This is to some extent surprising as it is relatively hard to buy ripple. This article will explain how by looking at the three best exchanges to buy ripple coin.

- What is ripple?

- How to buy ripple at Binance

- How to buy ripple at Changelly

- How to buy ripple at Coinmama

- Final thoughts

What is ripple?

There are a lot of intricate features associated with ripple, but the most simple description would be that it is, as a genuine crypto, that is very useful.

The use of ‘genuine’ refers to it not being a stablecoin. Ripple’s share price swings around dramatically unlike coins such as tether, which are pegged to fiat currency.

It is ‘useful’ because the ripple platform and its native coin XRP provide a very attractive and popular means of exchange. Ripple, more than any other crypto, is known for bridging the gap between blockchain and mainstream financial systems.

Top cryptos by market capitalisation:

| Symbol | Avg vol (3-month) $Bn | Market Cap ($Bn) | ||

| BTC-USD | 30.92 | 357 | ||

| ETH-USD | 14.97 | 67 | ||

| XRP-USD | 4.80 | 27 | ||

| USDT-USD | 48.08 | 19 | ||

| LTC-USD | 3.18 | 5.5 | ||

| BCH-USD | 1.90 | 5.3 | ||

| LINK-USD | 2.26 | 5.2 | ||

| ADA-USD | 0.88 | 4.8 | ||

Source: Yahoo Finance

Founded in 2011, ripple and the RippleNet platform come with extra layers of functionality. This makes it an ideal way to process real-time and cost-effective money transfers.

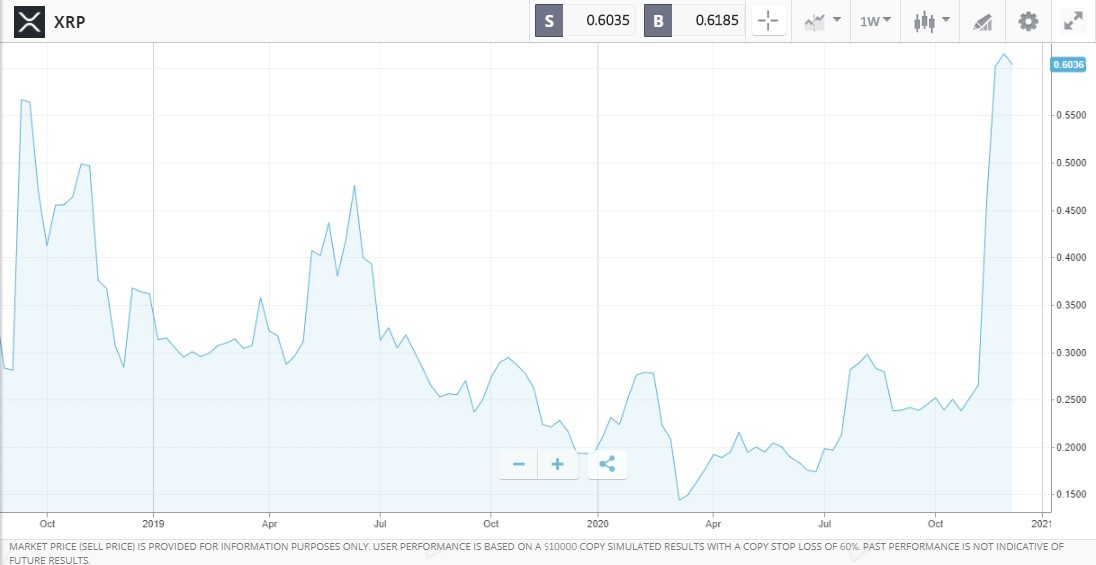

Source: eToro

The extra layers of functionality found on the ripple platform mean that internet-based exchanges can carry out real-time and cost-effective money transfers. Ripple is more than a buy-and-forget proposition. Instead, it reflects a real chance for blockchain technology to revolutionise the way the global financial system operates.

If you’re thinking of buying ripple, it is worth ensuring you are familiar with some of the workings of the platform as these are, after all, part of the reason for its price moves.

Ripple offers a range of financial transaction services including the below.

- XRPLedger – Based on blockchain technology the ledger’s protocols allow for speedy and low-cost processing

- xCurrent – Doesn’t actually use XRP and demonstrates the willingness of ripple to operate in the grey area between crypto and traditional finance. xCurrent uses a protocol called ILP (Inter-ledger protocol). ILP is doubly exciting, as not only does it facilitate exchange between crypto and fiat systems, but crypto-to-crypto too.

- xRapid – An on-demand liquidity solution. Designed to allow XRP to act as a bridging currency between financial institutions making cross-border payments in fiat currencies.

- Messenger and Validator – These form part of the xCurrent package. Both provide secure, verifiable means of communicating and checking details of financial transactions.

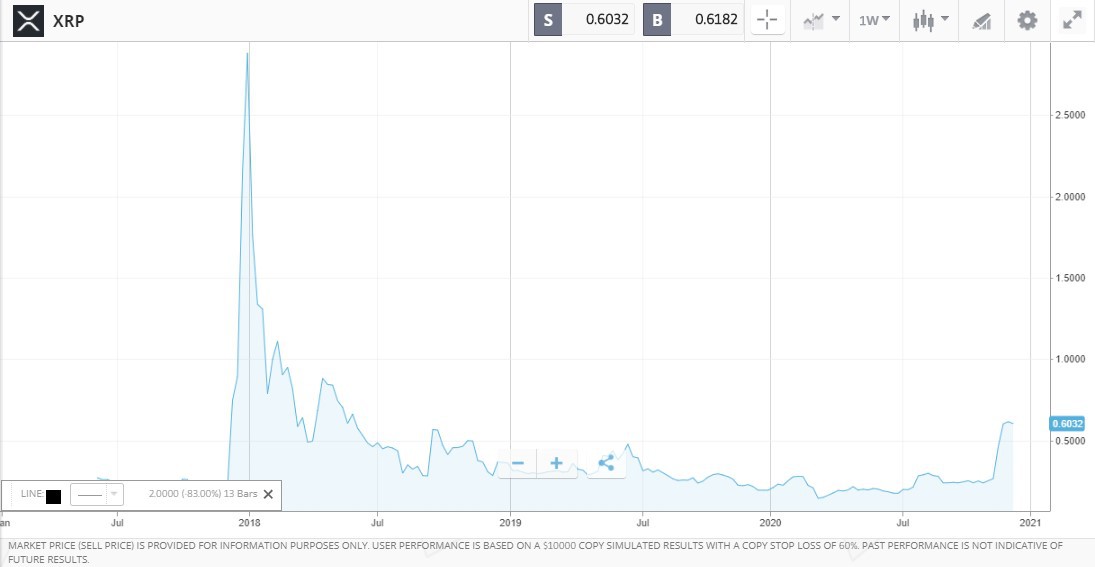

If these tools represent the foundations for future transaction networks, then ripple’s price can be expected to sky-rocket. Of course, nothing can be guaranteed and a quick glance at the ripple price chart shows that it suffers dramatic price slumps as well as rallies.

The 2018 sell-off across the crypto market didn’t spare XRP when it lost 83% of its value in the space of only 13 weeks.

Source: eToro

Since that crash, ripple has experienced slightly lower price volatility than some of the other names in the sector. Its toe-hold in the mainstream business of processing transactions gives those buying into it more stable and tangible data to base their valuations on.

There is still potential for further downsides. Some crypto purists think ripple has sold out by becoming mainstream. At the same time, banks are unsure of ripple’s viability due to the dramatic price moves in XRP.

If you want to just trade the price of ripple, you can do this by visiting brokers such as eToro, IG and Plus 500. CFD (Contract for Difference) markets are a popular option for many. If you want to own ripple outright then you’ll need to make use of one of the many crypto exchanges that offer ripple trading.

How to buy ripple at Binance

Dedicated crypto exchanges grew up with the coins themselves. There are now many to choose from that crypto trading does have a reputation for attracting scams and scammers. Caution is advised and one way to trade more safely is by using recognised exchanges and cross-checking your sources.

Buying ripple at the below exchanges is intuitive and easy. It takes only a few clicks to complete your purchase.

Source: Binance

Binance exchange is a relative newcomer and was established in 2017. It managed to muscle its way into the market by offering crypto traders what they want.

Binance claims its platform has superior security controls and the innovative SAFU (Secure Assets Fund for Users) helps support that claim. Being able to get your money back out never goes out of fashion.

It also offers low trading fees (0.05%) and best in class transaction times. Binance is now the world’s most liquid cryptocurrency exchange. It is the platform with the biggest volumes — these are across multiple crypto pairs, which includes those that let you take the next steps to buying XRP.

Binance caters to a global client base, has millions of registered account holders and the registration process is very user-friendly.

The path to buying ripple at Binance will depend on how you make your deposit into your Binance account.

- Bank Transfer – if you wire fiat currency funds into your account, your first step will be to buy stablecoins or another crypto such as Bitcoin or Ethereum. You can then use those coins to buy XRP.

- Debit / Credit Card – This is the more direct option. You can directly purchase XRP with credit or debit card on the Binance exchange (Visa or MasterCard).

Once your XRP purchase is completed, you can store it safely on your Binance account or on the Binance crypto wallet app Trust Wallet.

In terms of buying and holding ripple, Binance offers a complete package. It provides an extensive selection of markets to trade and caters to intermediate and advanced traders, not just beginners.

How to buy ripple at Changelly

Changelly offers a slightly different approach. You need to be a bit more hands-on than with Binance, but that actually appeals to a lot of crypto traders. The obvious advantage of being in charge of your own money is that you can ensure that there is less risk of it disappearing.

Source: Changelly

Changelly is another ripple exchange that requires you to use either bitcoin or ethereum to acquire XRP.

Changelly doesn’t require an in-built wallet. Instead, you will need to store your funds on a separate hardware or software wallet, but the platform supports most varieties. This does require some extra organising, but offers the potential for holding coins in an offline cold storage area.

Purchases of ripple at Binance are limited to crypto-to-crypto transactions. Fiat currency can be used to buy another crypto, which is then used to buy ripple. Bitcoin and ethereum are recommended as intermediary currencies due to their stronger than average liquidity.

The next step requires you keying in your XRP address. This is your ripple address, and then input the destination tag, which is a description of the transaction.

Changelly has a hardcore fan case due to its very user-friendly platform and competitive pricing.

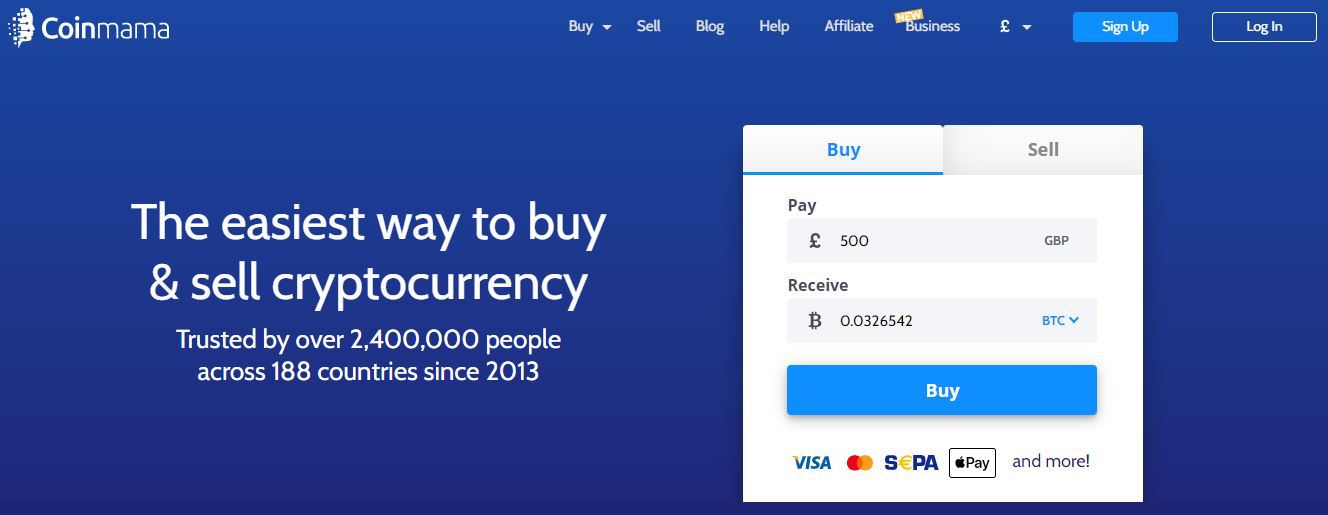

How to buy ripple at Coinmama

Coinmama has been operating since 2013 and has built up a strong reputation in the trading community. It now hosts 2.4 million accounts and has clients based in more than 100 countries.

Source: Coinmama

US clients are unable to trade ripple on Coinmama, but for non-US users the process is very straight-forward. Registering for an account is done online and it’s then a case of locating ripple among the listed assets.

The Coinmama platform supports the transaction, but not the ongoing holding of your position in ripple. This means you need to set up a crypto wallet prior to making any purchase at Coinmama. Once you’ve completed on your buy order, just enter in that wallet address and those ripple coins will be delivered to your wallet.

Coinmama might not be the most cost-effective way to process transactions in ripple. You need to be aware of the T&Cs, which apply to your trading, as fees can soon rack up, particularly as you have to use another crypto to buy into ripple.

There is positive feedback, with beginners especially drawn to the intuitive functionality of the trading platform and 24/7 customer support.

Final thoughts

Ripple’s approach to challenging the dominance of bitcoin is to offer something the more established coin struggles to. Ripple and XRP are the market-leading crypto in terms of transaction processing.

The native coin XRP has strong brand recognition and a wide range of global financial institutions use the ripple network.

Where ripple comes unstuck is that this success comes at the cost of losing some of its anti-establishment feel. The open-source and decentralised processes were supposed to revolutionise the established global systems, not merely profit from them.

Whatever your take on the prospects of ripple and XRP, the good news is that buying the coin can be very easily done.