The cryptocurrency world is constantly evolving, and there are more digital currencies created each and every day. While some are interesting to investors, and others – not, Bitcoin Cash is probably one of the most discussed and controversial cryptos out there – a spin-off of Bitcoin, Bitcoin Cash has a lot of interesting aspects that investors need to consider about this digital asset. In this article, we will look at the following:

- Background

- Price Performance History

- Bitcoin Price Predictions

- The Future of Bitcoin Cash

Background

Bitcoin Cash was created through a hard fork from Bitcoin in August 2017. During this time, the cryptocurrency market was gathering speed and the industry experienced an unprecedented boom in 2017. However, in January 2018, the Great Crypto Crash occurred, during which alt coins and Bitcoin lost 80% of their value in under 30 days. Proponents of Bitcoin Cash argue that the coin is a better version of Bitcoin, as the latter has strayed from its original purpose. The community that created Bitcoin Cash aims to bring the crypto on top of the alt coin chain and turn it into the leading medium of exchange in the P2P payment world. Some of the special features of Bitcoin Cash are low transaction fees and speed.

The low transaction fees of Bitcoin Cash are compared to those of Bitcoin, which are one point reached $55 per transaction in 2017. While the Bitcoin community has managed to improve the price per transaction, Bitcoin Cash still boasts a better pricing opportunity – typically a transaction of 236 bytes or less would cost around $0.005 on the Bitcoin Cash blockchain.

The Bitcoin Cash community was able to achieve the price advantage through having its block size at 8MB initially, while the block size of Bitcoin was only 1MB. The scalability issues of Bitcoin have turned many investors’ heads to seek out more efficient crypto opportunities. The Bitcoin network has famously experienced massive scalability issues, something which has dampened its growth over time, with many becoming disillusioned at its incapability to overcome this. In a recent hard fork, Bitcoin Cash even increased their block size further, up to a max of 32MB.

There were also other aspects of this hard fork that are noteworthy, like some of the original Bitcoin code being reactivated. Part of this was the opcode named ‘OP_GROUP’ which could cater for the opening up of the Bitcoin Cash network whereby tokens could be created in the same way as ERC20 tokens with the Ethereum network. If this is to materialize, there will a rise in the value of this network, with other opcodes also coming into play that could allow them create their own smart contracts. Finally, the hard fork also sees the upper turn size increased from 40 bytes to 220 bytes, which means that a lot more data is going to be able to be added onto their blockchain.

In 2018, on November 15th, 2018, a there was another hard-fork chain split of Bitcoin Cash this time, which occurred between two rival factions called Bitcoin SV and Bitcoin Cash. On the same day of the hard fork, Bitcoin Cash ABC traded at around $290 and Bitcoin SV traded at around $97, a drop down from $425 on November 14th, 2018 from the then un-split Bitcoin Cash.

The hard fork occurred due to a “civil war” in two competing bitcoin camps camps. The first community was led by Roger Ver and Jihan Wu of Bitcoin, who promoted the Bitcoin ABC, with a block size of 32MB. The second community was supported by Craig Wright and Calvin Ayre, who envisioned the idea of Bitcoin SV, which means “Bitcoin Satoshi’s Vision” – with a staggering block size limit of 128MB.

Price Performance History

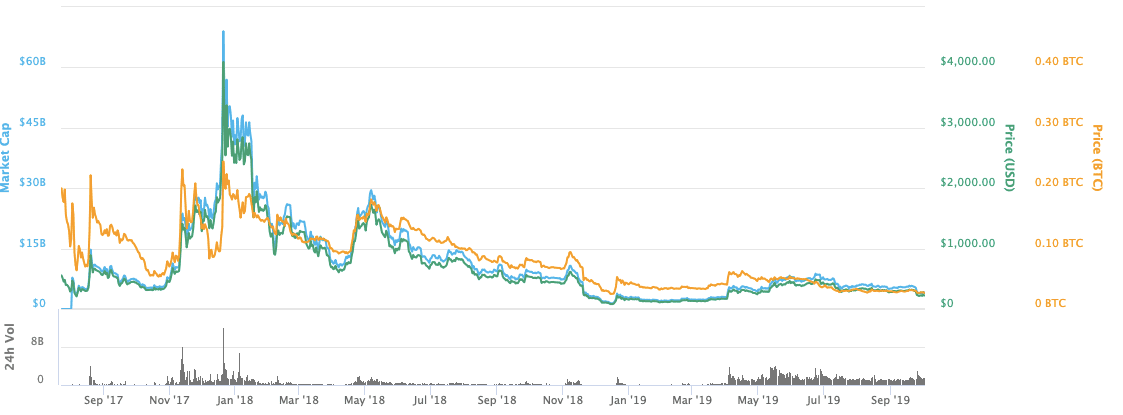

The price of Bitcoin Cash has come a long way since the cryptocurrency first came into existence following the Bitcoin hard fork on the 1st of August 2017.

- On launch day, the Bitcoin price was $2,718.26, with Bitcoin Cash being $380.01

- For the first few months, the Bitcoin Cash price did not see much increase, trading around the $360 level

- The coin managed to strongly move upwards along with the bull market that the cryptocurrency market as a whole was experiencing during that time period

- On December 20th, the price eventually maxed out and reached a high of $4,091.70

- Ever since reaching this high, there has been a gradual downward trend, and it was on the 6th of April that it bottomed out near the $606 mark.

- Since January 2018, the entire cryptocurrency market has seen a significant decline, with Bitcoin going from highs of $20,000 in December 2017 all of the way down to the $6,500 region in recent times

- Following Bitcoin Cash reaching its recent low, it managed to recover strongly, hitting $1,540 in mid-April.

- It was in early May that Bitcoin Cash reached its highest point since mid-January, nearing the $1,750 mark. This was during the time of the Bitcoin Cash hard fork. After this point, the price gradually declined and bottomed out at $222 at the time of this writing, a huge drop in the overall price of the coin since its inception.

What Affects the Bitcoin Cash Price?

Since the Bitcoin hard fork in August, there has been a number of controversies that have potentially affected the price of Bitcoin Cash. In November 2018, many people in the crypto space suspected that Bitcoin Cash may have been part of a “pump and dump” scene, which harmed the reputation of the coin tremendously.

This was a result of a brief spike in the price up towards the $2,500 mark before it drastically dropped down toward the $1,000 mark, all of which took place in the period of 48 hours. During this period, there had been many notable cryptocurrency influencers praising Bitcoin Cash loudly on various social media platforms.

While these comments showed the overall happy sensation that the cryptocurrency is moving in the right “price increase” direction, there was a suspicion that a “pump and dump” scheme is taking place. There were many who benefitted from the price movements, who made their positions not in the public eye. There was zero indication that these influencers had any ulterior motive behind their tweets, but this didn’t stop the community being suspicious and thinking that a pump and dump had taken place. There was then a controversy involving a worker at Coinbase.

Bitcoin Cash Controversies

- The largest US cryptocurrency exchange, Coinbase, halted the trading of Bitcoin Cash, following allegations made against a Coinbase employee who was suspected of insider trading. The worker allegedly had inside knowledge that Coinbase would be adding Bitcoin Cash to their crypto portfolio, and on this knowledge, executed profitable trades prior to the listing

- A subsidiary of the mining company Bitmain, called Antpool, received accusations that they were trying to artificially boost the value of Bitcoin Cash. The allegation came after an announcement that they had made in which they publicised their intention to burn 12% of all Bitcoin Cash mining rewards through their platform. They said that their intentions were to add more strength to the Bitcoin Cash network. However, many in the community were suspicious that Antpool were trying to engage in price manipulation via their announcement. Currently, miners on Antpool make up about 8.0% of the transaction in Bitcoin Cash

- Others have speculated that there are other reasons why Bitcoin Cash price has skyrocketed in the beginning, apart from its rising value to investors. One of those reasons was the increased trading activity in South Korea, which many commented, was an artificial and unbalanced height in the price

Recent Developments

Bitcoin Cash currently trades on cryptocurrency exchanges such as Coinbase, Gemini, Kraken, Bitfinex, Bitstamp and ShapeShift. The ticker symbol is BCH. In March, 2018, OKEx halted the trading of all Bitcoin Cash pairs except for BCH/BTC, BCH/ETH. The reason was inadequate liquidity. As of May 2018, Bitcoin Cash daily transaction numbers are around 1/10 of Bitcoin’s.

As of August 2018, payments through Bitcoin Cash are supported by service providers such as GoCoin, Coinify and BitPay.

In terms of making a Bitcoin Cash price prediction, this is not very straightforward. The cryptocurrency markets are well-known for their high levels of volatility and there are many factors, both internal and external that are going to impact the prices. Some of the positive aspects about Bitcoin Cash that could lead to growth include the scalability options that Bitcoin has been experiencing. If these issues continue, more and more people will likely convert over to Bitcoin Cash. Mining Bitcoin Cash is now becoming more lucrative than mining Bitcoin, so if more and more miners switch over, this could lead to growth. The fact that Bitcoin Cash is linked with Bitcoin will give investors a feeling of trust as they know that it’s going to be a token built from a strong base.

Bitcoin Cash Limits

The supply limit of Bitcoin Cash is similar to Bitcoin’s – 21 million coins to be mined. Many are expecting the price of Bitcoin Cash to increase as a result of the supply pressures. A factor that could inhibit potential growth in the price of Bitcoin Cash include the current dominance of Bitcoin. The current market cap of Bitcoin Cash is around $4bn, Bitcoin’s is $150bn. Another factor is the potential emergence of competitors, which may offer lower transaction fees and faster P2P transactions. There are some concerns with mining centralization. The main criticism that Bitcoin Cash receives is that it has a higher level of centralization than Bitcoin. While the greater block size was made with good intentions, the feature requires more computing power, which means more expensive mining rigs are needed. Therefore, the mining pool is smaller. There is a certain level of power that this minority may exercise when compared to the massive pool of miners engaged with Bitcoin.

Conclusion

As with the entire cryptocurrency market, the prediction of prices is a tricky business. The market is quite volatile and mainly driven by market sentiment, rather than intrinsic value. The primary concern is that Bitcoin’s community will continue improving it, and the “people’s currency” will eventually edge out Bitcoin Cash. Again, in-depth market analysis and expert opinions are the best guiding strategies to follow for the average investor.