Given the way cryptocurrencies have shaken up the financial markets, it’s worth remembering the first digital coin, Bitcoin, was created as recently as 2009. The intervening years have been marked by the coins becoming more mainstream, but questions remain about how the sector will cope with the challenges posed by a deep and sustained economic recession.

As cryptos have largely flourished during boom years, no one can, with any certainty, predict what will happen to cryptocurrencies in a recession. Recessions are an inevitable part of the natural market cycle, which means we will, at some point, find out. Some cryptos can be expected to find a recession challenging, but investors in the below coins have good reason to believe an economic downturn could result in positive returns, but is there such a thing as recession proof cryptocurrencies?

Read on as we explore which cryptocurrencies could hold up well and are likely to be worthy of your attention in times of recession.

Are Cryptocurrencies Recession Proof?

The entire cryptocurrency asset class, which is valued at hundreds of billions of dollars – and is still to some extent untested in such a scenario – will ultimately enter a prolonged recession for the first time. No one can be sure what an economic slowdown means for the prospects and prices of cryptos, but some potential price drivers are outlined below.

At a higher level, there is the question of whether cryptos can be viewed as ‘digital gold’. For generations, that precious metal has been seen as a safe-haven asset due to its ability to hold its value – despite the ups and downs of the global economy. Fans of cryptos, especially Bitcoin, point to them also being potentially effective stores of value that could become even more popular during a recession when other assets, such as stocks, appear less attractive.

One additional factor that makes the current situation harder to call is that recessionary pressures can be accompanied by inflationary ones. Policymakers are left balancing the need to support the economy by increasing spending, lowering interest rates and taming price rises.

Through 2022, central banks focussed on dealing with the problem of high inflation and hikes in interest rates. The US Federal Reserve increased US base rates by 0.75% at consecutive meetings and that led to dramatic changes in demand for cryptos. As bank savings rates increased, there was an increased chance that some crypto investors might switch to cash, and with borrowing more expensive, there was less likelihood of crypto speculators taking out loans to buy coins. Both of which represent a contraction in demand for virtual coins.

An alternative view is that a period of stagflation could damage confidence in fiat currency and generate a renewed move towards cryptocurrencies. The paradox of cryptos is that while they are unregulated, one of the core principles of the blockchain ecosystem is that the real value of coins can’t be manipulated by any one party. That democratisation that was inspired by the financial crisis of 2008 may look even more attractive if the desperate actions of policymakers result in investors losing confidence in traditional financial agencies such as governments and central banks.

Exploring the details and the different protocols used by the different coins points to some cryptos being winners and others being losers during a period where the global economy goes through a recession.

Which Cryptos to Invest in During a Recession

Identifying a recession is one thing but navigating one and preserving your wealth or spotting new opportunities is another.

With the above in mind, which cryptocurrencies could appeal and provide trading opportunities during a recession? Below is our list of potentially recession-proof cryptocurrencies – each one with its own compelling reasons for you to invest in them.

- Basic Attention Token (BAT)

- Binance Coin (BNB)

- ChainLink (LINK)

- Ethereum (ETH)

- Bitcoin (BTC)

- Dogecoin (DOGE)

- Polkadot (DOT)

Basic Attention Token (BAT)

Some cryptos attract investors by offering ways to store wealth or use blockchain functionality to carry out online transactions. The unique selling point of Basic Attention Token is different, and the approach of the BAT system could be just what is needed during a recession.

BAT’s appeal is the way its privacy-based browser Brave offers its users greater browser security as they surf online. Thanks to the way users engage with the blockchain, Basic Attention Token is able to and does share its ad revenue with members.

This new approach benefits advertisers, who can reach their target market rather than rely on a scatter-gun approach. The end users also improve their online experience because they are protected by ad-blockers, which means the adverts presented to them are more tailored to their tastes. The nice-to-have aspect is that users that view adverts are rewarded with BAT tokens at the end of the month.

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

The way search engine operators and big corporations interact with people online is becoming an increasingly contentious issue. The neat approach of Basic Attention Token is to turn the relationship into one that is mutually beneficial. That win-win arrangement and appealing business model looks set to help BAT potentially navigate a recession – few would predict that an economic downturn is likely to result in people deciding to browse the internet less often.

Binance Coin (BNB)

BNB, the native coin of the Binance platform, offers an alternative way to answer the question of whether or not there are any recession proof cryptocurrencies. BNB can be considered one of the most mainstream cryptos, thanks to it being approved by the New York State Department of Financial Service. This approval is issued in partnership with the well-regarded firm Paxos Trust Co. LLC. Those looking to stablecoins to invest in during a recession, could opt for Binance.

The coin’s value is also pegged to the US dollar. This could offer additional security and potential for capital gains thanks to demand for the dollar historically increasing during times when markets are stressed.

Binance Coin also benefits from its position as the coin used on the Binance Exchange, which is one of the largest in the world. Transactions on that popular platform have to be made using Binance Coin. This means that as trade volumes in other coins pick up, so does the demand for and the price of Binance Coin.

The proposition that crypto trading volumes might increase during a recession is based on the premise that crypto investors will re-evaluate the prospects of the coins they hold in their portfolios when an economic downturn hits. Even the big coins such as Ethereum and Bitcoin could be involved in a major rotation from one coin to another – transactions carried out on the Binance platform will all be conducted using BNB.

Binance (BNB) – Price Chart 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

It’s also likely that recessionary fears may lead to crypto traders deciding to minimise counterparty risk and concentrate their trading activity at established platforms such as Binance. It’s a well-regarded global operator that offers markets in a diverse range of cryptocurrencies. The fees and commissions charged by Binance are also some of the lowest in the market. The platform’s position as a cost-effective way to trade crypto increases the chances of Binance being the exchange that crypto traders head to when money gets tight.

ChainLink (LINK)

The innovative functionality of ChainLink could make it a useful platform for companies who are forced by a recession to reconsider the way they carry out their business. As cost-cutting exercises come into action, they could act as a catalyst for upgrades to more modern business practises, drawing on the potential offered by ChainLink.

ChainLink is a decentralised data oracle service, which has been gaining a lot of traction in the DeFi (Decentralized Finance) space since 2020. Even prior to recessionary fears sweeping through the financial markets in 2022, users were already heading to ChainLink because of the way it helps different crypto blockchains interact with the outside world.

The real-world uses of ChainLink include bolting on data feeds such as weather forecasts and asset prices to blockchains. The information is still decentralised, which makes it reliable and trustworthy, and firms will be able to consider ChainLink protocols as a way of potentially updating and rationalising their everyday practices – making this a crypto that could be positions to benefit from recession-based cost-cutting measures.

ChainLink (LINK) – Price Chart 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Increased use of ChainLink can be expected as the DeFi revolution gains momentum. Fortunately, the ChainLink blockchain is also easily scalable, meaning there are no limits on the value that ChainLink could provide to its users in the future.

Ethereum (ETH)

Ethereum has, for some time, held the position of the second-largest cryptocurrency in the market and could offer further potential during a recession as a result of its recent system upgrade. As of September 2022, the market capitalisation of Bitcoin was $382bn, Ethereum’s was $201bn and the third largest coin, Tether, was some way back down the list with a market cap of $67bn.

During a recession, size matters as critical mass and an existing fan base can help coins hold their value. Brand recognition is important too and Ethereum is well-known for being the big coin that has taken the best parts of Bitcoin, but also set out to add additional features to improve user functionality.

Further potentially good news for Ethereum investors is that the ETH blockchain has recently undergone a major overhaul. The Merge is a long-awaited upgrade from Proof-of-Work (PoW) to Proof-of-Stake (PoS) protocols, which was rolled out in Q3 of 2022. In the early part of 2022, the price of ETH held up well in comparison to its peers thanks to the prospects of ETH ultimately becoming more efficient and offering improved transaction processing times.

Ethereum – Daily Price Chart – 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

The Merge will radically change the amount of energy ethereum uses. It also helps the platform develop its potential for crypto staking. Staking is a process that can allow investors of Ethereum to tie up their holdings for a period of time, receiving a return similar to the interest paid on cash accounts, or dividends on stocks. Not all cryptos allow staking, so Ethereum could gain ground on its rivals if interest rates continue to rise and increase, boosting its chances of becoming a recession proof cryptocurrency.

Bitcoin (BTC)

The price of Bitcoin has for some time been tied to themes such as regulation, energy consumption, government crackdowns on mining and changes in the appetite mainstream financial giants have for the coin.

While those factors remain hard to unravel, the coin does have the advantage of being the original blockchain. This has resulted in a very loyal fan base of investors who are drawn to the coin’s strong anti-establishment ethos. As such, it could be regarded as the cryptocurrency with a strong store of value during a recession.

The counter-culture elements of Bitcoin means a lot of investors in the coin are taking the long view and they are potentially less likely to be alarmed by short-term ups and downs in the global economy.

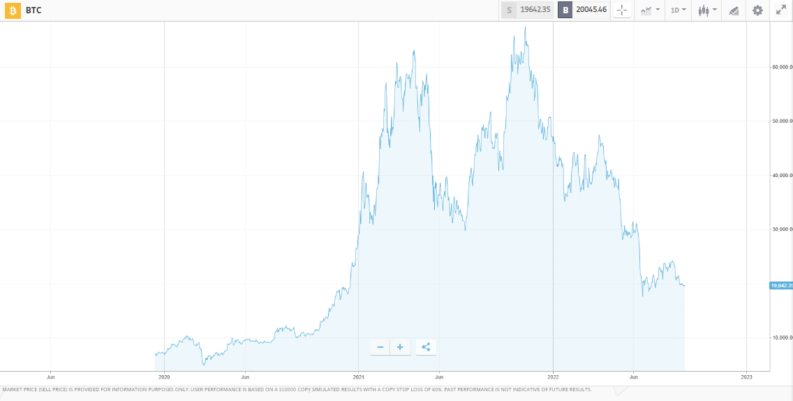

Bitcoin – Daily Price Chart – 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Although rival altcoins have developed functionality that makes them more useful in terms of processing transactions, Bitcoin is still seen as the crypto that sets out to be the most effective store of wealth. As mentioned, some analysts have also suggested Bitcoin can be seen as a reserve asset, much in the same way as gold, which has a historical track record of holding its value during an economic downturn, giving Bitcoin an opportunity to potentially call itself a recession proof cryptocurrency.

Dogecoin (DOGE)

Dogecoin is an interesting proposition as the global economy approaches a recession. It’s one of a group of ‘lotto-style’ coins, which do well when investors have enough spare cash to invest in altcoins as a hedge against them taking off and recording phenomenal price rises.

During the peak of the Dogecoin craze of 2021, the coin rose in value by 8,127% in little more than a year. Since then, the price has plummeted, but it is possible to argue DOGE is undervalued given that all recessions ultimately come to an end.

Dogecoin does have a secure place in the popular psyche and is still offered by most brokers – it’s not going anywhere, and the next price surge could be around the corner. The catalysts for the coin’s price surges are mercurial – one tweet from Elon Musk on the topic of his favourite cryptos can be all it needs for investors to make gains.

Dogecoin – Daily Price Chart – 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Dogecoin, in many ways, appears to be one of the coins that, at face value, is least likely to benefit from a recession. However, contrarian investors might see that as a buy signal.

The price of Doge has fallen by more than 90% since its price peaked at $0.5697 in May 2021. That opens the door to investors who see the bad news already being priced in. It’s a high-risk strategy, which would only merit a small amount of capital. However, as Doge has already demonstrated, the turnaround can come earlier than forecast. As such, it can be regarded as a cryptocurrency with the potential to bounce back from a recession.

Polkadot (DOT)

Polkadot’s cutting-edge processing methodology and range of additional nice-to-have features mean that it could be well positioned to ride out any shockwaves associated with a recession. The blockchain protocols, which are set up as parallel chains, mean the platform could be able to keep the crypto ecosystem operating effectively and efficiently. These are two aspects that will be required regardless of the state of the wider economy.

Polkadot’s role as the crypto that helps different blockchains communicate with each other gets past the problem of blockchains being inherently inward-looking. This has resulted in it taking a central role in the crypto sector. During a recession, even if transaction volumes drop off in one coin, Polkadot could expect to pick up new business from coins that prosper in the economic shake-up, adding to it recession proof cryptocurrency potential.

Another potential plus point for Polkadot is that it is one of the most energy-efficient coins. Concerns about the environmental footprint of cryptos are increasingly important for investors. There is also the cost of energy to consider. As energy prices have sky-rocketed during 2022, it has not only been environmentalists looking for a crypto that operates more efficiently.

Polkadot – Daily Price Chart – 2020 – 2022

Source: eToro

*Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

The third attractive feature of Polkadot is that it is firmly on board with the idea of offering investors a generous staking yield on their positions – the annual return on the coin is currently in the region of 10%. That means investors could expect a passive income return regardless of what is happening in the wider economy.

A recession might not necessarily be good news for Polkadot, but nor should it be an existential threat. An energy-efficient crypto that offers super-fast processing times, connects blockchains so they can reach their own potential and allows staking would appear to be in a position to gain market share from struggling rivals. Indeed, this could be regarded as a suitable all-round cryptocurrency in a recession.

Final Thoughts

Cryptos came about as a reaction to the widespread failure of the conventional financial system during the 2008 economic crisis. The fact that cryptocurrencies are not tied to any one government body still appeals to many. This attribute alone could help the coins take on the headwinds of a global recession where the markets lose confidence in the policies of establishment world leaders.

There’s a lot at stake – a recession-led shake-up of the crypto pecking order could result in one coin making a significant move towards being the dominant player in the sector. If that happens, then the promise of cryptocurrencies becoming the global currency of the future could move one step closer.

A recession could make or break certain cryptos, especially if there truly is evidence of recession proof cryptocurrencies in the market but it could also be bad news for the firms that operate in the financial industry. Some start-up crypto platforms could come under pressure as credit lines are cut – crypto traders take on enough risk-reward in terms of price volatility without also having to worry about the security of their platform.

Navigate to our list of trusted crypto brokers, which includes firms that have been reviewed by the AskTraders team to ensure they offer clients a safe way to enter the market. They have also been checked to ensure they offer competitive T&Cs and all the features that crypto traders need to tilt the odds in their favour, whatever the state of the global economy.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.