What is Grid Trading?

Grid trading is when a trader will seek to profit from price trends and the natural movements of the markets. They will place buy and sell orders above or below the current price at increasing or decreasing levels.

Alternatively, they could place sell orders at incremental levels above the current price or buy orders at progressive levels below the current price, in the hope of capitalising on a change in the trend of a market.

Should You Use Grid Trading?

This strategy can work in a CFD context as well, but it is not for new or beginner traders. It is for those who are fairly advanced, confident and tenacious.You should learn how to trade CFDs, gain a thorough understanding of all techniques, and build up your portfolio, expertise and planning capabilities before attempting grid trading.

If you’re new, attempt it in theory while you learn all the fundamentals of trading and other main strategies in general.

Doing this on paper while you grow in experience gives you an edge in the sense that it won’t be entirely foreign to you by the time you are at a level that allows you to trade using this strategy.

This technique is simple, but deceptively so. Throw CFDs into the mix, and the risks are much higher than normal, but so is the reward. You also need reserve funds.

How it Works

Let’s dive further into some more detail.

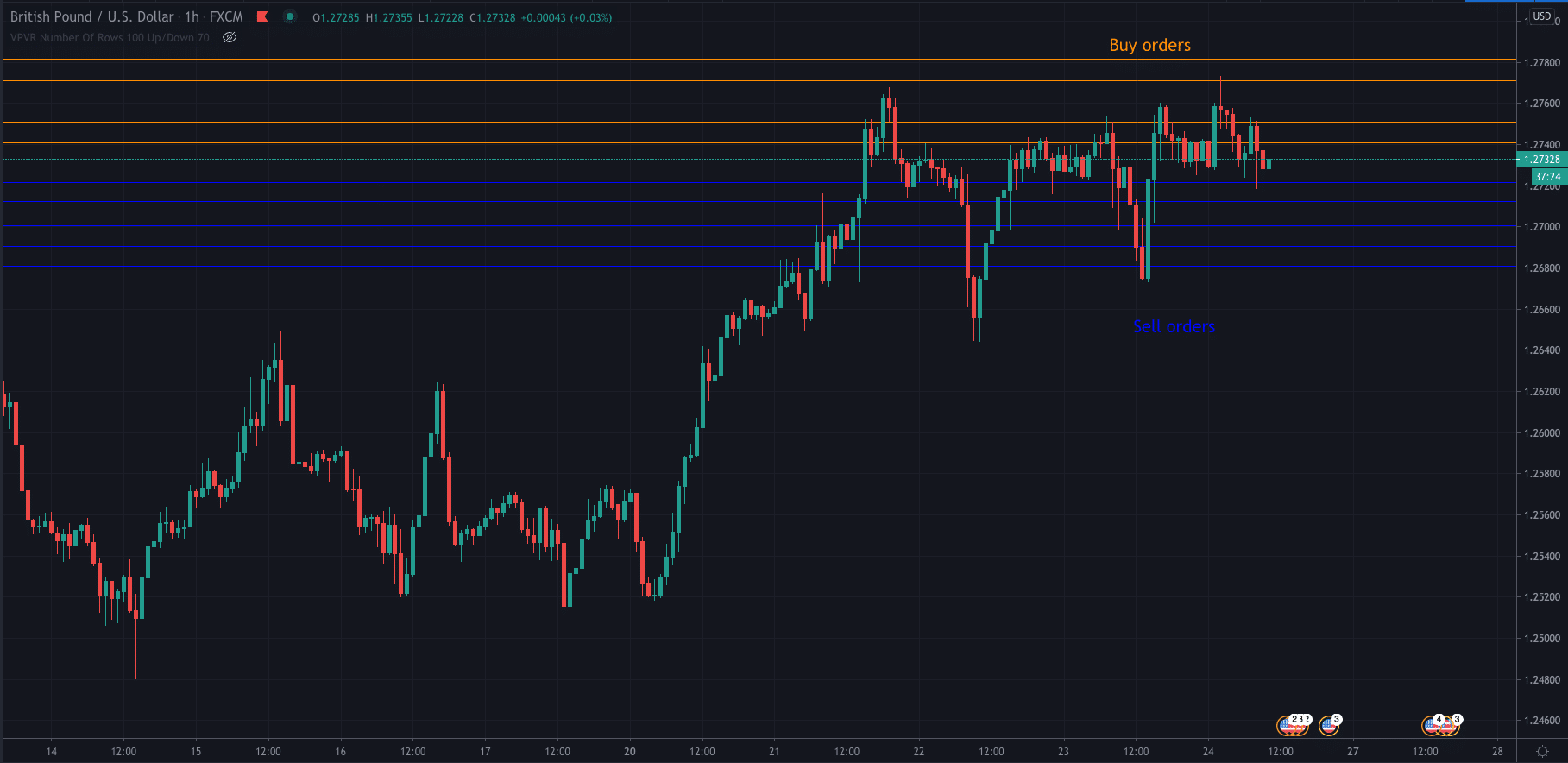

If a trader is looking at the GBPUSD, and the current price is 1.2725 (as you can see below), they would then place buy orders at certain levels above the current price. They could also place sell orders below that price at regular intervals such as you can see below. The trader is seeking to gain an advantage of the price trending in either direction.

Types of Forex Grid

There are two types of trading grid:

- Pure trading grid: Both buy and sell orders are set, regardless of the direction or range of the market. It is not influenced by whether a market is trending or consolidating.

- Modified trading grid: The modified trading grid is different as it is influenced by the markets current direction. Your directional bias will be affected by other market factors such as technical indicators or fundamental analysis. The modified trading grid is set up to capitalise on the trending market.

Why Do You Need a Grid?

Using grid trading is an excellent way of trading the markets, and if used correctly, it can be extremely profitable.

It also simplifies trading. There isn’t the need for technical indicators or complicated fundamental analysis, you simply pick out the key levels that you want to enter, set your grid to work and allow it to play out. Of course, trading is not that easy, but a trading grid does simplify the concept.

Finally, scaling into and out of positions is a great aspect of a grid trading system. Many amateur traders will enter one large position, and if they lose it will be exited in one go. Grid trading allows you to break up the size and enter smaller positions incrementally, therefore reducing your risk.

Pros of Grid Trading

The pros of grid trading are:

- Gradually increase your position size. You won’t need to risk a large majority of your capital on one entry and can scale in and out of positions.

- When using a pure trading grid, you can capitalise on both trending and consolidating markets.

- It can be easily automated and left to run without too much intervention. Simply set your order levels with your broker, and let the system play out. It requires less skill and management than other trading strategies.

- It is easy to understand. The strategy does not require much in terms of algorithms or technical indicators. It is easy to understand and simple to use.

- You are less likely to be taken out of the market on large price swings as you will have multiple entries at different levels.

Cons of Grid Trading

The cons of grid trading are:

- In a fast-moving market with a lot of volatility, your entries and exits may not be away from your designated levels, which could cause issues with risk/reward parameters and the grid itself.

- A temptation to take profits quickly. Grid trading is about riding the wave of a market move. If you take money off the table too quickly, your losing trades will be larger, leaving you with a significant drawdown.

- Consolidating markets may mean you pay a lot in swap fees. If you set your grid system and one or more of your orders are hit, but the market does not move much for a considerable period, you may end up holding multiple orders for an extended period. It means you will be paying the overnight costs on those various orders which will pile up.

Using a Grid Bot

What is a Grid Trading Bot?

A grid trading Bot helps you automate your trading grid system so that you don’t need to check and manage your trades constantly. The grid trading bot will allow you to establish your rules for entries and exits, and the computer will automate them.

Why Use a Grid Trading Bot?

There is little input needed on your side. In fact, most grid trading is typically managed by a Bot. You simply choose the Bot you want to use, input your levels and rules for entries and exits, then let the Bot work away and execute the positions for you.

Advantages of a Grid Trading Bot

Now, while using a trading Bot may sound complicated, it isn’t. Here are some of the advantages of using one:

- Minimises emotions: Above it was mentioned that one of the downsides of grid trading is the temptation to take profits early. Well, using a grid trading robot will take that temptation and other emotion pulls away from you. You can let the bot do its work with minimal input.

- Backtesting: A grid trading bot requires a defined set of rules, and to ascertain those rules, you will be forced to backtest your strategy to see what is perfect for your entry and exit points. Without those predefined rules, you will be unable to use a trading grid bot.

- Time: Using a grid trading bot will free up some of your time. You won’t need to be constantly managing the trades or watching charts. Once it is set up, you can leave it to play out and check it every so often.

Disadvantages of a Grid Trading Bot

Some of the disadvantages of using a grid trading bot are:

- Mechanical Failures: While using a bot may seem as though it is straightforward, there is always the risk of a mechanical server. Of course, this will depend on the type of bot you are using, but it is essential to understand what could go wrong when using a grid trading bot.

- Needs to be Monitored: While setting your bot and leaving it for the day may seem like a great idea, it is probably not the wises thing to do. That is because of the above point. You will need to monitor the bot to make sure no mechanical failures occur, and to manage them if they do.

How to Build A Grid Trading Strategy

To build a grid trading strategy, you will need to follow these steps:

- First, you need to choose the asset that your strategy will be traded on. Not all assets move the same, so it is essential to pick one that has strong levels and will work with your system.

- Choose the type of grid trading system you want to use, pure or modified.

- Pick the starting price for the grid. You will need to pick a position that is relevant to the current price level.

- Decide whether you are trading with or against the current price trend.

- Choose your entry levels. Pick the levels where you want to enter your positions. You will, of course, also need to decide if these are buy or sell orders and how far they are apart from each other. One final thing is to take into consideration how many levels you set.

- Next up, is your trade size, you don’t want this to be too large, but enough so that you are building a strong position size overall.

- Finally, manage your risk. It links to the above, with your position sizing, but you must consider both in detail.

You want to control the potential downside on each trade, so do you set trailing-stops? Fixed stops? Etc. Managing risk is the most crucial part of this setup.

You don’t want your account to be taken out by one big market move.

PEOPLE WHO READ THIS ALSO VIEWED: