Their popularity is partly based on how simple and versatile they are and the fact that they are ideal for short term trading strategies. Modern online broker platforms make trading with CFDs as easy as clicking a button and high-frequency traders can even use CFDs as part of their automated trading strategies. In this CFD trading guide we will cover:

- What is a CFD?

- What is CFD day trading?

- Good CFDs for day trading

- The most important rules of CFD trading?

- How to set up your day trading CFD account

- How to trade CFDs

- Next steps — strategy ideas for CFD trading

What is a CFD?

CFDs are an agreement between a broker and a trader. This is an agreement whereby both parties agree to pay each other the difference between what an asset is worth when a position in an asset is taken, and when it closes. The profit or loss on the trade is calculated using the trade entry and exit price points.

You can buy or sell a whole range of instruments including stocks, forex, cryptocurrencies, commodities and indices. You can build a whole portfolio of popular day trading instruments and trade in or out of them through the day.

Source: eToro

The good news for high-frequency day traders is that there is one over-arching contract set up when the account is opened. That covers all the subsequent trades so traders can concentrate on their trading activity and trade positions just by clicking a button.

What is CFD day trading?

The good news is that the top-tier online brokers offer a comprehensive range of services to help your day trading.

There are news services, including in-house TV channels following the markets. Research & Analysis is constantly being updated and ‘The Day Ahead’ and ‘Trade of the Week’ style broker notes are also widely available.

With day traders working on short-term investment horizons, there is a need to keep the mechanisms of trading super-simple and CFDs do that. The process of booking a trade is just a case of accessing a trading screen, entering how much you want to trade, of what asset, and clicking a button to confirm ‘buy’ or ‘sell’.

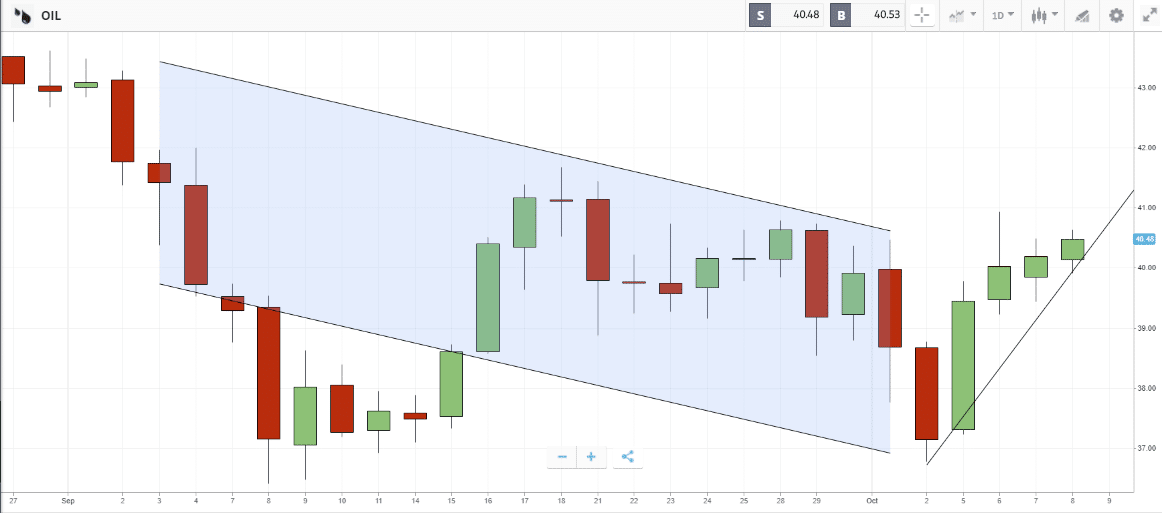

If you think crude is cheap and want to buy oil, clicking the ‘buy’ button to see your account reflect an exchange of cash for a CFD position in oil.

The trade execution process is fairly universal, so most monitors will look the same across any brokers you use.

Source: IG

While the US stock market is open, the price of Apple will fluctuate. If you made the right choice and there turns out to be more buyers than sellers, then you’ll post a real-time profit. Get it wrong and you’ll report a loss.

Two really neat characteristics of stock CFDs need to be highlighted:

- You can sell something you don’t already own– As day trading involves taking advantage of short-term price moves, being able to trade downside moves as well as upside ones is crucial. CFDs offer traders the ability to trade both ways.

- CFDs can be tax-efficient– If you’re UK domiciled and trading stocks then CFDs offer a way to avoid paying SDRT on stock purchases. This can be vital if your strategy involves you making a relatively small intra-day gain.

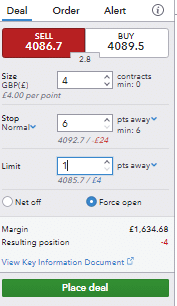

Day trading involves a relatively high frequency of getting into and out of positions. The process is made easy by online brokers that allow complete or partial closure of trades. The set-up is particularly user-friendly and you’ll usually find a button saying something along the lines of ‘close’ position.

Source: IG

Day traders often have a few positions on at the same time. As you close each CFD position, the difference between the opening and closing price will be established and shown as a realised profit. Your stock balance will return to zero and your cash balance will be initial investment + / – trading returns.

If you’re using leverage to scale up your risk-return and capitalise on small intra-day price moves, then there is more good news. Leveraged CFD positions charge interest — if you hold the position overnight. If you trade in and out of the CFD position before the time when all positions are recorded, then you’ll avoid what could be quite significant costs.

The exact time of the time-stamp on positions varies from broker to broker. The T&Cs of each are easy enough to find and worth doing as this could be one big way in which CFD trading helps your day trading.

Good CFDs for day trading

Most day traders start out by picking markets with higher price volatility. This means prices are more likely to move (for or against you) rather than just drift sideways. You’ll want to be out of the position before market close after all.

More liquid markets are associated with tighter bid-offer spreads. This again facilitates getting into and out of a trade in a short time-span and is why forex, indices and large cap stocks are favoured sectors of day traders.

The most important rules of CFD trading

There are some really important safety measures that traders can take to protect themselves.

The first is to ensure you use a broker regulated by a Tier-1 authority. Some brokers are regulated by more than one of the below, but look out for the rubber stamp of at least one of them.

- The Australian Securities and Investments Commission (ASIC) in Australia

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySec)

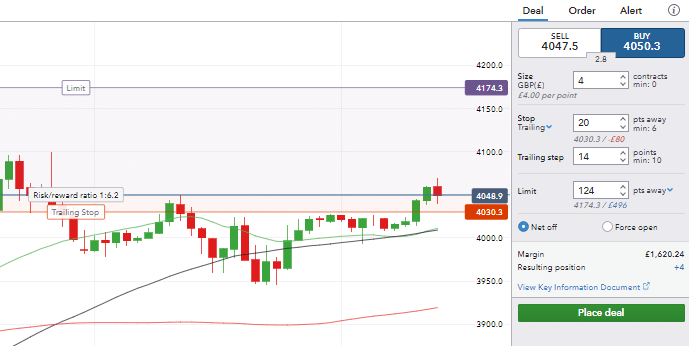

In the fast-moving world of day trading, it’s important to have confidence in your broker’s customer services department. Can the broker be contacted easily, what are response times like? Then there are the other risk management tools such as stop-losses, and trailing stops, which you might want to use.

Source: IG

How to set up your CFD day trading account

A demo account takes moments to set up. Trading using virtual funds allows you to test new day trading strategies before stepping up to trading them using real cash.

When you’re ready to go live, all regulated brokers will require you to process a more detailed application form. This will cover measures intended to protect the clients and takes only a few minutes to complete.

The final piece of the process is funding your account. Most brokers offer a variety of payment methods, from bank transfers to Skrill. Some of the options will process the transaction almost instantly.

How to trade stock CFDs

Day traders often give a lot of thought to the quality and cost of trade execution services at brokers.

The functionality of trading platforms makes them a pleasure to use and most trading interfaces have all the stop-loss, take-profit, leverage options close to hand so they can be adjusted at the time of trade.

As day trading includes a lot of trade execution and monitoring of screens, it’s worth trialling a variety of brokers and making sure you get one that best suits your preferences. A selection of popular choices can be found here.

Next steps — strategy ideas for CFD trading

Now that you are up and running, the question is how to identify and execute effective trading strategies.

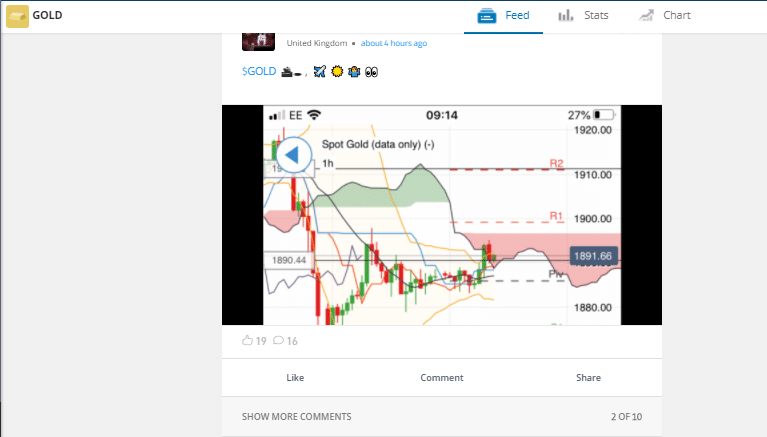

Source: eToro

The below day trading tips have been passed on by an experienced trader:

Beginners top tips:

- Get properly set up for day trading— A reliable and fast internet connection will stack the odds in your favour. You might also need to invest in some hardware. This ranges from having multiple screens to a replacement mouse in case yours malfunctions.

- Prepare for the demands of day trading— Depending on your strategy, you might need to be at your desk or at least have access to the markets for long periods of time.

- Benefit from the ideas of others — There is a large community of day traders and many of the participants are very happy to share their ideas.

- Accept your losses – Day trading is about working the win-loss ratio. The aim is to make a profit, not win on every trade. Cutting losses and doing that early can help you turn a profit by the end of the day.

Intermediate top tips:

- Back test— After the market has closed, be sure to review your day’s trading activity and try to pinpoint areas for improvement.

- Brush up on your technical analysis — Day Traders rely heavily on technical analysis and developing your understanding of the subject should be a continual process.

Advanced top tips:

- Don’t be afraid to not trade — As you become more experienced, you’ll notice that, some days, the markets just aren’t right for day trading. For example, ‘forcing’ trades during the quieter summer months can get you into positions you can’t get out of at a profitable level.

Final thoughts

Day Trading comes with its own distinct challenges. You’ll notice that plenty of people still make it work for them and investing some time in developing your trading skills can pay off. Using CFDs is pretty much a given, so choosing a regulated broker that offers CFD markets is a good first step.

People who read this also viewed: