It’s hard to come up with the name of a financial asset that has generated as much excitement, profit and, yes, losses as Bitcoin. The world’s first and still dominant cryptocurrency has only been in existence since 2009, but in a short space of time, it has turned some investors into crypto millionaires and billionaires.

Profiles of investors and traders of Bitcoin vary wildly. There are the purists who got on board because crypto blockchain technology is for them a way to revolutionise and democratise the global financial system. At the other end are short-term speculators taking advantage of the dramatic price swings found in the markets. Somewhere in between are a group that recognise Bitcoin as the next big thing and want to know more about it.

One significant additional agreement in the crypto space is operational risk. This is the likelihood of your cash or crypto going missing thanks to your own error or the actions of a scammer. All markets have this risk, but in the case of cryptos, it’s very real. Crypto markets are unregulated and some of the original means of buying Bitcoin required a degree of technical know-how. The good news is that as the market has matured, there are recognised safe and easy ways to get exposure to the sector. If you want to buy a bit of Bitcoin, this user-friendly guide will show you how. We can’t do anything for you in terms of managing market risk, the risk of price going against you – but we can guide you through the pitfalls.

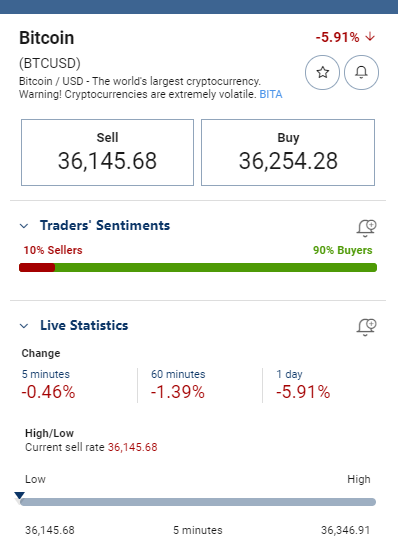

Bitcoin Price Chart

Source: Plus500

Why Buy Bitcoin in Singapore?

As mentioned, the initial buzz around Bitcoin was created by alternative thinkers who looked at the established global financial system and thought that it needed improving. The tool they chose to do this is a blockchain payments network called Bitcoin. Like any other digital accounting system, the participants in the network can hold assets in their accounts, called bitcoins. There are two neat features that go some way to explaining why the idea took off.

Transparency

The first is that everyone can monitor the blockchain and establish what each participant is holding. It’s similar to playing cards, but with the cards turned up, everyone around the table knows where the cards/bitcoins are. If any cards/bitcoins move from one person to another, everyone can see that happen.

Anonymity

While the accounting system is transparent, the ID of the account holders is not. On the Bitcoin blockchain, account holders are identified by numbers. While everyone can see the size of their BTC holding, only the account holder can access the coins in the account.

Independence

Unlike traditional/existing financial systems, Bitcoin isn’t overseen or managed by any particular body. There’s no central bank to print money. Instead, coins are ‘mined’ by computers that crack complex computer codes. There are no interest rate policies. Instead, coins are released to the miners as set rates according to the tamper-proof computer code that is part of the system’s DNA.

Why Do People Like Bitcoin?

The proposal made by fans of Bitcoin is that their extra-transparent accounting and extra-opaque profiling offer a system that is superior to the current one.

If someone fraudulently accessed your high-street bank account and wired funds to their own account, only two parties would know that it happened. Resolving the issue comes down to one person’s word against another. On a blockchain system, by contrast, each party would have to provide ‘keys’ to confirm the transaction. Only once this is done is a new ‘snapshot’ taken of the whole network.

The anonymity also appeals to many who feel that governments and central banks have too much influence over the monetary system. Central bank interest rate policies, for example, might include massive programmes of quantitative easing (QE). This benefits some in the financial ecosystem and disadvantages others, and the list of winners and losers is down to the discretion of unelected bank officials who are appointed from the establishment. It’s no coincidence that Bitcoin was born soon after the 2008 financial crash where governments and banks bailed out big banks. The alternative would have been to let some go bust, but instead the banks benefited, and the burden of trillions of dollars of debt associated with the QE programmes were left for the little guys to somehow resolve.

Bitcoin as a Means of Exchange and Store of Value

Fiat money systems work on the basis that something, a note or a coin, is accepted as a means of exchange. Once enough people trust the system, it doesn’t matter what you use as a form of exchange – it could be cowry shells, $10 bills or digital codes. Bitcoin is a global phenomenon and enough people have bought into that it is seen as a legitimate means of exchange. You can buy Bitcoin in Singapore and exchange it for goods in another country. A neat feature of this deal is that you avoid any currency conversion charges. You can send it to friends and family or keep hold of it as a store of value.

The price of Bitcoin is a function of its ability to be used and to be recognised as a store of value. The two are interlinked, but if Bitcoin is going to take off and really does become the world’s future and sole currency, then people will need to hold some. This will require exchanging fiat currency for BTC. Basic laws of supply and demand come into play and would result in the price of BTC being driven up exponentially.

Will Bitcoin Be a Success?

There are two major reasons why this hasn’t happened yet, or might not happen at all. The first relates to BTC’s use as a means of exchange. Resetting the blockchain after transactions have taken place takes time. A Bitcoin transaction is currently estimated to take up to 10 minutes to process. If you use Bitcoin to buy a coffee in a downtown café, it will likely be cold before the time your payment has gone through.

The second relates to its acceptance. What if the 10-minute processing times can’t be improved? If that is the case, then maybe another crypto – an altcoin such as Ethereum of Dogecoin – will be the currency of the future. It’s also important to factor in that the central banks and governments that Bitcoin is looking to challenge like things the way that they are. For one thing, they can track money flows and cut down on illegal activity such as money laundering or tax evasion. They also have regulatory tools to hold back Bitcoin’s advance, and even if consumers want to use a crypto-style coin, why don’t central banks set up their own? The People’s Bank of China is already some way down the road to doing this.

Recognising that Bitcoin could be worth everything or nothing, and that the debate on this is still running, it’s easy to see why price fluctuates so dramatically. One minute, Elon Musk is stating that Tesla will accept BTC as a form of payment – a major breakthrough for the coin’s credibility. The next, he has changed his mind because of the huge carbon footprint associated with mining BTC.

Where Can You Buy Bitcoin in Singapore?

Buying Bitcoin in Singapore involves exchanging fiat currency, such as SGD, for a key code that will record your holding on the blockchain. It’s possible to obtain a code by paying in crypto, or if you’re meeting someone face to face to complete the transaction, you can use whatever form of payment you like.

As Bitcoin has surged in popularity, service providers have come into the market to make the process more user-friendly. Three tried-and-tested routes to buying Bitcoin are crypto brokers, crypto exchanges and crypto ATMs.

Crypto Brokers

Plus 500 (CFD Provider)

Plus 500 is a well-established CFD broker that started out in 2008. Its Singapore business is carried out by Plus500SG Pte Ltd (UEN 201422211Z), which holds a capital markets services licence from the Monetary Authority of Singapore for dealing in capital markets products. The licence is No. CMS100648-1.

Source: Plus500

Not only is Plus500 well-regulated, but the platform also has an exceptionally user-friendly feel to it. It’s possible to set up an account and trade Bitcoin using a desktop or mobile device, and there are even other crypto markets on offer if you want to trade altcoins. Plus500 maintains its position as one of the established players in the broker sector by offering tight spreads on markets.

* 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Pepperstone

Pepperstone has also ticked all the boxes in terms of regulatory approval. It has been operating since 2010 and is licensed and regulated by Tier-1 authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Dubai Financial Services Authority (DFSA) in the UAE.

Bitcoin Price Chart

Source: Pepperstone

It offers a choice of trading platforms and competitive pricing terms in crypto markets. Beginners who feel that they might have a few questions to ask before making their first trade might note that Pepperstone’s customer service team is widely regarded in the trading community as being one of the best available. The broker has won multiple industry awards over many years.

Crypto Exchanges

Pepperstone and Plus500 also operate in the equity, forex, commodity and other sectors and so have to sign up for regulatory approval. Crypto exchanges are different in that they only offer crypto markets, and this means that they don’t have to be regulated. This can deter some who prefer to have the comfort that comes from placing cash with a licensed operator, but exchanges can at the same time offer a wider choice of crypto markets.

Binance

One of the established players is Binance, which offers a good all-round service and fees of 0.1%. You can trade up to 500 different cryptocurrencies on the platform and it claims to be the world’s largest crypto exchange, often recording the highest daily trading volumes in the market.

Coinbase

Coinbase brought crypto further into the mainstream when in April 2021 the parent company listed on the Nasdaq stock exchange. It offers 60+ crypto markets and has a strong brand, but investors in Singapore might note that you can only fund your Coinbase account with a credit or debit card. This means that there is an additional fee of 3.99% to pay, and given that trading crypto is hard enough, it’s a tough ask to expect users to pay that amount on administrative costs.

Gemini

Gemini allows seven different fiat currencies to be used to make Bitcoin purchases, and one of them is SGD. You can also set up recurring buys, so you can build up your position over time, and there are also dynamic price alerts that you can use to keep you updated on the performance of your crypto holding. There are some educational materials to help those who are new to crypto, and fees range from $0.99 to 1.49% of your order value. Beginners will also appreciate the ‘no hidden fees’ claim made by the platform, though Singapore citizens need to check the T&Cs as some of the introductory promotional offers don’t apply to them.

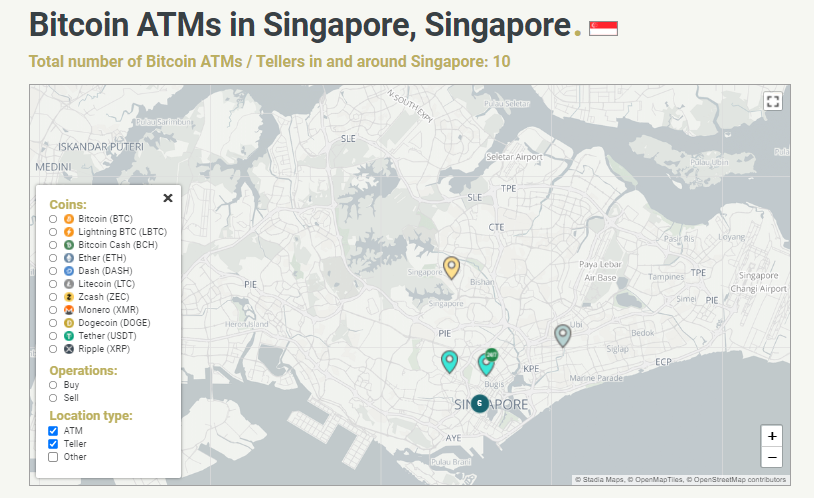

Bitcoin ATMs

ATMs that allow users to exchange SGD for BTC have been operating in Singapore since 2014. They are connected to the internet and convert fiat currency into Bitcoin and record the transaction by either sending the BTC directly to your wallet, or alternatively giving you the code on a piece of paper. A quick online search will reveal a map of current Bitcoin ATMs that Singapore vendors provide.

They are convenient and transaction times are fast, sometimes taking only 15 seconds to process. It’s also possible to largely remain anonymous unless you are buying a substantial amount of Bitcoin. Transactions over a certain size require you to provide photo ID. There is one catch: fees associated with ATMs tend to be on the expensive side.