The company’s investment platform is highly innovative and offers a wide range of product choice, and its investment finder tool is a particularly handy way of finding out how to select the instrument that’s right for you. In this Fidelity Trading Platform review, we will consider whether or not Fidelity is the best stock broker out there – and through a stock broker comparison, we’ll work out just how useful the Fidelity platform is.

- Customisable trading experience with the customer in control

- Fidelity Insight tool designed to provide information for good investment decisions

- Lots of anti-fraud mechanisms in place

- Excellent customer service team on hand in case of any platform issues

The Platform Experience

Investing with Fidelity is a simple experience thanks to the platform’s ease of use. Clearly designed with the casual retail investor in mind, Fidelity’s online platform has been crafted to make investment management an activity that is comprehensive and bespoke, without also being time-consuming. After registering to use the Fidelity platform, for example, the software brings together all of the different parts of your account, such as savings levels, investment performance and more, into one place so that you can understand how each of your instruments is performing.

The Fidelity trading platform also makes it simple to plan your account’s performance in advance, too. If you have cash earmarked for investment, but you want to wait until a certain point before you commit it, perhaps until after a major life milestone, for example, or a wider economic event, then you can deposit it in the secure Fidelity system and leave it until an unspecified future point before you commit it to an investment. If you have more than one Fidelity product, meanwhile, you can move between accounts on the platform quite quickly, which saves you time and allows you to focus on more valuable activities such as research, stock selection and more.

- Comprehensive account performance overview

- Easy to monitor different products or accounts

- Prior deposit system, add cash before investment commitment

- Time-saving and efficient

Easy Top-ups

The designers of the Fidelity platform clearly recognise that for many people investing is a process rather than a single event. As a result, the Fidelity system allows you to easily add extra funds in the event that you decide to expand your portfolio further down the line rather than committing to a complex and large investment programme in advance. This top-up function is particularly handy for those who are following a savings-based approach to investments: if you’d like to add a certain proportion of your monthly income into your investments, for example, then the Fidelity platform makes it simple to do this. Choosing to buy or sell a new investment trust, exchange-traded fund or individual share, for example, is as simple as clicking the “buy” or “sell” button.

It also aids those who want to take a time-based approach to their investments, too. By giving you the ability to alter the value of your investment if the market reaches a point at which you believe your portfolio will become more profitable, for example, the Fidelity system offers you a high degree of control over timing and allows you to make your own decisions about when to finalise your investments.

- Control how much you invest and when

- Add extra funds to your account easily

- Time your investments around market conditions

- One-click portfolio expansion

Investment Finder Tool

Those who have a good idea of what they want their investment portfolio to look like but aren’t certain about which part of the market they should zoom in on, will find value in Fidelity’s investment finder tool. Located on the Fidelity website for maximum accessibility, this tool asks the user to select what sort of investment type they are looking for, funds, for example, or investment trusts, along with a handy primer on what each type of investment means. Once this has been selected, a range of filters will appear to give the user more choice over the sort of investments they want to see. If the Shares investment type is chosen, for example, a range of filter options such as the Morningstar rating, the market cap and the dividend yield will appear. This allows the user to remove the sorts of investments which don’t suit them and their personal financial circumstances, while keeping those which do. The results can then be filtered again in the third stage on the basis of a range of data metrics, including long-term performance, annualised performance and previous profitability. For those with a basic knowledge of investing, but who require a curation service for added insight, this tool is a great way to locate the right investment type for you.

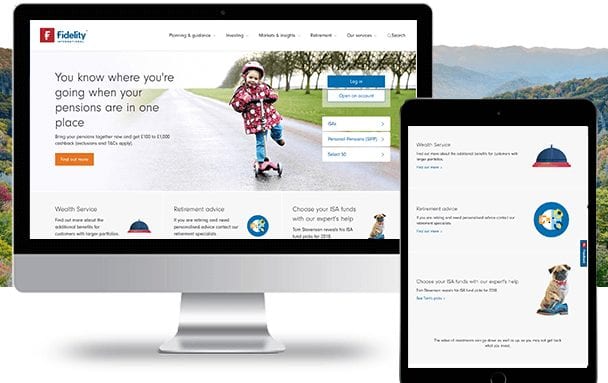

Mobile Management

The Fidelity system can be accessed through a web browser on a desktop computer, but it can also be reached wherever you are thanks to Fidelity’s mobile app. This can be downloaded to a smartphone or a tablet and allows you to access the same functions as the computer-based version. Gone are the days of long-winded administrative processes, riffling through newspapers and multiple tabs on your desktop to find the best investment for you. This handy app is ideal for those with other occupations or those for whom investing forms an income sideline, this functionality means that portfolio management can easily take place around other commitments such as work. Seeing your account organised into a simple overview means that you can track cash levels, performance and more at the touch of a button. The Fidelity mobile app, meanwhile, contains a wide range of features including the “Fidelity Insight” section for resources like financial news from your chosen sector, detailed chart data for indices and stocks relevant to your portfolio, and news on everything from US market analysis to Asian equities. To help make your investing as easy as possible, the Watchlist feature allows you to track whatever aspects of the market you’re interested in.

- Management of your portfolio available wherever you are

- Clear overview of performance, cash levels and other account data

- Watchlist feature designed to boost your industry knowledge

- Fidelity Insight provides handy market research information

Platform Security

Investing large sums of cash requires some prudence in order to ensure that your financial information and assets are not compromised. As a result, the Fidelity system is highly secure, and was designed with user safety in mind. The platform comes with a range of safety features, including an automatic log off system which prevents you from remaining logged in if you become inactive, as well as a fully encrypted website with a certificate that is verifiable through your web browser.

The Fidelity Security Key system, meanwhile, aids secure logins thanks to its username and password encryption service, while Fidelity’s membership of the fraud prevention organisation Cifas means that resources will be available for you in the event of a data breach. Fidelity has a number of other policies in place which protect you and your investment, too. Fidelity will never send an email which directs you to a login page, for example, and you being aware that this is the case reduces the risk that you will fall victim to a phishing scam. It also encourages you to practice good online safety behaviours. Fidelity is also committed to not asking you to provide sensitive information, such as your full PIN number, over the phone or via SMS or email.

- Automatic log off during inactive periods

- Full encryption services available

- No over-the-phone PIN number requests

- Membership of anti-fraud organisation Cifas

Customer Service

The Fidelity customer service platform has lots of advantages, including a UK-based phone contact service which is open six days a week. The Fidelity website also has a handy chart which illustrates when peak call volumes occur: it’s advisable to get in touch between 9 and 10 am or between 5 and 6 pm from Monday to Saturday if possible, as that’s one of the quietest times on the phone lines. For those who particularly value security or who plan to exchange sensitive information with the customer service team, however, Fidelity has developed an online chat service which is accessible for those who have an online account and are logged in. Broadly speaking, many Fidelity customers find the platform’s customer service offer to be satisfactory, with one TrustPilot user describing their experience in very positive terms: “You get a representative right away and it is clearly a human who is not frantically working 10 customers at the same time and has not been mandated to copy-paste stock gibberish instead of providing real help.” There have been some negative reports, but a broker comparison reveals that this is common throughout the industry – and not something that is unique to Fidelity. In order to maximise the chances of a beneficial and useful conversation with a customer service team member, it is wise to have all relevant documents to hand when you call or open an online chat.

Fees and Payments

The Fidelity system offers a lot of value, and the fees are generally relatively competitive. As is the case with many, although not all, brokers in the same field as Fidelity, the fee you will need to pay to use the Fidelity trading platform is linked to the total value of your investments. Fidelity’s basic administration fee for a do it yourself ISA investment currently sits at 0.35% for funds. This figure is higher than Barclays Direct Investing, for example, which charges a competitive 0.2% on funds, but is much lower than Tilney’s Bestinvest which has a fee of 0.4%.

For those who want to use the platform to re-invest any dividends which are made, Fidelity will charge £1.50, and while Hargreaves Lansdown offers a fee of 1% up to £10 for this service, a competitor like Barclays Direct Investing will do it for free. Although these may seem to some investors like significant chunks out of their investment income, it’s worth remembering that Fidelity also avoids charging fees on a range of services which often are charged for by other providers. There are no fees in place for account creations or closures, for example, while there is also nothing payable for transferring out pension products to a scheme based either here or overseas.

- Fidelity fees are competitive

- Often lower than major competitors like Hargreaves Lansdown

- But other competitors offer even cheaper charges

- No fees on pension transfers or many account services

Fidelity: Our Verdict

As one of the leading names in the brokerage world, Fidelity has developed a reputation for being a market leader. There are plenty of advantages to using the system, including simple control over investment amounts and leading market insights available through the mobile app. Although there are some slight disadvantages to using the platform, such as mid-range fees rather than low-cost fees, or occasional negative reports of bad customer service, they are often outweighed by the high quality of service received in other areas of the platform. The Fidelity system offers a wide range of product choice designed to suit both those with a stocks and shares specialism, as well as those who need to maximise their ISA allowances. It is also committed to investor security by ensuring its site is properly encrypted. In particular, Fidelity’s fee structure regularly saves its customers money by making a large number of services free, despite these services often being paid-for across the industry: these include a free pension transfer service and a no-cost account setup process. Ultimately, Fidelity is a platform which can offer the casual or part-time investor an innovative, convenient and often cost-effective way to manage and grow their investment portfolios.

PEOPLE WHO READ THIS ALSO VIEWED: