If you’re a crypto investor, then ‘staking’ is a term you’ll see referenced with increasing frequency. It’s an increasingly used buzzword because the process could be the route cryptos take in becoming more widely accepted. For that reason, more and more investors are looking at coins which allow staking.

Staking is how some cryptocurrencies verify their transactions, and proof of stake (PoS) has two benefits over the proof of work (PoW) methodology that is the main alternative. It allows crypto holders to earn rewards on their holdings, and it uses much less energy. Read on for a comprehensive explanation on crypto staking.

What is Crypto Staking?

In a proof of stake blockchain, staking is how new transactions are added to the blockchain. By staking, holders of coins become part of the reconciliation process and are given the status of being a validator. In short, by tying up your crypto for some time, you play a more significant part in the reconciliation process and, in return, might receive rewards, usually in the form of more coins.

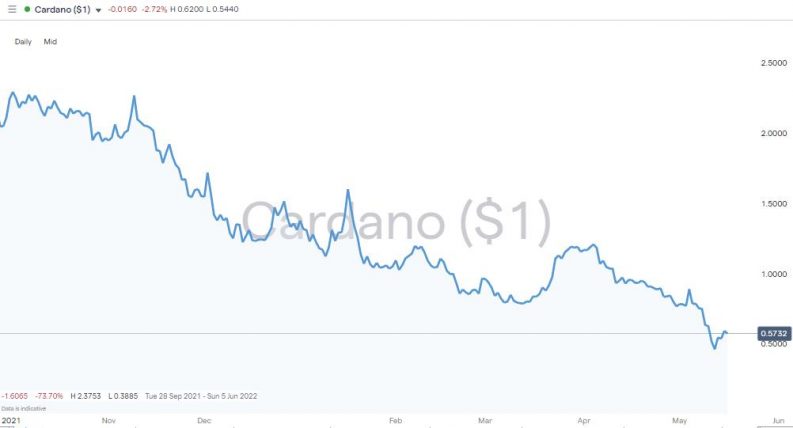

Popular cryptos which use staking include Cardano. It has an eco-friendly approach and has always used staking, and Polkadot is a protocol which allows different blockchains to connect and interact with each other. Solana and Ripple make the most of PoS technology to offer a blockchain framework which has fast processing times and low fees.

Cardano Price Chart 2021 – 2022

Source: IG

How Does Crypto Staking Work?

One of the most important things to remember about crypto staking is that the coins you stake are still yours. The period when you stake them is just one where you can potentially collect rewards for playing a part in supporting the accounting ecosystem.

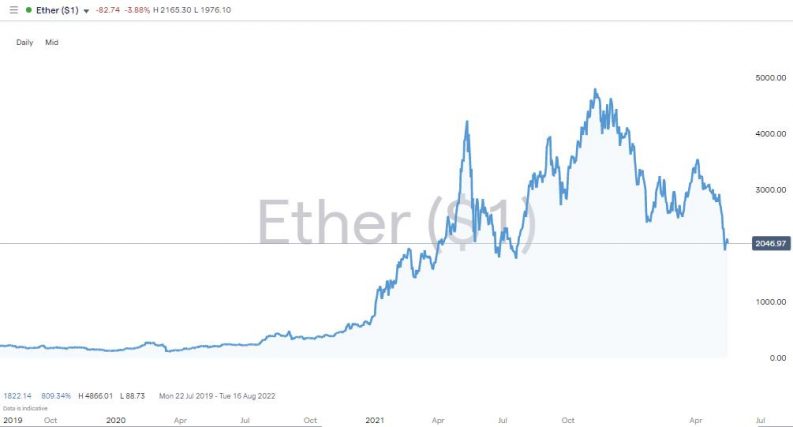

The unstaking process can take some time to process, so you might not be able to sell your coins immediately. For Solana, the unstaking process is suggested to be 48 hours. Coinbase states that the most widely staked coin on its platform is Ether, part of the Ethereum network. This #1 ranking is partly because ETH currently can’t be unstaked, so staking is a one-way street. Ethereum is putting through an upgrade that will complete its conversion from PoW to PoS, but the timeline for that coming into place keeps slipping and is currently quoted as being sometime in 2023.

Ethereum Price Chart 2019 – 2022

Source: IG

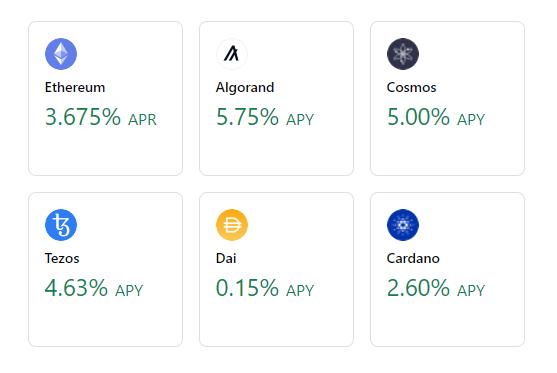

What Kind of Rewards Can Staking Provide?

Rates vary according to market conditions and the different platforms, but Coinbase reports current yields for the major coins to range from 0.15 – 5.0% APY.

Source: Coinbase

Smaller and emerging coins use the prospect of higher rates of return as a means of developing market share. It is essential to check how long coins are tied up for and also to check their fundamentals. There’s little long-term benefit of double-digit annual rewards of a coin that doesn’t have much chance of success.

Why is Crypto Staking Needed?

Crypto staking is one way of addressing the fundamental challenge of crypto blockchain systems being decentralised. Traditional databases use a closed system where a single administrator enters data which acts as a record of account. In the case of decentralised blockchain systems, each participant in the system contributes updates on transactions and mining activity. Once they have been tallied and reconciled, the system records each participant’s holdings.

The greater the number of participants, the more work is involved. Crypto fans see that effort as worthwhile as the openness of decentralised blockchains and the ‘crowd sourcing’ nature of the operation mean that records are verified by thousands of users rather than one administrator.

How Does Staking Differ from Proof of Work

PoW systems such as the one adopted by Bitcoin reward ‘miners’ who solve complex mathematical problems. The first miner to get the answer correct adds a layer of transactions to the blockchain and is rewarded, for example, by being credited with Bitcoin. In PoS systems, rewards are allocated more arbitrarily.

Why Are There So Many Different Types of Crypto Proofing?

Proof of stake and proof of work are the two most common mechanisms to operate the accounting infrastructure of blockchain systems. The original crypto, Bitcoin, uses PoW methodology, and PoS was first introduced in 2012 when Peercoin hit the market. It’s sometimes easy to forget that cryptos are a relatively new concept, leaving room for other ‘consensus mechanisms’ to exist. These include proof of activity, proof of burn, and proof of capacity.

Why so many? As the sector hasn’t yet fully matured, each approach represents a chance for a disruptor style Alt-coin to come up with the holy grail of crypto processing – a reliable, secure, fast, and efficient infrastructure. The prize for the winner could be to become the base currency of the global financial system. If that were to be the case, then the value of the victorious coin would be exponentially higher than it is today.

Benefits Associated with Crypto Staking

The benefits of proof of stake have a lot to do with the inherent inefficiencies of the rival system, proof of work. PoW encourages competition between miners, and as the price of BTC has sky-rocketed, more miners can afford to operate even when the win-loss ratio is small. One successful attempt at cracking the mathematical equation can generate enough income to justify significant investment in a bank of electricity sapping computer servers.

PoW encourages an arms race where IT equipment is constantly being upgraded, and ever more electricity is being used. This article on the amount of electricity Bitcoin uses outlines how the unregulated PoW free for all could have a catastrophic impact on the global environment. On the other hand, Proof of stake doesn’t require miners to solve complex equations, making it a much more eco-friendly way of running a blockchain network.

Risks Associated with Crypto Staking

Staking can require you to lock up your coins for a minimum time, and during that period, you’ll be unable to sell your holding. This might result in incremental rewards being gathered, but crypto prices are highly volatile, so a +20% drop in the price of a coin would be a more significant influence on the total return on your trade.

Another price driver to consider is that coins such as Ether, where staking is allowed but unstaking is restricted until a tech upgrade materialises, suffer from a price overhang. That reflects the likelihood that there will be a rush for the door when staked coins can finally be sold.

The crypto sector is still emerging, and whilst the technology used for staking has been well thought through, there is an element of risk due to potential threats to the system’s security. Many of those threats are still unknown, but one which has already been identified is the risk that a large player could have enough nodes and influence to scam the framework. It is less likely with huge established blockchains such as Ripple, but smaller coins are exposed to the risk of one large investor cornering the market.

How to Stake Crypto

The surge in investor activity in the crypto markets has resulted in regulators developing their approach to the sector. The coins themselves are unregulated instruments, and specialist platforms such as Coinbase remain largely outside the scope of regulators such as the Financial Conduct Authority (FCA).

The Wild West feeling of those platforms and the need for specialist wallets has put many off investing in crypto, but some online brokers regulated by the FCA offer a safer route into the crypto markets. Trading in coins remains an unregulated activity, but account holders can take comfort that some brokers offer trading in markets such as equities which are regulated by FCA, CySEC, and other Tier-1 regulators. In short, they know the game’s rules, even if the crypto markets they offer are unregulated.

1. Find a Broker

Firms which offer crypto markets can be found on this shortlist of good crypto brokers. They’ve also been reviewed by the AskTraders team to ensure they offer the T&Cs, research tools and mobile apps which give their clients the best chance of being successful.

2. Open & Fund an Account

The process of setting up an account can vary from broker to broker. Those firms which lean towards the ‘crypto purist’ end of the spectrum require specialist wallets to be set up. Investors looking to develop a greater understanding of hot and cold wallets might consider this review of the best crypto wallets.

Investors who want to gain exposure to crypto without going down a tech-heavy rabbit hole might opt to open an account with a broker. That broker allows clients to buy crypto outright (not in CFD form) and then stake it. Setting up an account is very straightforward and takes minutes to complete. Once done, the same account can be used to trade anything from crypto to the best copper mining stocks and Apple Inc shares.

3. Buy Crypto

Buying crypto is precisely the same as purchasing any other instrument. If you’re buying Amazon stock, oil or Ether, navigate to that market from the broker home page. The dashboard for your staking crypto will have price charts, research notes and the latest news. Remember, staking crypto does have additional benefits, but the fundamental principles still apply, so use technical and fundamental analysis to buy low and sell high. Another factor to consider is risk management techniques which apply regardless of the market being traded.

4. Stake Your Crypto

Staking is becoming an increasingly important part of the crypto environment, and brokers and platforms are now supporting clients who want to do so. If it is something you want to pursue, it’s worth checking which of our shortlist of brokers supports staking. Alternatively, if your broker doesn’t support staking, you can move your coins to another wallet.

5. Consider Joining a Staking Pool

It’s possible to join forces with other crypto holders to create a larger node in the blockchain framework. The process of joining a staking pool means you’re more likely to be noticed, increasing the chances of rewards being allocated to that group.

The rewards to a pool are shared accordingly among its members, so being part of an excessively large pool might improve your strike rate but result in smaller individual payouts. Being a member of a smaller pool might offer the promise of a larger share of any reward but make it less likely to be forthcoming.

You still own your crypto when you’re a member of a staking pool, but most pools take a commission on any rewards. The average commission in the market is somewhere between 2 – 5%, but it’s equally important to check the reliability of the pool’s tech infrastructure. Crypto pools can only earn rewards when their servers are operational, so look for a pool with close to 100% uptime.

6. Receive Your Staking Payments

Exact T&Cs vary across the different coins and platforms, but any returns from coins staked are credited monthly with zero interaction required from the account holder. This makes it a passive income stream with obvious similarities to interest payments made on a savings account.

Final Thoughts

Many firms support staking and heading here will put you in the best position to start with a legit platform. Staking offers the chance to generate a passive income, but there are outstanding questions regarding the possibilities of cryptocurrencies being successful still being answered.

Any crypto which wants to become the world’s base currency needs to tick two boxes. The first is to be a reliable store of value, and the second is to be an effective means of exchange. To date, Bitcoin’s prominent position has been based on its proof of work methodology, making it the go-to coin for those looking to buy crypto on a buy-and-hold basis. Bitcoin’s long transaction times remain an issue, and PoW processing can take minutes to process a transaction. That’s not so much of a problem if you’re buying a Tesla but is prohibitive if you’re buying a coffee on the way to work. Proof of Work is also bad news in terms of carbon footprints.

If cryptos using proof of stake protocols match the reliability of the tried and tested PoW approach, then they would look a better long-term option. They have greater scalability, lower running costs and faster transaction times. That is why so many are researching which coin to invest in and are then using staking to earn a return as part of a long-term strategy.