What does CFD stand for?

CFD is an abbreviation of ‘contract for difference’. Every trade put on by an individual is an agreement between the individual and the broker they are using.

If you buy an asset – for example, gold or bitcoin – and the price goes up, the ‘difference’ between your entry price and exit price will represent your profit. If the price goes against you, the ‘difference’ between the entry and exit price will determine your loss.

How do CFDs work?

CFDs involve a broker monitoring the price of an asset in a real-life market, and providing you with the opportunity to sell or buy a position in it. If you buy and the price goes up, then you make a profit. If you sell and the price goes up, then you make a loss, and vice versa.

The platforms provided by top-tier brokers are user-friendly and come packed full of tools and learning materials to help you develop your trading skills. The monitors have live-market feeds so that the price of your position matches the price of the underlying.

The data feeds are all automated, and you can watch the world’s financial markets moving in real time. You’ll feel like you are trading the markets – because you are. The CFD you trade is just an instrument that provides an easy and convenient way to do so.

CFDs trading example

As with most things, the mechanics of a CFD trade are best understood by going through an example.

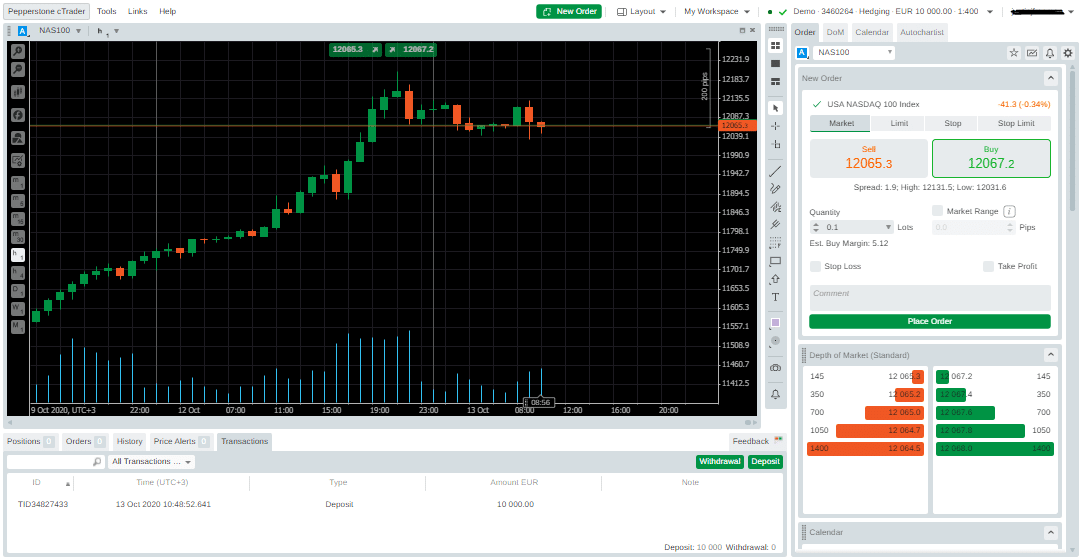

We’ll put on a CFD trade using the Pepperstone demo account. Pepperstone will provide us with an initial balance of €10,000 in virtual funds. We’ll practice trading risk-free with that until we get things working correctly.

Step one

Logging onto the platform will take you through to the trading dashboard. Our analysis points to the tech stock bull run continuing, so we are looking to buy units of the Nasdaq 100 index (NAS 100).

Clicking on the market for NAS 100 takes us to a dashboard where we can see the price chart, trading volumes, and the ‘buy’ and ‘sell’ buttons on the trade execution sidebar.

Deciding to buy 10 lots, we enter that number into the required data field. As soon as ‘buy’ is clicked, we have opened a trade, and we can see the P&L on the position start to move.

Source: Pepperstone

Step two

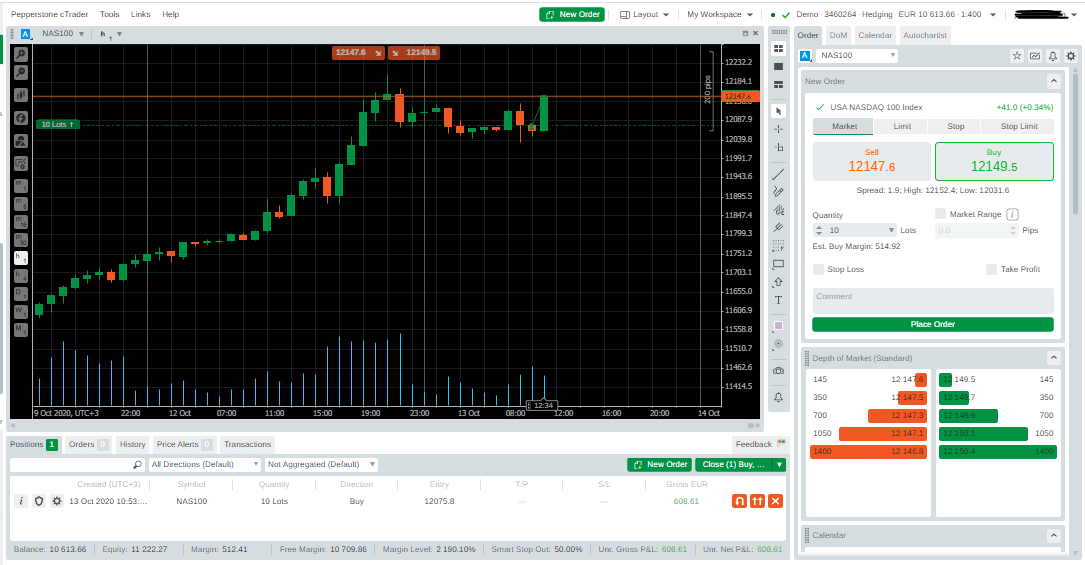

The P&L on our CFD position in NAS 100 will be calculated as per the below formula:

= Opening price +/- Live price x Size of your holding

= 12067.2 +/- Live price x 10 lots

A few moments after opening the long position in NAS 100, the price has fallen to 12055.4. Our position shows a negative P&L of -$110.80. This is calculated as follows: 12067.2 – 12055.4 x 10.

Your CFD position will continue to post real-time unrealised P&L.

Step three

Approximately one hour after our trade was first put on, the market has moved in our favour. The price that we can sell our position at is now 12147.6, which converts to an unrealised P&L balance of more than €600. We take the offered closing price and exit the trade.

Source: Pepperstone

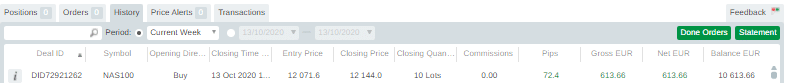

It’s never a bad idea to lock in some profits. A decision is made to sell our 10 lots of NAS 100. This secures a realised profit €613.

After closing out our trade, our cash balance increases by €613 to €10,613, and our market exposure falls to zero. We now have no open positions.

Source: Pepperstone

Major CFD trading benefits

Millions of people trade CFDs because they come with a lot of neat features. Here are some of them:

- You can buy or sell the markets– Traditional buy-and-hold strategies involve taking a position in an asset – for example, buying British Telecom shares and selling them at a later date. With CFD trading, you can sell short – so if you think that Tesla Inc. stock is overvalued, you could sell it today and buy it back at a profit if the price falls.

- CFDs suit modern online trading platforms– The digital revolution that has swept through the investment industry makes trading from desktop and mobile devices as easy as clicking a button or touching a screen. CFDs are so straightforward that they blend in perfectly with this new approach.

- CFDs can be tax efficient – It depends on where you live, but you might find that by using CFDs, you avoid transaction taxes on your trading.

- CFDs can be used to trade any market– As you and your broker have a contract on the ‘underlying’ asset, it doesn’t matter what that asset is. This means that a whole range of markets can be traded using the same format. There’s no need to learn new skills if you move from trading CFD equities to CFD cryptocurrencies. The basic principles are the same.

- CFDs are very simple to use – The contract you have with the broker covers all of your trading activity. You don’t need to sign a new one each time you trade. This means that you can trade as frequently as you like, in whatever market you choose.

Main risks involved with CFD trading

The price of the CFD you are trading will move up and down according to the price of the asset it represents. If you hold a long position in oil CFDs and the price of crude falls by 5% on the exchange, then the value of your holding will also fall by 5%. There are other risks that are also worth factoring in:

- Market risk– CFDs are a user-friendly way to trade the markets, but they do nothing to help you if your initial decision is wrong. If the price moves against you, then you’ll make a loss.

- Unlimited losses – CFDs are complex instruments. For example, selling short means that you have unlimited downside on a trade. The price can feasibly go against you upwards – to infinity. As unlikely as this is, it plays on traders’ minds, and a ‘short squeeze’ caused by rising prices can make them cut positions.

- Operational risk– The positions you hold in CFDs are relatively easy to access and understand. There is always a risk that you ‘fat-finger’ your trade instruction, so it’s good practice to always check your trades to make sure that you did what you intended to do.

- IT risk – Access to an online trading account requires a secure and reliable internet connection. Some brokers have ‘dealing desks’, which can be contacted by phone if the internet goes down. In reality, if you’re trading the markets, you’ll want to be operating within a good technical framework.

- Leverage risk– CFDs allow traders to scale up their risk-return ratio. You use your investment as a deposit on your trading and trade in bigger size than if you bought an asset outright. Trading with leverage is very risky.

- Counterparty risk – Any contract relies on both parties honouring their side of the agreement. If you make a profit on your trades, you are still exposed to the risk of the broker not paying you. This is counterparty risk and there are ways to mitigate it.

Is CFD trading safe?

There are many possible ways to lose money when trading CFDs. Market risk is unavoidable, leverage multiplies any losses, and you can just get the basics of booking a trade wrong.

One very significant risk that stands out from the list above is counterparty risk. Putting on a position in a CFD trading account means that you are setting up a contract between yourself and your broker, rather than a direct investment in the markets. This explains why a CFD is a derivative product. The price of your position is derived from prices in the underlying market.

All CFD providers will insist that you place funds with them before allowing you to live trade the markets using CFD products. If your trading is unsuccessful, they will automatically debit your investment account.

However, the broker doesn’t place money upfront in your account to ensure that you get paid out if your trade is successful. This means that most of the protection of individual traders is largely down to the approach of regulatory authorities. You should look out for the following:

- Segregation of funds– Your capital is held in an account at another bank, not in the broker’s name.

- Financial Services Compensation Scheme (and similar schemes) – Government-backed guarantees of cash deposits, up to a certain amount.

- Negative balance protection– You can’t lose more than your initial stake.

- A reputation worth protecting– It is vital to establish that your broker is a bone fide operation. An established track record can help tick that box.

- Stock market listing– If the firm you use is a publicly listed company, then it will have to comply with the rules and regulations of the exchange. Nothing is ever guaranteed, but another layer of protection is something to welcome.

Take a leaf out of the book of the big investors. Pension funds and family offices have designated teams whose job it is to check and then monitor third parties. You should also be proactive in doing what you can to ensure that your money will be safe.

Due diligence (1) – Only use regulated brokers.

CFD brokers that operate under licence from any of the below Tier-1 authorities have to comply with a range of rules and regulations that are designed to protect their clients.

- UK Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySec)

- Australian Securities and Investments Commission (ASIC)

Due diligence (2) – It’s also worth crowdsourcing the thoughts of others in the trading community. Regulators offer some protection, but if you’re wiring funds to a third party, then a Google search about whether it is trustworthy is always a good option.

Terms to know

- Underlying asset –The asset that is used to source the price of the CFD position you hold with a broker.

- Exposure –This is the size of your CFD position – the value in cash terms of your holding in a particular asset.

- Leverage – This is the size of exposure in relation to the margin. If you deposit $5,000 and buy $10,000 of bitcoin, then your leverage is x2.

- Leverage ratio –The above position would be expressed in statements as a leverage ratio of 1:2. Most brokers allow the leverage ratio to be adjusted according to client preference.

- Margin –This is the amount of your capital that is required to hold a leveraged position in a CFD. Any trade that is leveraged is traded on margin.

- Margin requirements – If the price on your leveraged CFD position generates an unrealised loss on the trade, then the broker might require you to place more funds with it if you want to stay in the position.

- Closed out – Should you be unwilling or unable to deposit more funds to meet your margin requirements, the broker will at some point sell out of your positions so that it doesn’t carry the risk of the trade.

- P&L –The profit and loss on your trading positions.

- Unrealised P&L –The profit/loss on open positions. Calculated using the difference between the trade entry price and live price.

- Realised P&L –The profit/loss on closed positions. Calculated using the difference between the trade entry price and trade exit price.

- Balance –The amount of capital you hold at the broker. Also known as equity, it is the cash you would have if you sold out of all open positions. Calculated by taking the initial deposit – cash used to put on open trades + the value of open trades +/- realised P&L.

- Go long –To use cash in your account to open a trade that buys a CFD asset you don’t already own.

- Go short– To use cash in your account to open a trade that sells a CFD asset you don’t already own.

- Lots –The units that some assets are traded in. Stock indices such as the FTSE 100 are typically traded in lots.

- Overnight funding – Charges applied to your account in relation to leverage. The fee associated with effectively borrowing money from the broker to take a bigger position than your funds allow.

- Dividends –As with a stock, if you own a CFD, you will receive a dividend if you own it the day before the ex-dividend date.

- Mark to market – The process of making sure that the price of your asset held in CFD form follows the price of the underlying asset trading on an exchange.

What is leverage in CFD trading?

The risks associated with leverage are possibly best described by the process involving you buying (or selling) more than you can ‘afford’.

A non-leveraged trade involves exchanging an amount of cash for the same amount of an asset – for example, using $500 to buy $500 worth of Apple Inc. stock.

Using leverage of 1:5 involves buying $2,500 of Apple Inc. stock but only using your $500 as margin – a deposit on the position. If the profits move rapidly due to leverage being part of the trade, then the broker still has your $500 as collateral.

In the leveraged scenario, any price move will have a x5 impact on your P&L. If the price goes down 10%, then in the first example, you’ll lose $50, and in the second, you’ll lose $250.

In cash terms, the leveraged trade will see the price of the underlying asset move by 10%, but your capital will suffer a 50% hit. Your balance will fall from $500 to $250.

CFD trading tips

Use stop orders

Stop orders are automated instructions to close out your position. They mean that you can manage the risk and return on your trades without having to watch a screen the whole time.

A stop-loss order will sell a position if it makes a certain loss. A take-profit order will close out a position and lock in the profits. You decide whether you want to use these and what price levels they are set at.

CFD demo account

When you have found the right broker, it can be tempting to jump straight in. However, avoid the temptation and start practicing first on a demo account. Even experienced traders use demo accounts if they are testing a new strategy idea. Looking after your cash balance is crucial, and it’s recommended that beginners start trading using virtual funds. They offer a chance to iron out operational errors as well as trading ones.

How to choose the right broker

You’ll notice from the image of the Pepperstone trading platform that at the time of trade, the prices to buy and sell were different – 12067.2 in relation to 12065.3. This is the bid-offer spread and a characteristic of CFD trading.

This spread is how brokers make most of their income, but the good news is that competition between firms means that they don’t get too wide. Even so, it’s always worth checking that the spreads offered by your broker are in line.

CFDs and tax

CFDs were invented in the 1990s as a means of allowing traders to access the markets more tax efficiently. In the UK, Stamp Duty Reserve Tax (SDRT) is a charge applied to purchases of equities. It’s calculated as 0.5% of the value of your position.

A lot will come down to where you live. However, it’s worth noting that one of the advantages of using CFDs rather than the traditional approach to buying equities is that sometimes the SDRT charge is removed from your P&L.

CFD trading strategies

Now that you have got to grips with the mechanics of CFD trading, it’s time to develop an effective trading strategy. As you might imagine, there are countless approaches to trading the markets. Some of them are:

- Scalping– Short-term, frequent trading aiming to capitalise on small price moves.

- Day trading– Intra-day only – no positions held overnight. One upside for CFD traders is that there are no financing charges.

- Range trading– Buying and selling as the price oscillates as it moves in a general direction.

- Pairs trades– Selling one asset and buying another – this allows for some market neutrality.

- Trend following– It is possible to use a CFD for long-term investment aims. Trend following involves taking medium- to long-term positions designed to follow market momentum.

- Fundamentals– Taking positions based on the real-world business credentials of an asset.

- Carry trade– Popular among forex traders. Trading currencies off the back of interest rate levels.

- Technical analysis– Using historical price data to predict future moves.

- Copy trading– Taking the trading decisions of other traders and applying them to your account.

- Social trading– Crowdsourcing the ideas of others and then trading them yourself.

The key to strategy choice is to find the one that suits you. Different strategies require different skill sets. Some strategies take up more of your time than others. Researching different approaches is worthwhile and best done in a demo account.

Best CFD trading platform

CFD trading can be seen to come with certain benefits. Some of these are specific to the way that CFD financial instruments work. There is also a high risk of losing money, which makes choosing a good broker even more important.

Price will be a consideration, but some brokers that offer basement-level fees provide little else. Educational and research materials will be important if you are going to make the most of your trading.

If you’re looking to trade on the move, then choosing a broker with a high-quality mobile app offering will be important.

Brokers that offer trading signals and trade entry and exit points are particularly popular with beginners.

It is possible to find a broker that ticks all the boxes. This list will help you find a regulated broker that provides a top-quality platform, great customer support, useful research and cost-effective pricing.

PEOPLE WHO READ THIS ALSO VIEWED: