For the investor looking to take a chance on the industry and get in before the potential leap in investment, AskTraders has come up with the below shortlist of the best hydrogen stocks to buy right now.

Hydrogen Extraction and Application

Hydrogen extraction and application have their foundation in a number of high-CO2-emitting industries. As a feedstock used to lower the sulphur content of fuels, and used in ammonia production, hydrogen has long been applied to energy-intensive chemical processes.

There is a multitude of ways to extract hydrogen from the air, water and ground. The most common and cheapest way currently is to apply steam to natural gas extracted from the ground. To a lesser extent, similar applications on processed coal are found in heavy industry.

Lower carbon-emitting extraction methods can be found in nuclear processes or lessening the impact of fossil fuel extraction via storing the CO2 produced in the ground. The wide array of production methods has given rise to a rainbow of colour coding to represent the various ways to extract hydrogen. There are nine in total.

The most common method today is grey hydrogen – fossil fuel reforming via steam. Blue is the sequestering and storing of carbon emissions from the grey method and is attracting investment from refiners sitting on legacy assets.

Green is the supposed cleanest method and applies a current from renewable power generation to the electrolysis of water in order to split the hydrogen and oxygen molecules. Green hydrogen is widely seen as the most preferred from a policymaker’s perspective, and as a result, is attracting the bulk of the new investment.

Once derived from the water, the hydrogen can be routed into existing industrial processes or into the expanding fuel cell market. Fuel cells are a rebinding of the hydrogen and water molecules via a catalyst, generating an electrical current.

Fuel cells though less efficient than batteries, at scale are able to compete and offer potential to heavy machinery looking for a long-lasting and long-range consistent energy source.

In certain corners, such as the North West of Australia, green hydrogen is gathering attention due to the ready availability of year-round solar energy and the close proximity of a wide variety of heavy machinery operating in iron ore extraction that could benefit from the steady power output of a fuel cell.

Best Hydrogen Stocks To Buy Right Now

Bloom Energy Corporation (NYSE:BE)

BE designs, manufactures, sells, and installs a wide array of fuel cells that are set to power the next generation of hydrogen-fed drive trains.

The BE flagship is the Bloom Electrolyzer. Installation at various sites is expected to commence in the coming weeks and months. The pairing of the Bloom Electrolyzer with renewable energy sources will generate green hydrogen for the mass market at a competitive price, making it an interesting hydrogen stock for investors.

BE saw revenues climb 22% in 2021 over 2020 and have recently narrowed in on positive net operating cash flow, narrowly falling short in Q2 2022. For two straight quarters, BE has only had to tap capital markets to a small degree, providing evidence of the board’s confidence in the sales pipeline.

The current sales-to-market capitalisation ratio of four times is the expensive side of the S&P 500 (currently 2.28 average). With 24 months of growth at 25%, the ratio would be 2.6 at today’s price of $21.36 and would send the firm into the market-average sales to market cap with above-average growth prospects.

Bloom Energy- Weekly Price Chart – 2021–22

Source: eToro

*Your capital is at risk.

For those early investors willing to take a risk on the explosion in the requirement for fuel cells and Bloom’s positioning in that market, there is certainly potential for upside in BE’s share price over the next few years.

Global X Hydrogen ETF (NASDAQ:HYDR)

For those investors excited about the opportunity that the next generation of hydrogen power technology brings but want the diversification effect of a portfolio of companies or to lower their individual transaction costs, HYDR is the hydrogen stock solution for you.

HYDR holdings are companies that are participating in the advancement of the global hydrogen industry. From advancing hydrogen extraction, fuel cell production and related technologies, the array of holdings stands to benefit from the expansion in the application and utilisation of hydrogen energy.

With holdings in not only BE but a number of other international fuel cell developers, manufacturers, and utilities, HYDR considers the entire value train of hydrogen.

Today, 17 governments have published hydrogen strategies and more than 20 are working toward them. The IEA has hydrogen as a central keystone in the road to net zero emissions by 2050, with hydrogen covering 10% of the final energy consumption by 2050.

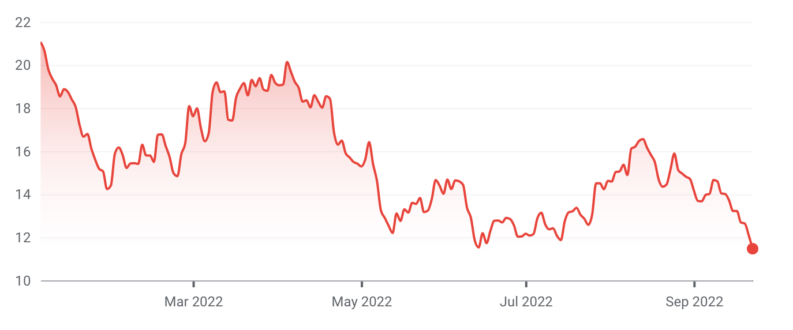

Global X Hydrogen ETF – YTD – 2021–22

Source: Yahoo! Finance

*Your capital is at risk.

Holding a wide portfolio of fuel cell equity under HYDR could be a good strategy to ensure the investor is covering as many bases as possible in the patchy technological advancement and in the general funding uplift from the public sector.

Fuel Cell Energy Inc (NASDAQ:FCEL)

FCEL is focussed on the application of fuel cell technology in the energy distribution sector. FCEL provides its clients with a mix of solutions under the SureSource umbrella of power generation and distribution.

FCEL has had to struggle to get and keep a foothold in the growing renewable energy sector, with a large proportion of recent investment going into the ever-cheaper solar cell voltaic sector. Declining revenues have meant that the board has had to continue to tap the capital markets and dilute their share price.

A recent uptick in sales and an encouraging quarterly top line revenue of $43m USD in the quarter ending July 2022 imply a near 85% increase in year-over-year revenue, suggesting the tide is turning for FCEL.

Fuel Cell Energy Inc – Weekly Price Chart – 2021–22

Source: eToro

*Your capital is at risk.

Currently trading at over eight times implied annual sales and burning through $56m USD per quarter before issuance of capital stock, FCEL is not for the more risk-averse investor. The valuation is trading on an elevated implied future growth and will rely on a few hurdles and continued government incentives in order to generate a return for the unblinking shareholder.

BP Plc (LSE:BP)

BP might not be the first company that comes to mind when investing in green technology, though it could be one of the first to profit from this transformational sector.

BP recently announced a 40.5% stake in the massive Asian Renewable Energy Hub (AREH). The AREH is a large green hydrogen, solar, and wind infrastructure development in the North West of Australia that will develop around 1.6 million MT of hydrogen per year.

The intention of the Asian Renewable Energy Hub is to feed the significantly large mining iron extraction and transportation sector of the Pilbara, and its proximal residential power, and ammonia for the farming market.

BP- Weekly Price Chart – 2019 – 2022

Source: eToro

*Your capital is at risk.

BP has several other investments in the pipeline. Its large and comfortable balance sheet makes possible the kind of large-scale heavy infrastructure projects required for profitable operations and renewable operations. Indeed, the Asian Renewable Energy Hub is one of these investments – one that will see hydrogen stock investors engaged with BP’s exploits in this sector for much time to come.

Why Invest In Hydrogen Companies?

As the cost of solar and wind comes down, the cost of hydrogen production is sure to follow suit and make the fuel cell infrastructure reliant on hydrogen more competitive in price.

There is a wide-ranging suite of applications of fuel cells in the power generation and transportation sector, with heavy industry gaining the most traction at this early stage.

The strategy of hydrogen and fuel cell adoption is a key component of the global CO2 emission reduction climate goals and will continue to attract investment for years to come.

According to the IEA, by 2030, up to 6 million fuel cells could be deployed, a large marketplace and revenue opportunity for those hydrogen companies currently listed on global stock markets.

What To Know Before Investing In Hydrogen Companies

Hydrogen infrastructure and fuel cell power generation are still in their infancy. Currently, the technology is not as competitive in price as other renewable energy sources and is behind the lagging battery in the transportation sector.

There is an inherent risk in any investment and the hydrogen sector is no different. The stated opportunity is there, but it is a long road to scaling, price competitiveness, and implementation. You should always perform due diligence and be comfortable with the level of risk you are taking on when making any investment.

Asktraders has a wealth of quantitative and qualitative tools, as well as in-depth market coverage to keep investors up to date with the hydrogen market and a wide range of related sectors. Performing due diligence is indeed an essential step to take before making any investment.