Ethereum’s price depends on three things. Firstly, sentiment around crypto markets in general will play a major role in determining how things play out. Secondly, sentiment regarding the other similar utility tokens will play a role. Finally, there are several factors unique to Ethereum, including scalability, that will drive the price.

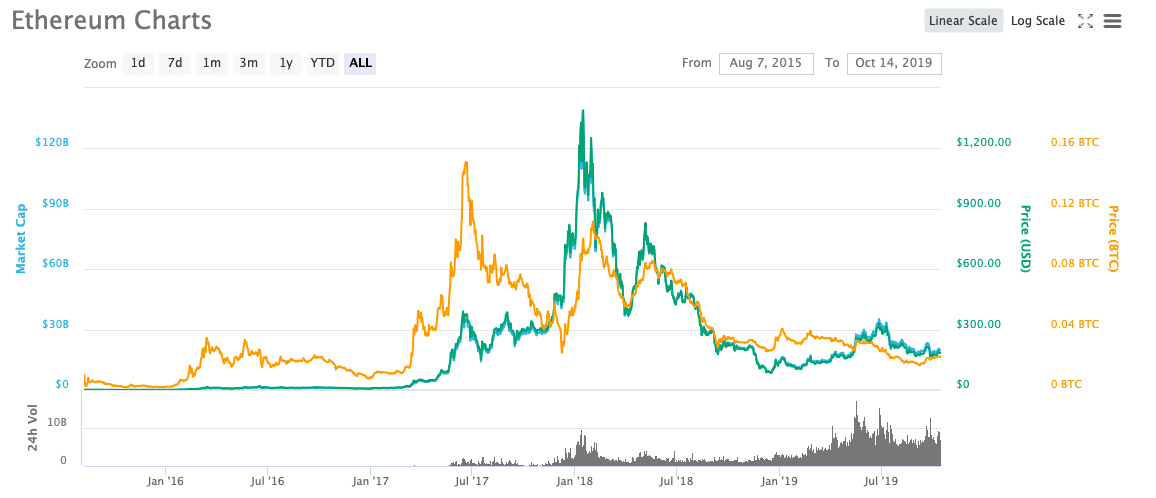

- After a strong run, Ethereum topped out at $1400 and then bottomed out at $185

- ETH is facing pressure from other utility coins

- Future will depend on crypto markets, other utility tokens and factors unique to Ethereum

- Scalability is a concern for ETH

Ethereum – Essence

Ethereum is a blockchain network designed to operate like a giant decentralised cloud computer. It is an enhancement of the Bitcoin blockchain which allows scripts known as smart contracts to automatically be executed when prescribed conditions are met.

The Ethereum network is designed so that decentralised autonomous organizations, or DAOs as they are knowns, can run on it. DAOs are like companies without shareholders or a centrally controlled management structure. The Ethereum network is fuelled by Ether, a cryptocurrency, which is used to pay miners and developers.

Ethereum allows DAOs to be built on its blockchain and then issue their own Ethereum compliant tokens to fuel their own economies. Each DAO solves a specific problem in a real-world industry.

The Ethereum network was started by Vitalik Buterin and other developers in 2014. Ether, or ETH, gained over 15,000 percent in 2017 when hundreds of DAOs were launched on the network.

At the beginning of 2018 ETH hit a high of $1,400, but then volatility and uncertainty about Ethereum’s scalability caused the price to fall to as low as $377. Numerous other similar blockchains have been launched, some of which could overtake Ethereum in the future. However, ETH remains the second most valuable cryptocurrency after Bitcoin. Then, in the beginning of 2019, ETH dropped and now is trading for only around $200 on international exchanges.

Utility tokens

Utility tokens are cryptocurrencies that allow holders to buy services on a decentralised platform. Ethereum’s native token, ETH, is just such a utility token and allows users to pay miners to execute smart contracts and run the network.

Because utility tokens can be used to buy services they have value. If the number of tokens being used on a network remains fixed, or increases only gradually, while the number and value of the transactions on the network increases, the tokens must increase in value to accommodate the growing token economy.

This is the premise on which the value of utility tokens like ETH is based. If we ask will Ethereum go up, we need to look at the potential for the token economy to grow. To create Ethereum price predictions from 2018-2020 we need to look at what will happen to ETH’s token economy during that period.

There are already hundreds of platforms operating on the Ethereum network. If more are built, or if the existing platforms get busier, then the token economy will grow and the value of Ethereum will increase. The risk is that the price already reflects too much potential growth. The other problem is that Ethereum might not be able to handle more transactions.

In 2017 and 2018 investors also ploughed a lot of capital into several projects that are competing with Ethereum to offer very similar services. The most prominent of these are EOS, Stellar, IOTA and NEO.

EOS is the newest of these projects, but as of June 2018 was already the fifth biggest cryptocurrency. By that time, it was so new it hadn’t even launched its own network, and was operating with an Ethereum compliant ERC-20 token.

However, EOS managed to raise $4 billion dollars to fund development. The team behind EOS believe their technology is superior to Ethereum’s. They also plan to develop their token economy by using the capital they raised to fund start-up projects which will operate on their blockchain. EOS are also trying to make their technology more accessible to programmers without blockchain experience.

Stellar is another smart contract platform, but is being designed for the financial industry. In many ways it is more of a competitor of Ripple than of ETH.

NEO is a controversial platform being developed in China. While many people doubt their technology is as good as Ethereum’s, they have managed to build a fanatical base of supporters and have formed several strong partnerships.

IOTA is a little different. It’s a project aiming to be the backbone of the internet of things or the economy of connected devices. It’s similar to ETH, but designed solely for platforms that connect devices.

Ethereum Price Predictions

2019:

In 2019, it is highly likely that Ethereum can see a major boost in its price especially at the end of the year. The reason for that may be the mass adoption of Ethereum, strong capitalization and value per coin increase.

2020:

2020 is expected to be a good year for Ethereum. dApps will see even greater adoption in the beginning of the year. The first quarter will see Ether’s price as high as $2,000 in the best case scenario. But that opinion is according to experts. Given the fact that the current price is $185, there can be no huge change in the price, though the value of Ethereum is rising up.

2022:

According to analysts, 2021 and 2022 will be excellent years for Ethereum, since the network and coin may be through more partnerships and integrations in the coming years. The value is estimated to go up and can reach as high as $2,500.

The cryptocurrency market in 2019 – 2022

Cryptocurrencies are highly correlated and Ethereum’s price may be driven more by what happens in the rest of the market than by specific news about ETH. 2017 was the year the world really learnt about cryptocurrencies and there were the first signs of them going mainstream. This caused massive price moves as millions of people poured billions of dollars into the market.

In 2018, the cryptocurrency market stabilized, but still, a huge amount of market cap was blown out after the “crypto winter” of 2017.

Most of these investors were retail investors. Retail investors tend to buy when prices are rising, and they tend not to be price sensitive. That means that if the market is trending lower they won’t buy and will be net sellers. However, if prices begin to rise again, retail investors that missed out in the 2017 rally will probably begin buying and may cause another big rally. This rally may take the market back to the previous highs, but not higher than that.

The investors that really count are institutional investors that control massive funds. While these investors have more buying power, they are also far more cautious and need good reasons to buy. While some institutional funds have already started buying, most are watching and waiting. The real buying from these investors will happen when they see signs of mainstream adoption – but that probably won’t happen before 2020.

Price scenarios

We can now lay out a few price scenarios for Ethereum by putting all the above factors together. This is more constructive than making definitive predictions. The best-case scenario would see the crypto market regain its highest levels, or better, with utility coins outperforming the broader market, and ETH continuing to dominate the space.

If that were to happen, ETH would undoubtedly reach the previous high of $1,400 and as we mentioned even $2,000 by 2022. If Bitcoin reaches $19,000 again, and Ethereum trades above 0.15 times the BTC price, we will be looking at $2,850 and above.

The worst-case scenario would see the crypto market remaining in a downtrend, with ETH underperforming the utility token sector. If ETH trades back to 0.02 time the BTC price, and BTC trades down to support at $3,000, ETH would be around $60.

Obviously, both scenarios are the extremes and we will be more likely to ETH somewhere in between. There is strong support at $200, and only really negative sentiment would see it below that. Resistance at $800 will probably contain the price until the fundamentals begin to prove that it is worth more. So, in the absence of new developments in the industry, we can probably expect ETH to trade in a range between $200 and $800.

Conclusion

When looking to predict Ethereum’s price for 2019 to 2022, it’s good to remember that the entire cryptocurrency market is quite volatile and accurate predictions are not possible. Instead, we tried to give some possible price variations on Ether, as well as the major developments going on for Ethereum.

Another factor is the competition amongst utility tokens including ETH, Stellar, EOS and NEO. Ethereum has dominated until now, but these other networks are trying very hard to displace ETH.

Finally, we need to consider the token economy for ETH. ICOs hold big positions in ETH which the need to sell to cover expenses. If this selling is not offset by new sources of demand, the price will slide.

ETH will probably trade in the $200 to $800 range until 2020 unless we see new developments on the network, or a major rally in the crypto market. Going forward, 2021-2022 may see a huge increase in price (up to $2,500), if dApps continue to gain mass adoption and investors see more value in Ethereum than currently.

PEOPLE WHO READ THIS ALSO VIEWED: