Investing and trading success often hinges on timely information, but making sure you stay ahead of the markets at all times can be difficult. Luckily, with the various technological advances in the broker space, various brokers now provide their users with the opportunity to set up alerts.

YOUR CAPITAL IS AT RISK

Below, we will take you through how to set up customised alerts that notify you of price movements that meet your criteria and breaking news impacting your investments.

IG Markets

IG Markets offers a variety of customizable alerts to notify you about potential trading opportunities across various asset types such as stocks, forex, and crypto.

Types of Alerts on IG Markets

The types of alerts they provide include:

Price alerts: Traders can be notified when a specific price level is reached or when the price changes by a certain percentage.

Indicator alerts: You can set up alerts based on technical indicators like moving averages or RSI, helping you identify potential support and resistance levels.

Economic calendar alerts: When it comes to data releases, IG Markets provides notifications about the results.

How to Set Up Alerts on IG Markets

To set up price and indicator alerts on IG, you need to:

- Access the “alert” tab on the platform (on the right side of the page).

- Choose between price or indicator alerts.

- Define your specific conditions (e.g., price level, indicator value).

- Then click “set alert”.

- You can manage your alerts in the alerts tab on the left side of the page.

Here's how to set up an economic calendar alert:

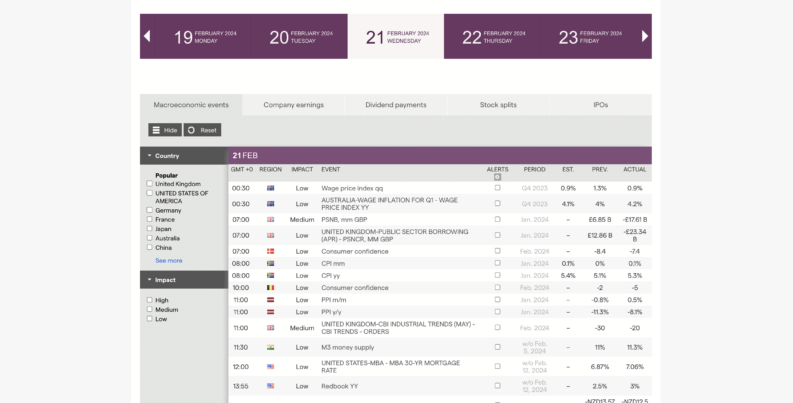

- Click on the economic calendar tab on the left side of the page.

- An economic calendar will then open in a new tab.

- Find the event you are interested in, then tick the box in the alerts column.

- You can then specify when and how you would like to be notified (within the platform, on your mobile device, or via email).

- IG will also inform you if certain markets move significantly following the event.

Note that calendar alerts are only available for live accounts.

Trading 212

Like IG above, Trading 212 offers a few types of alerts, although they are not the same.

Types of Alerts on Trading 212

- Price Alerts: Trading 212's price alerts will notify you when a specific instrument reaches a set price, either once or recurring.

- Automatic Price Alerts: Trading 212's automatic price alerts are set each time a new position is opened. By default, a 10% change in the price is the threshold that triggers an alert, which works for both directions.

- Volatility Alerts: notify you when you are about to invest in a volatile instrument.

How to Set Up Alerts on Trading 212

- First, open up a price chart

- Next, for the mobile app, hit the price alert icon at the top right corner (on the web-based app, you can click the clock icon under the price section of the instrument's graph).

- Finally, you can then set a price for your alert and confirm.

Volatility alerts are automatically set up. They can be switched off when they appear after you open a position. Automatic price alerts, as mentioned, are set up each time a new position is opened. You can able and enable automatic price alerts within the settings.

eToro

eToro's platform is extremely user-friendly. While the types of alerts are limited, they are still very useful for traders and investors.

Types of Alerts

eToro offers two main types of alerts to its users:

Price Alerts: Traders and investors can receive notifications when an asset's price reaches a specific level.

Volatility Alerts: Users can be alerted when an asset on their watchlist displays volatility.

How to Setup Alerts on eToro

- First, navigate to your watchlist.

- If you are on the eToro app, swipe right next to the instrument you would like to set a price alert for. If you are on the web version, click on the three dots next to the instrument.

- When you are on the new screen, select a rate or percentage change for the instrument to trigger a notification.

- Finally, click create alert.

Why Are Alerts Useful For Traders?

Alerts can be extremely beneficial for traders due to various reasons:

- Firstly, they allow traders to stay informed when markets are volatile. At times, there can be significant spikes in volatility. Markets are already fast moving and alerts help you stay informed by notifying you of specific events without needing to constantly monitor charts or news feeds.

- Alerts can also notify you of potential opportunities in the market. For example, they can make you aware of a key area of interest.

- For some, sitting and watching trading screens all day can result in impulsive trades that do not follow a plan. Alerts allow you to take a break from the screens and notify you only when a key area has been hit.

- Following on from the previous point, alerts can then help you capitalise on opportunities.

- Managing risk is another factor alerts can help with, warning you of changes in your positions or, in some brokers' cases, letting you know there is an important news release on the way that may impact your position.