Listed companies will, at their discretion, distribute profits among shareholders at regular intervals. That means investors can benefit from capital growth (the share price going up) and dividend returns (the income stream they receive).

With many central bank interest rates still hovering near zero, global savings accounts often offer lower annual returns than those provided by high-dividend stocks. The dividends are not guaranteed to the same extent as the returns on a savings account, but historical data points to them being relatively consistent over the long term. The added kicker is that if you pick the right dividend stock, you can expect to see the share price surge and lock in a capital gain.

The approach forms a core element of modern investing, and the popularity of the method means a lot of information and research is freely available. Picking the right stock is part of the process, but you also need to choose a trusted broker that offers the services you need. This review will outline the easy steps to buy the best dividend stocks in India.

Five Best Dividend Stocks in India

India's stock market is full of stocks that pay healthy dividends. As of the 30th of September 2021, the average annual dividend paid by member firms of the Nifty 50 index in India was 1.17%. Some smaller firms that aren't members of the Nifty 50 pay dividends higher than the average of the blue-chip index. From a risk-return perspective, the added security of the firms in the Nifty 50 comes from having larger market capitalisations and longer track records. That makes Nifty 50 members the ‘best' if not the highest yielding, dividend stocks.

The information about each company's yield-return is freely available because India’s listed companies must provide dividend information in their financial reports. That makes it easy to compile a list of the best five dividend stocks in India. One top tip is to factor in each firm's track record of paying dividends. The fact that a company is in the top-10 this year is no guarantee that they'll be there next year. Reliability is vital; look out for names that consistently return cash to investors, like these:

1. Infosys Ltd

Bangalore based Infosys has been operating for more than 40 years and in that time has built up a global client base extending over more than 50 countries. The firm provides IT, consulting, and outsourcing services to big-name brands such as Goldman Sachs and employs more than 267,000 people.

The firm is committed to long-term business goals as outlined by the recent statement from the founder, Chairman and CEO, N. R. Narayana Murthy.

“Good corporate governance is about maximising shareholder value on a sustainable basis while ensuring fairness to all stakeholders: customers, vendor partners, investors, employees, government and society.”

Source: Infosys

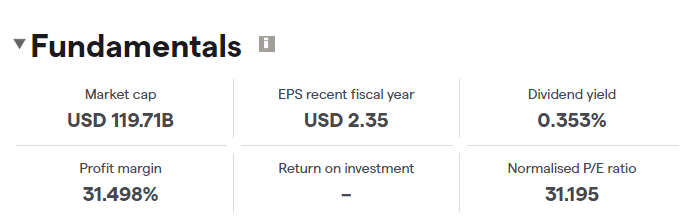

Source: IG

The shares can be traded using local brokers or the ADR (American Depositary Receipt) version of the stock listed on the New York Stock Exchange and available to trade at offshore brokers.

- 2021 – Annual dividend amount per share: 1.1596%

Source: IG

Infosys has benefited from some outsourcing operations being fast-tracked following the Covid pandemic, which is reflected in some impressive performance data for the three months ended the 30th of June 2021:

- Revenues increased 18% to RS278.96bn

- Net income increased 23% to RS51.95bn

- Revenues reflect Financial Services and Insurance (FS) segment increase of 24% to RS92.17bn

- Retail, Consumer packaged goods and Logistics (RCL) segment increase of 23% to RS 41.75bn

- Manufacturing (MFG) segment increase of 20% to RS27.02bn

- North America segment increase of 18% to RS172.06bn

2. Reliance Industries Ltd

Headquartered in Mumbai, Reliance Industries offers investors the chance to invest in a range of sectors. The firm's diverse business operations include energy, petrochemicals, gas production, retail, telecoms, textiles and media.

- 2021 – Annual dividend amount per share: 0.29%

- 2018 – 2021 – Average annual dividend amount per share: 0.37%

Source: IG

Shares in the firm can be bought on the domestic exchange. However, to make things easier for international investors, offshore brokers offer a GDR (Global Depositary Receipt) available through them.

3. HDFC Bank Ltd

Big blue-chip firms can be good dividend payers. India's largest private bank by assets and market capitalisation and the third largest company on the Indian stock exchange is no exception. Incorporated in 1994, it now has 120,000 employees and is well-positioned to benefit from the growth of the Indian economy. It focuses on the retail sector, issuing loans and credit cards to its millions of customers who are now being invited to embrace new technologies such as the digital payment products Payzapp and SmartBUY.

Source: IG

Source: IG

For the three months ended the 31st of March 2021, HDFC posted the below positive returns:

- Interest income increased 5% to RS1.276trn

- Net interest income after loan loss provision increased 11% to RS529.45bn

- Net income increased 25% to RS325.98bn

- Net interest income after loan loss provision reflects Wholesale Banking segment increase of 39% to RS126.16bn

- Retail Banking segment increase of 4% to RS391.94bn

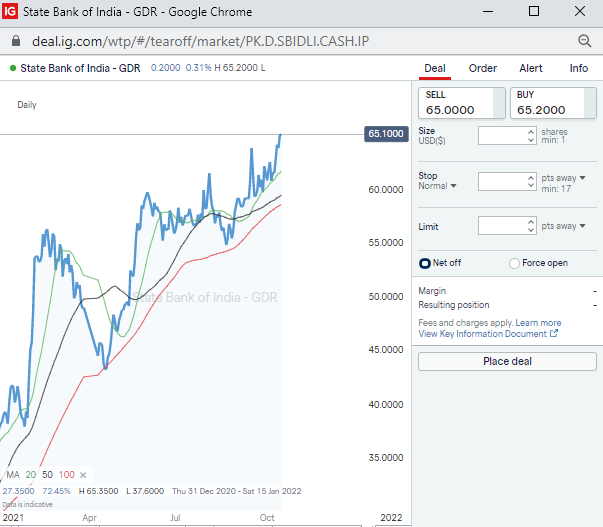

4. State Bank of India

State Bank of India is an Indian multinational public sector bank and financial services firm. Its head office is in Mumbai, Maharashtra, and it is the 43rd largest bank globally. In the Fortune Global 500, the State Bank of Mumbai was ranked 221st in the list of the biggest corporations in the world, 2020 – the only Indian bank to make that list.

The bank has been operating for more than 200 years and is one of the most trusted firms in India. That doesn't mean business growth and enhanced income streams aren't on the agenda. The firm has several corporate divisions busy developing market share, including SBI General Insurance, SBI Life Insurance, SBI Mutual Fund, and SBI Card. SBI has spread its presence globally to service members of the Indian diaspora and operates across time zones through 229 branches in 31 foreign countries.

Source: IG

- 2021 – Annual dividend amount per share: 0.82%

- 2011 – 2021 Annual dividend yield range from 0.33% – 3.42%

5. ICICI Bank Ltd

Financial services firm ICICI Bank is included on the best dividend stock in India list based on its potential rather than current yield. The company offers a range of services extending from domestic insurance to investment banking. Therefore, it is well-positioned to benefit from the uptick in global interest rates that many analysts are forecasting. The higher the base interest rate, the more chance banks will improve their profit margins.

- 2021 – Annual dividend amount per share: 1.1596%

Source: IG

The bank's market cap of $65bn offers investors some security, and the normalised P/E ratio is a relatively low 22.2. Shares in the firm can be bought in local or ADR form using onshore or offshore brokers.

Source: IG

The financial statements for the three months ended the 30th of June 2021 point to the potential of the firm in terms of future dividend payouts:

- Interest income increased 3% to RS230.97bn

- Net interest income after loan loss provision increased 85% to RS165.1bn

- Net income increased 52% to RS47.47bn

- Net interest income after loan loss provision reflects Net Interest Margin, Total percentage increase of 5% to 3.89%

- Other interest increased by 71% to RS12.43bn

- Interest or discount on advances or bill increase of 2% to RS156.97bn

Why Invest in High Dividend Stocks Now?

While all investment is inherently risky, high-dividend stocks sit at the safer end of the risk-return spectrum. They might lose ground to growth stocks when markets are booming but perform better when the economic outlook deteriorates.

- Firms with solid revenue streams tend to offer protection from economic slumps. They can iron out bumps in long-term business cycles.

- The income generated is passive. Nothing more is needed than to continue holding your shares – the firm and the broker will organise the dividend payment process.

- Inflationary fears are casting a shadow over the stock markets. Dividend stocks tend to outperform growth stocks during times of inflation.

- Some dividend stocks have just maxed out on growth. A firm that has reached a capacity size and decides to carry on churning out dividends is not to be dismissed. There may be barriers to entry to rivals which make that firm a safe if relatively dull bet.

- The COVID-19 pandemic and associated lockdowns highlighted how shock events could impact the markets. Having a percentage of your portfolio in the best India dividend stocks helps diversify the risk profile of your holdings.

What to Know Before Investing in India Dividend Stocks?

It's possible to make substantial long-term returns from high dividend stocks, but every investment decision involves a trade-off. Below are some of the potential downsides to keep in mind.

Opportunity cost

By tying cash up in more risk-averse positions, you are forsaking the chance of catching the next big thing and making a short-term speculative gain. Amazon, Zoom and Google (Alphabet) are examples of firms that have seen their share price increase by many multiples in a short time.

Many firms categorised as growth stocks have never paid a dividend. Instead, they are backing themselves to provide investors with capital gains by reinvesting their spare cash into new business projects. This approach can result in a share price soaring far higher than it ever will with a high-yield India stock, even if the firm has never made a profit, let alone paid a dividend.

You still don't remove all the downside risk

While high-yield stocks are largely insulated from economic downturns, they aren't immune. The unprecedented events of 2020 rocked even the most respected of business models. As the global economy ground to a halt, so did international trade and firms in the travel sector, which had previously been safe bets in terms of dividends, faced the threat of going into administration.

Many big investors, like pension funds, buy into dividend stock specifically for the income yield. There can be a rush for the door if that dries up because there isn't much else to attract investors.

You still need to optimise your trade entry point.

Dividend yield depends on what price you pay when you buy. As the dividend paid to shareholders is paid according to the number of shares you hold, the lower the entry price, the higher the yield. If Investor A buys into a stock at a price twice that of Investor B, then A's long-term dividend yield will be half of B's. Using technical analysis and momentum trading strategies can help you buy the dip.

Dividend dates

Dividends are paid on specific dates and getting to grips with the terminology can help you understand how the dividend calendar works. This report discusses terms such as Record Date, Ex-Date and Payment Date and outlines the process, which is relatively straightforward. The good news is that dividends tend to be ‘priced in' to the share price. This means that as a stock approaches Record Date, the date when the shareholder is identified and allocated their share of profits, the price will reflect this.

Dividends and the Warren Buffet Paradox

Some high-dividend stocks are associated with firms that have reached capacity in their market. They have stopped reinvesting cash in expansion programmes because there just aren't many around. They might not be as exciting a proposition as some growth stocks, but they might also be lower risk. Their returns are stable and consistent rather than spectacular and speculative.

Investment guru, Warren Buffet, runs strategies that invest in high-dividend companies and targets firms just like the one described. One interesting point to make is that his investment vehicle, Berkshire Hathaway, ironically has never paid a dividend to BRK shareholders. That is because Buffet backs himself to make a better return by holding onto the cash than returning it to his investors in the form of dividends.

How to Find and Evaluate India's Dividend Stocks

If you're looking for dividend stocks, step one involves understanding the process used to calculate yield.

- The formula is annual dividends per share ÷ price per share.

- You simply divide how much was paid in dividends in cash terms in a given year per share by how much one share cost to buy.

- Dividends are categorised as Interim or Final. Interim is paid at some point in the financial year and the Final dividend after the firm's AGM. The total annual dividend income from a stock is the sum of these two elements.

The estimated yield calculations applied to each of the five stocks referenced above were calculated using the most recent dividend per share divided by the share price for each company. If prices had been taken on another date, then the yield calculation would have been different.

With dividend investing being so popular, many brokers and research firms offer tables and charts that present the data in user-friendly formats and based on real-time prices. That way, investors can use historical dividend data as the best guess of future income streams and current market price to estimate the prospective yield.

Historical returns are no guarantee of future ones, but it's handy to have such tools to hand when trying to steer a profitable course through the markets. AskTraders has also produced research notes such as this, which go into the subject in greater detail.

Choosing to use a well-known and regulated broker not only means you're protecting yourself from scams, but it's also the case that the established brokers have had more time to invest in the additional services and tools such as dividend yield calculators.

How to Start Trading Dividend Stocks Online

1. Choose a Broker

Finding your target dividend stock is the first part of the process – the second is choosing the right broker. The question ‘How to find a safe broker?' is a good one to ask, and any broker regulated by one of the below financial authorities is worthy of your shortlist:

Tier-1 Regulators:

- Securities and Exchange Board of India (SEBI)

- Monetary Authority of India (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Indian investors who use onshore brokers regulated by SEBI can take comfort from the regulator's mandate, which is:

“To protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto.”

Source: SEBI

It's also perfectly legal to buy shares in high dividend Indian stocks using an offshore broker. The distinction here is that the broker may be regulated by another organisation such as FCA or ASIC. Each of these regulators has similar mandates to SEBI. Offshore brokers can have a more global outlook and offer a wider variety of markets or instruments.

Good online brokers allow you to carry out all your trading and portfolio management using desktop or handheld devices. The added convenience of trading using your mobile phone appeals to many, and you can even complete the account registration process next time you have a few spare minutes. Those brokers that have moved entirely online have slashed the costs and charges associated with trading and have revolutionised the investment industry.

The mobile app and desktop platform will be your way into investing in the markets, so the good news is you can try them out for free. Demo trading accounts take seconds to set up and offer a chance to practice the mechanics of investing using virtual funds. It's a risk-free way to test a broker's capabilities and develop your trading skills, such as how to pick high dividend stocks. Test driving a demo account before trading with real cash is strongly recommended.

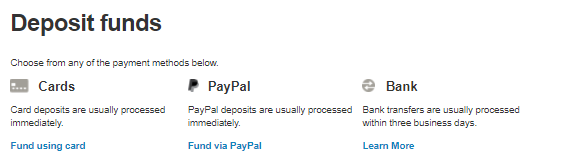

2. Open & Fund an Account

It takes minutes to set up an account with a broker and invest in India's best dividend yield stocks. The process can be done online using a desktop or mobile device. The few minutes spent setting up an account can be considered a good investment if the high dividend Indian stocks you buy generate income returns for years to come.

Source: IG

The online registration process involves providing some personal information, verifying your email and uploading proof of ID. Most accounts are confirmed instantly, and then it's a case of wiring funds into your new account. Popular payment methods include bank transfer and debit/credit cards. Payments using cards are usually credited immediately. e-Payment options are also possible, and as soon as the funds hit your account, you're ready to start trading.

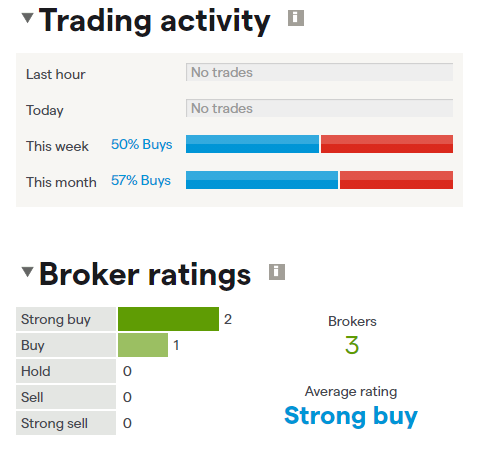

3. Research Companies Using Fundamental and Technical Analysis

Successful dividend trading relies on working out the long-term income streams of a company. Good brokers offer in-depth fundamental analysis of the different stocks. It might include news reports, analyst research notes or commentary from other investors. Tapping into this free research is an excellent first step and helps filter stocks that are ‘high-yield'. Once you've established which Indian dividend stock to buy, the next step is to consider technical analysis. This approach considers historical price data and uses it to build ‘indicators' that help traders spot short-term dips in price and other optimal trade entry points.

Source: IG

4. Open an Order Ticket & Set Your Position Size

The online stock buying procedures are easy to follow. Stripped down to the basics, it's simply a case of entering the number of stocks you want to buy into the trade monitor – then it's a case of clicking or tapping the ‘Buy' button.

Source: IG

5. Set Your Stops & Limits

Risk management tools that might be useful include ‘Stop Loss' and ‘Take Profit' orders. These are instructions that automatically close out some, or all, of your position if price reaches a certain level. Stop-losses help you scale out of a position if price goes against you, and ‘take profits' help you lock in gains if you make the right call. They can be added at the time of trade or any time afterwards and can help you trade the markets without having to watch screens all the time.

An alternative approach to risk management is to trade in small sizes. High-dividend stocks in India are relatively secure investments, but it's worth remembering that you should only trade with cash you can afford to lose. Following that rule means you'll also take the emotion out of trading and reduce the risk of panicking during a short-term price slump. If you choose not to use stop-loss orders, you remove the risk of being ‘stopped-out' during a momentary flash-crash. These can happen, and it's particularly frustrating to be kicked out of a position thanks to a brief price drop, especially if price quickly returns to the previous ‘normal' level.

6. Select and Buy India Dividend Stocks

Once you've input and checked your trade instruction, it's just a case of clicking ‘buy'. This will convert part of your cash pile into a stock position, and that asset will fluctuate in value according to live-market prices.

Your P&L (profit and loss) can be monitored using the portfolio area of your account, and that is where you'll head to close out your trade when you want to sell up. It is highly recommended to carry out one more check before putting your position to one side and letting it generate income for you. That is to check your portfolio positions and ensure that you bought what you intended to buy. Even professional investors make ‘fat finger' errors, and any mistakes are best rectified before price moves too far from the entry point.

One important check to make is that you bought your high dividend India stock outright and not in CFD format. CFDs are a popular trading tool and have some extra functionality compared to buying shares outright, but they incur daily financing fees. These stack up over time and eat into profits. If you're looking to hold your high-yield strategy position for longer than a few weeks, it will very likely be more cost-effective to avoid trading it as a CFD.

Summary

Most investment portfolios have space for India dividend stocks, and there are good reasons to include them. They help balance out the volatile returns of more aggressive strategies involving growth stocks and currently beat cash savings account returns in terms of annual yields. Beginners, in particular, might benefit from the fact that price volatility in dividend stocks in India can be at more comfortable levels. The sector is attracting a lot of attention right now, thanks to inflationary pressures in the global economy and a need to move into investments that offer some protection from rising prices.

The long-term approach benefits from some thought being given about which broker you use. Some brokers, for example, offer news alerts and high-quality research to keep you up to date on performance. Others compete on price, but the most important thing is choosing one which is reliable and trustworthy.

Indian dividend stocks might not be the most exciting market to invest in but making money never went out of fashion. Long-term data shows that in terms of investor returns, they offer a more than reasonable risk-return ratio. Sometimes you don't have to reinvent the wheel, and following established practices carried out over many generations of investors can still pay off.