Whether Ethereum and bitcoin can solve their energy use problem poses an existential threat to both coins. But the crypto space is a natural home for tech-savvy, innovative thinkers, and the success, or not, of their proposals will go some way in determining the direction of the next price shift in both coins.

How Much Energy do Ethereum and Bitcoin Use?

Bitcoin uses as much energy as Argentina and Ethereum as much as the Netherlands. Put another way, a single transaction on Ethereum uses an amount of energy equivalent to the power consumption of an average US household over nine days. Bitcoin's numbers are even worse.

When Satoshi Nakamoto founded bitcoin in 2009, that energy demand might not have been apparent or seen as so much of a problem. But fast-forward to the current day, and energy use on that level clashes with the move to a low-energy and low-carbon way of doing things. It's not a good look for an insurgent payment processing platform such as Ethereum when incumbents such as Visa can process 150,000 transactions using the same amount of energy as Ethereum does to process one.

Is There Any Way Back?

Some of the brightest minds have been addressing the problems associated with crypto energy use. These supporters of the two largest coins see the carbon footprint of cryptos as a problem to be fixed and just part of each coin's natural development. Interestingly they've taken two radically different approaches.

Ethereum Moving to Proof-of-Stake

Ethereum's status as the big coin most suited for making transactions means nailing down low-energy protocols is essential to its progress. As a result, the platform has adopted an approach that, if all goes to plan, will fundamentally change how it operates.

Like bitcoin, Ethereum was set up using proof-of-work (PoW) protocols. This means the platform is managed by its users, who complete complex algorithmic equations which ensure the books and records of the platform are accurate. In return for ensuring that every user is aware of what they hold, the ‘miners' are rewarded with additional coins.

The upgrade proposed by Ethereum involves moving from PoW to proof-of-stake (PoS) protocols. In a PoS system, the accounting process is supported by users ‘staking’ their holdings. By locking in their positions for a period, those staking coins make the accounting process far easier to complete, and in return, they receive additional coins.

The latest forecasts from Ethereum.org predict that moving to PoS could result in a 99.5% reduction in energy use. The keen-eyed will see this as a win-win; users receive more coins, and the Ethereum energy bill plummets. The high-profile shift has even been given its own name, ‘The Merge’. But part of the reason ETH plunged in price in 2022 is that although the move looks great on paper, the most pertinent question for investors is why The Merge hasn’t happened yet.

When Will Ethereum’s Merge Happen?

In technical terms, the Merge represents the joining of the existing execution layer of Ethereum (the Mainnet used today) with a new PoS consensus layer called the Beacon Chain. That simple upgrade would eliminate the need for energy-intensive mining and instead secure the network using staked ETH coins. The ETH1 coins on the PoW system will merge with the ETH2 coins on the PoS system, and one single ETH coin will continue in operation for the foreseeable future.

The Merge is expected to help Ethereum operate more sustainably but also opens the door to further upgrades which will permit the platform to scale up its operations. The success Ethereum had with supporting the NFT market when it broke onto the scene in 2021 is just one example of how it’s the go-to blockchain platform for those developing new innovative concepts. No one can be sure what is around the corner, but ETH 2.0 looks set to be one of the most future-proof cryptocurrencies in operation.

It's important not to underestimate the amount of work The Merge represents to Ethereum's programmers. The project has been riddled with delays, but 2022 looks like the year it will finally happen. Announcements from Ethereum state that the speed of the rollout has been balanced against getting it right and ensuring client safety, but the proposed date of the Merge has been consistently put back to later in the year.

What Will Happen to the Price of ETH After The Merge?

Huge technical upgrades aren’t taken on lightly, but if Ethereum can successfully pull off The Merge, then the price of ETH can be expected to rise. Specialist exchange Coinpedia predicts the price of ether could shoot above $12,000 in 2022 if Ethereum's upcoming transition to Ethereum 2.0 is successful. Other analysts have offered more conservative forecasts. $4,000-$5,000 is a consensus figure reported by many analysts and is the price range quoted by Bloomberg intelligence analyst Mike McGlone. Either way, both of those price forecasts represent a significant improvement on the sub $1k price ETH was trading at in June 2022, just after announcements that The Merge had once more been delayed.

Ethereum Price Chart – 2020 – 2021 – The Merge

Source: IG

What could go wrong with the Merge? Well, quite a lot. To some extent, the series of delays is the least of the worries for holders of ether. In fact, they point to more pressing concerns about security. Ethereum suggests that the new protocols will be even more secure, but many aren’t convinced.

Jack Dorsey, the founder of Twitter, has tweeted that PoS protocols don’t offer as much security as PoW ones. Alyse Killeen, the founder of Bitcoin-focused venture firm Stillmark, went further when she said on Twitter, “Ethereum is in so much trouble…ensuring security is becoming harder and harder.” She also concludes that proof-of-stake is less secure than PoW and that Ethereum will be more vulnerable to attacks.

Another popular myth to debunk that might influence the price of ETH is the claim that The Merge will make transaction times faster. The ethereum.org site states, “Though some slight changes exist, transaction speed will mostly remain the same on layer 1.”

Bitcoin’s Approach To High Energy Use

Bitcoin has decided to stick with PoW protocols, which means most of the sustainability developments centre on the type of energy used by miners. A shift to green energy is currently best described as a ‘work in progress’. The industry is unregulated, and energy costs are a crucial determinant of whether miners make a profit. Campaign group Change The Code Not The Climate have released reports of the project heading in the wrong direction. Campaign director, Michael Brune, said:

“Coal plants which were dormant or slated to be closed are now being revived and solely dedicated to bitcoin mining. Gas plants, which in many cases were increasingly economically uncompetitive, are also now being dedicated to bitcoin mining. We are seeing this all across the country,”

Source: CTCNTC

Could Bitcoin Boost The Renewable Energy Sector

The renewable energy sector doesn’t need saving, but it faces challenges that bitcoin mining could help with. Taking a longer-term view of bitcoin’s approach allows more wriggle room for crypto fans and even offers a ‘wild card’ element to the debate.

One argument suggests that the problems associated with intermittent renewable energy supply will lead to bitcoin miners tapping into the wind, solar, and hydro sources at times when natural weather conditions result in those plants producing more electricity than a network needs. West Texas wind farms can at times generate 32GW of electricity but only transmit 12GW to load centres elsewhere in the state. As a result, eco-friendly bitcoin miners are flocking to the region.

Bitcoin miners who tap into the power supply at the right time can take advantage of super-low rates and use what is effectively surplus electricity. One spin-off from this is that investment in the renewable sector would be accelerated thanks to a new client base coming online. Crypto miners could be ideal customers of renewable energy companies as they would be willing to operate in line with the notoriously variable power supply levels.

Eco-concerns about mining extend to the IT hardware used. The competitive nature of the operation encourages miners to upgrade their systems, and many devices aren’t transferable to other tasks and are discarded. It’s calculated that Bitcoin mining produces as much as 30,700 tonnes of e-waste annually, comparable to the small IT equipment waste produced by countries such as the Netherlands.

Once more, a shift towards using renewable energy could help cut back on that problem. Older units can be commercially viable if fuelled by low-carbon energy sources like nuclear or hydro. In this instance, the opportunity cost of using older units is lower, so they can be used in conjunction with more up-to-date hardware.

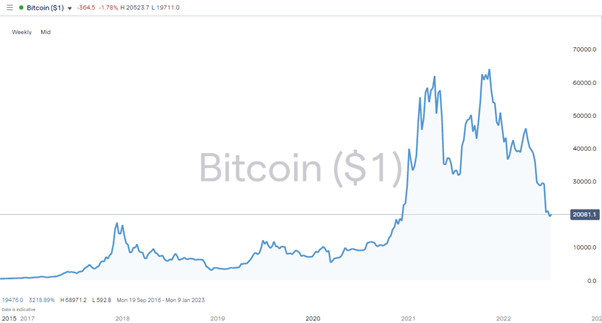

Bitcoin Price Chart – 2020 – 2021 – Going Green

Source: IG

How Will Energy Use Impact the Price of Bitcoin

Bitcoin’s position as the largest crypto by market cap comes down to its use as a store of wealth rather than a means of transaction. Visa, for example, can process a greater number of transactions per second, 1,700, compared to bitcoin’s four per second and use less energy in doing so. To many, that doesn’t matter because bitcoin investments are about keeping some exposure to bitcoin in case the crypto’s game-plan of becoming the world’s base currency does materialise.

Moving to renewable energy is also wholly feasible, and some miners also engage in carbon offsetting. It’s just a case of weeding out the more unscrupulous miners who might otherwise stick to using coal and oil-generated power to run their activities. 57% of the energy used for crypto mining currently comes from renewable sources, and miners will follow the market and always opt for the cheapest form of supply.

Sticking with PoW protocols gives bitcoin an edge over rival coins in terms of security but could still be a problem. Each mined coin requires many different competitors to take part in a race to see how quickly they can package the transactions and solve a small mathematical problem. There is only one winner, but the energy used by unsuccessful miners still counts against bitcoin’s carbon footprint. It’s also predicted that the puzzle-solving will be made harder over time, which means more miners using more energy.

Final Thoughts

Bitcoin and ether have taken dramatically different approaches to solving the problems associated with their energy use. While the new initiatives have been in progress for some time, it’s still unclear how they will pan out, and that uncertainty looks set to influence the price of BTC and ETH. But something has to give because, as things currently stand, Bitcoin's total annual power consumption is presently 145 TWh, approximately 0.32% of total global energy consumption.

If one of them manages to solve the riddle, then it will significantly improve its chances of one day becoming the default currency of the global financial system. If that happens, the price of that coin would be exponentially higher than it is today.

Buying any financial instrument is inherently risky and the energy use issue facing cryptos adds another variable to an already hard-to-call market. Whether you’re an experienced trader or a newcomer to the potential of crypto, one risk which can be managed relates to broker selection. Scammers operate in the markets, so choosing a firm from this shortlist of trusted crypto brokers will get you off to the best possible start.