Have you ever bought a stock at 10, bought more at 8, bought more at 6 and felt the agony? Have you then seen the stock go even lower, you taking the stop at 5, feeling useless, finally realizing “good I took the stop I will never look at this stock again”, only to see the same stock trade at 8 the following week? This is the classical problem most traders do not understand, nor do they have the tools to control this negative behaviour.

What if I told you that even experienced traders fall for the most classical pitfalls of trading? You would probably get discouraged from even thinking about trading. In order to trade successfully, you need to study a lot, be up to date with information etc, but even more important is understanding the psychology of both the individual as well as the aggregate market.

This is the first step. For longer term success you also need to understand the “game” of risk and profit and loss management. Let’s start with market psychology.

Example Of Typical Market Psychology

The image below shows what most people have experienced when it comes to trading: frustration and agony. Trading is an emotionally demanding profession. Psychology of both the individual, as well as the market psychology, constantly affects the decision process. It is therefore vital to understand this process.

Below is a hypothetical chart showing various phases of a typical trade.

The trader, call him Simon, enters a long trade after his friend John recommended this is a great trade. Initially, Simon is off making good money.

Despite making money, Simon feels like a relative loser, why did he not buy the stock when John said, a week earlier. He would have been “richer” by now. Despite making money, Simon feels like a relative loser as he did not buy at the same great price as John. The initial recommendation by John made Simon only watch, but eventually he bought and made money directly.

Pullback After The Gain – Doubling Down Into Losing Position

The stock reverses soon and Simon is initially happy, thinking he can buy more at a cheaper price. He ends up buying the second batch and is now into the evil game of averaging down a position, i.e. buying more at a lower price.

Suddenly, the stock starts moving lower but with increased intensity. Simon is still happy to buy more at cheaper prices, but the bargain is starting to feel a little too much of a bargain. Why is this stock down so quickly? Who cares, John said it is a great stock and he knows his stuff. Simon is into averaging down as well as trading on other people’s “tips”, another dangerous “game”, but he does not realize this yet.

Simon has by now bought the third batch and is underwater, negative on the overall position, but he is feeling ok about it. Why? Simon has bought at a total price that is below John’s price. Simon has now engaged into another fallacy, referencing and comparing to others. Simon is happy he is long at a lower price in relation to John.

The sharp fall in the stock is getting a bit “annoying” as the loss is relatively big for Simon. No worries, next time the stock bounces I will sell is Simon’s reasoning. The problem is the stock does not bounce but continues trading lower.

At this stage Simon is developing negative behaviour, can’t really sleep like he did before he got involved into this stock. He looks at the constantly sinking share price and it is all starting to affect his mood. He tried calling John a few times, but he is not picking up.

A few days down the road, the stock starts accelerating to the downside, Simon has bought the fifth batch, as the SEC starts an inquiry about a purchase the company made last year. The stock is in free fall pretty much.

Referencing your own behaviour

Eventually Simon decides taking the stop thinking, “what an idiot I am, why didn’t I take the stop directly, why, why, why”? After taking the stop, he is exhausted but relieved. He lost a lot of money, but he is happy, no more misery. A few days later he looks at the stock, realizing it has gone down even more. Despite having lost all the money, Simon is feeling happy as the stock continued lower. This is another classical problem of referencing your own behaviour. Why on earth should you feel anything in a stock where you do not have a position in.

A few days later the stock bounces, Simon is watching it again, but as the stock takes out a new low, Simon is once again back to feeling happy.

John is still not picking up the phone, but who cares, John has lost money and is probably even more depressed than Simon.

A few days later, the stock starts moving higher. Simon is still happy as he promised himself to never trade this stock again. That same day John calls Simon, all upbeat, having spent a few weeks on a “well deserved” vacation in Thailand. Simon is puzzled, how can he be so happy having lost all the money. After a short conversation, Simon finds out John sold out his position right at the top and went for the trip to Thailand. Simon is feeling disgusted. Simon is the big loser and he wants to throw up thinking back on the past week’s trading in this stock.

What is “worse” is that John once again outlines his bullish arguments about the positives going on in this company, especially now as the SEC did not find any wrongdoings. Add to this that John bought the stock again last week, close to lows.

Simon can’t hold back his feelings now; “you bought it again”?!

Exhausted By Emotional Trading (Or Watching)

The stock continues higher. Simon has one thing in his mind, had he not sold his stocks everything would have been much better. Stop losses! Who invented these stupid stop loss rules? A good company is a good company, you do not need stop losses when you are dealing with a good company. The agony Simon feels now is another classical pitfall of many traders. They “get married” to companies and positions and fail to see trading as a “job” where feelings are controlled.

The stock continues higher, Simon feels totally exhausted again, this time by just observing the stock climbing higher and calculating how much he would have saved by not taking that stupid stop loss. A few days later, John calls him, says he had averaged up, i.e. bought more shares as the stock was going sharply higher and fundamentals looked good.

Finally, Simon gives in to his promise, buys the stock again, feels once again happy as he starts making money initially, and he actually bought at a lower price than the first time.

The story has most ingredients to what all traders have experienced. Agony, fear, happiness, depression, guilt, relief and many other feelings. The inexperienced trader will be guided by feelings, while the professional trader knows how to control these feelings. Feelings must be managed and can not ever interfere with trading. You must have the proper methodology of how to treat your feelings and how to manage your risk and money.

The chart displays greed and fear at its best!

There are several studies suggesting that majority of day traders lose money. It is important to understand the reason why you are making or losing money. Do you overtrade, do you take appropriate risk, do you make money by being lucky?

You simply must understand your p/l!

EMH and decision making under uncertainty

Traditional financial literature is based on the efficient market hypothesis (EMH) that states: one cannot consistently achieve returns in excess of average market returns on a risk adjusted basis, given the information available at the time. The theory basically assumes all available information is reflected in prices; therefore, one cannot predict future prices.

Why do people trade then? Why do we have people that produce extraordinary results year after year?

There are challenges to the EMH theory due to deviations from the above. Psychological aspects affect humans and we don’t live in a perfect world. Two examples that affect the financial markets are:

- Information is asymmetric – this simply means that two different counterparties in a transaction have different knowledge about the transaction. In any given point of time people will have different information.

- Investors possess feelings – recall the example of Simon and John in the above example. One common term often referred to is herd behaviour among investors that is all but rational.

Behavioural finance tries explaining the economic man but includes the various imperfections of the irrational human. A few aspects the theory considers are:

- Cognitive bias – this is the unconscious mechanisms humans can’t control. You can try to control it but the definition itself states it is not possible to control it, but you can develop skills how to cope with the pitfalls of cognitive biases.

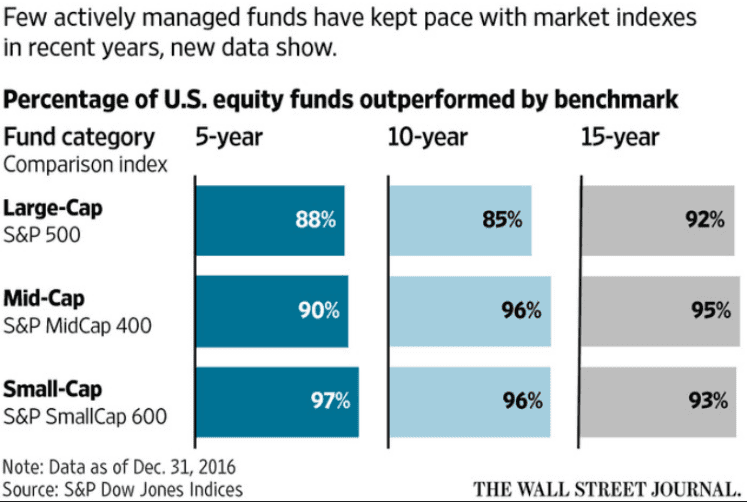

- Overconfidence – good periods in trading often make the trader less aware of potential risks and negligent behaviour often leads to falling p/l. Most people exaggerate their own skills, which in turn produces the fallacy of over believing their own abilities which eventually lead to overconfidence. Most portfolio managers believe they will beat their benchmark index, but still most continue to underperform. Have you ever heard a portfolio manager that thinks he will perform worse than his benchmark index?

- Overreaction – positive or negative reactions are usually exaggerated and lead to less rational behaviour. How many times have you seen financial assets move sharply one way, only to reverse a few minutes later? Markets are not perfect; we experience various forms of liquidity traps that increase volatility. Add to this most of all trading conducted by computers these days and overreactions are a part of everyday trading. Believe it or not, but below is trading in one stock over a few seconds, spread out over a few of the US exchanges and marketplaces.

- Information bias – focus on relevant information versus irrelevant information. Investors are bombarded everyday with tons of totally irrelevant information from media, internet etc. What is the relevant piece of information worth focusing on? How do you decide what is noise and what is relevant information?

Irrationality itself is unpredictable but cognitive aspects, deviations from rational behaviour are predictable. We can predict to some degree the behaviour of people and control our own personal cognitive shortfalls. Remember the old proverb from Keynes?

“Markets can remain irrational far longer than you or I can remain solvent.”

Expectations

All decisions are based on expectations. Humans base their expectations on hope, fear, good, bad and various other feelings. Information from past experiences also form our future expectations. Add also new information to the above mentioned and it is fair to say the process of decision making is complex. The human brain simply needs to take in and process vast amounts of information that is affected by various past experiences and is finally mixed with new information.

How does this affect my trading?

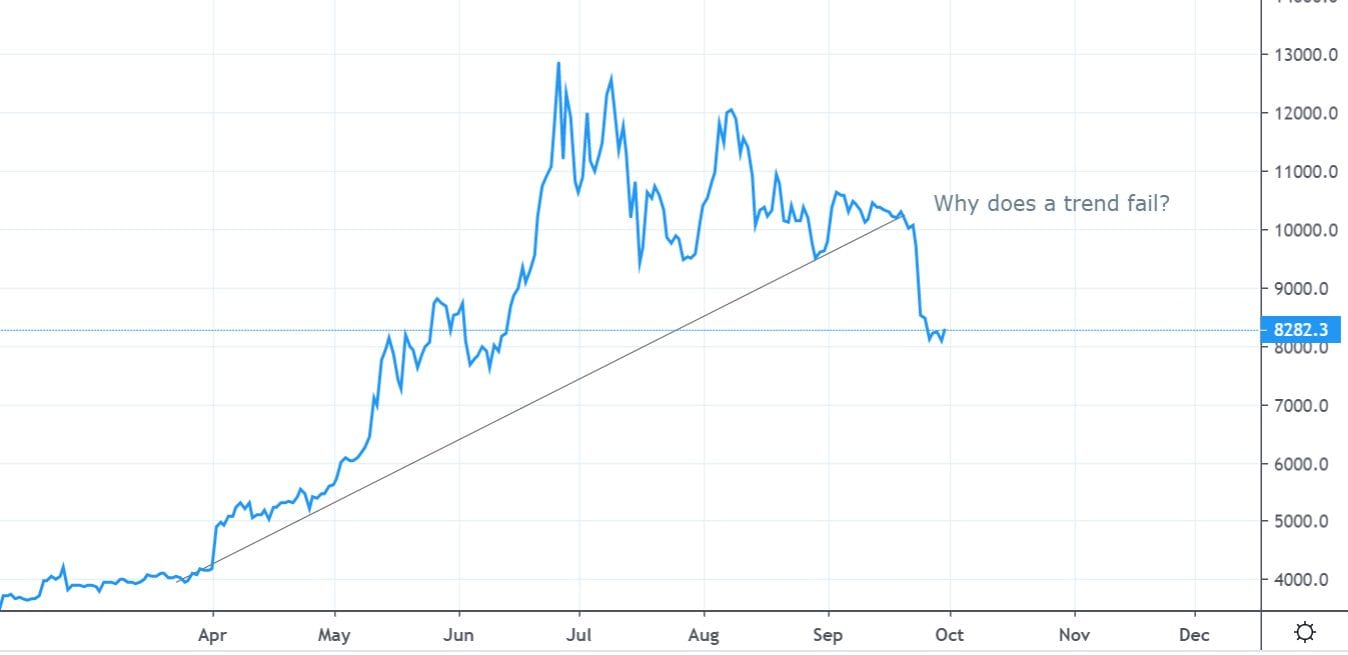

Consider a trend line for example. Past information and experience tell the trader a specific stock should find support on the trend line and bounce, but trend lines still get broken. Why does this happen? Is this an effect of new information or psychology of humans affecting the trend line itself? Many people often refer to technical analysis as self-fulfilled prophecies, but they still give credit to technical analysis and charts. If people expect a stock to bounce on a certain level and it bounces, the following times we reach the same level, people will have an even higher expectation of the stock bouncing on the level for example. The expectation of the stock bouncing can often lead the bounce itself. The even more interesting scenario is when a stock is expected to bounce by most, but it fails and breaks down. Expectations are formed, but not realized, and this often creates big volatile price moves. One perfect example of realized expectations and then “failed” expectations is the moves we have seen in wild Bitcoin.

Consider the expectations during the phases of the trend line holding, and then the big moves lower as the trend is broken. All these moves have little to do with new information hitting the markets but is more a pure play o the human psychology and expectations.

Expectations and goals

Another central concept is the traders’ expectations versus the goal. As outlined above, most fund managers, traders, financial decision makers believe they will beat the market but still most portfolio managers underperform (irrespective of fancy charts of Sharpe ratios etc they show you when selling their product). It is amazing how irrational the investing/trading space is. There is probably no other industry where the individual performances underperform so much to what the goals and expectations are.

I used to run several trading desks at major investment banks and every year all the traders on my desk would try convincing me they would provide higher returns than the previous year, irrespective of market conditions and irrespective of what they had produced the previous year.

Having goals is important, but when goals are not realistic, you start forming expectations on your “irrational” goals, which eventually becomes dangerous as you as a trader end up engaging in too much risk in order to realize your goals based on “wrong” expectations.

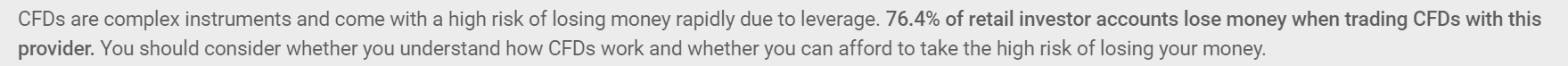

These days the retail client is given relatively complex trading platforms, but they are never explained how to trade and even less how to manage their risk. Just log on to any of the social trading platforms and you will hear about trader X having gained 15% last week and you can start copying his/her trades. Making 15% in a week is great but setting such goals will affect you in a negative fashion, and you will eventually end up losing a lot of money as having expectations based on unrealistic goals is fatal. How many traders do you know that talk about risk and money management, and not their great trades? If people only tried to understand the psychology behind trading (and ultimately the risk aspect of trading), we would not have the warning texts CFD brokers of today must present on their ads.

Final words: The belief that one will beat the market (or your past p/l) affects the investment/trading decision process!

Overconfidence affects all decision making.

There are many fallacies when it comes to how people evaluate opportunities. A classical fallacy is the gambler’s fallacy (Monte Carlo fallacy) where people, for example, believe that because the roulette wheel has been showing X reds lately it must mean a black is up next? How many times have you been to the casino where guys stand next to the roulette and bet on red just because we have had 10 greens in a row?

The gambler’s fallacy is present not only in gambling but in trading as well. How many times have traders expected a stock to bounce just because it has traded down X days in a row? Expecting a bounce just because the stock has traded lower is not rational. Such behaviour can be fatal to your trading as you expect non rational events to take place.

The Decision Process

The decision process of a trader is extremely complex. The cognitive process affecting all humans is always present (remember we cannot control this). Genuine decision making is also often a habit or routine, i.e. the past influences future decision making. Very seldomly does a trader objectively and rationally make the decision process from the start without incorporating experience. Whenever you look at a chart pattern for example, you will automatically compare it to another similar technical trading set up you have seen before. The past is always present as the decision process is formed.

Add to this that a trader makes decisions in a stressful environment, constantly bombarded with new information while watching asset prices move in real time. These external factors affect the decision process in a complex way. This is of course more applicable to shorter term traders than to long term investors.

How many times has a trader been planning to buy a stock, waited for a good entry level but the stock moved quickly, maybe new information hit the market, and suddenly the trader starts chasing the stock 5% higher to then see it revert down after he bought it? This type of behaviour creates an enormous stress. These are decisions made under stress since the process is dictated by the environment (the market) and is not a rational, non-stressed process where you rationally evaluate your best option. Traders rely many times on their experience which can be good, but all experience has a cognitive bias.

Probably the most well-known theory in behavioural finance is the Prospect Theory by Tversky and Kahneman. In short, the Nobel prize awarded duo’s theory can be summarized as:

- People focus on individual losses or gains and not on total wealth.

- Loss aversion rather than risk aversion is the main theme. People tend to evaluate a single trade instead of focusing in the overall value of the entire portfolio.

- Given two positive options people choose certain over probable payoffs, even if the expected value is more favourable for the probable outcome – This is best seen when people take profits too quickly as they trade. A certain profit in a stock is more valuable to the person than continuing to add to a winning trade (more on this later). This is a classical dilemma for most traders, especially new to the game of trading.

- Given two negative options people, one certain and other probable, people choose the probable, even if the expected value is for a higher loss – they have the chance to escape the loss – this is the psychology of stop losses. Stop losses are emotionally hard to digest but should be treated as the most normal aspect of trading. Instead of taking the stop loss, people continue to add to losing positions and rely on hope as a strategy (recall Simon from our example above).

- Risk aversion – preference for a sure outcome over a prospect with an equal or greater outcome.

- Loss aversion – Losses loom larger than gains. Losses are much more painful for people. People see losses as much more traumatic events than profits, even if the loss is smaller than the profit. How do you feel when you make 5k USD? How do you feel when you lose 4k USD?

- Certainty effect – strong preference for positive outcomes.

- People overestimate small probabilities and underestimates high probabilities. Otherwise people would not buy lottery tickets, nor bet on roulette wheels.

- Framing of goals influences how people take risk.

- Loss or gain depends on reference point. One example: you buy a stock at 50, it goes to 100 (you feel great), the stock then goes back to 55. You are still up 10% on your investment but how do you feel? Most people feel they have (almost) lost money since they tend to have 100 as the reference point. This is very present among traders that trade swing type of trading.

The Mindset of a Trader

Below is a classic example of decision making and has big implications with regards to how traders need to adjust their decision-making process. It is a “mind game” which clearly shows the above discussed clearly. In a hypothetical example, let’s assume:

You pull out a marble by chance from a box:

- A: You get 1000 USD if the marble is blue. Otherwise, if the marble is red, you get zero.

- B: You get 700 USD for sure.

Majority go for the second option; people take 700 USD which is certain money in the bank even though the expected value of the situation A is larger. This is a direct effect of the certainty effect Tversky and Kahneman have explained so well. This is exactly how novice traders (and actually many experienced traders) continue doing. People end up justifying “it is never bad to take a profit”. The problem is when you take the profit, you also end the chance of a winning trade developing into something amazing. Imagine, instead of taking the profit, you continue to average up, just like John did in the example above. Adding to a winner is the winning trading strategy, i.e. deploying more capital to the winning trade, instead of like Simon did, averaging down, losing money, becoming depressed etc.

The following example below has the same expected probabilities as the example above but, instead of certain outcome, we have changed it to be an uncertain event.

- A: You lose 1000 USD if the marble is blue. Otherwise, if the marble is red, you don’t lose anything.

- B: You lose 700 USD for sure.

In this example where there is a possibility of losing people tend to go for option A. This gives them a possibility of escaping the loss, despite the probabilities favouring the other option. This is exactly the problem Simon had. Instead of cutting the position and taking the stop, he continued to average down, put more money into a losing trade, buying more, hoping for it to bounce so he can sell out flat. This is the “chance to escape” people so often come back to. Escaping the loss is a big fallacy people tend to come back to year after year.

The successful trader needs to think the rational way, i.e. add to winners and cut losers. Everybody knows this phrase well, but still people end up doing the inverse.

PEOPLE WHO READ THIS ALSO :