However, some traders choose to ignore the economic calendar despite the massive potential it has to protect them from volatile price moves, and potential losses, that may occur after some economic releases.

There are two types of traders who wilfully ignore the economic calendar, the first group being technical traders who focus solely on technical analysis, and the second group being beginner traders.

This article aims to demonstrate the benefits of using the economic calendar to beginner traders, but I’m sure technical traders will find a few gems in here.

Therefore, we will dig into the following topics:

- What the economic calendar is

- How to read the calendar

- And finally how to use it when trading

So, let’s get started.

What Is the Forex Economic Calendar?

The economic calendar is a schedule of economic events that could have an impact on the financial markets and their price moves. Whether you are trading forex or any other asset class, economic data could impact your positions in the market, so it is important to keep an eye on the calendar throughout the day.

Finding a Trading Calendar

Many trading brokers, websites and platforms provide their own economic calendars, allowing for ample resources for staying on top of the latest upcoming economic news. Most of these calendars are similar and have automatic updates, are easy to read and provide various features to make the analysis experience simpler.

How to Read the Forex Economic Calendar

The economic calendar typically lists the most important events and data releases from major countries across the globe each day. You choose to focus on a single day a week, or a month, which can help you plan your trades accordingly.

Some of the most common events shown on the Forex economic calendar include central bank interest rate decisions, GDP figures, trade balance data, inflation figures and employment reports.

Most calendars usually have an in-built filter that allows you to choose macro releases based on their priority levels and the country or region of origin. The list also includes the time when each event is set to occur, the affected currency, and the organisation releasing the report among other details.

The economic calendar usually shows the previous data recorded for each macro report such as prior employment figures followed by analysts’ consensus estimates and the actual figures contained in the current release.

How to Use the Economic Calendar in Forex Trading

By analysing news events and fundamental releases, forex traders can monitor market conditions and predict potential price fluctuations surrounding key events. As a whole, this can form a crucial part of a forex trading strategy.

Interpreting the economic calendar requires knowledge of which geopolitical events and macro releases can impact a specific Forex pair. For example, macro releases from the United Kingdom are likely to affect all currency pairs that feature the Sterling pound such as the GBP/USD pair.

Geopolitical events and economic releases from the United States usually have the widest impact on Forex pairs because the US dollar is the world’s reserve currency and is one-half of all major currency pairs such as the EUR/USD, GBP/USD, USD/CAD, and USD/CHF currency pairs.

Ignoring major fundamental releases may put you at a disadvantage if the release triggers significant price swings in currency pairs that you are holding.

How to Use the Economic Calendar as a Beginner

As a beginner, you may not be familiar with how most economic releases and news events affect certain currency pairs. However, you can start by focusing on two to three currency pairs and monitoring their reactions to your chosen macro releases and news events. Do not trade more than five currency pairs as a beginner given that you are still developing your trading skills.

You can look at how each pair reacted to specific news events and macro releases in the past if you have a backtesting software. You can also do this manually in case you do not have backtesting software. By studying the pair’s reactions to your chosen macro releases or news events, you can then predict how it will likely react to future releases.

However, you should never assume that the Forex pair you’re trading will react in exactly the same manner it did to a past news release as each moment in the Forex markets is unique. Therefore, you should always use proper risk management with all your trades even those that look most promising.

Most beginner traders are best served to avoid trades that are likely to be affected by major news events given the significant volatility usually associated with such events. However, you can always take the trade after the event if the technical setup supports your thesis.

How Most Traders Use the Economic Calendar

Many technical traders choose to stay out of the markets whenever there is a major announcement scheduled as you never know which direction the price will move after the release, which is a prudent trading strategy.

Some traders choose to capitalise on the price movements that may occur after such releases by placing trades just before or after the releases. Such trades usually carry significant risk and are not recommended for beginner traders, but can be very profitable for experienced traders.

The last group is made up of traders who choose to trade the markets bases solely on fundamental releases and news catalysts while ignoring the technical analysis part of trading. We consider this to be a very risky strategy as technical analysis plays a significant role in ensuring a trader’s consistency and long-term success.

The Forex markets are usually quite sensitive to news/geopolitical events and certain macro releases, but long-term profitability as a Forex trader requires one to combine both technical and fundamental analysis in their trading.

An Example of Trading In-Line With the Economic Calendar

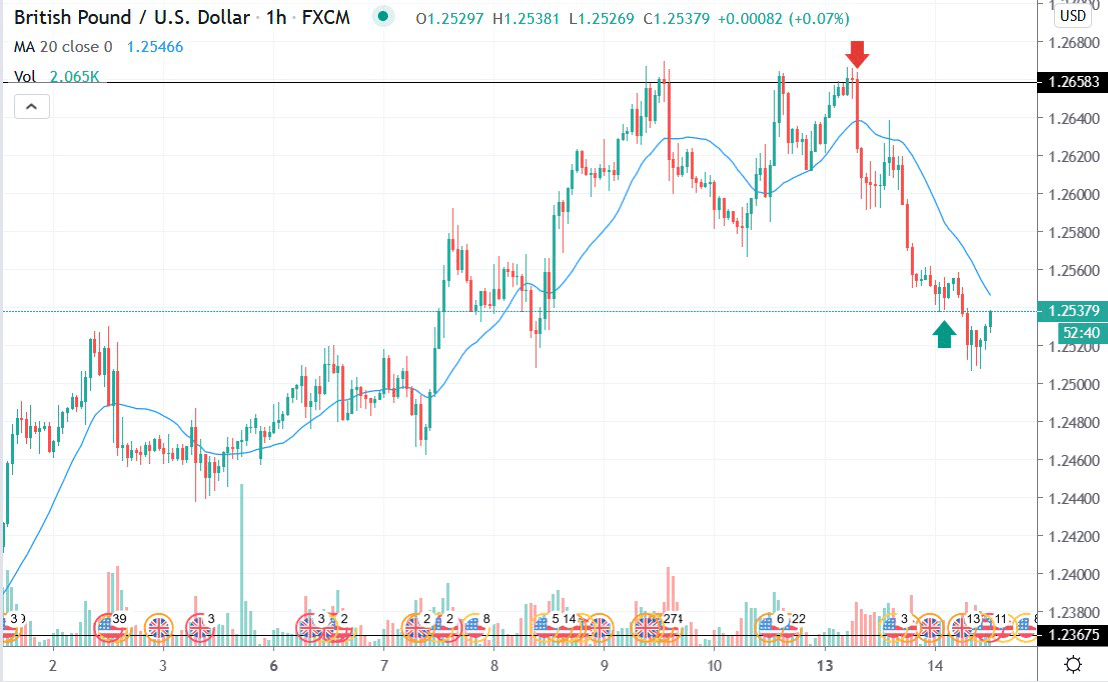

Let’s look at a recent example of a trade opportunity on the GBP/USD currency pair. During our weekend analysis of the pair, we noticed that the economic calendar was showing that the UK’s Office for National Statistics was set to release the country’s GDP report on Tuesday.

Our technical analysis of the pair revealed that the GBP/USD currency pair was trading near a major resistance level, which we identified as a low-risk trade entry location. So, we placed a bearish trade on the GBP/USD currency pair on Monday morning after the price hit the key resistance level and turned lower.

Our trade moved over 100 pips into profit by the end of Monday, as shown in the chart below.

Most traders would be best advised to close their trades before the GDP report on Tuesday morning as it is hard to predict what the price will do after the release, which is a great decision.

Some swing and long-term traders may choose to hold on to their profitable trades through the GDP release betting that the price would keep falling afterwards, and they would have been right in this case.

However, fundamental only traders might have missed the entire move given that our trade entry was based off a technical level, which in this scenario was a major resistance level.

The Bottom Line

The economic calendar is a critical part of the foreign exchange markets, which are driven to a large extent by geopolitical events and fundamental releases. Every trader can improve their profitability by incorporating the economic calendar into their trading routines and strategies.

Therefore, we encourage both beginners and experienced technical traders to incorporate the Forex economic calendar into their trading strategy to ensure that they are not caught unawares by scheduled macro releases and geopolitical events.

Do not ignore the economic calendar simply because you are a technical trader. Remember that the ultimate goal of trading the markets is to make profits, and the economic calendar can help you achieve this noble goal.

PEOPLE WHO READ THIS ALSO VIEWED: