Cryptocurrency trading involves keeping up to date with ground-breaking technological advances and socio-political changes. There’s a lot to learn, but there’s also the opportunity to make (or lose) a lot of money. This article will look at how AI (Artificial Intelligence) can help you trade crypto. What it is, how to use it, and possibly as importantly, which service to use for automated cryptotrading. We’ll look at:

- The appeal of crypto

- How to trade crypto

- How is AI used in crypto trading?

- Good AI firms for trading crypto

- Future trends to look out for in AI trading of crypto

- Final thoughts

The appeal of crypto

Crypto is a revolutionary idea. It’s one that might bring about a complete overhaul of the financial markets. If that happens, then fortunes will be made. As a result, individuals and companies are already buying and selling cryptocurrencies and making dramatic profits and losses.

Highlights of the crypto sector include:

Price volatility

The chances of crypto becoming ‘the’ global currency are very slim — they’re up against a lot of vested interests, not least the world’s central banks. But if the crypto you’re holding does become the global base currency, then even a small holding would likely make you incredibly wealthy.

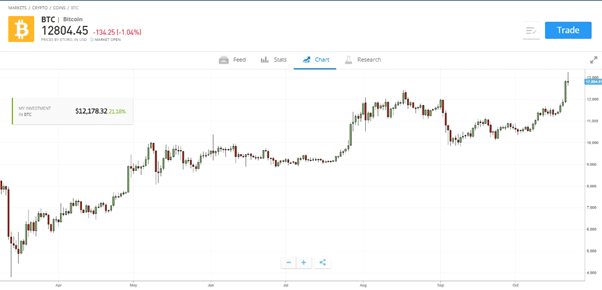

When you factor in current favourites in the race — these include Bitcoin, Ether and many other altcoins — they might not even be top of the pile of digital coins in 12, 18, 24 months’ time. As such, it becomes clear that it’s a market with a high level of risk-return. This causes dramatic price moves.

Source: eToro

A unique asset

Cryptos can be actively traded or bought and forgotten about. There’s something for every type of trader. It also appeals to some who don’t have any other interest in the financial markets — all of which makes trading cryptos a unique experience.

How to trade crypto

The popularity of cryptocurrencies has been the result of a groundswell of demand from the trading community. For a little while, mainstream brokers were playing catch-up and first-generation traders had to use dedicated crypto exchanges and organise special ‘wallets’.

Things have thankfully moved on. Regulated, online brokers such as Pepperstone, IG and eToro all offer a user-friendly way to gain access to the crypto markets.

It’s easy to buy or sell cryptos at the click of a button. If you trade using CFDs, you can also sell short.

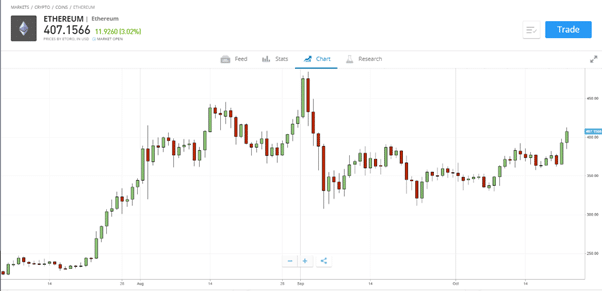

Reflecting the price volatility, and the appeal of the market to novice traders, leverage at regulated brokers is capped at 1:2. If your broker is offering leverage higher than that, then that is a red flag. They might not be regulated by a tier-1 regulator.

Source: eToro

How is AI used in crypto trading?

The crypto markets trade 24/7, so at any point in time, millions of traders are actively monitoring or trading positions. With so much data to analyse, there has been a shift towards using artificial intelligence (AI) software to lighten the workload.

Systematic trading involves collecting and analysing historical market data, mainly prices. Then developing strategies that use back-data findings to catch future prices moves and make the trader/analyst a profit.

AI offers an extra layer of sophistication. It involves a task being performed by a machine or software program, but demonstrates some aspect of human intelligence. It might be that the AI incorporates, planning, learning, reasoning, perception, problem-solving or data manipulation, for an automated trading experience.

AI comes with distinct benefits:

- Reliability: Using software to process data reduces the risk of human or input error.

- Speed: Machines are the fastest way to process large datasets and back-testing can involve immense quantities of data.

Good AI firms for trading crypto

AI has been around for decades, but there is still lots of progress being made. As a result, those developers and programmers who believe they’ve found a ‘secret sauce’ offer their AI products in return for a fee.

Although many models and programs claim to be accurate, it takes top-quality software — at a high price — to get the best results.

Endor

Endor is a leading firm in this department and has been conducting tests and research to improve these tools. It analyses human behaviour and has created a search engine function that allows users to search for solutions to various market circumstances.

Previously, these tools were mainly accessed by larger companies or firms. However, they have now been introduced into the crypto world to supply highly accurate predictions for various market conditions through Endor.com Protocol. Smaller investors can receive crucial insight into the market without paying an unreasonable price or conducting extensive analysis of their own.

Endor sees its role as the ‘Google for predictive analytics’. This involves the firm taking data relating to user activity and recycling it back into their models.

Any users who are willing to take part in this sharing of data are rewarded in Endor tokens. It’s open to everyone and no data science expertise is required.

Signal

Signal is a firm that has ventured into a similar project, selling indicators and signals to traders who do not have the necessary skills or knowledge to identify their own. The Signal platform provides these indicators in a user-friendly way and is based on data gathered by AI.

There is also a prediction market that will not only help with quality predictions of market movement, but will also allow skilled traders and data scientists to monetise their abilities and knowledge by selling their analysis and predictions.

Through the creation and use of these automated trading strategies, both new and experienced investors can benefit in their trading careers.

Future trends to look out for in AI trading of crypto

Although these tools are already extremely useful and reliable, developing certain aspects of the programs would make these tools even better.

Narrow AI and General AI

Knowing the difference between these two can help you spot the next AI trends.

- Narrow AI: Intelligent software programs that can carry out specific tasks without being explicitly programmed how to do so.

- Artificial general intelligence: Based on an accumulation of experiences. This is closer to human intelligence and is the area, which, once developed, will most likely convert into easier and more profitable trading.

Advancing the interoperability of software

Automated cryptotrading with AI would benefit greatly if blockchains were able to connect and share data with the programs that are managing the trading process. This would create smoother automated trading execution on platforms, including handheld devices.

Traders would then be offered the additional advantage of having straight-through-processing of execution. The alternative is the slower and operationally more risky process of executing trades manually.

Improving the potential for effective analysis

If there is to be an improvement in the exchange of software and systems, traders might be able to access the data collected by each individual blockchain. Interaction is currently limited because the respective blockchains cannot transact data and therefore only reflect information about a single cryptocurrency.

Combining information

It would be to any trader’s advantage to be able to access a range of cryptocurrency analysis, from providers such as Endor and Signals, and coins such as Ether and Bitcoin. You would be granted a better overall insight of the relations between all the various financial markets.

This would then feed through as better trades. These connections can be further enhanced with the use of application programming interfaces (APIS) and other tools and developments.

In short, greater interoperability will allow for a larger collection of knowledge and insight, and better strategies for automated trading functions in the cryptocurrency market. This could be the gateway for novice investors to find their place in the trading industry, even with minimal understanding, and further the growth of the crypto market.

Final thoughts on automated trading

Crypto trading is, for many, a very emotional experience. The wild price moves can trigger a range of strong emotions. As extreme signals are easier to read, this could make existing AI models more suited to the crypto markets. This is something to hold in mind if you look to extract your crypto AI skills and apply them to other, more subdued markets.

It would help everybody if the processing times of blockchain calculations could be improved upon. It would take them closer to being a bona fide currency. The current waiting time of minutes for some coins makes them unlikely to become a means of transaction.

As that processing time comes down in size, it will also benefit with automated cryptotrading. A quicker turn around of data will just make things easier.

Finally, as the topic is a long way into the IT world. It’s worth remembering the programming saying ‘Garbage in. Garbage out’. The quantity of data is important, but quality standards also need to be maintained.