The IG trading platform Metatrader 4 (MT4) is highly popular with Forex traders globally who like its ease of use as well as its range of additional tools. MT4 has versions that are suitable for Mac, iOS and Windows, and the Windows version has added extras, including a Forex rate reviewer and multiterminal use.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

The IG trading platform has an interface that makes it ideal for those new to trading but also for those traders with more experience. So is the IG MT4 the best Forex broker currently available?

Table of contents

A user-friendly interface

Trading can initially be a complex field to enter, especially with little experience, but MT4 is known as a flexible platform for traders to use and is not that complicated to operate. The platform can be used for a variety of options, so trading strategies can be tested, deals closed and quotes analysed by using a wide range of practical tools. There are options for traders to use LIFO (Last in First Out) as their preferred method of trading, or they can opt to use hedging so that potential gains or losses are offset.

IG MT4 can be set against an alternative platform, MT5, as a broker comparison. MT5 uses LIFO as its default position and does not support hedging, so traders need to be clear about the types of options that will serve them best. In terms of system requirements for PCs, MT5 requires more than MT4, and it also takes more RAM.

The MT4 platform can be accessed by traders from all over the world, and the data can be received in a number of major languages that include Spanish, French, Chinese, Japanese and Russian as well as English. This makes the platform highly accessible, hence its popularity. Preset templates are provided so that charts can easily be read, and traders can simplify these if they wish, as colours and styles can be edited. If a feature is not required, it can be deleted, and there is easy access to online information.

Mobile trading

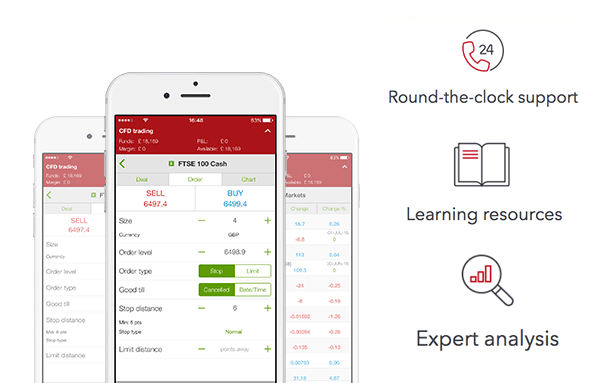

With the ubiquity of tablets and smart phones, it has been essential for Forex trading platforms to keep up with the technological challenges of serving traders who are constantly on the move. IG MT4 would commonly be used on a desktop or laptop computer, but the platform has also been designed to let traders use the IG application on smart phones and tablets, either powered by Android or iOS.

There is good functionality for the mobile app, with traders able to access interactive quote charts, a full set of trading orders and analytical tools that are the most popular. The interface is very similar to the version for desktops and traders can monitor their account status and track the history of their trades as well as buying and selling financial instruments with a single click. Added features include push notifications and the ability to chat with other traders.

As trading takes place effectively 24/7, as markets open in different time zones, it's an essential part of a trader's toolkit to have that access from anywhere in the world, be it to Forex markets or keeping an eye on stocks and shares prices and how they are moving on an ongoing basis. The ease with which traders can now access information makes MT4 a powerful platform to keep in touch with market fluctuations and take advantages of trading opportunities at any time of day or night.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Analytical functions

One of the most important things that traders need is to find out the direction of the Forex market, and IG MT4 has a range of analytical tools that do just that. The IG trading platform’s Forex technical analysis detects particular trends and patterns that consist of typical shapes or figures formed on symbol charts. A number of technical analysis tools use trends that have been identified and make forecasts on exchange rate changes in the future as well as defining entry and exit points into the market and setting levels of Stop Loss and Take Profit.

The analysis tools are made up of 30 built-in indicators, more than 2,000 free custom indicators in addition to a further 700 paid ones. These let traders analyse the market at any level of complexity. In addition, there are 24 analytical objects that include channels, lines, arrows and shapes and the Fibonacci and Gann tools. Using these tools, traders can forecast future price dynamics, and the objects can be applied manually to both charts and indicator windows.

Symbols can be displayed in nine timeframes, and traders who want their own indicators in addition to the 30 already available can either write their own or get assistance from an experienced developer who will help program exactly what is specified. The ability to forecast price direction, set support and resistance levels and detect a variety of trends with these analytical tools make this IG Metatrader an essential part of any trader's portfolio of technical support.

Automated trading

Sometimes it's not possible for people to spend as much time as they would like on their trading, so the MT4 platform developers have established algorithmic trading, also know as automated trading, as one of its strongest features. It allows traders to develop and apply what are called Expert Advisors and technical indicators to get rid of any obstructions when carrying out analytical and trading activity. By using the MQL4 IDE – Integrated Development Environment – traders can develop trading robots, the Expert Advisors, and technical indicators that can be as complex as required.

At the core of this feature is programming language MQL4, an object-oriented method for trading strategy development that offers a tool that is highly efficient, flexible and functional. There is a built-in MetaEditor specifically designed to develop trading strategies using MLQ4, and it also features a debugger, with compilation being performed in the editor. When the initial work has been completed, the application is moved automatically to MT4, which uses a strategy tester to test or optimise it, another part of the MQL4 IDE element.

The MT4 platform then runs the trading applications, making the last piece of the virtual environment. Traders can use the indicators set up to analyse markets and the Expert Advisor to trade in them, and though it requires some work to get set up, it can provide extremely useful back-up to a trader's own hands-on trading.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Using MT4 for Forex and CFD

As the most popular platform for trading Forex and Contracts for Difference – CFD – financial instruments, MT4 has impressive functionality. It doesn't matter if a trader is a novice or highly skilled, as the platform caters for all levels of experience. For traders who want to start working in the Forex market, it's important they understand the basics of how Forex works to make the most of the MT4 platform.

It's a global market that trades solely in currency and is larger than all other financial markets due to the volume of trades made every day. Financial industries, including banks, private investors and funds, buy and sell all manner of different currencies that are worth trillions of dollars, a figure that continues to grow. Technology means that currencies are traded 24 hours a day, with a number of currencies, including the US dollar, Japanese yen, Euro, Pound sterling and Canadian and Australian dollars, considered the most popular in Forex trading and are paired up.

Traders can also pair less popular currencies and speculate on the movement of currencies, buying and selling at the right time in order to make a profit when a currency drops against its pair. When traders open an IG account, they get instant access to the enhanced MetaTrader 4. Although MT4 is known mainly for its use for Forex trading, it can also be used to trade other markets, commodities, cryptocurrencies and indices via CFDs or for spread betting.

Charges with IG MT4

As with any broker, IG works to make its charges as transparent as possible. Traders should always look around to see how Forex trading platform comparison charges compare. Those who sign up for an account with IG can get reduced minimums over six weeks trading UK share CFDs and for two weeks for spread betting and any other CFDs.

When a trader adds share dealing to an existing IHG account, there will be a £5 commission rate on UK shares as long as at least one CFD trade or spread bet has been placed during the previous month. It's particularly important for traders signing up for an IG account to take time to examine the charges and costs, as there are many different methods of charges being made. Especially for inexperienced traders, it can take some time to fully understand the complexity. There are different methods for charging for

- Commodities

- Forex

- Shares

- Indices

- Equity options.

In addition, there are share dealing charges and Smart Portfolio fees, and traders can examine a formula sheet for charging to further understand future costs. IG notes that total costs will increase in proportion to a trader's sizes and volume of trading.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Protection of traders' money

IG states that when a trader puts money into an account as a retail client, there are a number of protections in place. Money is held in segregated client bank accounts held at regulated banks. Assets, for example shares, and money are not merged with IG's assets and shares at any stage. The trader's assets are held by a custodian using segregated client asset accounts, and all processes are authorised and regulated by the FCA (Financial Conduct Authority). IG asserts that all money and assets of traders are ring-fenced as a further protection in the unlikely event that the company goes into liquidation.

The company also doesn't use client money or assets for business activities, unlike banks that are permitted to use their clients' finances for business purposes. Essentially, this means that the cash or assets belong to the trader and not to IG, and because they are held under trustee arrangements, they are all easily identifiable as belonging to the client. Shares bought at or transferred to IG are also held in segregated client accounts with approved custodians and under nominee arrangements. Traders should be aware that shares may be pooled with the shares of other clients, but never with shares that IG owns. This again makes ownership easy to identify in the same way as with cash holdings.

Our verdict

IG was established in 1974, so it has over 40 years of experience in financial trading. With more than 178,000 clients worldwide and trading in over 16,000 markets, it is well placed to offer a high level of service. The company was the first of its kind, and its continued growth in a highly competitive field demonstrates a deep understanding of financial markets and how to help traders work in them. In our IG review we found that its MT4 platform is arguable one of the best trading platforms available, giving a wide range of tools and information so that those just starting their Forex and other trading work can easily understand the basics as they develop their experience.

For traders who have been in business for some time, the option to use advanced tools with charts and other analyses at their fingertips provides a secure and up-to-date environment for constant trading. Add in the ability to develop an automated trading programme and the knowledge that charges are kept as low as possible with all client money and assets protected, and you have a platform with IG MT4 that offers a powerful tool for successful trading.