and has been developed specifically to support new and intermediate traders. It can be accessed using desktop devices or the award-winning eToro app, which is available on iOS and Android mobile devices.

The broker provides a range of research and analysis tools, including trade entry indicators and in-depth reports.

The copy trading function has a filter tool that makes it easier to select which traders to follow. You can apply common-sense parameters such as risk-rating, how long they have been trading and the number of other copiers.

Customer Support

The platform is one of the most straight-forward in the industry, but in the unlikely event that you do need to reach out to eToro customer support, they can be contacted via email.

#2Pepperstone

What We Liked

What We Liked

- Regulated by the ASIC, FCA, CySEC, BaFIN, CMA, SCB and DFSA

- Choice of four industry-leading platforms

- Low-cost trading with raw spreads

- Super-fast execution — most orders executed in less than 30ms

- No account inactivity fees

Melbourne-based Pepperstone is an Australian online broker which started out by catering to domestic clients. It got so good at it, that it’s now a global player. Pepperstone’s success is based on a reputation for providing clients with high-quality access to the international markets. The broker is known for award-winning customer service and for providing CFD accounts designed to suit active traders.

Broker Fees

Execution spreads at Pepperstone are super-tight. The average for EURUSD in the Razor Account is 0.17 pips, but being variable, they are set to take advantage of peaks in market liquidity and spreads in major currency pairs can be as tight as 0.0 pips.

Average spreads on gold are an impressive 0.13 points.

Trading Limit

Leverage extends as high as 1:500 for professional clients and 1:30 for retail clients.

Features

- CFD trading on FX, indices, gold, shares (US, AU , DE and UK) and more

- MAM and PAMM programs are available

- A choice of two account types, Standard and Razor

- Scalping and hedging are allowed

Regulation

Pepperstone is ASIC regulated under ABN number 12 147 055 703. The length of time the firm has been operating is another reason for confidence. The ASIC licence was granted on 27th October 2010. The cherry on the cake is that Pepperstone is also registered by the FCA, CySEC, BAFIN, CMA, SCB and DFSA

Platform

Pepperstone offers its clients the choice of four market-leading platforms, MT4, MT5, cTrader and TradingView. They are all third-party services, and each one could stake a claim as being the best trading platform in Australia. It’s also available in mobile app format.

It’s robust, effective, packed with powerful trading tools and are 100% fit for purpose.

There is a wide range of educational material and research tools designed to take your trading skills to a level where you can make the most of the trading platforms. Intermediate and advanced options include running your own algo programs, which ‘listen’ to market data and then execute trades for you.

Customer Support

Pepperstone has developed a reputation for providing market-leading customer service. If you’re running positions in foreign exchange or the stock market, there will likely be times when you need to get support and fast.

Pepperstone has picked up an impressive array of customer service awards over many years and thankfully shows little sign of letting its standards slip.

#3Vantage FX

What We Liked

What We Liked

- Trade a wide range of asset groups, including forex, commodities, crypto, shares and indices

- Free demo account and easy to use platform

- Market-leading price spreads, including 0.0 pips trading on RAW ECN accounts

- Institution-grade trade execution infrastructure. Fast, reliable trading

- Choose between MetaTrader4 and MetaTrader5 trading platforms

Vantage FX’s approach to trading is winning it a lot of fans. It’s a neat blend of user-friendly functionality and sophisticated trading tools, and the platform has all the hallmarks of being designed by experienced traders.

There is a ‘next generation’ feel about the platform, which is backed up by the many industry awards the broker has won. Beginners will be pleased to know that it does the simple things well but also supports trader development via a range of neat additional tools and services.

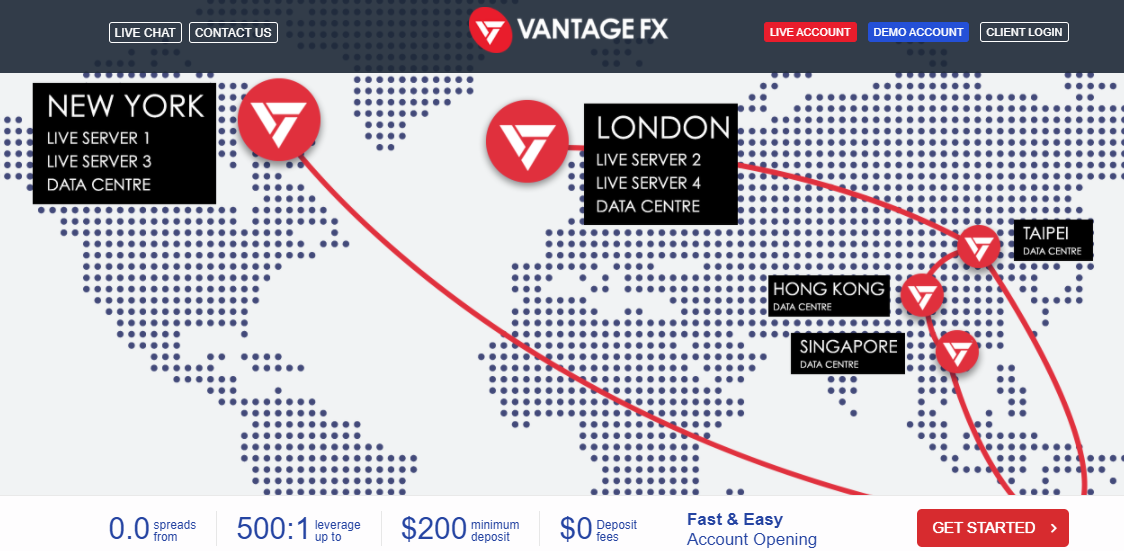

Source: Vantage FX

To experience the Vantage FX difference, we recommend taking a few moments to set up a free demo account. It gives an insight into how the ground-breaking broker has analysed client needs and built a platform that is pushing the boundaries of what traders can expect.

Broker Fees

Vantage FX has a very aggressive approach to pricing. The RAW ECN account has spreads as low as 0.0 pips and a per-trade commission of only $3. The other Vantage FX accounts have similarly competitive T&Cs, but a lot of the appeal of the broker relates to the quality of its trade execution.

The institution-grade trade infrastructure used by Vantage FX means trade execution is reliable and fast, as well as cost-effective. The broker has access to deep pools of market liquidity and this translates to better quality trading.

Source: Vantage FX

Trading Limit

Vantage FX’s default leverage starts at 1:30, but the Vantage FX Pro account unlocks rates as high as 1:500. Those able to access that premium-grade account also benefit from dedicated client support.

Source: Vantage FX

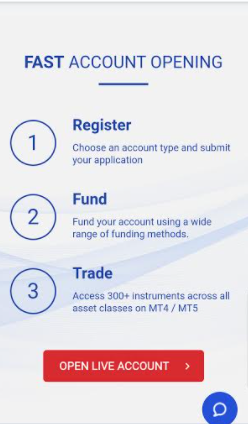

Features

- Functionality that is ideal for beginners, but a trading platform that supports traders as they grow

- A service that is focussed on fast, reliable, cost-effective trade execution

- Streamlined account registration process

Source: Vantage FX

Regulation

As stated on its site: “Vantage Global Prime Pty Ltd, trading under Vantage FX, is regulated by the Australian Securities and Investments Commission (ASIC), AFSL no. 428901 and is located at level 29, 31 Market St, Sydney, New South Wales, 2000, Australia”. (Source: Vantage FX)

Clients’ funds are held in a segregated account with Australia’s AA rated National Australia Bank (NAB).

Source: Vantage FX

Platform

The industry-leading MetaTrader4 and MetaTrader5 platforms are both available at Vantage FX. They can be accessed via PC and Mac in downloadable or WebTrader format.

There are three more third-party platforms on offer, each one of them providing a different angle to trading the markets. ZuluTrade, DupliTrade and MyFXBook Autotrade are all first-rate services and support those looking to get involved in social trading and copy trading or just improving their trading skills.

The Vantage FX trading platform allows the broker’s clients to access their account anywhere, anytime and the mobile apps available on iOS and Android devices ensure you’re never too far from the markets.’

Customer Support

The award-winning Vantage FX customer support team can be contacted around the clock by phone, live chat and email. The broker is multi-lingual and available to clients on a 24/5 basis.

#4Tickmill

What We Liked

What We Liked

- Some of the most competitive pricing in the industry

- Award-winning 24/5 customer service — ideal for beginners

- Powerful research tools with an emphasis on spotting trade entry and exit points

- User-friendly platform with lots of educational materials

- Free demo account with no time-limit

- Minimum opening account balance of just $25

Source: Tickmill

Tickmill is an ideal option for beginners who want to set up quickly with a low-cost broker. The free demo takes moments to set up and there is no time limit on its use.

If you want to jump straight in and try trading real cash, the minimum account opening balance of only $25 will be appealing. Being able to start off trading in small size is a good option to have as it reduces the risk of blowing up your entire trading account before you develop effective risk management skills.

Once set up, you’ll soon discover Tickmill is much more than a low-cost, no-frills broker. It provides access to a wide range of global financial markets, is regulated by Tier-1 authorities and its award-winning customer service team is on hand around the clock.

Tickmill is building a solid reputation in the trading community and seeing more and more new clients sign up. It’s also won a considerable amount of industry awards including:

- #1 Broker for Commissions and Fees — 2021 ForexBrokers.com Annual Forex Broker Review

- Best Commodities Broker — 2020 Rankia Markets Experience Expo

- Best Forex Education Provider — 2020 Global Brands Magazine

- Most Reliable Broker — 2020 Online Personal Wealth Awards

- Best Forex Broker Asia — 2019 Forex Awards

- International Business Magazine’s Best CFD Broker Asia

- Forex Awards — Most Transparent Broker

Tickmill is a trusted broker with a global client base. It provides its clients with everything they need to set up to trade the markets. It’s a great place to start trading and you can head here to try it out.

Source: Tickmill

Broker Fees

Tickmill offers three different types of accounts. They all have market-leading pricing schedules but offer slightly different T&Cs so that new clients can find the one which suits them best.

The best example of how aggressive Tickmill’s pricing is that spreads for the Pro and VIP accounts begin at 0.0 pips. Those who trade using the VIP account will find those super-tight spreads are matched by commissions which go as low as $1.6 per lot, per side.

Trading Limit

Maximum leverage settings are set at 1:30, but Pro account users can extend this to as high as 1:500.

Tickmill does not apply any restrictions on types of trading strategies used, which means scalping and hedging are allowed.

The minimum account opening balance is $25.

Features

- Impressive trading infrastructure including ECN and VPS services ensures clients are treated to fast, reliable, cost-effective trading and trade execution speeds, which average 0.20 secs

- Pricing that’s hard to beat

Regulation

The Tickmill group of companies are a serious operation and the firm employs more than 200 people worldwide. It also serves clients in more than 200 different countries and is regulated in some of the world’s most reputable financial jurisdictions.

Source: Tickmill

Tickmill Ltd is regulated as a Securities Dealer by the Seychelles Financial Services Authority (FSA) and has licence number SD008.

The FSA is established under the Financial Services Authority Act 2013. The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in Seychelles through a solid regulatory regime.

Tickmill Asia Ltd is authorised and regulated by the Labuan Financial Services Authority.

Licence number: MB/18/0028

Platform

Confirmation that Tickmill has gone about things the right way is that it offers its clients access to the most popular trading platform in the world, the tried and tested MetaTrader4 platform. MT4 is known for its reliability and powerful software tools and comes with the option of bolting on a vast array of third-party tools and services.

The standard version of MT4 comes with 30 built-in indicators and provides the option to customise these to suit your trading needs. The desktop version is available as a downloadable platform, in an online WebTrader version and is compatible with Mac and Windows. The mobile app format of MT4 is free to download on Android and iOS devices, which adds up to Tickmill clients being able to trade the markets how they want, when they want.

Tickmill’s Expert Advisors (EA) service is an established way to trade using algorithmic models — either your own or those of third-parties. Automated trading is popular with those who have to juggle their other commitments with a desire to gain exposure to the financial markets. Some third-parties charge fees for providing their trading signals, but it is something to consider if you want a more hands-off way of trading.

Additional trading tools are provided to help Tickmill clients navigate the markets. AutoChartist, Myfxbook, and Pelican trading all help clients spot trade entry and exit points and all are highly-regarded in the trading community.

Customer Support

The award-winning and multi-lingual Tickmill customer service team are available via telephone and email and operate on a reassuring 24/5 basis.

Source: Tickmill