Founded in 2011, ripple is a blockchain system that works as a means of exchange. It’s already bridging the gap between crypto and mainstream finance and that is where its strength lies. As we explore ripple, this article will cover:

- What is ripple?

- How has XRP traded since 2011?

- What’s special about ripple?

- Tips for trading XRP

- How do I buy XRP?

- Final Thoughts

This review will outline the reasons why millions are buying XRP and how to buy Ripple XRP safely.

What is ripple?

In its simplest form, the ripple platform makes use of blockchain technology to enable users to exchange digital currency. Sometimes referred to as the RippleNet, this framework has caught the attention of investors because of the additional layers it adds to the process.

Ripple’s cryptocurrency token is called XRP. On the ripple platform, XRP can be easily converted into fiat or cryptocurrencies or indeed traded in its own right.

The extra layers of functionality found on the ripple platform mean that internet-based exchanges can carry out real-time and cost-effective money transfers. This helps it stand out from other blockchain platforms which solely serve their native coins.

The range of financial transaction services which ripple provides includes the below:

- xRapid – An on-demand liquidity solution. Designed to allow XRP to act as a bridging currency between financial institutions making cross-border payments in fiat currencies.

- XRPLedger – Based on blockchain technology, the ledger’s protocols allow for speedy and low-cost processing

- xCurrent – Doesn’t actually use XRP and demonstrates the willingness of ripple to operate in the grey area between crypto and traditional finance. xCurrent uses a protocol called ILP (Inter-ledger protocol). ILP is doubly exciting as not only does it facilitate exchange between crypto and fiat systems, but crypto-to-crypto too.

- Messenger and Validator – These form part of the xCurrent package. Both provide secure, verifiable means of communicating and checking details of financial transactions.

If the ripple framework is going to leverage off all these tools and be the base for future financial systems, then ripple will see increased demand and go up in value.

How has XRP traded?

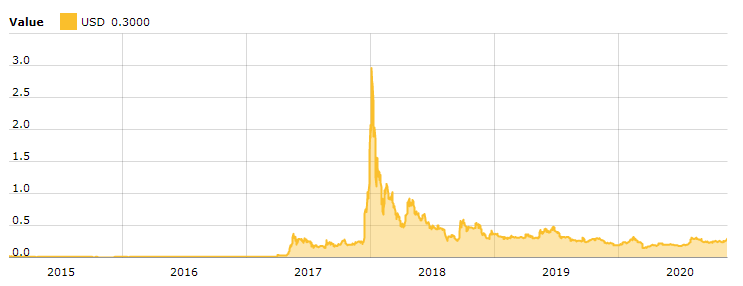

If you’re asking yourself, how can I buy XRP? The good news is that price has fallen back from recent highs.

As cryptos go, ripple, which was founded in 2011, has been around a relatively long time. Looking at historical price data can go some way to helping predict future moves.

The price history goes a long way to answering the question – is ripple worth buying? The weekly candlestick chart dating back to 2019 shows the crypto’s wide spike and decline. What is noticeable is that ripple’s price volatility is less extreme than that of some other cryptos.

Source: FXCM

Source: Cointelegraph

The relative stability in price since the last quarter of 2018 is down to ripple crossing over into being a ‘normal’ business. It processes payments between global institutions and individuals.

This might appeal to those looking to trade a market with some of the extra movement associated with crypto, but maybe not too much that they get shaken out of positions.

What’s special about ripple?

Ripple was developed a few years after bitcoin and the emphasis on payment processing shows how it benefits from being a second-generation project. It was also developed early enough (2011) to get a head-start on most other Altcoins.

Payment frameworks take time and money to set up and ripple has a distinct ‘first adopter’ advantage. Any likely challenge to the role of rippleNet is likely to come via technological upgrades rather than like-for-like competitors.

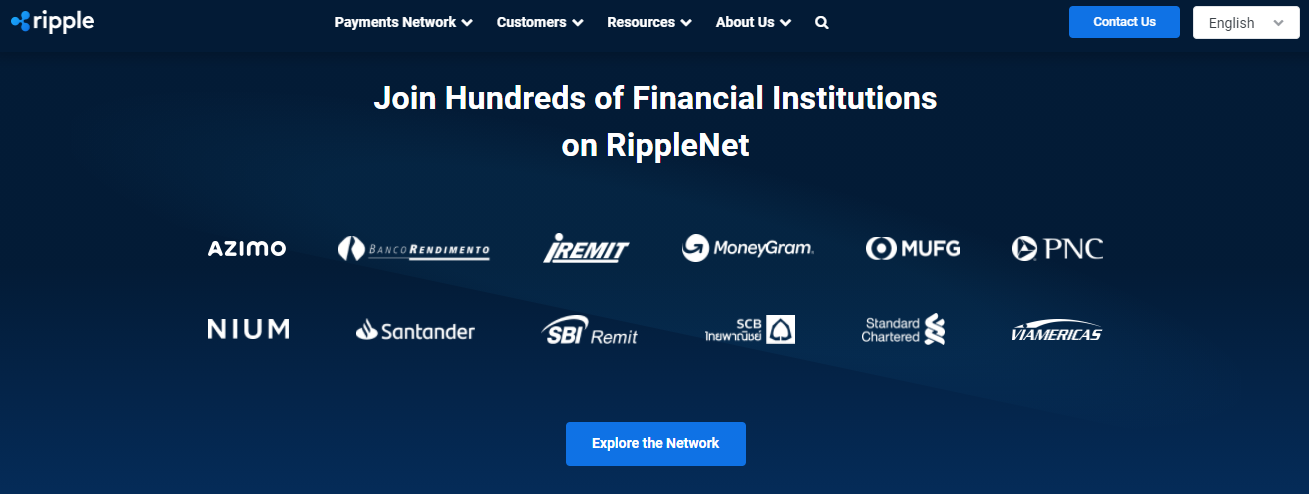

The really exciting features of ripple relate to the ability to also support other tokens and processes. It forms the moment when crypto blockchain frameworks shake hands with traditional financial systems.

Source: Ripple

One particularly attractive feature of ripple is that it supports multiple currencies and tokens. You can use the platform to exchange XRP but also, Japanese yen, US dollars, bitcoin, litecoin, pound sterling, euro, Russian roubles and many more.

The mechanics of the ripple platform also support the case for buying XRP.

- Faster – The ripple network allows for transactions to be processed on average processes every four to five seconds. This compares well to bitcoin's average, which is in the region of 10 minutes and Ethereum’s 1–2 minutes.

- Cost – The cost of a standard transaction on the ripple protocol is about 0.00001 XRP. The cost of 1 XRP is currently around $0.29. The transaction fee is so cheap that bitdegree.org describes it as ‘practically free’.

- Trading Volumes – The XRPLedger can process 1,500 transactions per second.

The top-11 rankings of cryptos positions XRP as fourth placed crypto by market capitalisation.,

| Symbol | Last price | Avg vol (3-month) $Bn | Market Cap ($Bn) | |

| BTC-USD | 16,301.09 | 27.59 | 302.20 | |

| ETH-USD | 453.63 | 13.95 | 51.46 | |

| USDT-USD | 1.00 | 42.10 | 17.88 | |

| XRP-USD | 0.27 | 1.88 | 12.44 | |

| LINK-USD | 12.29 | 1.54 | 4.83 | |

| BCH-USD | 249.37 | 1.90 | 4.63 | |

| LTC-USD | 67.54 | 2.36 | 4.45 | |

| BNB-USD | 27.99 | 0.43 | 4.04 | |

| DOT2-USD | 4.44 | 0.44 | 3.90 | |

| DOT1-USD | 4.40 | 0.49 | 3.87 | |

| ADA-USD | 0.10 | 0.58 | 3.18 | |

Source: Yahoo Finance

Ripple may not currently be regarded as effective a store of wealth as BTC. None of the Altcoins come close to matching bitcoin in that area. ripple is though some way ahead of BTC and most other Altcoins in terms of being an effective means of exchange.

Tips for trading ripple

Enthusiasm for cryptos does need to be reined in slightly as safety of trading should be your first priority. Market risk – the risk that price might go against you is a given. Unfortunately the crypto trading sector also has a reputation for scams and scammers.

The first step towards not being defrauded is to use a broker that is regulated by a tier-1 authority. Fortunately, the increased interest in cryptos has encouraged some big-name brokers to start offering the coins on their trading platforms.

There are a lot of brokers to choose from, and looking for one that is licensed by one or more of the below regulators is a move in the right direction.

- The Australian Securities and Investments Commission (ASIC)

- The Financial Conduct Authority (FCA)

- The Cyprus Securities and Exchange Commission (CySEC).

Once you have a short-list of potential brokers then thinning down the number of contenders can be done in a variety of ways.

- Demo accounts – These are free accounts that allow you to practise trading using virtual funds. They provide a risk free way of learning the basics and test-driving the different brokers.

- Crowd-sourcing – The online trading community is a great resource. Sites that allow other traders to discuss their experience will give you more colour on the different firms.

- Professional research – Tables such as this top-5 list provides names of brokers that are well known in the sector. Compiled by industry veterans, they take some of the leg-work out of reviewing the options.

How to buy ripple?

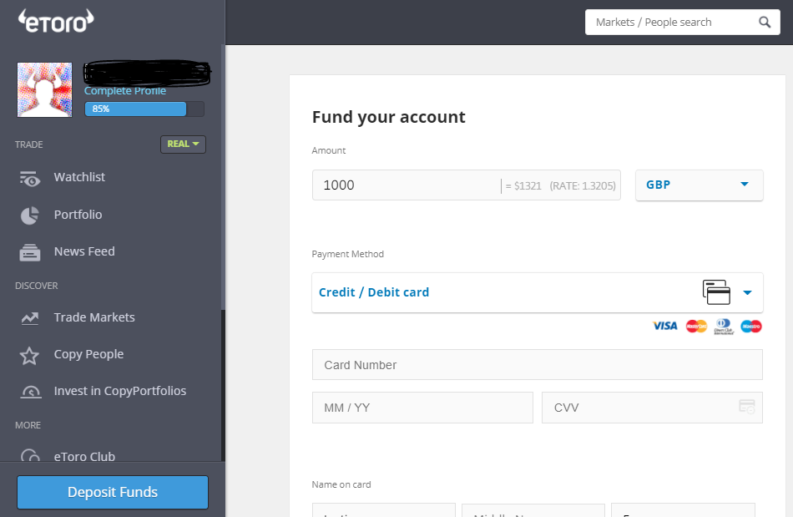

If you’re ready to purchase ripple, then it’s simply a case of signing up with your chosen broker. This should include some online form filling to ensure the broker satisfies their KYC (Know Your Client) obligations. Then wire funds into your account.

Specialist Exchanges are one option. If you’re looking for a cheap and convenient way to buy ripple cryptocurrency then the pricing at online brokers such as Pepperstone, IG and eToro, is worth checking out. The tariffs are fairly transparent and kept low due to competition between the brokers.

Source: eToro

You don’t have to dive into the markets. If you are biding your time and asking yourself ‘should I buy ripple now?’, then you are starting from a good place. There’s no need to jump in and a clear strategy is an essential part of successful trading.

Once you buy ripple online, you can keep the position at the broker. The account is an ideal place where to store ripple.

The regulatory cover is determined by the country you live in. So, if you are looking to buy ripple in the UK, and use a broker authorised by the FCA, then it’s that organisation’s regulatory umbrella you will operate under.

Final thoughts

Owned by Ripple Labs, the creators deserve credit for realising that their way of challenging bitcoin was to set up an Altcoin that offered cheaper and faster transaction processing.

This is important as there can only be one winner in the race to being the world’s future currency. Being an effective way of carrying out transactions will be key to winning the race.

Having been around for some years, XRP has gone some way to building brand recognition and breaking down the stigma associated with blockchain and crypto technology. That is important for a platform that aims to support fiat currencies and third-party tokens.

One significant headwind facing XRP is that the roots of cryptocurrencies have a firm anti-establishment feel. The open-source and decentralised processes were supposed to liberate cryptos from the big established institutions.

To be successful, XRP and ripple will need to balance the fundamental ethos of crypto with being an accepted and effective means of exchange. Nor is ripple the only crypto taking that approach, with this piece of research outlining how ripple compares to one of its direct competitors.