Ripple is a particular type of digital asset, one that is often confused by people as being a cryptocurrency. It is a money-exchange protocol that provides an instant, low-cost, secure alternative to traditional banks.

YOUR CAPITAL IS AT RISK

Ripple’s protocol also has a token called the XRP. The XRP is a tradeable cryptocurrency and can be bought on many popular crypto exchanges. This article will explain the Ripple platform in-depth, how it works and where to buy, sell or exchange it.

Table of contents

ESSENCE AND HISTORY OF RIPPLE

Ripple is a real-time gross settlement system (RTGS) and currency exchange managed by a network of servers that validate and compare all transactions. Unlike Bitcoin, which uses a proof-of-work (PoW) model that requires high computing power and energy, the Ripple platform has meagre energy needs. The servers that make up the network are distributed worldwide and can belong to individuals and companies. The integrity of the network is ensured through a consensus process between all the servers involved in validating the transactions.

Ripple is a complete protocol for fast, secure and low-cost money transfers across the world. Its token, called the XRP, is a tradeable cryptocurrency, but the Ripple protocol doesn’t rely on XRP to validate and process the transactions. All types of currencies can be sent through the protocol: fiat currencies, commodities and even airline miles.

The Ripple network mainly caters to companies that send large sums of money since the Ripple protocol can quickly handle transactions of any size. That’s a significant advantage of Ripple. Many financial institutions have recognised its potential and started cooperating with Ripple Lab, the company behind the Ripple network and its XRP token. Names such as RBC, Santander, Standard Chartered, Credit Agricole and American Express are testing money-transfer services based on the Ripple network.

Ripple can be summarised as follows:

- Ripple is a money-exchange protocol, while XRP is its token

- It uses a network of independent servers to validate all transactions

- Unlike bitcoin and ether, XRP can’t be mined

- A growing number of financial institutions have already adopted Ripple’s transaction protocol

THE PEOPLE BEHIND RIPPLE

Long before Ripple was introduced in 2012, a web developer from Vancouver named Ryan Fugger developed Ripplepay in 2004. Fugger planned to create a decentralised monetary system which would allow individuals to exchange and even create their own money. Based on this concept, Jed McCaleb, Arthur Britto, and David Schwartz started developing a payment system where transactions will be verified by independent servers rather than through the process of mining, as is the case with Bitcoin

The team founded OpenCoin Inc., which began to develop the Ripple protocol based on Fugger’s ideas. The protocol, which forms the cornerstone of Ripple, allowed for the instant exchange of money between two parties. OpenCoin also developed the XRP token to enable financial institutions to make fast and low-cost money transfers, with the ultimate aim being to compete with Western Union.

Since then, Ripple’s team has focused on increasing the market share in the banking industry and signing multiple agreements with major financial institutions. The company has offices in Sydney, London and Luxembourg.

DIFFERENCES BETWEEN RIPPLE AND BITCOIN

While bitcoin’s purpose is to take advantage of blockchain technology to offer a decentralised and anonymous payment protocol, Ripple is different in that many operations are centralised and overlooked. Banks and Ripple Lab control the servers that validate the transactions and can restrict certain activities or even freeze accounts if a transaction seems suspicious.

The second significant difference between Ripple and Bitcoin is in the tokens. Bitcoin relies on thousands or millions of miners who provide their computational power to validate bitcoin transactions, creating new bitcoins. XRP, on the other hand, can’t be mined.

Ripple Lab has published 100 billion XRP tokens, and according to the company, this is the total number of XRPs that will ever exist. However, there’s no guarantee that Ripple Lab won’t release additional XRPs later. The fact that XRPs aren’t necessary for the Ripple network to function and that they can’t be mined is a major point of criticism for Ripple’s opponents.

RIPPLE AND FINANCIAL INSTITUTIONS

Ripple is primarily used by financial institutions that cater to many customers and large cross-border payments. According to Ripple, more than 200 global financial institutions, including banks, have tapped into their payment solutions for cross-border settlements.

Unlike traditional payment methods, which are slow, expensive and with high failure rates, Ripple’s network provides instant settlement via its independently verifying servers, real-time traceability of funds and low operational costs.

The company’s payment solution, RippleNet, has played a crucial part in how top payment providers and banks have adopted the new way of doing things. RippleNet’s prowess in cross-border settlements has pushed the boundaries of what is technically possible and supports fast, efficient, and low-cost transactions across borders.

Still, the centralised nature of Ripple’s nodes which financial institutions and Ripple Lab handle doesn’t differ much from the traditional banking industry. The servers simply validate the transactions, which is pretty much the same as the traditional banks. In a sense, Ripple acts as a “bridge” between the internet and financial institutions.

ESSENCE OF XRP

XRP is the name of the token behind Ripple’s network, similar to “ether”, the token behind Ethereum. The big difference between XRP and other coins is that XRP cannot be mined and is not necessary for Ripple’s network to function.

As of 3rd February 2022, there were 47.74bn XRP in circulation. The total supply of XRP is 100bn, so approximately 52.25bn coins from the entire supply are still owned by Ripple and are due to come into circulation. The company promised that it would not create additional XRPs, but there’s no guarantee of that.

Ripple Labs currently releases around one billion XRP in the markets each month to fund new acquisitions and grow the business. By adding to supply, the platform applies downward pressure to the price of XRP, and as this practice is entirely at the discretion of Ripple Labs, it could change in the future.

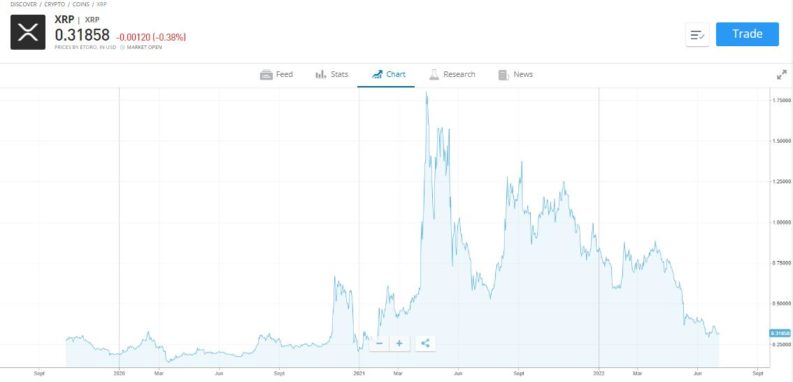

The current price of an XRP is around $0.31, bringing the total market capitalisation to $15.2 billion. That makes XRP the seventh-largest cryptocurrency in terms of market cap. This represents a slide in value as it has at times ranked third in recent years, only behind bitcoin and ether. During the period of the crypto-hype in late 2017, XRP reached its record-high of $3.30, and its more recent price-high is $1.77, recorded in April 2021

Ripple Price Chart – 2019 – 2022

Source: eToro

HOW TO BUY XRP?

The rising prices of many cryptocurrencies in December 2017 caused a massive influx of investors who didn’t want to miss the bull market. Ripple was a popular coin to buy then, jumping tenfold in price from $0.3 at the beginning of December to $3.30 only a few weeks later.

Crypto investing has been made easier by various platforms supporting trades in markets such as XRP. It’s possible to buy Ripple using a specialist crypto exchange such as Coinbase, Bitstamp, Kraken, Coinone, or Coincheck.

Those looking to gain exposure to the sector without going all-in on learning about special ‘wallets’ and ways of checking if their unregulated exchange is trustworthy now have an alternative route into the market. Mainstream brokers such as eToro offer their clients the option to trade crypto from the same account they use to trade other instruments such as stocks, forex and ETFs. The onboarding process at these brokers is designed to be user-friendly, and the functionality is often set at a level to help support those who are new to trading.

Although all trades in crypto fall out of the scope of financial regulators, the multi-asset brokers such as eToro that offer crypto and other markets carry out some regulated activities. That means they are familiar with client care rules, funding requirements and other guidelines introduced to make brokers safer.

CRITICISM OF RIPPLE

Crypto’s aim of bridging the gap between traditional and new-age financial systems could make it the currency of the future, but it also exposes it to criticism from both sides of the crypto debate.

Crypto-purists who support the fundamental principles of decentralised blockchain-based cryptocurrencies, such as bitcoin and ether, state that the inability to mine XRPs is a significant disadvantage of the coin. All coins are distributed directly by Ripple Labs, which means the founders retained a large percentage of them (approximately 60%) which also brings the Ripple platform more criticism. The move towards holding unreleased coins in escrow has gone some way to resolving this issue. Still, for die-hard fans of the revolutionary edge blockchain brings, Ripple is seen as being something of an impostor.

Ripple’s relationship with regulators can so far be described as a lose-lose. Purists say Ripple is not entirely decentralised since the company or regulators could potentially interfere in the network and restrict certain transactions. This goes directly against the main advantages of blockchain, such as the inability of third parties to interfere and change the network’s operations. The fact that Ripple’s nodes do not perform proof-of-work but merely validate the transactions is also being criticised. The fact that this results in a significant reduction in energy consumption compared to bitcoin’s network, for example, isn’t enough compensation for many.

On the other hand, in May 2018, a class-action lawsuit was filed against Ripple “alleging that it led a scheme to raise hundreds of millions of dollars through unregistered sales of its XRP tokens. The charge brought by the SEC claims billions of coins were created ‘out of thin air', and that means someone profited by selling them to the public. The charge that Ripple is essentially a “never-ending initial coin offering” has resulted in a high-profile and long-running court case between the regulator and the platform. That’s never a good look in an industry where reputation is everything, and until a resolution to the dispute is found, the price of Ripple can be expected to be suppressed.

An even more fundamental threat to Ripple is that its dominance in the payments sector would plummet if big players like the US Federal Reserve decided to create their own payment solution based on Ripple’s processes but backed by established institutions. Where the US leads, the rest of the world tends to follow, so a move by the Fed would challenge Ripple from a global perspective.

In short, there are few parties engaged in payments processing who would look past a payment processor owned and controlled by the United States government to take up the services of a private company currently facing a lawsuit for conducting unregistered securities offerings.

CONCLUSION

Ripple’s platform offers many advantages compared to traditional payment methods. It’s fast and secure, and the transaction costs are only a fraction of a regular wire transfer. The network is based on independently verifying servers which validate each transaction and keep a record of all transactions in a public ledger. All transactions can be traced, and UNLs (Unique Node Lists) ensure high security of the protocol.

Since large sums of money can be exchanged in a few seconds, Ripple caters mainly to enterprises and has reached agreements with dozens of financial institutions, including American Express, Santander and UniCredit Bank. Many other banks have reported experimenting with Ripple’s protocol for their services.

The question for holders of XRP is whether the Ripple platform offers the magic formula which allows two different financial systems to co-mingle or whether it’s neither one nor the other. This answer to that question appears to be some way off, and that means the price of Ripple can be expected to fluctuate wildly like other cryptos.

Buying Ripple could be a bumpy ride, but whether you’re an experienced investor or new to trading, a simple step towards boosting your chances is to sign up with the best-fit broker for your needs. There are hundreds, if not thousands of brokers offering markets in XRP, and this shortlist of trusted brokers who trade Ripple contains the names of firms that AskTraders analysts have vetted. They offer competitive T&Cs and neat support services that provide the best route into the market.