Both cryptocurrencies have seen significant price fluctuations over the past 12 months. They both have their own unique value propositions which have enticed investors and have increased their popularity. This article will look at the “Ripple vs Ethereum” argument to see if the two can be compared and to what extent. In order to do this, the article will look into the following sections:

- Ripple vs Ethereum – advantages of each coin

- Ripple vs Ethereum – disadvantages of each coin

- Essence: Second and third largest cryptocurrencies

- Future Outlook

Essence and History of Ripple

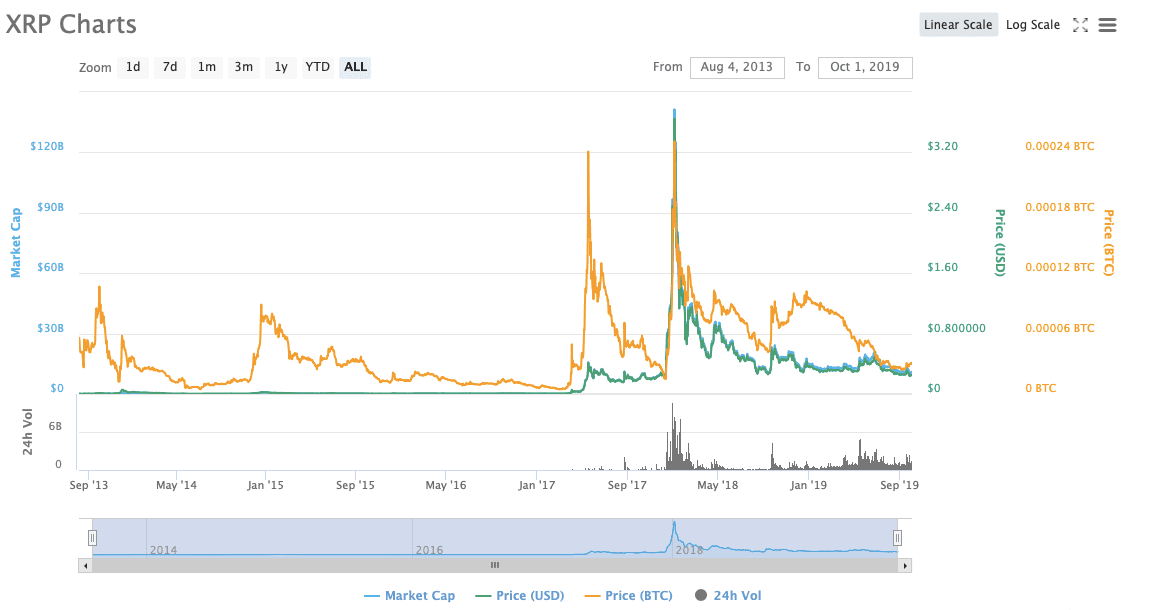

Ripple is currently the third largest cryptocurrency by market cap ($10.1bn, according to Coinmarketcap).

Ripple can actually refer to a number of things. First, many confuse Ripple (the company) with Ripple (XRP, the cryptocurrency). These are two different creations.

Ripple is a real-time gross settlement system or RTGS, a remittance network and also a currency exchange system. All are created by the company Ripple. Ripple may be one of the earliest payment protocols to have existed. According to sources, its history dates back to 2004, with Rippleplay, which was developed by a web developer in British Columbia. Four years before Bitcoin, the first version of Ripple was thought of as an alternative way for people to create and exchange their money. In 2005, the very first “draft” of Ripple was released, the famous RipplePay.com, which allowed people around the world to have secure payment and trades.

Later on, Arthur Britto and David Schwartz began developing a new digital currency where all transactions were made valid once all members in the network agreed on it. As opposed to bitcoin, Ripple “valued” the consensus among members in its own network instead of relying on ledgers.

With this in mind, the new payment system was designed on improving bitcoin as a currency. In such sense, Ripple aimed to reduce electricity used for mining and transactions, provide better and faster experience for users. Right afterwards, the founder of Ripple, Ryan Fugger, was approached by Chris Larsen, the current CEO of Ripple, the company, together with McCaleb. The team convinced Fugger of the new idea of cryptocurrency and Fugger stepped out. Once on the “throne”, Fugger and McCaleb created OpenCoin Corporation.

Ripple in 2012-2013 (OpenCoin and Ripple Labs)

The OpenCoin Corporation began developing Ripple as a totally new payment protocol, one that could realize a fast and direct money transfer between any two parties around the world. The special feature of the protocol was that it could work with many currencies, such as gold, Indian rupees, US dollars, euros and even airline miles, according to Wikipedia. Also, there were almost no fees and the tranasactions happened very quickly. It was about that time when Ripple, the cryptocurrency, was created. Again, the idea of the new digital asset was to enable banks and different financial institutions to transact in a quicker and cheaper manner, without sacrificing security.

OpenCoin saw huge success in its development, especially when the venture capital companies that supported it were Google Ventures and Andreessen Horowitz. In 2013, Ripple linked with bitcoin, and the Bitcoin Bridge was born. What this innovation helped Ripple do is that all Ripple users were able to pay in any type of currency to a bitcoin address. So, essentially, Ripple allowed a bridge for any type of currency to be exchanged for bitcoin. Chris Larsen is the current CEO of Ripple Labs Corporation.

Financial Institutions Breakthrough

While Ripple may be a cryptocurrency and its huge market capitalization shows interest from investors, it is really the banking industry that is benefitting from Ripple as a technology. As early as 2013, banks turned to Ripple in order to widen their services portfolio for customers and offer “alternative remittance options”. Ripple really put the global perspective on payments, especially those that were previously too expensive or too “far” for a proof of stake or proof of work protocol as the Ripple network uses a consensus protocol.

Advantages of Ripple

- Ripple has received a lot of traction for its cross-currency payment system. The company has already signed partnerships with more than 100 banks and financial institutions across the world, including banking giants such as BBVA and Standard Chartered Bank

- Ripple is essentially making the entire payment process more efficient, quick and transparent that what was currently available, especially for cross-border transactions. XRP acts as a liquidity tool

- The network of blockchain allows parties to feel more confident about the security of the transaction and execution is faster – payments are processed within second on the XRP network. The ability of Ripple to handle large transactions in minimum time makes it an ideal choice for large institutions as well, such as banks

- Mostly, the Ripple network is tailored towards large companies, governments and banks as opposed to the everyday consumer. There is a massive amount of potential for Ripple going forward into the future, as they bridge the gap between the digital currency world with that of the traditional financial world. They have also been making profits for the few years, which is not so common among cryptocurrency / fintech companies.

Disadvantages of Ripple

- Ripple is aimed to be used by large institutions and those who are dealing with large sums of money on a regular basis

- There are more efficient options for everyday consumers who are dealing with much smaller sums and transactions. Ripple is inherently private and not very decentralised as about 70% of the tokens are currently owned by the Ripple Labs team

- This centralization means that they have a significant control over the future of the platform, XRP and everything related to the Ripple network

- There are concerns that at some time, a significant amount of these tokens in the possession of the team will be sold off to crystallise profits and the market will be dumped with large amounts of XRP, which would lead to a significant oversupply and most investments will be wiped out

- Currently, there are almost 100bn XRP tokens in existence, with about 55bn of these are in an escrow account

Essence and History of Ethereum

Ethereum is the second largest cryptocurrency by market capitalization after Bitcoin as of today. Just like Bitcoin, Ethereum is an open-source computing platform that is also based on blockchain and is also public. However, the operating system of Ethereum is based on the so-called smart contracts.

The founder of Ethereum is Vitalik Buterin. The Russian-Canadian software programmer, who dropped out of the University of Waterloo and became part of the prestigious Thiel Fellowship Foundation, which granted him $100,000 to develop an innovative idea.

Buterin co-founded Bitcoin Magazine in 2013. After winning the grant from the Thiel Foundation, he went on to fully develop Ethereum and the new technology based on smart contracts.

The one thing Buterin has always argued was that Bitcoin, while truly revolutionary in design and structure, needed a scripting feature. The scripting features or rather languages allow specific programs and applications to be built on the operating system so that there are multiple uses and developments along the way. According to sources, after Butelik came up with how different Ethereum will be, his team went on to work on the project. According to Wikipedia and official sources, the actual work on Ethereum began in the beginning of 2014 through a company based in Switzerland, Ethereum Switzerland GmbH or as it is often referred to EthSwiss. Later on, the Ethereum Founded was founded. Not long after that, in the summer of 2014, the token sale (ether) began and the team raised funds to continue to work on improvements on the new technology. While Ethereum was met with enthusiasm, there were certain issues regarding the viability of the project and how scalable it could actually get.

The name of Ethereum was made up by Vitalik, who said that ether meant the invisible medium that was responsible for the light to travel and was everywhere in the universe.

Enterprise Ethereum Alliance

Ethereum became so successful and popular that in only after three years of its creation, in 2017, the Enterprise Ethereum Alliance (EEA) was born. This Alliance includes some of the largest Fortine 500 companies, together with numerous startups and research institutes. The organization grew extremely fast starting off with just 30 members and reaching 150 just three months after its foundation, noting a CAGR of 62.4% for the three months or 400%. Some of the most well-known members of the EEA are Microsoft, BNY Mellon, Toyota Research Institute and more.

Ether

Ether is the underlying cryptocurrency that operates under Ethereum, which provides a public distributed ledger for all transactions that take place with Ethereum. The currency is mainly used for paying for gas, different computations in transactions and paying for transaction fees.

Characteristics of Ethereum

The validation and transactions happen in the same way as they do with Bitcoin. All records are called blocks, which are interlinked with one another through the process of cryptography. The major difference between Ethereum and Bitcoin is that the transitions that occur in Ethereum are state ones, since Ethereum uses balances and accounts. States are not deposited in the blockchain, they are stored in the so called Merkle Patricia tree. Transacting with Ether requires both public and private keys which denote the addresses of the Ether.

There are some unique features when it comes to Ether’s addresses. All Ethereum addresses are made of the prefix “0x”, a specific identifier for hexadecimal.

When we compare Bitcoin and Ether, we should keep in mind that Ethereum is not the cryptocurrency, but rather Ether is. There are certain differences between the largest two cryptocurrencies by market capitalization. Some of them are:

- Ether has a much lower block time than Bitcoin. For comparison, while there are many improvements going on behind Bitcoin’s network, the block time for Ether is around 15 seconds, while for Bitcoin is around 10 minutes.

- The transaction fees that apply to ether are much lower than that for Bitcoin. Again, for comparison, at the end of 2017, the price per transaction for ether amounted to around $0.32, while for Bitcoin – $23.

- Another very important difference between the two is the mining process. While for Bitcoin the rate at which mines new coins halves every four years, ether mining involves more or less constant rate of producing new coins.

- While Bitcoin has a limited supply of $21 million coins, Ether does not have a limited supply so far. As of the beginning of 2018, the supply of Ether in total was around 99 million Ether coins. However, just as with Bitcoin, Ether is expected to become a deflationary currency in the future. For now, there is no exact time on when and how this will happen.

Applications

The Ethereum Virtual Machine (EVM) is a 256-bit register stack and represents the runtime environment for Ethereum’s smart contracts. The EVM is probably the most crucial element of Ethereum, as it allows the stack to run the very same code exactly as required.

Smart Contracts

The smart codes that run on Ethereum are usually coded in different computer languages, so that they can be used for different applications and functionalities. The EVM code is used to “crunch” the smart contracts and run them on the Ethereum blockchain for completion. Some of the languages that are used for smart contracts include Serpent, Mutan, Solidity, LLL and Viper.

According to data, these smart contracts may be vulnerable since they are open to the public and are not easy to fix if there is a “bug”.

Ethereum is probably the most versatile open-source computing platform, since it is used for multiple applications and has multiple uses across sectors and industries.

Some of the most famous deployments of Ethereum include: Prediction markets, IoT, crowdfunding, online betting and gambling platforms, security data systems, online financial exchanges, social media apps etc.

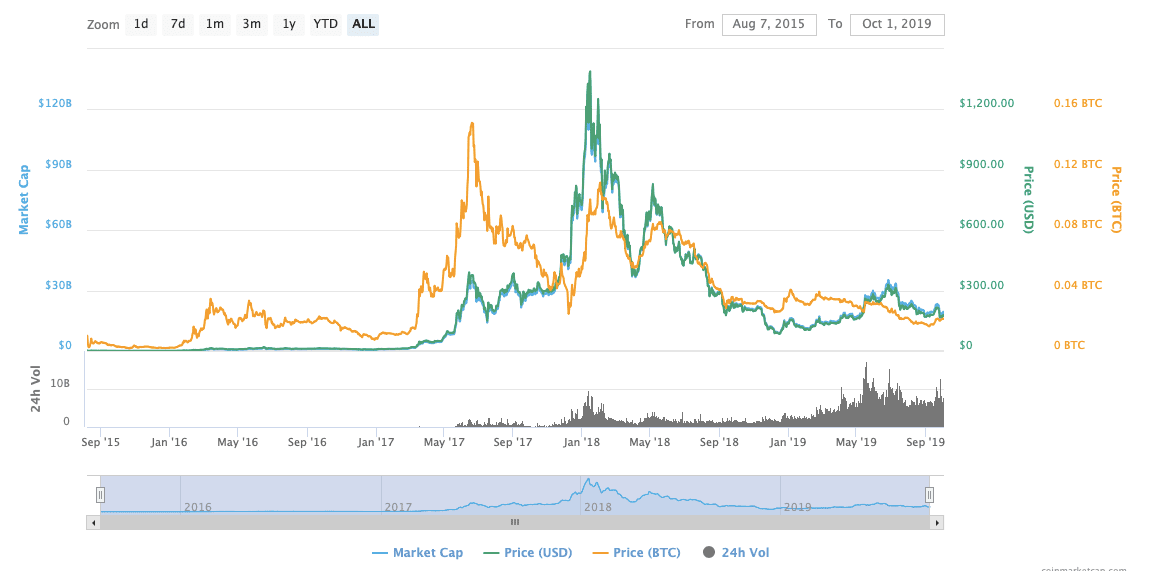

Ether’s Price Movements

As it can be seen from the historical chart from Coinmarketcap, Ethereum’s price has been climbing and decreasing even more rapidly than Bitcoin’s price. At the beginning of 2015, Ethereum cost was fluctuating between $1,23 and $2. However, the rapid increase in price occurred in the spring of 2017, when Ethereum only cost around $10. From then on, the price started climbing rapidly and by July 2017, the price was already above $300. With more application and improvements on Ethereum, the price continued to skyrocket and in the very beginning of 2018, Ethereum hit its all-time high of almost $1,500. The fluctuation in price has been mainly due to concerns with security and future development. While the crypto bull market may be gone, as some analysts predict, it can be clearly seen that Bitcoin and Ethereum have a cointegration relationship when it comes to their price movements. While all altcoins go up and down with Bitcoin, more or less, Ethereum probably mimics Bitcoin’s price swings most closely. One possible explanation for that is: blockchain is the foundation for both cryptocurrencies. Blockchain has been embraced by corporations and governments, but it has also affected the price of Ethereum and Bitcoin. This is perhaps one possible reason why once Bitcoin goes down, the whole cryptocurrency market goes down as well.

As of September 2019, the price of Ethereum has gone down again, as can be seen from the Coinmarketcap historical price chart.

Advantages of Ethereum

Similar to Bitcoin, Ethereum is also a public blockchain network, so it is transparent and secure at the same time. The main application of Bitcoin, however, is operating as a peer-to-peer medium of exchange electronic cash system. This means that the focus of Bitcoin in blockchain is on following the ownership of Bitcoin tokens, whereas the blockchain for Ethereum is more focused on operating the programming code for any decentralised application. This is why Ethereum has found numerous applications in multiple industries and businesses.

Ether as a currency will always be needed as long as the Ethereum network is in operation, because it is needed to execute the code on the network. The majority of blockchain projects these days are also based on Ethereum, which means that it has tremendous potential looking into the future. Smart contracts are a massive application that Ethereum has provided and the market is constantly expanding. There is also no limit on the supply of ether, so there is never going to be a shortage of tokens or the prices being driven up simply due to a lack of supply issue – an important differentiator when it comes to Bitcoin vs. Ethereum.

Disadvantages of Ethereum

The main disadvantage associated with ether and Ethereum is that the ether digital currency is tied to how successful the Ethereum network is going to be in the future. If the network fails, then ether also fails. There are a few projects currently in the works by other parties that aim to replace the role Ethereum currently plays in the creation and publishing of DApps. If they can come to market and have similar or superior features, then this could see a decrease in the popularity of the network. The likes of NEM and Stellar are two examples of these types of projects. Like Bitcoin, there are significant issues regarding scalability with the Ethereum network that need to be addressed going forward.

The founder of Ethereum Vitalik Buterin has talked about these concerns at length and there has been a lot of work being put into finding a solution for it, with Raiden often being heralded as the ultimate solution to this issue. There have also been some bugs and issues discovered within smart contracts that have caused some concern. While the positives of smart contracts are clear for all to see, these contracts are still prone to human error. This could lead to disastrous consequences depending on the specific issue and if a contract does in fact go bad, there is no control point that can be reached to try and resolve this issue.

Ripple vs. Ethereum – Are They Competitors?

Ripple and Ethereum are very different in what they are looking to achieve. Ripple is mainly focused on being an electronic cash system for large groups such as governments, corporations and financial institutions. XRP caters to global transactions that require minimal costs and quick processing times. Ethereum, on the other hand, is focused on providing a platform on which decentralised applications can be created and turned into their own projects. Ethereum also allows for smart contracts to be created. Both cryptocurrencies are different in their essence and value to the cryptocurrency community.

Ripple is undeniably the alt coin for financial institutions, while Ethereum has found applications in numerous industries, especially with the smart contracts feature. These are both projects that are in it for the long haul and they have a basis in value that is justified, rather than simply relying on promise and future forecasting. Some even argue that they do have intrinsic value and their prices are not derived by market sentiment only.

Conclusion

Ripple and Ethereum are trying to fill different niches in the cryptocurrency world. Ripple is looking to bridge the gap between cryptocurrencies and the traditional financial system. Ethereum is trying to take blockchain technology and cryptocurrencies into a more mainstream setting by providing the perfect ground upon which exciting projects can build their offerings. They are both well-positioned towards the top of the market cap rankings and it will be interesting to see if they can challenge Bitcoin for that top spot in the years to come.

PEOPLE WHO READ THIS ALSO VIEWED: