Bitcoin is still the largest crypto by market capitalisation, but other cryptocurrencies, known as altcoins, are jostling to challenge BTC for the top spot. As they’re coming from the back of the pack, this means that altcoins can be associated with extreme price moves when investors pile into them in the hope that their chosen one will become the dominant crypto.

There are very plausible reasons to believe that one of the many altcoins could claim that prize. Bitcoin is the best-known crypto, but is plagued with certain legacy issues, not least its processes resulting in a high carbon footprint. The trick is identifying which one of the altcoins is the best option, and this requires looking at their relative strengths.

This article will consider how the valuations of the different coins are formed, how to buy them, and which ones are currently being tipped for future success.

Table of contents

What Are Altcoins?

‘Altcoins’ are a group of cryptocurrencies that were created after Bitcoin. Specifically, an altcoin is a cryptocurrency that is not Bitcoin. There are more than 21,000 altcoins, each one with its unique features, each with a chance to be the number one coin in the future.

The underlying blockchain technology used by altcoins is largely similar to that used by Bitcoin. However, given that Bitcoin was first introduced in 2009, altcoins can tap into technological advances that have occurred since then, the aim being to include innovative features that can make them a superior product.

Upgrades associated with altcoins can be in terms of functionality, usability, transaction costs and speed, or energy use. Others looks to explore new markets such as NFTs that didn’t exist when Bitcoin was first created.

The main benchmarks to measure any crypto against are the same as with any fiat currency – the ability to be an effective means of exchange and store of value. Bitcoin’s main strengths in this area are that its fans see it as an effective store of value and that it has first-mover advantage.

Altcoins, by comparison, come packed full of new ways of doing things. This means that they have the potential to gain market share by being more user-friendly.

What Are the Top 10 Altcoins?

An important note here is that the top altcoins by size and market capitalisation might not necessarily be the best picks if you’re looking to buy them. In the same way that Bitcoin is fending off competition from its rivals, so are more established altcoins. It’s a fast-moving and competitive environment.

Top 10 altcoins by market capitalisation:

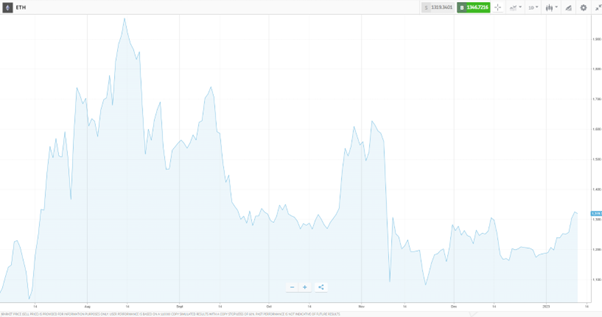

- Ethereum (ETH) $163.4bn

- Tether (USDT) $66.2bn

- BNB (BNB) $44.5bn

- USD Coin (USDC) $43.7bn

- Ripple (XRP) $18.4bn

- Binance USD (BUSD) $16.4bn

- Cardano (ADA) $10.9bn

- Dogecoin (DOGE) $10.2bn

- Polygon (MATIC) $7.5bn

- Solana (SOL) $5.9bn

Bitcoin (BTC) $335.9bn

There is still potential for the more established altcoins to continue growing. Bitcoin has a market capitalisation of $335bn, which dwarfs the size of the rest of the leading altcoins, even when they are combined. Bitcoin is still twice the size of the second-biggest crypto, Ethereum, but while Bitcoin’s use as a store of value is well-known, it doesn’t have functionality features to match some of the other coins.

The Problem With Bitcoin

Transactions using Bitcoin are typically quoted as taking up to 10 minutes to clear but can take more than one hour. This is a considerable handicap to any ‘currency’ looking to become a means of exchange. It leaves room for altcoins to focus on working around legacy IT issues to create processing protocols that make themselves more usable.

The altcoin Solana, for example, is set up differently from Bitcoin. SOL has in total more than 1,900 validators, and a smaller cluster of around 150 validators process as many as 50,000 to 65,000 transactions per second. This enables them to process transactions nearly instantly and makes it the crypto with the fastest transaction times in the world.

If you’re looking to buy a coffee on the way to work, Solana would be able to support that transaction, whereas using Bitcoin would result in a very different outcome.

The way that the Bitcoin blockchain network is set up also results in its operations requiring an extraordinary amount of energy. It’s calculated that Bitcoin accounts for approximately 0.55% of total global electricity consumption. This equates to the amount of the energy consumption of Argentina, Malaysia or Sweden.

The high energy use comes down to the fact that Bitcoin’s blockchain is set up to use proof-of-work (PoW) protocols. Other altcoins have been set up to operate more efficiently, and Ethereum in 2022 underwent a process called the Merge, which moved its processing from PoW to proof-of-stake (PoS).

After the Merge, Ethereum was immediately consuming 99.9% less energy. Other altcoins such as Powerledger (POWR), Cardano (ADA), Stellar (XLM) and Nano (NANO) can lay claim to being even more energy efficient. The altcoin SolarCoin (SLR) actually incentivises the use of renewable energy by issuing one SOL coin to users who can verify that they have generated one megawatt hour of solar power.

How to Buy Altcoins

When they first came to the market, buying altcoins required setting up specialist wallets and registering with a dedicated crypto exchange. That route is still possible, but it looks first generation compared to the super-friendly functionality of online broking sites.

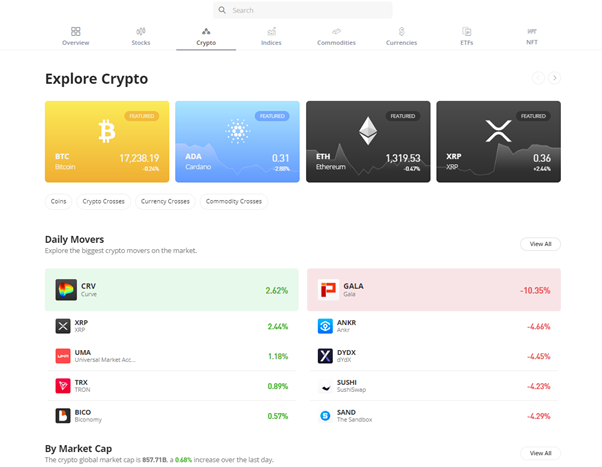

As demand for cryptos has gone more mainstream, additional brokers have entered the space to provide the opportunity to buy altcoins. This has resulted in healthy competition driving down the costs of trading and encouraging brokers to offer more markets.

Once you’ve completed the registration process and wired in funds to your broker account, you’ll be ready to enter into the altcoin market. The sites are packed full of trading tools to support beginners and advanced traders. There are also customer service teams on hand to help with queries.

Trading altcoins is as easy as clicking a button or tapping a screen. It can be done in desktop format or on the go using handheld mobile devices.

Where to Buy Altcoins

Crypto trading falls out of the scope of financial regulators. However, there are steps that investors can take to minimise the risk of their broker not being legit. It is worth seeking out brokers that offer trading in altcoins as well as other financial instruments such as equities, bonds and forex.

Trading in stocks is regulated, so a broker that also offers stocks will be set up to comply with the rules and regulations associated with that market. Trading in cryptos will still be a case of ‘buyer beware’, but some of the good practices that the firm has adopted for other markets make it more credible.

Broker comparison sites are an excellent way to narrow down the field. This piece of research has done some of the hard work for you and has shortlisted the names of some good crypto brokers.

One good tip when considering where and how to buy altcoins is to take advantage of the free demo accounts that the better brokers offer. These are a risk-free way to get a better understanding of how each altcoin market trades and if a particular broker is a good fit for you.

What Determines the Value of an Altcoin?

This could be the million-dollar question. It could also be the ‘zero-dollar’ question. Valuing altcoins involves a binary equation. If the one you choose succeeds and becomes the world’s base currency, then its value will be far greater than it is today.

To succeed, altcoins will need to meet the same criteria as all fiat currencies – they will need to be:

- Reliable and trusted.

- An effective means of exchange.

- A store of value.

Bitcoin currently has a strong market position in terms of the ‘store of value’ criteria. As a result, if you’re looking to buy altcoins, then you might want to look at one that seems likely to be strong on the other two points.

Some of the studies of altcoins involve breaking down the infrastructures and protocols they use. As outlined in the analysis of PoW and PoS protocols, there are different ways to set up a blockchain. It should also be mentioned that Bitcoin’s reluctance to switch to PoS is to some extent influenced by PoW protocols currently being considered more secure.

Innovation in terms of processing techniques results in altcoins having additional advantages over Bitcoin. Ethereum, for example, allows users to build and deploy smart contracts and decentralized applications (dApps), which can be used to support new markets such as NFTs.

There are plenty of free-to-access research sites that break down the tech jargon into a format that allows you to get a better idea of each crypto’s pros and cons. Key terms to familiarise yourself with include:

- Proof of Work – PoW is the protocol used by Bitcoin (BTC).

- Proof of Stake – PoS is another protocol. It was developed to meet some of the issues faced by PoW.

- Smart Contracts – A key feature of the altcoin Ethereum. These act as a lubricant to the blockchain processes. Smart contracts run with little interference from third parties. They store data relating to holdings while also enabling the easier movement of funds.

- Symbiont Distributed Ledger – This can process 80,000 transactions per second, which is a step in the right direction for any crypto looking to be widely used. It is targeted at institutions that need to allow complex financial instruments.

- Stablecoins – These are tied to existing currencies such as USD. As a result, they are less volatile than other altcoins and Bitcoin.

Which Altcoin Should I Buy?

Analysis needs to factor in more than high-brow notes relating to mathematics and computer systems. It also needs to factor in real-world challenges. Altcoins and Bitcoin are part of a movement that has a stated aim to revolutionise the global financial system. This means that they are up against a lot of vested interests.

Central banks, investment banks and high street banks face a dilemma because blockchain technology is an innovative and cost-saving tool. Many banks are already a long way from adopting its use, and accepting cryptocurrencies as a bona fide currency does expose them to a disruptor, which could work against their interests.

Many who buy altcoins are trading a change in the chances of that crypto being successful. The markets are such that good news can lead to a significant price spike. It’s not necessarily the case that you have to hold that coin for the length of time for it to be finally successful, or not.

Altcoin trading is as popular with speculators as much as investors. For them, it’s about finding the altcoin that is mispriced, rather than the one that will beat the other 1,000 contenders to first prize.

The number of altcoins on offer is staggering, and some have grown to be a considerable size and real contenders for the top position in the sector. Other lesser-known coins are currently trading at prices so low that they offer investors the chance to make life-changing sums of money.

Some investors focus their attention on unearthing one coin and dedicating their time and resources to establishing its prospects. An alternative approach is to diversify your capital by buying a fund-style product that contains a basket of altcoins.

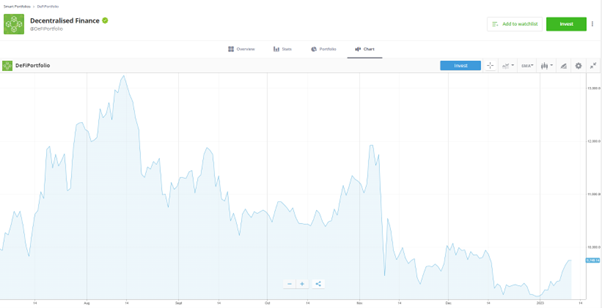

The DeFiPortfolio at eToro, for example, aggregates selected altcoins and crypto assets that have exposure to the DeFi market. This is one of the most promising and disruptive applications of the new technologies associated with the crypto sector.

Final Thoughts

The crypto sector is continuously growing and changing, sometimes at an incredible pace. This leaves room for insurgent altcoins to break through and post impressive returns for their investors.

Altcoin investing is known for having a high risk-return profile.

One risk that can be managed relates to the security of your broker. While crypto trading is unregulated, some brokers offer a more secure way of accessing the market. This list of good crypto brokers includes the names of firms that have been reviewed by AskTraders analysts to ensure that they offer the best route into the market.